By: Mark Glennon*

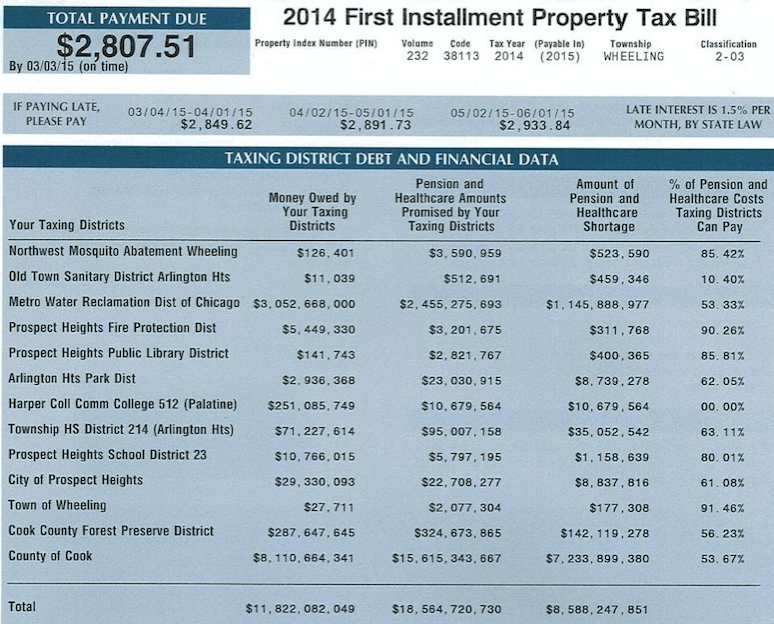

Nobody of any political stripe or party can defend property tax rates now exploding in many communities surrounding Chicago. Aside from rank unfairness, some towns are on a clear road towards self-destruction. The resulting loss in home values is a personal tragedy for those who can least afford it, making this is an issue on which progressives and conservatives must agree. The crisis will worsen because stunningly large, further bills have just been stuck in the drawer, not yet sent — unfunded municipal pension liabilities.

This article collects data on the towns and villages surrounding Chicago with the highest “effective property tax rates.” That’s simply the percentage that annual taxes represent compared to true market value of property. It’s the real rate. It avoids the obfuscation of nominal rates, equalization factors and other adjustments that plague property tax analyses throughout Illinois, which few understand.

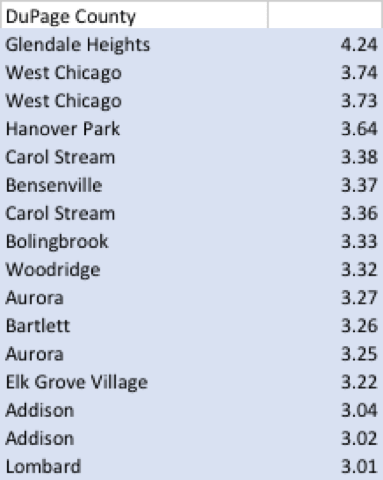

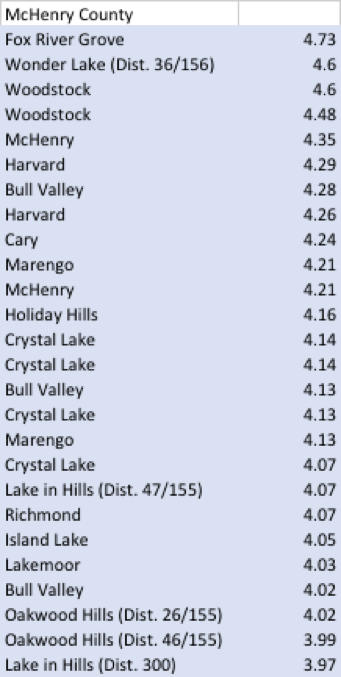

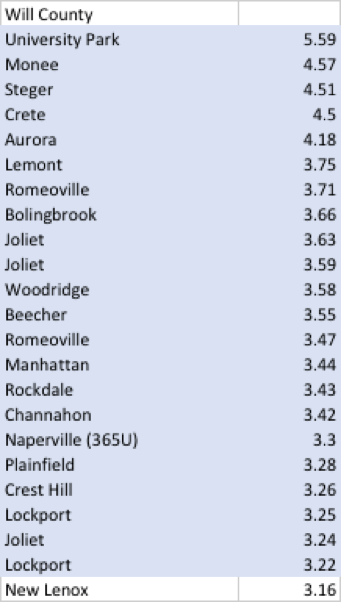

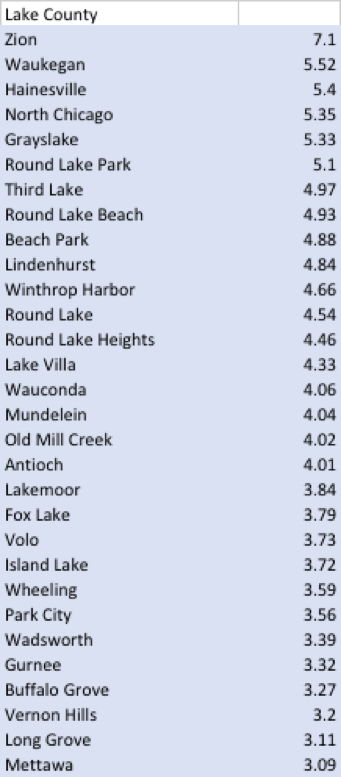

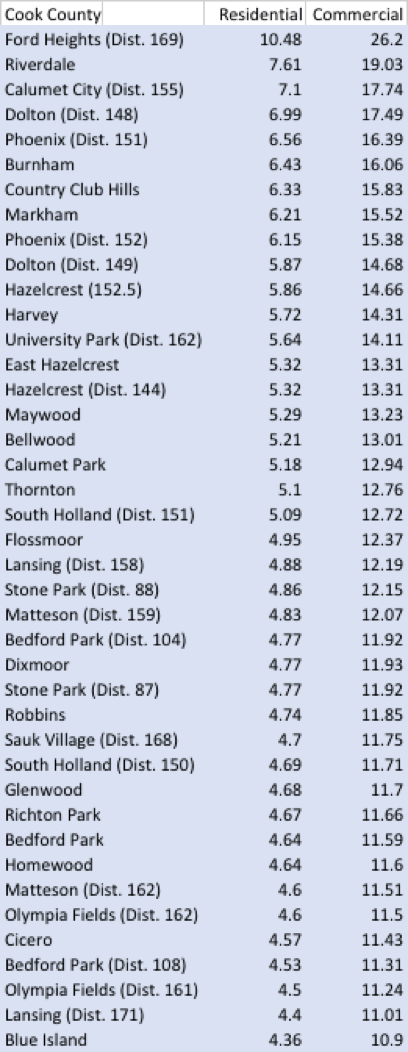

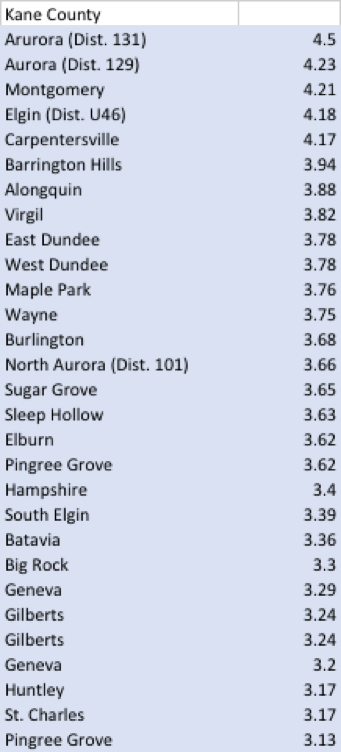

Last week, we wrote about this topic for south suburban Cook County, where exceptionally high rates predominate, dooming the area. This article is about other communities in Cook County and its five surrounding counties — McHenry, Will, DuPage, Lake and Kane.

Some communities have relatively low rates, such as those with a large base of commercial property to tax. Oak Brook’s, for example, is just 1.25%. Others have lower rates because home values are high, so big bills mean lower percentage rates. Lake Forest, Hinsdale and Barrington, for example, have rates under 2%.

Below, by county, are the communities with effective rates over 3%, which I think are into the danger zone, for reasons I will explain. Some others are past that and on to suicide. Any casual look at recent sales data and asking prices says market values and effective rates in the most oppressed communities are worsening, so these numbers may be low. These numbers are extracted from a database on effective rates recently compiled by the Chicago Tribune:

How much is too much? At what point do rates become a self-destructive death spiral driving values down and rates up? Opinions vary and it depends on the community. Your opinion, based on personal familiarity you have with any of these towns, is probably more sound than mine or any experts. In general, however, my sense is that most would agree that rates over 3% are into the danger zone of sparking a downward spiral. Over 4% and it’s is too late. Here’s why:

First, the national average residential effective rate is only about 1.5%, even in urban areas, as reported in this year’s annual report of the Lincoln Institute of Land Policy and Minnesota Center for Fiscal Excellence. (Rural areas have lower rates.) That’s half of what I suggest as the danger zone.

Second, the average 30-year mortgage rate today is under 4%, so taxes over that exceed the cost of a mortgage. However, the real cost of rates over 3% and moving toward 4% is staggering, and truly approaches confiscation.

Thinking of it like a perpetuity is appropriate. Homeowners are putting up their homes as collateral for a perpetuity. The value or cost of a perpetuity, finance professionals correctly say, is the annual payment divided by market long term interest rates which, again, are well under 4%. So, for example, a family with a home worth $200,000 paying $8,000/year in property taxes (4%) is effectively forced to buy a perpetuity costing over $200,000 — more than the full value of their home. And that obligation is secured by a first lien on their home, ahead of the bank’s mortgage. “Homeowners” are hardly that; they actually just hold a very junior residual interest.

Finally, the cost in terms of suppressed home values is mind-boggling, and it falls especially hard on the poor and middle class. Home prices in the Chicago area have badly lagged behind other major metro areas over the last ten years, according to the Case-Shiller Index, as we wrote earlier.

Other causes contributed to that, but high, increasing property taxes are are the most direct and clear reason for that underperformance. Adding up the lost value for the whole Chicago area means tens of billions directly out of the pockets of area homeowners. That loss may be sustainable for people with means, but for the poor and middle class, home equity usually is the only meaningful asset they have.

Property owners in the most oppressed communities around Chicago already know this story, but it has gone largely untold in the press. Kudos to the Chicago Tribune for compiling the database from which effective rates above are taken. But even the Tribune, often said to be financially conservative, missed the story in its own data. Instead of seeing the high suburban rates, its article announcing the database saw it as proof that city taxes are low. Its headline was, Even with Emanuel hike, city homeowner property tax rates still below suburbs.”

One reporter on this issue is has been Phil Kadner. He’s been writing about it as it developed over two decades from a liberal’s perspective, mostly for the Tribune’s Southtown section covering the south suburbs. Most recently, he wrote, “The people who suffered most from the property tax debacle were senior citizens driven out of their homes by soaring bills and students in poor communities who received a second-rate education.”

“The answer, by the way, can be found across the border, in the booming suburbs of northwest Indiana,” wrote Kadner. Hat tip to him for being on top of this meltdown since the beginning. Employers and homeowners have been fleeing to Indiana for its business climate and effective property tax rates under 1%.

Note a few things about two Chicago area counties. First, that list above for McHenry County is actually the entire county. That is, all towns in that county have rates over 3%, which is certainly scary. Update: McHenry County residents are fed up, apparently. A new Northwest Herald article details the exodus underway because of property taxes.

Second, you may notice that the highest rates for Cook County are in its south suburbs. That area is clearly in a death spiral, which was the focus of our article last week. Finally, Cook County generally taxes commercial property at 2.5 X the effective residential rate, which is why those rates are separately listed above for Cook County. (The exorbitance of those commercial rates is a separate story.) For the collar counties, however, commercial rates are the same as residential.)

Perhaps most frightening of all, much larger property tax bills remain to be sent out. Most communities with high rates are working class ones with the worst unfunded pension liabilities. Aurora, for example, with rates well over 4%, has police and fire pensions with unfunded liabilities totaling an absurd $262 million. Elgin, also with rates over 4%, is $175 million behind on pensions. (Elgin’s police, by the way, have an average salary of $95,000/year on top of which the city pays over $60,000/year in pension contributions. That’s not uncommon and we are linking to similar stories about Illinois municipalities.) The list of impossible municipal pension obligations goes on and on. You can see all their numbers in the state’s latest biennial report.

Look, folks, we have an unprecedented, monumental problem, and it’s not a partisan issue.

Many Illinois towns, as well as Chicago and the state, simply are not generating the revenue, growth and jobs they need to pay for the promises they’ve made. Only radical solutions will work. A genuine freeze on effective property tax rates is one way to halt the march towards a death spiral so many municipalities clearly are on. For some others, that won’t do — a roll-back is imperative. If you have other ideas, let’s hear them, but “more revenue” demonstrably isn’t the answer for these communities.

*Mark Glennon is founder of WirePoints. Opinions expressed are his own.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

You correctly observe that the tax burden will make buyers less willing and able to pay a seller’s asking price. How quickly will taxes fall in response to lower market values? How many government services will deteriorate (education, police protection, health, etc. In worst case situations (Detroit) people either abandon their homes or live in them without paying taxes until foreclosure occurs — resulting in more empty houses. If tax assessments go down bassed on lower market values the tax collection trajectory will start pointing downward. Landlords won’t be able to afford repairs to the property. However, legislators fail or… Read more »

You already SAID the solution: we made too many promises we SHOULDN’T HAVE made and now we can’t keep. Municipalities are now demonstrably insolvent. Soon they will face inevitable liquidity crises…as the saying goes, you go broke quickly, then all at once. The solution is doing what every other organization in the US does: enter into some form of reorganization either through a court or privately negotiated, in order to reduce the liabilities (aka promises) which now cripple the organization. I would hardly call this “radical” – more like typical. But for various reasons the majority of citizens will end… Read more »

I totally agree. Bankruptcy or some similar reorganization is unavoidable, as anybody who does that work in the private sector would immediately see if they look at the numbers. That’s true for dozens of muncipalities including CPS and Chicago itself.

You’re too trusting of the Tribune data. Tribune rates don’t take exemptions into account. Census data do and put McHenry County avg. property tax rate at around 2.5%, not 4%+. Still very high but be careful about your assumptions.

The census data are wrong and outdated. Yes, the Trib data does not reflect exemptions, but it does not make that big a difference. From what I can tell, their numbers are in fact a bit low, even if you include exemptions, because they still work off the official assessments. If you do some sampling you can see that even with exemptions the Trib data look low.

And here’s a new must-read article about the stampede of people fleeing McHenry County because of property taxes: http://www.nwherald.com/2015/11/24/mchenry-county-property-taxes-residents-vote-with-their-feet/anngsfp/

Mark: Great article and research ! I’d add another conclusion: It’s nearly if not completely impossible to estimate how much poorer the (non-govt) citizens are, because of all the govt largesse, and all the transfer of income from taxpayers to govt. AND, how much job-creation and prospects of gainful employment, the citizens have been harmed by this excess taxation. It’s unfathomable how much harm the state, city and local govts have done to the people (people who haven’t had their bread buttered by govt). I’m surprised no one at U of C in the “Milton Freidman” school of economic thought,… Read more »

Rauner was 1000% correct in his campaign, Crony capitalism is killing Illinois. Property tax rates are evidence of it-as is the continuous flight of people out of the state. No one in Illinois owns their home-they rent it from government.

The colonies revolted because England restricted trade (mostly for tea) and taxed us without representation. Paying high taxes is one thing if the money went towards assets and expenses the community needs. It’s quite another thing to tax one group of private middle class people, to simply hand the money over to another group of public sector middle class people above and beyond salaries. At that point it is not taxation, it’s blatant redistribution under the protection of law.

I would hardly call people that get a raise every 4.5 months middle class. https://www.illinoispolicy.org/reports/contract-with-top-union-yields-big-payouts-for-state-workers-2/

Rick: PERFECTLY STATED ! Mine was similar, not as ‘perfect’, last week in Mark’s article on the southside prop taxes where we grew up