By: Mark Glennon*

A research report published by Morningstar yesterday empirically validates a central criticism of public pension plans — that corruption and excessive public pension debt go hand-in-hand.

Morningstar’s Director of Policy & Research, Scott Cooley, ran a simple correlation test between historical levels of corruption and unfunded pension liabilities for all states. Sure enough, corrupt states tend to have larger unfunded pension liabilities. The correlation “easily meets the test for statistical significance,” concluded Cooley.

We’ve known from earlier studies that corruption is costly for taxpayers in many other ways, and Cooley describes some of that earlier work. But his new study adds the pension element.

Illinois is at or near the top of all state rankings on historical corruption and per capita unfunded pension liabilities.

How does the causation work in this correlation? Cooley writes that, “In Illinois and many other states with high levels of corruption, the opacity of pension-funding calculations would make it easy for public officials to shortchange public workers’ pensions and direct state resources elsewhere.”

But there’s more to it than that. Causation works in a number of ways, running in both directions. As government officials and union leaders get older and more powerful, they become more and more tempted to worry about about maximizing their own pensions and less concerned about the public’s interest. They have the power to increase benefits, “spike” and game the system in other ways, all while hiding the true costs to taxpayers. They select the trustees, managers and actuaries who generate the phony assumptions and models. They set the rule on what’s pensionable income and what isn’t. They corrupt the pensions, but the pensions also corrupt them.

Which is why our constant refrain on this site has long been that defined benefit public pensions are hopelessly opaque, corrupt and corrupting, and are incompatible with any fundamental notions of fiscal responsibility and open government. Get rid of them as fast as fairness and the law allow.

*Mark Glennon is founder of WirePoints

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

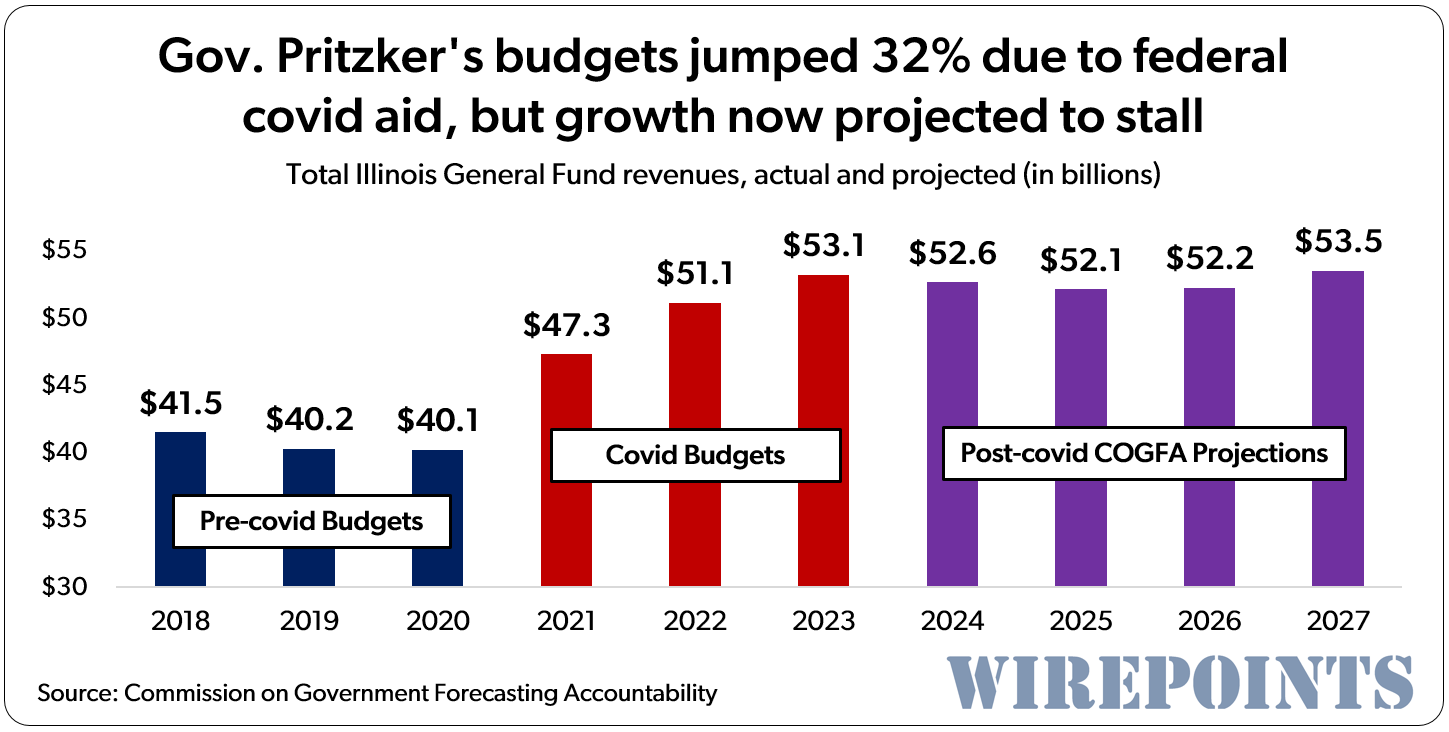

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more. Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow. Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.