By: Mark Glennon*

“We have a recovery plan that the school district and the city council should consider,” says Chicago Teachers Union President Karen Lewis in release yesterday. “We look forward to working with you and members of the city council.”

Read the whole list in their “revenue recovery plan” contained in the release, but here’s the real gem: They’d like to reinstate arguably the most job-killing, despised, idiotic tax in history — the head tax. That’s a per-employee tax on employers, and they want it levied at four times the level it was previously levied in Chicago.

Come on, Rahm, Springfield. Pursue the obvious solution for CPS and CTU. Bankrupt or reconstitute CPS, end the CTU, fire them all and rehire the good ones. Most of them shouldn’t be let anywhere near a school.

*Mark Glennon is founder of WirePoints. Opinions expressed are his own.

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

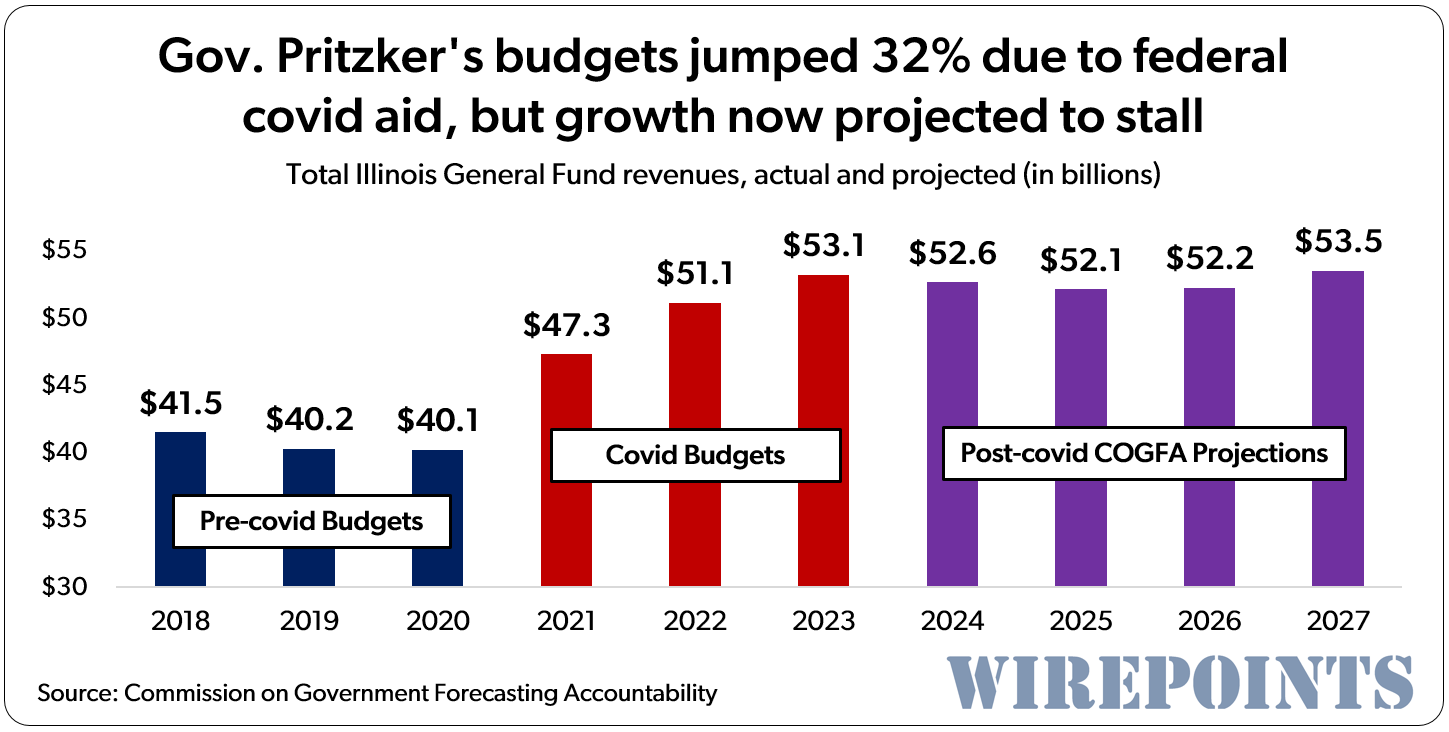

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more. Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow. Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

I voted with my feet in 1997. My real estate taxes were high when I left back then. The Big Blue Model will only keep increasing taxes in Illinois.

As you might have guessed, the Employer Expense Tax (Head Tax) exempted not-for-profit and educational organizations, meaning CTU was exempt from paying it. And I seem to remember the elimination of the head tax was somewhat related to the minimum wage hike, like a small giveback from the city for a much larger ask.

CPS could raise revenue by charging CTU for dues withholding services. How about 15% of gross salary? That shouldn’t impact CTU operations as usually 20% of dues revenue is set aside for political contributions.

Not disputing your point Nixit….but for clarity…the numbers you propose would work like this: for a teacher making 50,000 salaray a year(we could pick any number) 15% of thier Gross would be $7,500. And for Union dues: at 50K salary the yeary dues are $250.00 per year and 20% of that is $50.00.

So for comparison ya got a figure of $7500 on one hand and $50.00 on the other.

Double the figures obviously at $100.00 K Salary. Mark likes when we use actual numbers and figures so I threw them in.

Full teacher union dues are about $1,000 a year.

Old thread resurrected…I meant to say 15% of union gross receipts/revenue, not salary. So if dues are $1,000, the “dues withholding service” would be $150 and paid by the union, not the member. It’s a service that the unions value. And the govt is starving for revenue. Why not charge for it? At the very least, an expanded sales tax on services should include union membership. Health and country club memberships would be included, so why not AFSCME? Let ‘s not forget that union dues are tax deductible, so non-union taxpayers are basically subsidizing union influence in government (although I’m… Read more »