By: Ted Dabrowski and John Klingner

There’s another government-worker benefit wreaking fiscal havoc in Illinois: free and heavily-subsidized health insurance for retired state workers, teachers and community college employees.

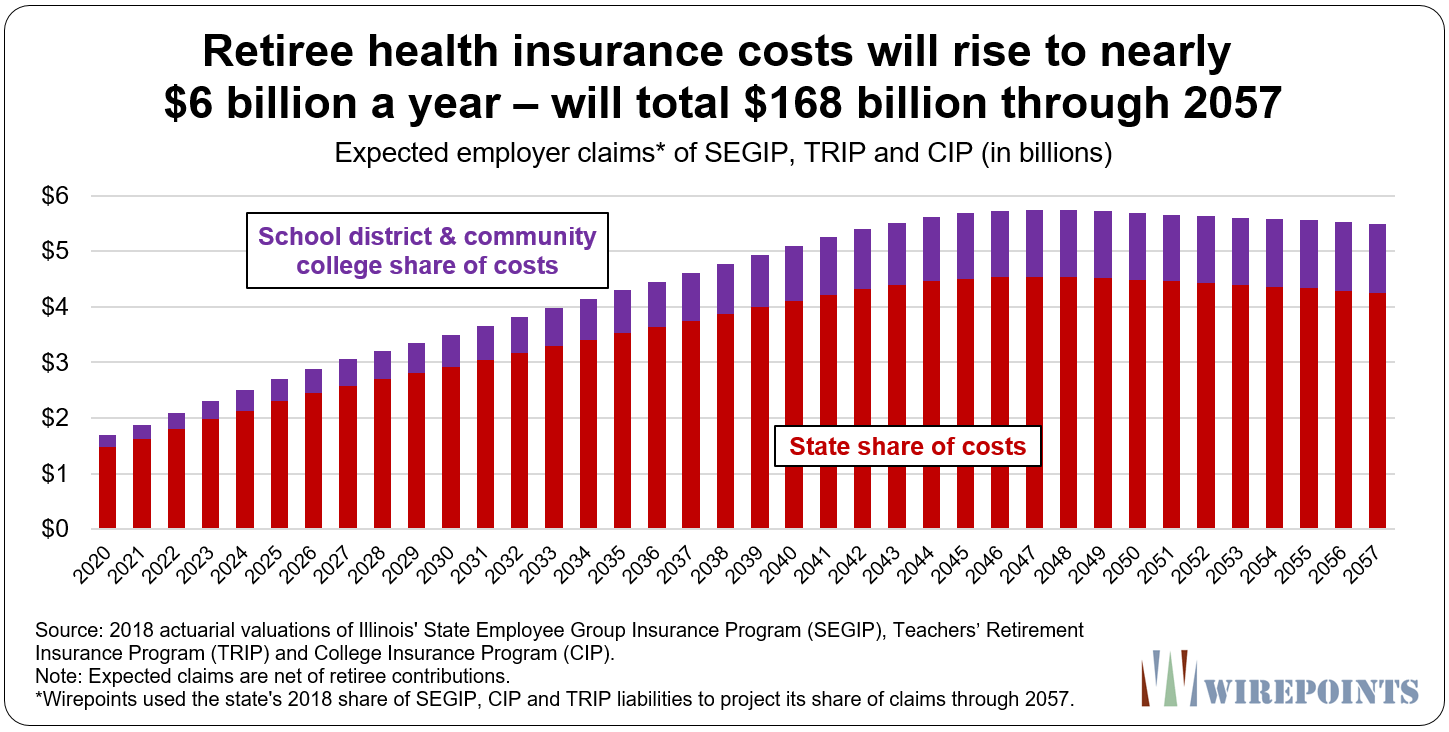

According to the latest state actuarial reports, over the next 38 years Illinois owes a total of $168 billion in health insurance benefits to retired public-sector workers.

The state’s actuaries say Illinois should have $68 billion set aside and invested today so it can safely make those $168 billion in future payouts. The problem is, state politicians haven’t set aside anything at all.

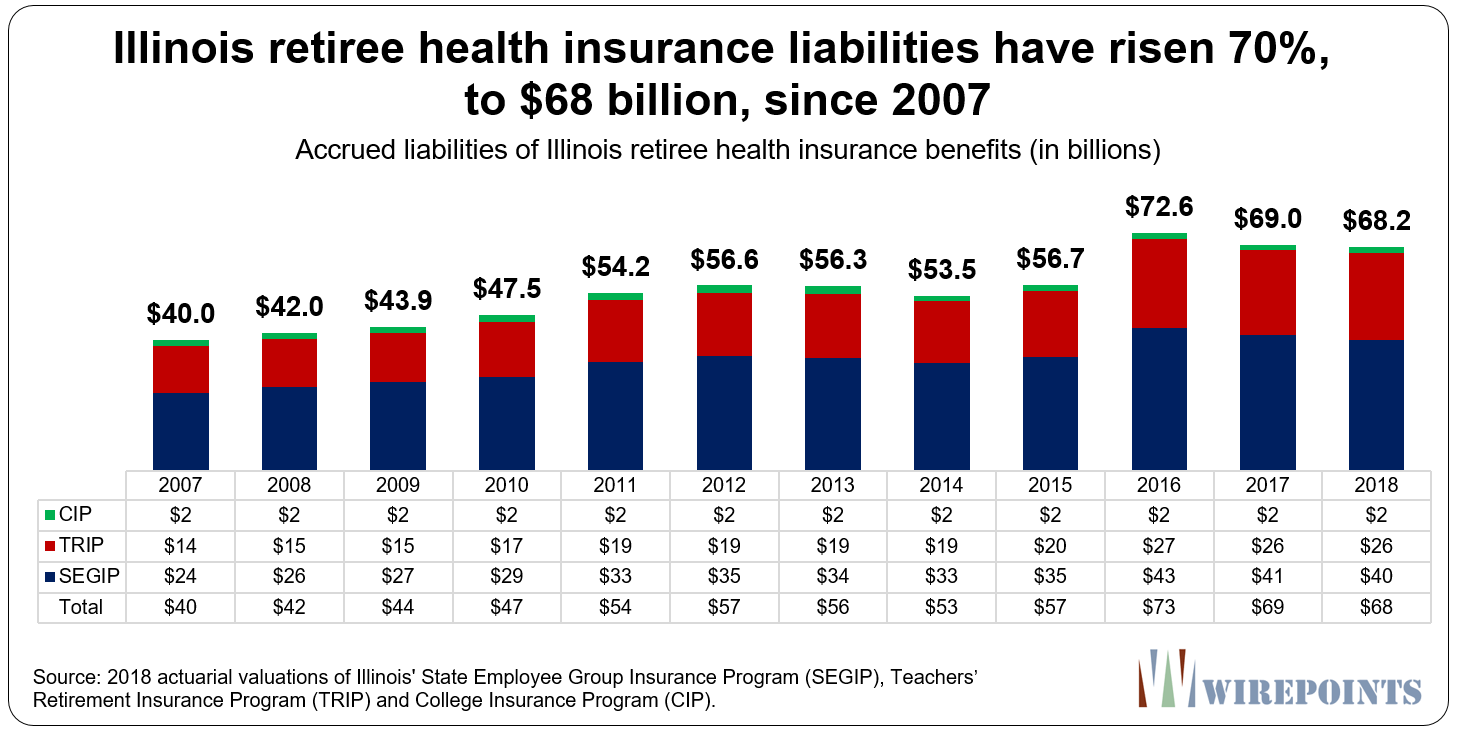

That $68 billion hole is yet another financial time-bomb. It’s been totally ignored thus far by Illinois’ lawmakers. Unfunded health insurance promises have grown 70 percent since 2007 and they play a large role in Illinois’ overall retirement crisis.

Rather than properly pre-fund its future retiree health insurance obligations, the state pays only for the yearly costs as they are incurred under what’s called a “pay-go” system. Government payments for claims will rise from $1.3 billion today to as much as nearly $6 billion in the next few decades. Illinoisans can expect those rising costs to further squeeze the state and other local government budgets.

Illinois’ “other” retirement debt

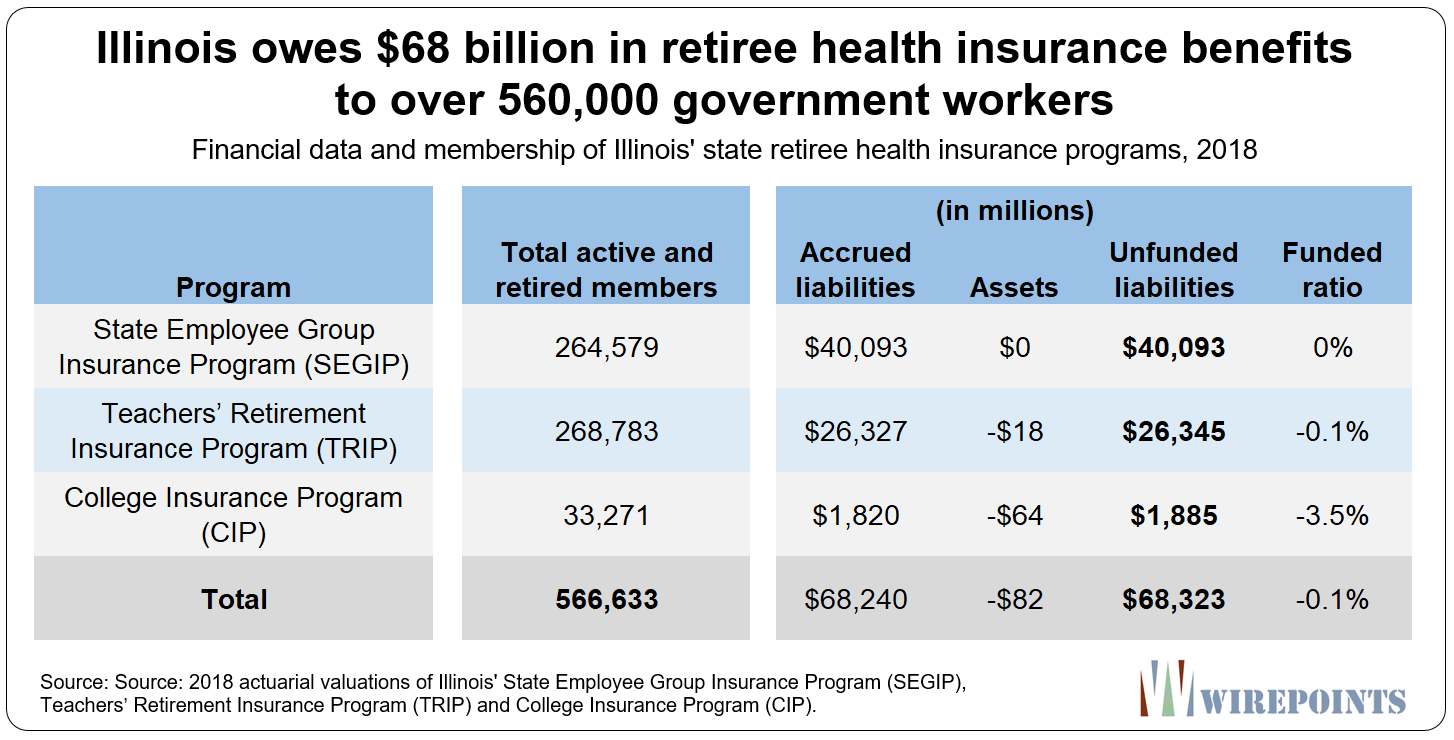

Illinois provides more than 560,000 state workers and retirees with subsidized retiree health insurance benefits. Beneficiaries include:

- State employees and retirees, including state workers, public university employees, judges, and lawmakers, who participate in the State Employee Group Insurance Program (SEGIP);

- Teachers in the Teachers’ Retirement Insurance Program (TRIP); and

- Community college employees in the College Insurance Program (CIP).

The responsibility of paying for those programs is divided between the state, school districts and community colleges.

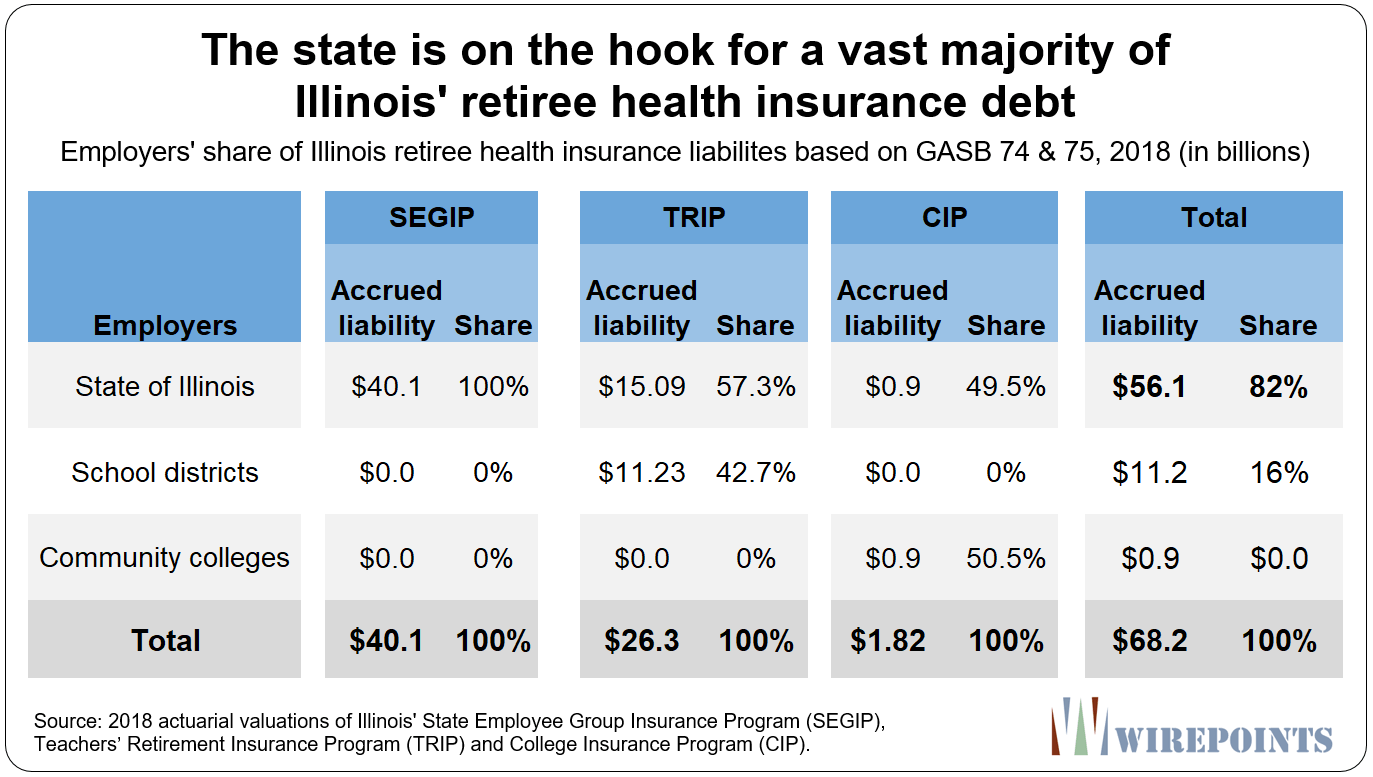

Since the state is entirely responsible for making the yearly contribution to SEGIP, it’s on the hook for the whole funding shortfall in SEGIP, or $40 billion.

The state is also officially responsible for about 57 percent of TRIP’s annual costs, with school districts responsible for the rest. That means the state is on the hook for a bit over half of TRIP’s $26 billion in liabilities.

The state also pays for about 50 percent of CIP’s annual costs, with community colleges paying the rest. That means the state is on the hook for about half of CIP’s $2 billion in liabilities.

In total, the state is officially on the hook for $56 billion in retiree health debt, while community colleges and school districts are responsible for $12 billion.

New federal accounting rules, GASB 74 and GASB 75, which came into full effect in 2018, now require state actuaries to divide responsibility for health insurance debt among affected employers based on their share of annual costs.

From the actuarial firm Milliman: “GASB 75 states that the “projected long-term future contribution effort” of the employer is considered in the determination of an employer’s proportionate share…Note that the proportionate share of the NOL (Net OPEB Liability) will be included with the individual employer’s balance sheet and the proportionate share of the OPEB expense will be on the individual employer’s income statement. This is a significant change from GASB 43 and 45. In those statements, no liability or expense was calculated for the individual employer’s financial reporting.”

Retiree health benefits

State workers with 20-plus years of service receive free health insurance during retirement. (SEGIP offers state workers a 5 percent discount on their retiree health insurance for every year of work, maxing out at 100 percent for 20 years of work. Retirees who retired before 1998 earned free health insurance after just 8 years of service.)

According to a 2011 study by Mercer on behalf of the Commission on Government Forecasting and Accountability (COGFA), most SEGIP members end up receiving free insurance: “Roughly three fourths of current retirees have at least twenty years of service and, therefore, do not have to pay contributions.”

Wirepoints also analyzed the 2018 state employee pension database and found that 73 percent of State Employee Retirement System (SERS) members have worked the requisite years to get free retiree health insurance.

The present value of that benefit for career workers is worth $200,000 to $500,000 per retiree, depending on the pension tier and age of the employee, according to a 2016 FOIA obtained from the governor’s office.

Free retiree health insurance provided entirely at the employer’s expense is a benefit that’s rare in the public sector and almost unheard of in the private sector.

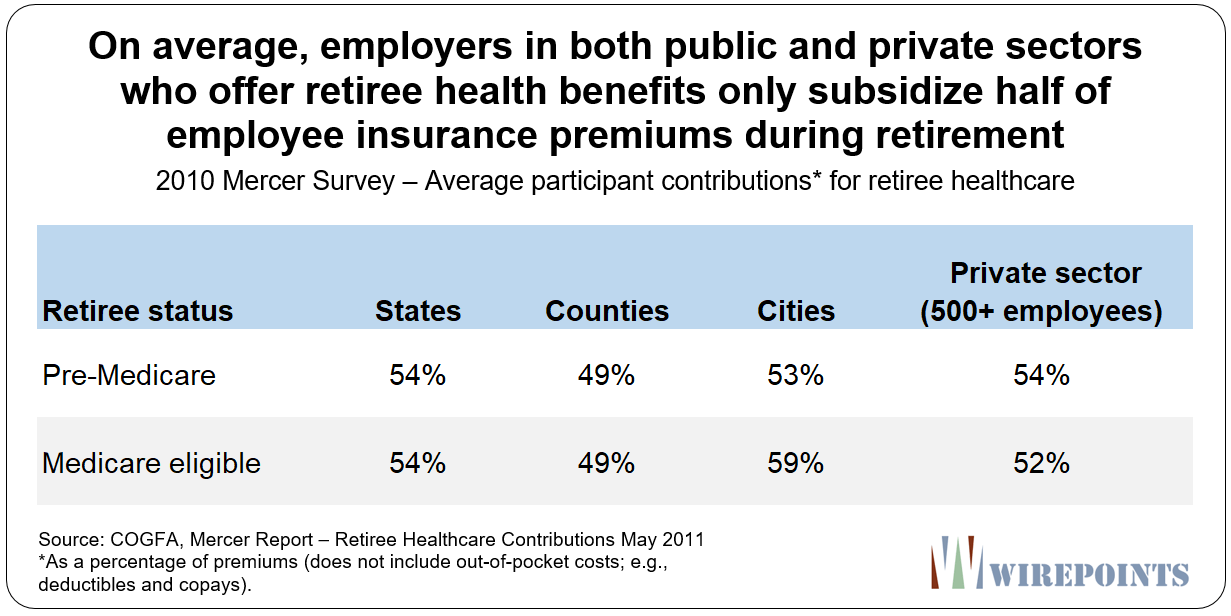

The Mercer study found that, on average, state, county and city governments across the nation that offer retiree insurance benefits pay only half of their employee’s premiums during retirement.

Mercer also found that most small- and medium-sized employers in the private sector do not offer retiree health benefits. And the 25 percent of large employers (500-plus employees) who do offer retiree health insurance benefits pay only half the cost of insurance, on average.

Members of TRIP and CIP get different, less generous benefit packages, but still receive insurance subsidies worth 50 to 75 percent of their premium costs – subsidies paid for by taxpayers.

A growing budget problem

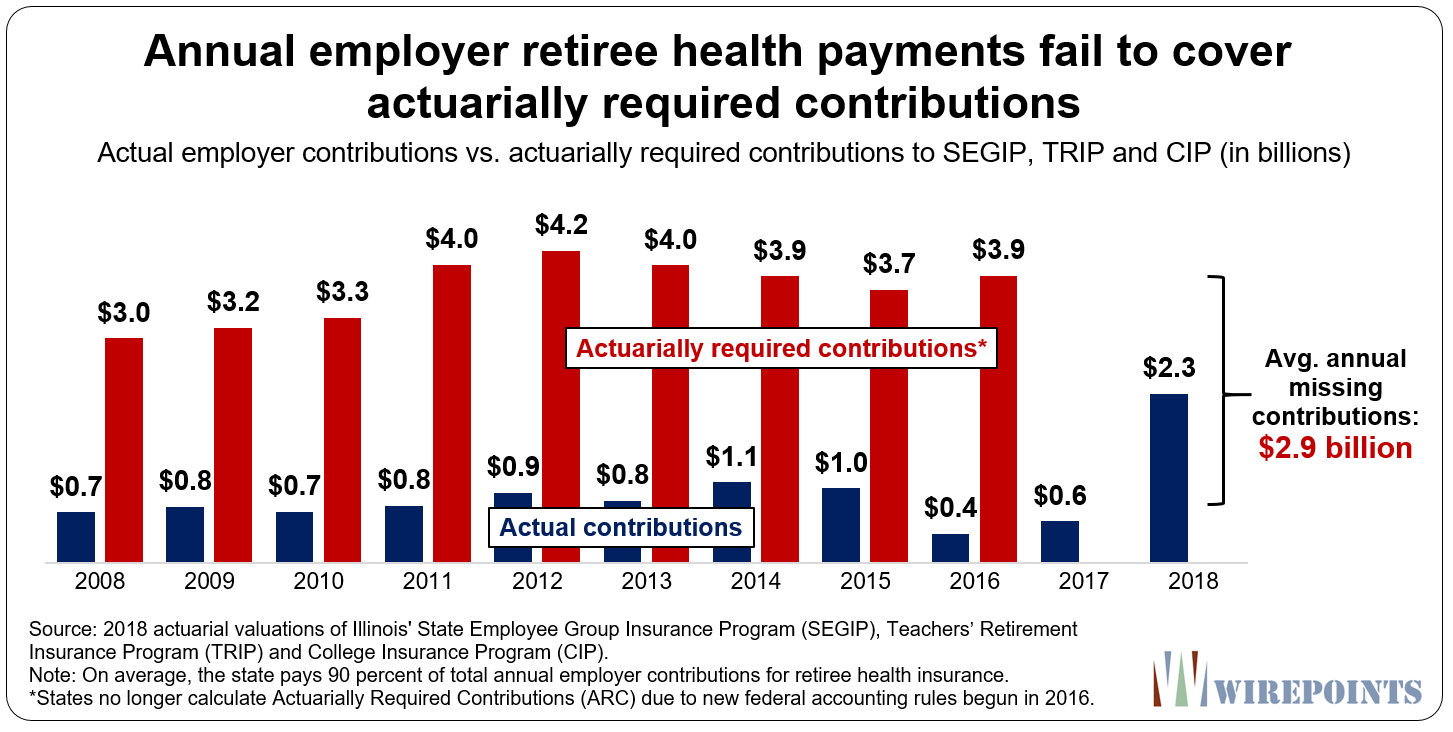

Because Illinois operates on a pay-go basis for retiree health insurance, Illinois falls far short of paying the actuarially required contributions, or ARC, for health benefits. The ARC is the amount actuaries say the state should pay to cover current year costs and to pay to down some of the unfunded liability.

By 2008, the state funding shortfall had already reached $42 billion. But instead of paying that year’s $3 billion ARC, Illinois contributed just $700 million – the amount needed to only pay just that year’s benefit claims.

That same level of underpayment has continued since then. Illinois consistently underfunded retiree health by about $3 billion a year between 2008 and 2016 – the last year ARC data is available. (New federal accounting rules, GASB 74 and 75, were fully implemented in 2018. The new rules no longer require actuaries to provide ARCs.)

Those yearly funding shortfalls, along with recent changes in accounting, have pushed up Illinois’ retiree health insurance shortfall to $68 billion.

The rising shortfall matters since the annual pay-go cost of retiree healthcare is growing rapidly. By 2027, the pay-go amount will total $3 billion a year, with the state responsible for paying more than $2.5 billion of that amount.

Costs are projected to peak in 2047, with the state responsible for paying $4.5 billion out of a total $5.7 billion in health insurance costs.

In total, the pay-go amounts will grow by 4.6 percent annually through 2047, which will put constant pressure on Illinois’ budget.

Retiree health elsewhere

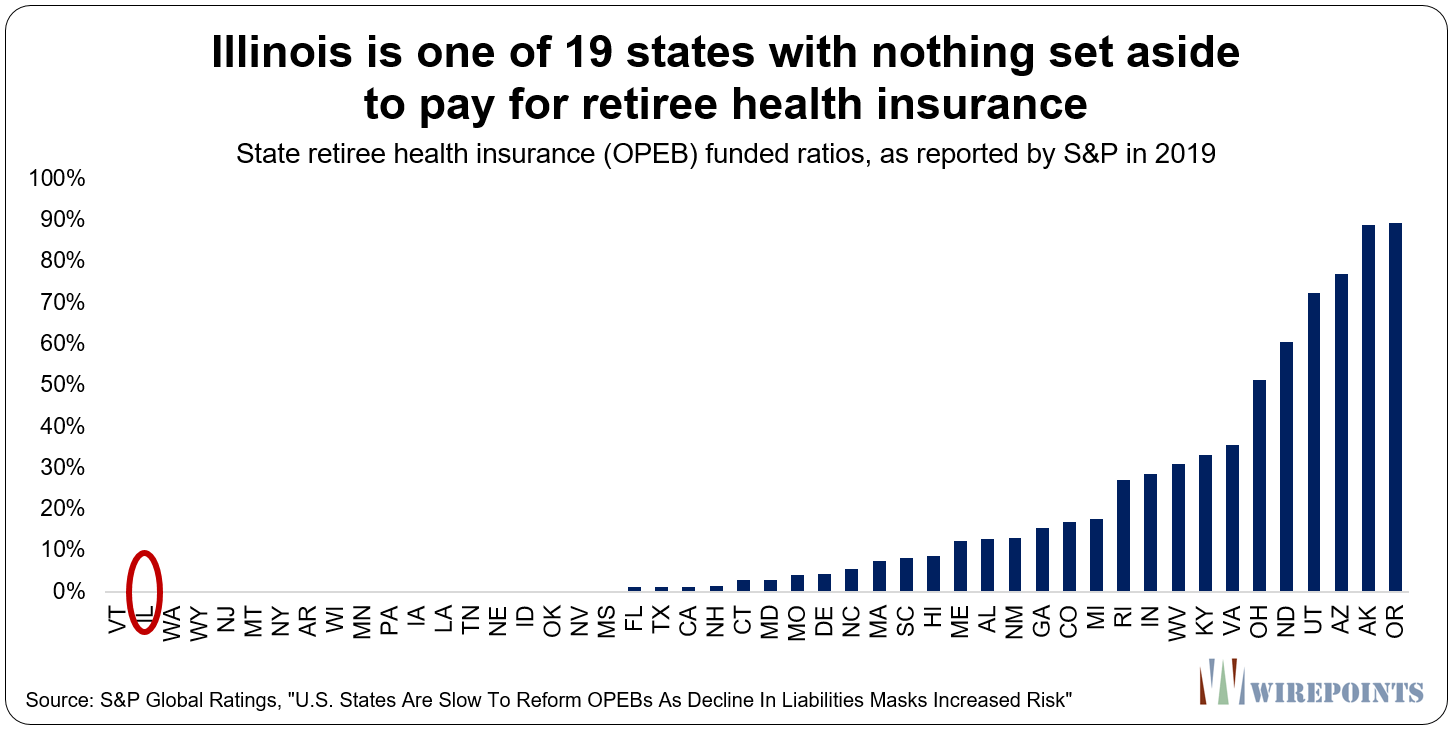

Illinois is not alone in treating retiree healthcare as pay-go. Nineteen states have absolutely nothing set aside to pay for retiree healthcare. And over two dozen more have less than a quarter of the money they need, according to a 2019 report by S&P.

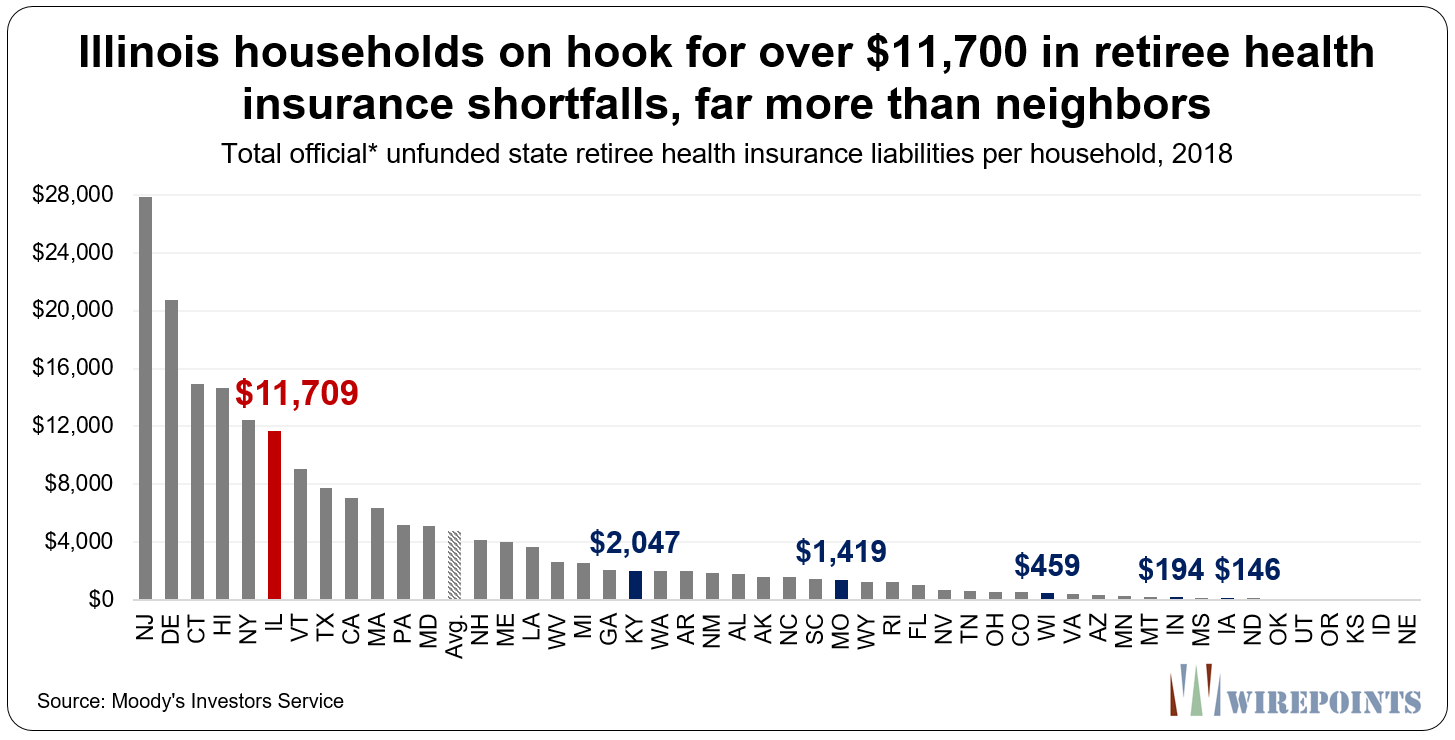

But the extent of underfunding is extreme in Illinois. That’s particularly true when comparing the unfunded retiree health care debt per capita in Illinois versus our neighboring states.

According to Moody’s Investors Service, as of 2018 each Illinois household was on the hook for more than $11,700 in official unfunded retiree health benefits, the 6th-most in the nation (Moody’s uses Illinois’ official unfunded liability of $57 billion). That amount is more than double the national average and six times what Kentuckians owe. And it’s many, many times more than what residents in states like Wisconsin and Indiana are burdened with.

Retiree health is yet another debt that makes Illinois noncompetitive versus its neighbors.

Reforming retiree health insurance

Illinois’ state pension crisis is already the nation’s worst. Layer on top of that free and heavily subsidized health insurance benefits and it’s no wonder Illinois faces the most extreme retirement crisis of any state in the nation.

Illinois lawmakers can change that by enacting reforms that significantly reduce the state’s liabilities. Of course, like any other major retirement reform, it requires an amendment to the pension clause of the Illinois constitution.

Without reforms, retirement costs are on track to damage Illinois beyond repair.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

The best day of your life is the day you move out of Illinois.

There is no hope, DOA, a goner for ever.

The Greed of the cops, teachers and firemen have destroyed the quality of life for the honest hard working taxpayer. Leave HIGH TAXES, POOR SERVICES AND LOUSY WEATHER.

Here’s a thought. Suppose if Sanders or Warren are elected. Both are pushing Medicare for All. If that ever happens that basically puts everyone on Medicare. Would all the health care costs for public employees in Illinois and around the country then be transferred to Medicare and possibly Medicaid? That would save taxpayers here at least $73B or more (that’s the number floating on various sites). Also most of the public employees here get Cadillac or better healthcare compliments of John Q.Taxpayer which would give them a longer lifespan due to better access to healthcare professionals. That would add billions… Read more »

Yes, we will have permission to show up with pitchforks and torches to the homes of IL government retirees who voted to force common folk into Medicaid for All while they themselves retain their Cadillac state of IL taxpayer health plan.

“Illinois owes $68 billion in health benefits to government retirees. Politicians haven’t set aside a penny to pay for them ”

~ Well, as morbid as this sounds, if the state can’t pay its retirees’ medical bills…..maybe they’ll forego medical treatment, and die young… that fixes a lot of the pension crisis if there aren’t any pensioners to pay! Genius!

One issue with this is had the money been set aside the amounts should have risen with the market growth and compounded interest on bond type of investments. So not only are the taxpayers penalized on the amounts not allocated to begin with but also on the growth that would have been attained. Just two of the many facets of the pension problems.

Wirepoints team, I have really enjoyed reading your analysis for the past few months but I have a proposal. You have thoroughly laid out the data and this is another great article, however I am really interested to learn more about what could *actually* happen. Where does this go? What are the scenarios? Does it go on forever? I would love to see everyone make some predictions and lay out a few scenarios. Thanks!

My personal view remains that it’s most likely that we will see a continuing, gradual train wreck, not a single big bang. Yes, there could be a big bang, perhaps triggered by a recession, natural disaster, riot in Chicago or whatever. Either way, a meltdown is inevitable and someday the masses will wake up. “It’s happening,” is how I put it before, just gradually. https://wirepoints.org/its-happening-wp-original/. But you are right — we are do for an update on that. Other opinions are welcome, but I think nobody knows for sure when an insolvency turns into a liquidity nightmare.

I agree with you on this. The process will be long and drawn out as each successive politician seeks creative new ways to kick the can down the road to the end of their administration. I might crown Jim Edgar’s ramp as a prime example of this. We can not expect a Court with judges within the pension system to rule against it and the politicians on both sides of the aisle are in the system as well.I don’t seriously foresee the Illinois voting base ever caring to learn or be aware of the problems as many of them are… Read more »

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

Ernest Hemingway, The Sun Also Rises.

By the time “everyone” realizes that there’s a crisis, it will be decades too late to avoid extraordinary hardship for someone. My bet is that eventually it will be retirees who get stiffed. Even today, it might be possible to rejigger the pension systems so that retirees get SOMETHING while taxpayers stop getting robbed to the point where escape is an existential necessity. As Hemingway alludes, destruction of this kind is parabolic. As always, the obstacle is “what about me?” It’s human nature to (1) get the most for doing the least, and (2) define “wealthy” as those who have… Read more »

Unfortunately, Illinois has the distinction of being the first state down this path. Comparing a cities experience (like Detroit) to an entire state is probably lacking in value. I wish there was a way to profit from Illinois seemingly unstoppable collapse, like a few analysts did when the housing crisis hit the U.S. economy as depicted in the movie “The Big Short”. FYI, the movie is excellent. I’ve watched it several times and I finally understand what happened back in 2007/2008.

For what little free advice is worth, my personal experience (and confronting the mathematical axioms involved) revealed that while superficially attractive, it’s difficult to the point of near-impossibility to “make money” on a collapse in value. I’m intimately familiar with short-selling, put options and inverse index funds/ETF’s. Tl;dr, your timing has to be perfect. I made some pretty huge returns during major declining phases since 1998 yet I STILL ended up in a net loss each of those times, because I kept stupidly clinging to a mis-read on the larger trend. That, and a colossal mistake being too early short… Read more »

I disagree, I believe the federal SALT cap change was the beginning of the end, the transitioning event anyway, I got the hell outta there soon as I heard about that. real estate values are down for the year… will be interesting to see the migration numbers next year for 2019

my realtor who is pretty established and a long time chicagoan is headed to florida even, I guess he sees the writing on the wall as well.

As a long time Chicagoan and realtor, I was thinking the exact same thing about going to Florida. It is all but impossible to remain enthusiastic about selling your product (Chicago Real Estate) when you come to Wirepoints and read the truth everyday.

When you update your 2017 analysis, it would be interesting to connect the dots between homes with underwater mortgages and the ability of taxing authorities to mud-wrestle mortgage lenders over who gets the swag at foreclosure auction. (Yes, I know the goobermint gets first dibs.) In a very real sense, homes in IL were subjected to a process called rehypothecation (where the same underlying asset is promised as collateral for more than one loan.) We no longer hear much about MERS, the real estate holding system that side-stepped county title registries and literally clouded the titles to millions of properties… Read more »

Look what happens in France, for example, when dependent people face cuts. Expect some version of that to play out in Chicago and Illinois.

And you know damned well the first thing “MEDICare for all” politicians will do is exempt themselves , all govt sector workers and unions from having to go onto Medicare for all.

I have mentioned this before that when teachers “OPTED” out of S.S. and Medicare decades ago they opted into a state retirement (pension) program. When was this on any referendum or ballot so that the citizens of that state had any say in the matter? This is like taking out a huge mortgage and having your neighbors pay the bill. Most get Cadillac health plans provided so generously by the state (taxpayers) instead of basic ACA coverage available now. If they want to upgrade they can do so but at their own expense. Most of us have to provide for… Read more »

Railroading the populous is the Illinois way, it seems.

Another fantastiacaly depressing articale. The $68 billion health insurance shortfall is only for state employees(SEGIP, TRIP, CIP)-correct. Any estimates on health insurance shortfall for Chicago and all the 100s of other municiple funds? Or how does that work

All this is under the assumption that enough idiots remain in Illinois working as docs and nurses, rather than becoming teachers and pension- entitled public workers . At what point will society face the question: what idiot would ever become a doctor or nurse in Illinois ? Illinois teachers make double the houtly compnsation of Illinois nurses when the present value of free guaranteed health insurance and pensions are considered. Doctors make less than school administrators per hours worked, when one considers that medical professionals must pay for their own liability insurance, health insurance, fund their own retirements, and pay… Read more »

I agree. School superintendents never have to worry about malpractice or litigation like doctors and nurses do. If they do supers have the best lawyers available to them at taxpayer expense. Do you know if the actuarial tables for teachers are based on life expectancy of the general population or just teachers? School districts have Cadillac health plans which should increase lifespans compared to the mortality rates of people in inner cities. Are these lumped together based on S.S.tables or are demographics factored in?

How the Supreme Court rules in this case (https://www.npr.org/2019/12/11/786838620/supreme-court-hears-another-obamacare-case-with-a-twist) will likely also help determine whether unfunded state government promises can be enforced under the existing Illinois Constitution. Of course, given the present Illinois Supreme Court, any litigation would have be be brought in federal court.

Do state retiree health benefits cover employees from their retirement through Medicare eligibility or through death?

The state covers the gap between retirement age and Medicare age — they get Medicare. That piece is the bulk of the cost. The state also pays for supplemental coverage after Medicare kicks in.

According to SERS’ Rule of 85, an employee can retire at any age without a reduced pension benefit if their age plus years of service credit equal 85 years. So someone could go work for the state at age 22, retire at 54, get their full pension vesting plus free Cadillac health care coverage for their family for the next 11 years. Damn.

Mark. What about all the teachers who “OPTED” out of S.S. and Medicare and opted “IN” to our pocketbooks without our consent? Because our state is so generous with our money.

Calling it insurance seems a misnomer. It’s no doubt a contract right and certainly an expectation. However it’s no longer a reasonable expectation. It’s a preview of what would happen should the state and municipalities “do” pay-go for retirement income when the pension trusts run out of money. “Would” and “should” connote that we are unlikely to reach that point. Instead we’ll be struggling with a welfare system that will dramatize for all the consequences of mis-governance. No doubt public employees will continue to assert that they deserve better welfare payments and a place at the head of the soup… Read more »

The federal government has already ahown us the solution to this problem! VA hospitals are apparently good enough for our bravest retirees, so I don’t see why Illinois can’t mandate that it’s retirees use state run hospitals, or else opt out with a modest voucher

I for one would be pleased as punch if those who sent us to war got the same treatment back home as those they sent. The term poetic justice comes to mind.

Is it just me, or do the articles here all seem to be saying the same thing, but are just presented a little differently each time. It’s probably just me, and if so, I do apologize. Maybe I’ve hit my saturation point for charts and graphs. Just a suggestion, but if possible, maybe simply tell some individual stories of people who left Illinois, why they left, what did their friends and family think, and what regrets (if any) they may have. I remember a couple weeks ago you wrote about a man that moved to Illinois (to his regret), That… Read more »

Thanks for the comments, Mike. To your first point, read most of the traditional media and you won’t find the facts or the truth about the real numbers, the trends or the depth of the crisis. Most media paper over it and leave readers thinking that a progressive tax hike, a LaSalle tax, some more bonded debt, maybe a reamortization here and there, a securitization for good measure, and all will be well. That’s one of the reasons why the average Illinoisan thinks there are easy way outs of the state’s problems. (Many of the people that truly understand the… Read more »

Mike-If you search on this website info on “North Cook News property tax” same for West and South Cook news property tax there many stories of individual people and towns who are affected by high property tax’s and lower home values. These are going back 3 or 4 years.

The data is desperately needed, and even with the stellar work of Wirepoints, there remains quite a bit to explore, especially given the opaque nature of government in Illinois and the media’s financial innumeracy. This excellent article alone gives rise to questions. Will health care benefits alone swallow the additional $3.5B expected to obtain under the so called Fair Tax? It seems so, with even higher rates of tax and the middle class being burdened to follow. One thing I learned in athletics – you could easily fool yourself and think you were working hard when the reality was the… Read more »

Willowglen, that’s why we are raising money to expand! It’s indeed frustrating to see so much bad stuff out there but not have the time to tackle it with just 3 people. But we are making nice progress towards that expansion.

Mike and other readers: We are interested in your further opinions on that. It’s a question we often wrestle with. On the one hand, you regular readers will find repetition in many of our original articles. On the other hand, about 2/3 of our readers on any particular article are entirely new to our site, and the vast majority of Illinoisans remain poorly informed. So, we have erred on the side of leaving the repetition in. More variety, as you suggest, is one answer, but other suggestions and comments are welcome.

Mike–its a war out there. It’s wp, ipi, tia and a few other voices up against the ill/cc massive $ machine, public sector unions( and their pr spin machine–martire, ctba, miller, gfrc, most of apologist press). Think wp is winning the war when substantive articales are quoted in wsj, bond buyer, etc. Does anybody take old ralphie martire seriously anymore, even the mainstream press seems to have given up on him & ctba. I for one appreciate mark & ted having patiance to answer all my dumb question. Keep pushing the math, charts & graphs!!!! The math will win

Thanks to both Ted and Mark for responding in the comments. The fact that the site authors so closely follow the comments is a big positive for me.