Even more evidence Illinois can thank the federal government’s covid bailouts for its budget bonanza – Wirepoints

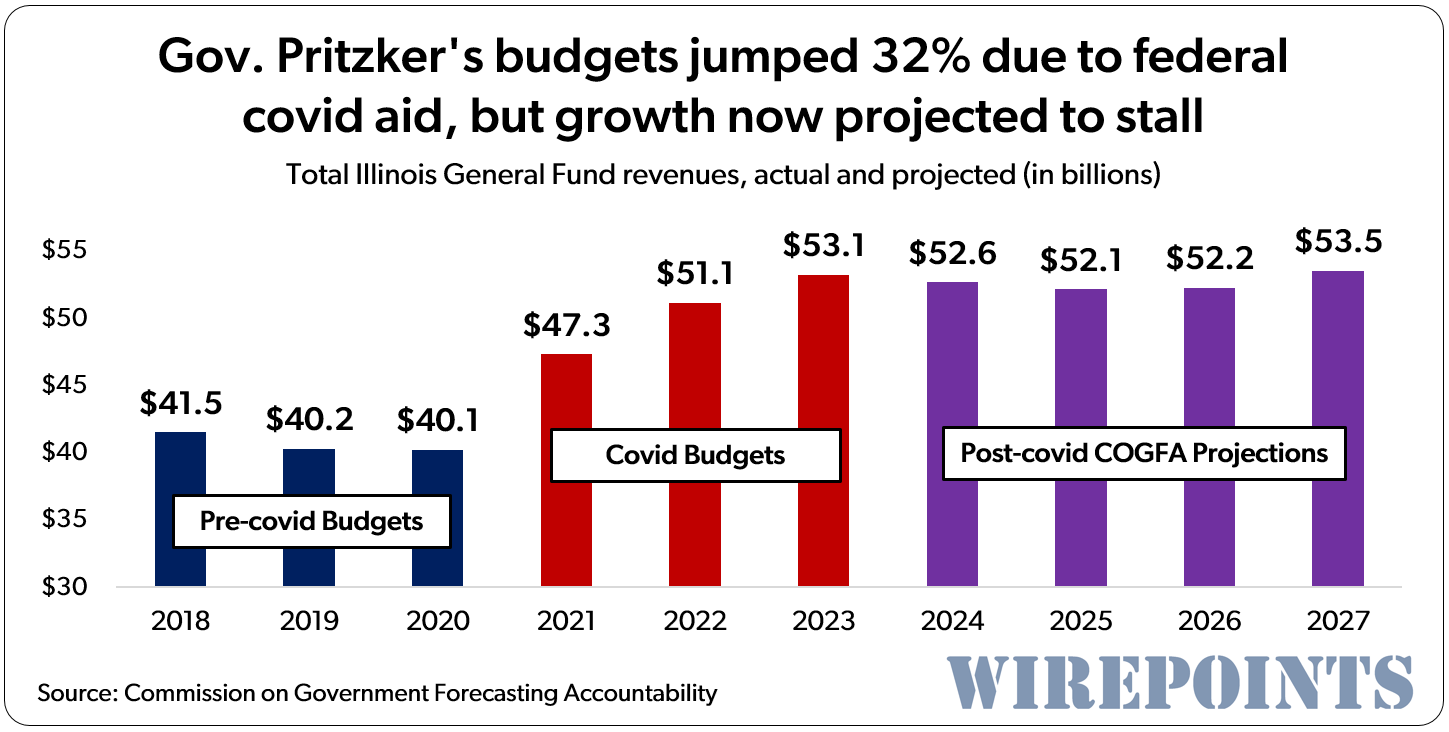

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

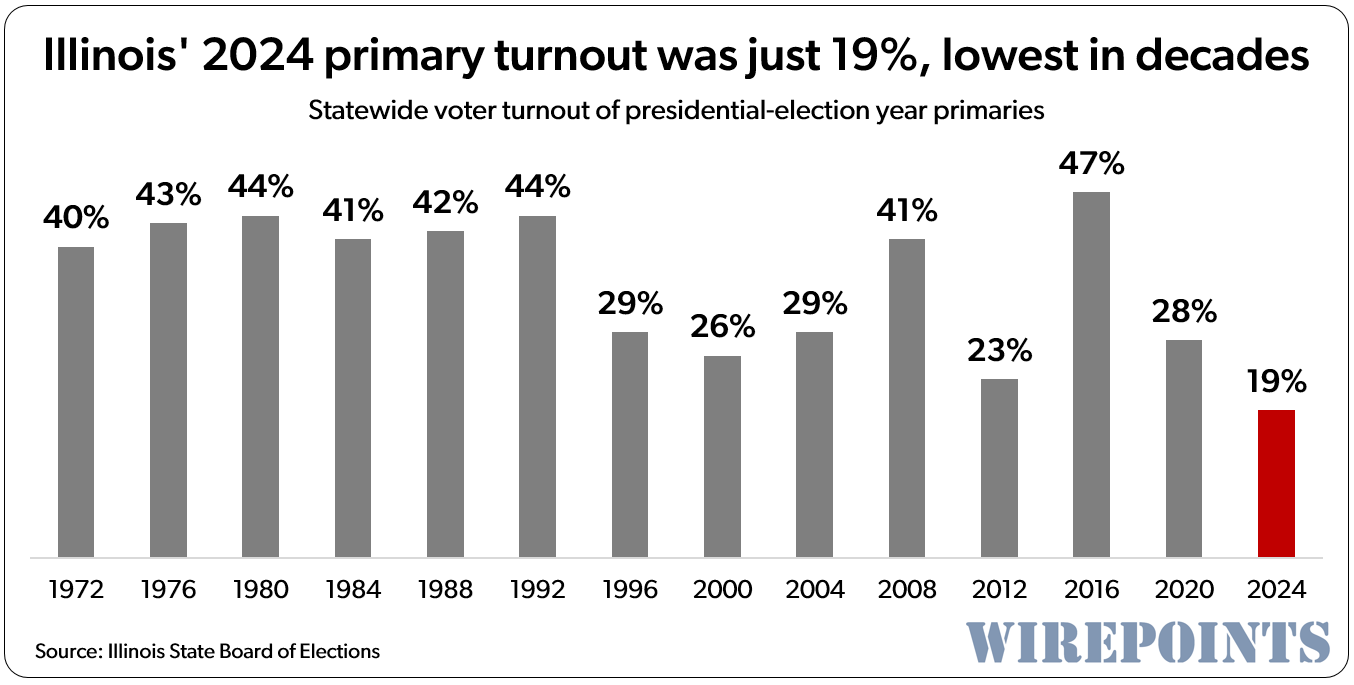

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical. Illinois just suffered the lowest presidential primary turnout since 1960, according to the Illinois State Board of Elections. Blame voter apathy on a lack of competitive elections. On gerrymandering. On the concern people have, thinking their votes don’t matter. It’s likely a little bit of each.

Illinois just suffered the lowest presidential primary turnout since 1960, according to the Illinois State Board of Elections. Blame voter apathy on a lack of competitive elections. On gerrymandering. On the concern people have, thinking their votes don’t matter. It’s likely a little bit of each.

One interesting thing for tax filers is that the April 15, 2020 date is the date by which any final tax must be paid. But self-employed filers apparently don’t need to make the first estimated payment, the April 15, 2020 payment on their 2020 taxes – that too has been postponed to July 15. So what happens to the June 2020 second estimated payment, and the September 2020 estimated payment? Think about that for a second – 3 out of the 4 estimated 2020 tax payments will be paid between June 15, 2020 and September 15, 2020 (with the final… Read more »