Your property taxes pay for government workers’ guaranteed salaries, benefits and pensions while you get no such guarantees – Wirepoints on with Jeff Daly of WZUS Decatur Radio

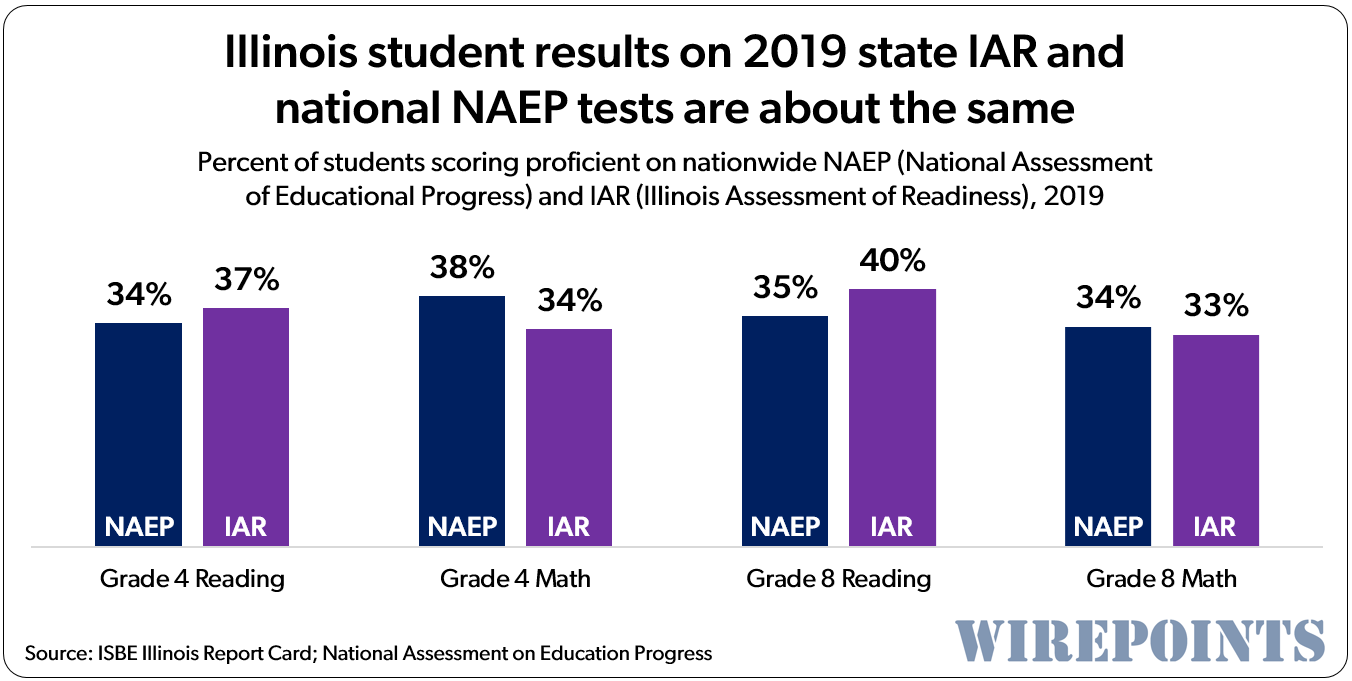

Ted joined Jeff Daly to discuss why Illinois’ property taxes are such a national outlier, why Illinoisans are forced to pay the high, guaranteed salaries, benefits and pensions of the government class, why Illinoisans aren’t getting their money’s worth for what they pay, the teachers unions’ influence over elections, and more.

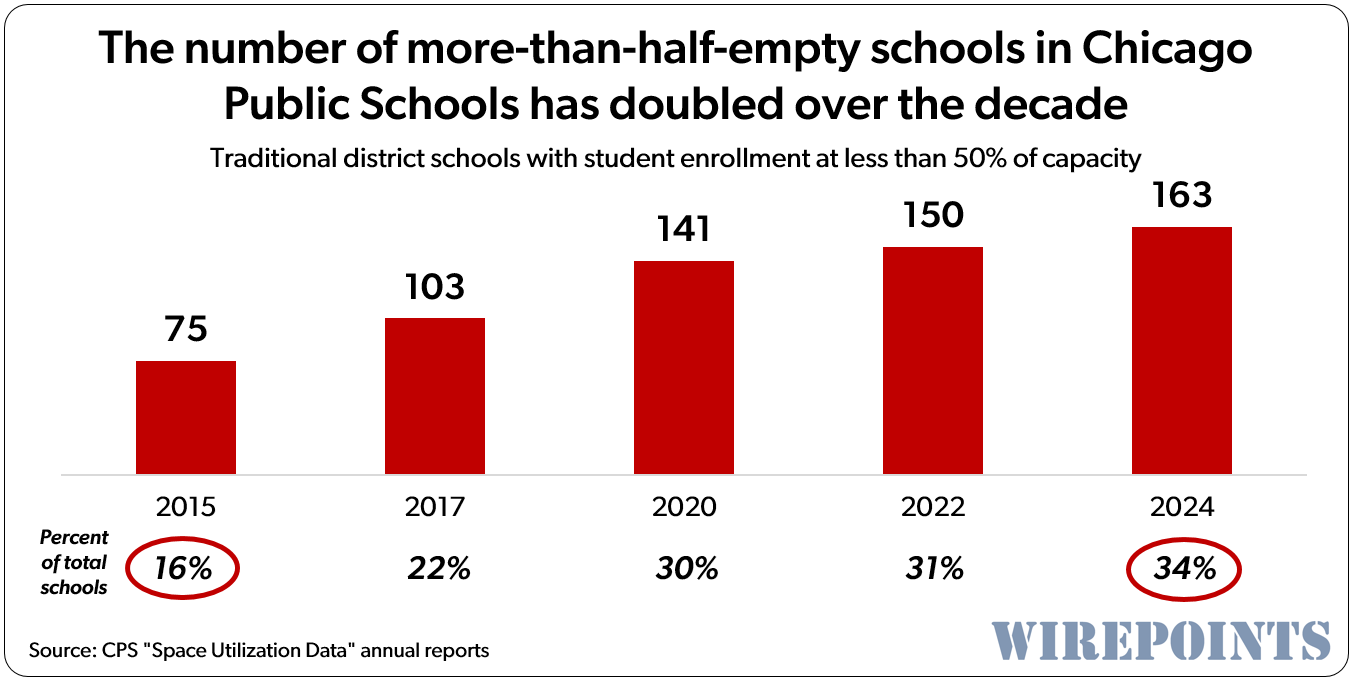

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level. Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Illinois already has one of the highest regressive tax burdens in the country

This impacts lower income citizens unfairly Freeing the Governor to raise income tax rates which he will do will further burden citizens. Democrats have been screwing them for years IT HAS TO STOP NOW!! Demand a constitutional amendment to fix the pension disaster