By: Mark Glennon*

“This bond deal is a win win win,” said Illinois Comptroller Susana Mendoza a few days ago on Twitter. And she’s taking much of the credit for paying down bills with the bond proceeds, listing that among her top ten accomplishments for the past year.

In fact, the bond sale was a shameful necessity that merely pushed debt into the future. Bragging about its impact on on our budget crisis is just the latest official propaganda from elected officials keeping Illinoisans blind to the disaster ahead. Mendoza and her office are among the worst offenders.

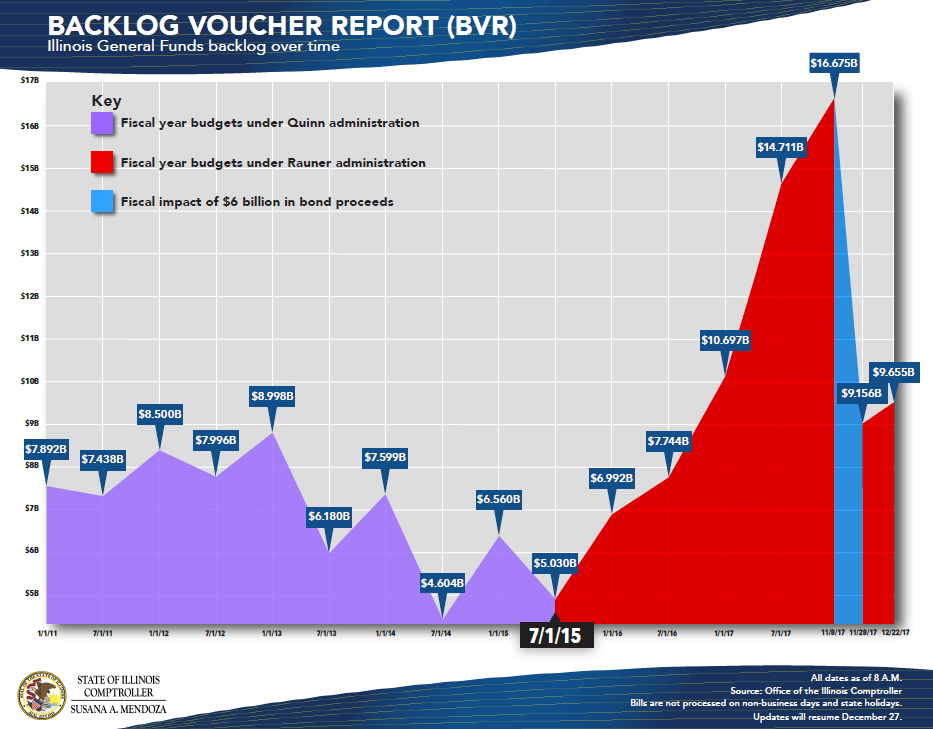

The bond deal she referred to is the $6 billion dollar sale in October, proceeds of which were used to pay down some of the state’s backlog of unpaid bills. The bond sale was rational because it substituted a lower interest rate for stiff late penalties the unpaid bills carried, but make no mistake that it was a desperate act forced by circumstances. Pushing current operating expenses into the future is inter-generational theft. Nobody should be bragging about that.

And let’s take a look at what it really accomplished. The state actually took in $8.7 billion, according to Mendoza. That’s more than the face amount of the bonds primarily because the state also gets a partial funding match from the federal government on some of the bills that were paid.

Well, the bill backlog hit a high of $16.67 billion just before the bond proceeds came in, so subtract the $8.7 billion in proceeds you’d probably think the current backlog should be something less than $7.97 billion. After all, we had a big tax increase that was also supposed to help cut the backlog, and Mendoza’s office said the revenue from that would start showing up in September. But the backlog today is $9.65 billion, which is up half a billion dollars from December 4 when it was $8.9 billion.

And what’s with the silly chart on her site she uses to pin all our fiscal problems on Governor Rauner (who does share part of the blame)? It’s copied below. The big blue drop is all to her and her party’s credit, I guess, and the red is all Rauner’s fault. Come on.

She should at least get the numbers right. Note how it doesn’t show the true low point of $8.9 billion on December 4. (That was her own number at the time). Maybe she just doesn’t want to show how badly the tax increase is failing to reduce the bill backlog.

Finally, the bill backlog by itself doesn’t mean terribly much. She shouldn’t be emphasizing it as if it’s a proxy for how well we are doing. It’s just one account among many the state has. It’s the consolidation of all of them that really matters, and that picture is much, much worse. See our earlier article on that linked here.

Illinois will start the new year heading straight into the abyss with it’s foot firmly on the gas pedal.

Nobody in government is saying how bad it is, including two who are in particularly good positions to do so — Comptroller Mendoza and Governor Rauner.

*Mark Glennon is founder of Wirepoints. Opinions expressed are his own.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Fun With Charts: 1) Notice how the Y axis starts at $4.5B, not zero. 2) You could overlay a line chart showing bond obligations spike on 11/28/17. 3) Why, on 1/1/14, three years after the tax hike brought in an estimated $24 billion, were unpaid bills only $300M lower? 4) Before 1/11/11, unpaid bills were only $7.9B, and that was coming right out from a 3% rate. How were we able to keep unpaid bills so low with a 0.75% lower rate?

The answers to both questions 3 and 4 revolve around pension funding. Prior to the 2011 tax increase the pension payments either were not made, or only made by borrowing money. After the tax increase, the statutory payments were basically made from the increased revenues.