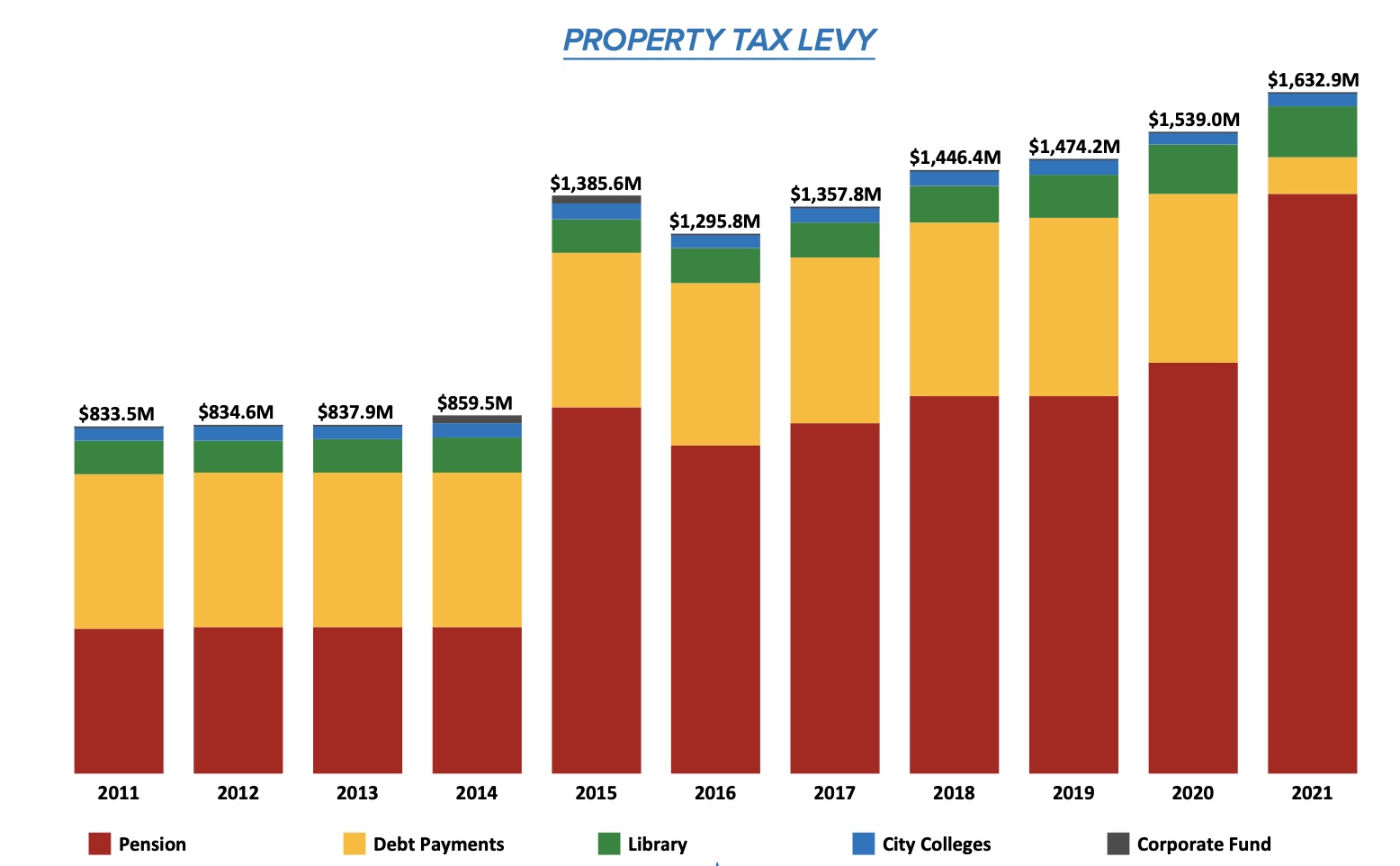

What’s the impact of Chicago’s pension cost on its property taxes? This one chart from the city’s new budget forecast is an indication. It shows how the property tax levy increased over the last ten years. The levy is the total amount collected in property taxes.

Note the red at the bottom, which is the portion of the levy the city has budgeted for pension contributions.

The above is only for taxes that fund the city’s main operating account — its Corporate Fund. Property tax bills in the city include separate charges for the school district and other overlapping taxing districts.

The above is only for taxes that fund the city’s main operating account — its Corporate Fund. Property tax bills in the city include separate charges for the school district and other overlapping taxing districts.

Also, since money is fungible, it’s a bit arbitrary for the city to budget a portion of the property tax to pensions. The city has other revenue sources, though the property tax is the biggest.

Still, the chart makes the point everybody should know: Pensions are a huge and growing crisis. They are the 800-pound gorilla in the room — for Chicago, the state and most of its municipalities.

We will be writing much more about the budget forecast when the budget is formally proposed next month.

-Mark Glennon

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Property taxpayers may have thought they already paid the bill for non-working public school district employees (who collected full salaries and benefits in 2020-2021).

Think Again!

These creatures may be getting duplicative payments of UNEMPLOYMENT Benefits.

Illinois Businesses which are burdened with replenishing Unemployment Insurance compensation funding may find this horrifying:

https://www.ctulocal1.org/posts/psrp-summer-unemployment/#:~:text=On%20June%2025%2C%20Governor%20Pritzker,for%20unemployment%20again%20this%20summer.

Just in case you thought you might be able to verify this suspicion with FOIA, Think Again! Governor has engineered law which makes obtaining evidence of school employees receiving full salaries PLUS full+COVID-Enhanced Unemployment Benefits nearly impossible (for any average citizen. If ACLU still operated under its original Charter, they might be able to afford to breach these defenses of Public Unions’ potential malfeasance erected by Governor).

https://ilga.gov/legislation/publicacts/102/PDF/102-0026.pdf

Got a property reassessment from Mr Kaegi in yesterdays mail—INCREASE OF +25%!!, on my 1,200 sf bungalow. Yikes, at my age this might be the nail in the coffin.

What is the portion of the levy that gives the cost estimated for the pension funds ?

This is disappointing to say the least. I live in Lake County, but 66% of my property taxes go to the local school districts and their pensions. But pensions are the second biggest part of my property tax bill.

Why the hell are we paying for libraries at all, and so much? So bums have a place to go watch porn? Who really uses the library anymore? The books are out of date.

Niles library spends 1/2 a million a MONTH!!… they all had a big hissy fit when a couple conservatives got on the board and wanted to trim it a small bit.

… or lock themselves in bathroom stalls or sprawl mumbling in a chair while intermittently challenging someone who wants to read in a different chair in the same “quiet room” with my favorite Clint Eastwood quote — “are you feeling lucky?” The librarian appears and shrugs. A police officer in the lobby looks the other way. The chair of the library board makes an inane comment about her helplessness due to budget cuts. The City Council chair says I must be a racist or worse. She’ll get re-elected. (excuse me: THEY’LL get re-elected.) They is indispensable because of spending a… Read more »

The parking lot around the Homer, Lockport, etc. libraries usually have only a few cars of the employees. Go in and they are empty. Look at the reference or technology books and they are literally two decades out of date. I hate the pseudo word re-invent, but libraries as they are now are a total waste of funds. You’ll usually see a few kids below 8 after that age no kids go to the library. Then you’ll usually see the token 80 year old man learning how to use the mouse on the computer. Then you’ll see a few perverts… Read more »

Same out here Fountaindale library district between Bolingbrook, Romeoville, and Crest Hill ( the one in the middle of no where next to Menards ) is such of waste of taxpayers money, and yes everything is outdated. Oh and by the way the one in Crest Hill, everyone thinks it’s a office building, tell ya something.

Here’s some info on how Canada’s pensions are calculated

https://www.pspp.ca/page/how-your-pension-is-calculated

Here is how Canada calculates cost of living or CPI

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/cpp-price.html

Plus the maximum salary to calculate pension is $180,758 Canadian dollars which is still less than most supers/professors make. No maximum here in Illinois.

“Reliance” is a major factor in enforcement of contracts. If you tell me that I will receive X+3% after 30 years then I plan my life and expenditures accordingly. “Impossibility of performance” is a doctrine that recognizes some cutbacks when it is not reasonable to expect continued performance of the contract. Bankruptcy is the ultimate recognition that performance “ain’t gonna happen.” When the party obligated to pay, such as a city or a state, is precluded from going “out of business” federal law provides a cumbersome process to maintain a functioning government and that process “adjusts” obligations accordingly. Hence pension… Read more »

Can CPS graduates spell the word “budget”?

r-a-c-i-s-m

Show this chart to your typical Chicago resident and they can’t comprehend it. That’s the problem.

most chicago residents-” i’s dont care bout dat,jus gives me ma fwee stuffs”!!

That’s why its time to leave Illinois.

The deal with government workers used to be that in exchange for job security, low stress, lighter workloads and hours, favorable working conditions, heavy benefits and early retirement, and a terrific pension, workers would receive a slightly discounted rate of pay versus the private sector during their working years. The pension was to make it so they didn’t have to save from their paychecks, like private sector people do. Over the years that has dramatically changed. Now, they get all of the former benefits, but their pay is actually wildly above what the private sector pays. They now get the… Read more »

The problem some see with automatic 3% compounding of public pensions will be “solved” when we hit period of prolonged inflation. Remember the late 1970’s in terms of inflation? Those days are bound to return at some point, and that 3% compounding will devastate the purchasing power of IL public employee retirees. You can laugh with glee when that happens as surely it will. It looks lately that this will be such a year if the CPI figures for the last few months persist. Still, if one looks back at the CPI figures over the last 30-or-so years you’ll find… Read more »

It has occurred to me that inflation is probably one of the few things that will make this a little better. But that same inflation affects many other people, who can barely live on their means as it is. No, I’m not concerned about the government worker making $150,000 in retirement. But I am concerned about friends and family who only have social security and a limited savings to work with. And they worked all their lives. No one will be there to fix their purchasing power reductions due to the foolishness of the federal government. Our beloved public union… Read more »

SS checks track the nation’s rate of inflation contrary to your implication otherwise. Likewise most employees receive yearly wage increases at least tracking that figure. Those two things undermine much—but certainly not all— of what you’ve said about the private employees and those on SS.

And SS participants already paid full taxes on those wages because, unlike pension contributions, Social Security “contributions” are not tax deferred.

In theory, that is true. However, the government uses an index which does not tally up all of the inflation that people face every day and long term. This index has been “modified” many times since even the 1980’s. The modifications always seem to put downward pressure on “inflation” as a number. It doesn’t take a cynic to understand why — social security and debt affects the government greatly, so they have a big incentive to minimize it. There is a great website called Shadowstats, which demonstrates this: http://www.shadowstats.com/alternate_data/inflation-charts All of this does a disservice to social security recipients in… Read more »

You cannot have an unbiased opinion if you collect a public pension.

Like with say, Illinois lawmakers, judges and their staffs.

It is not “solved” by higher inflation. COLAs – most certainly 3% and compounded COLAs – are very uncommon in the pension world. They’re almost unheard of in private sector pensions. They didn’t even exist in Illinois’ pension systems until 1969. A pension system is under no obligation to keep up with inflation, just provide that base benefit to live on. That we tacked on AAI is a nice add-on – a benefit for which pensioners do pay and to which I don’t entirely object – but that we are locked into 3% compounded that every year regardless of inflation… Read more »

These people don’t live in the real world. They are so delusional they think that they actually have earned all of this.

“Earned” is something of a nebulous term. Did you “earn” your salary, for example? If you think so, why should I necessarily agree? In reality what’s “earned” is what’s done by performing satisfactorily to a given contractual situation. If you’ve performed “satisfactorily” you’ve “earned” your salary. The same concept applies to other situations such as the one applying to retirees. The one whose earned his salary or retiree income doesn’t have to perform to your standards at all.

I suppose Hunter Biden feels the same way about his “artwork” that is going for $500,000 a pop.

He earned it!

And the $50,000 a month he received from Burisma in Ukraine, while Daddy-O was VP.

He earned that too!

My point is that the public sector has perverse “contracts” that are not based on the actual market conditions of demand/supply of labor, but instead on corrupt, extraneous quid pro quos exchanged exclusively by malefactors in the government and unions.

They did earn it. They exchanged their labor for pay as well as deferred compensation. Their employer offered them a specified wage and pensions and they fulfilled their end of the contract. Taxpayers didn’t pay enough to support the benefits that their elected officials promised. Now taxes need to increase to cover these contracts.

Not sure exchanging two years worth of sick days for pension service credit qualifies as labor.

The communist calls paying government employees to not work “earning it”

Of course you do, communist.

Not quite; the pension problem can also be solved by reducing the salaries of pensionable employees.

Too true. If not just common sense, this was confirmed by a judge (in San Diego, I believe). It is illegal, in some states, to reduce pension formulas for existing workers, but one can legally achieve the same result by freezing (or lowering) pay. Only one problem. What Illinois Entrepreneur says is simply untrue… “Over the years that has dramatically changed. Now, they get all of the former benefits, but their pay is actually wildly above what the private sector pays.” In fact, in many states, probably including Illinois, pension, “reform” (reduction) for new employees will likely result in offsetting… Read more »

Yes, in theory, but expect a statewide strike lasting for years by all unionized employees if anyone dares suggest cutting a union member’s pay by even one penny.

True-In many cases we have total pension pickups for teachers like here in Rockford and maybe partially for school employees but not sure on how much. Plus the amount each taxpayer contributes to the “pension pickup” is determined by the value of your property. Remember these contracts are made behind closed doors and I would wager that most homeowners in Rockford are clueless that they make the pension contributions. Maybe homeowners should get the pension since we are making the contribution so the higher my property taxes the larger my taxpayer pension will be. LOL Only in an alternate universe.… Read more »

The items you’ve mentioned are part of employee costs whether for salary or other bennies. If you/they want the services provided then there are costs involved to provide them, and most such costs are determined by contracts–even the “pension pick-up” which just another form of salary as far as the local Board of Education sees it. If the local citizenry demanded that to be dropped the changes are fairly great that the employee salaries would be increased commensurately, don’t you think?

Compensation would go up that’s for sure.

This is what I get for my school tax dollars. Great investment.This is 2019

https://wrex.com/2019/05/09/13-investigates-rps-205-teachers-say-failing-students-still-get-moved-on-to-next-grade/

Not necessarily. America is just now waking up to the fact that many school boards have in fact been infested with union-connected individuals there to represent the interests of teachers and not the community or the students. There are many recall battles taking place, and parents will be watching more closely in future elections. The problem is that the unions are organized and do this for a living; the parents and concerned citizens are not. These people will have to get better at running for these posts if they are to beat the unions. In the meantime, the Boards rubber… Read more »

And, considering that school board positions in IL are unpaid, what is their motivation to favor the unions so heavily and that’s especially true for people who run business in that community. They know full well that angry the community if not good for their businesses. Considering just those two factors it seems to me that your point of view is not as solidly logical as you might have thought.

There is most definitely some serious union shenanigans that go on in many board elections. My evidence is anecdotal, but I’ll take a look and do some research to see if there is any reporting I can find. I know that others on this site have some experience with this as well.

There is little doubt that teachers watch school board races closer than most people in the community. But, that doesn’t mean that the winner is always in their corner. Pres. Trump seemed to think that about “my justices” many of whom turned down his various legal arguments. In short, school board members act on their own consciences more than the behest of someone else or some other group. After all, its not a paid position. So, their conscience is their guide more than in most elections where personal financial decisions may be more of a factor.

James, here is the article I was thinking of, right here at Wirepoints.

This is more than just “teachers watching school board races.”

I would think you’d agree?

https://wirepoints.org/a-teaching-moment-why-reformist-school-board-challengers-got-clobbered-in-illinois-wirepoints/

Well, the article is certainly food for thought, isn’t it? There are several points of interest, but to me one of the main things to remember is that school board elections typically see low voter turn-out, meaning if any person or group wants to sway the outcome there’s the place you are more likely to do so with enough organization, persistence and advertising such attempts require. Teachers clearly have a personal interest in seeing that the purse strings are managed in their favor, of course. So, the chances of a financially conservative candidate winning are somehat lower when they are… Read more »

“Remember these contracts are made behind closed doors”

They are made with elected school boards. Welcome to representative government. Don’t like the deal cut then elect different board members.

Agree in part only. None of the details of the contract are allowed to be made public even by board members. I have never heard any of the details brought to public scrutiny before the contract is ratified only after. Are the board members working for the taxpayers or did the unions get them elected? Suppose a prospective board members platform is I will cut spending or I will reduce costs to taxpayers. The chances are slim to none that they will get elected. And what about gerrymandering? It would be difficult for a republican to get on the board… Read more »

See my post above.

This is exactly what is happening, as many people are waking up to what the teacher’s unions have done to their school boards.

We’ll see if concerned parents will beat the teacher’s unions, but it’s a fight that the unions didn’t expect to have to wage. It will mean more money the unions will have to plow into local races, and their candidates will have to openly lie about their positions in order to win.

Generally, parents want superior schools for their children. A proxy for that has been the tracking of housing along with the school district each house represents. The public at large seems to think big-bucks school districts bring superior educational attainment. Maybe yes and maybe no. But, the correlation, if there is any, isn’t as perfect as many might think. There are other factors at play, but the socioeconomic status of the community is one that has common mention. Its likely a fact that people with higher incomes tend to be better educated and value the same for their children more… Read more »

If you talk to teachers about this (and I have) they say that they can only do so much — it starts at home. Good teachers love teaching in “big-bucks school districts” because A) the pay is better and B) the kids tend to care more and connect more with the teachers. The kids mostly have better discipline. The job is fulfilling. When the parents don’t care, or are too preoccupied with other things, the kids really suffer. Teachers can help somewhat with that, but only with great personal effort and energy. After a while, that reservoir dries up, and… Read more »

Freddy – FOIA your school district and ask them to provide the evolution of the pension pick-up. What it started out at, any contracts where the pickup was either first offered or increased, etc. I’d wager the value of the pickup has been long forgotten and unaccounted for in current compensation.

Good idea. I don’t think they gave up any salary increases in lieu of pension pickup.They got both. Every contract in Dist 205 is larger than the year before except for one year. Now approaching $500M with declining enrollment. This is why transparency is paramount. If details are made public before ratification it would give a good idea on what to expect in increased costs to homeowners. The homes that have higher value probably send their kids to private schools but their values have mostly decreased due to high taxes. Also people forget that it is the states primary goal… Read more »

I think it flipped sometime around 1990. Teacher salaries began to improve greatly in the 1980s. Then pension spiking became prevalent and more pronounced (like 20% compounded raises over 2 years), then institutionalized, compounding the problem. Then pension enhancements (like increasing the service year multiplier, ERIs, compounded COLAs, etc) for pennies on the dollar exacerbated the problem. Basically, you had a large number of pensioners receiving pensions that don’t properly reflect their actual career earnings.

I can’t think of anything more undervalued in the public sector than job security. It is easily worth at least 20-30% premium on top of base pay.

Especially given that so many of them cannot be fired for performance. They literally have to commit a crime to be dismissed from their job.

FWIW, an American Enterprise Institute study calculated the Illinois job security advantage at 5 percent of wages, slightly below the national average.

FWIW

This problem is incredibly simple and complex simultaneously. Its simple in that anyone with a modicum of economic sense knows that if you forever pay less (in the actuarial sense here) than what you owe the outstanding debt keeps rising. The complexity of it arises from political reasons for doing such stupidity by appeasing all groups involved through decades of purposeful actions otherwise which would have averted or at least seriously reduced the current level of the problem. The fingers of blame point in various directions, none of which want to give an inch as to a compromise. So, what’s… Read more »

I guess it’s only boring if you don’t own a business here, or have to pay for it.

Its boring only in the sense that its been said over and over again in many different ways here and other places as well. So, while showing it as a chart is attention-getting for some the idea itself itself is far from new to anyone who has paid attention to such things over multiple decades or even multiple years lately at least. If you found the chart more interesting its likely you haven’t done such things

I agree that it’s redundant, but that’s kind of the focus of Wirepoints. They have a sustained approach to this topic, versus the rest of the flighty media, which writes the “we owe billions more — what a surprise!” article once a year when COGFA comes out of their cave.

The fact that it’s redundant and a bit tiresome means Wirepoints is doing their job.

And to be honest, I get tired of seeing it as well, because nothing happens. But I’m committed to spreading the word and at least staying engaged. At this point it’s all I can do.

That’s how we see it. You regulars here are probably one-percenters in terms of following the news, and we accept the reality that you may see redundancy. But the good news is that our reach expands consistently. We have more and more local media picking up our work and our web traffic is always expanding, so more and more people are being exposed to things they haven’t seen.

I agree wholeheartedly with your overall approach of spreading the word as to the existence of basic governmental financial problems. Again, its only “boring” to me and maybe other regulars here in that we’ve seen this topic discussed and shown in many ways. That’s not to say other people who don’t follow Wirepoints with regularity would feel similarly; I’m reasonaly sure they don’t. You are doing a good service here slogging through all of these day to day without the obvious fatigue of saying essentialy the same sorts of things over and over again. Keep up the good work; its… Read more »

Yeah, James, I thought the rising rate of defaults in instruments contained in mortgage backed securities or CDO’s was boring in 2006 – as you say – yawn. Delinquencies were steadily increasing but we were assured that the rating agencies gave any number of these collective 30 trillion dollars or more of investments safe ratings – again yawn. Then the deficiency numbers got big – real big – to the point where banks around the globe could not meet capital calls and we looked at a world economy being ruined. Obama’s actions in saving the banks was a wise and… Read more »

Sure, its boring to some of only in that we’ve so many versions of this same story over and over again. That’s not to say its unimportant nor even unimportant to be publicized repeatedly. There are always going to be people who are unaware that problem exists or that its a great a problem as it is. Its a HUGE problem, and I’m not saying otherwise.

I have a shadow mortgage on my home because of these pensions. My property taxes are far too expensive.

Maybe you should start a campaign to increase income taxes in exchange for property tax reductions? Taxes need to go up so decide where….tax retirement, services, income taxes, property transfer taxes, etc…?

That’s a way around the prohibition for a progressive income tax system while still generating more income taxes from those who can more easily affort it while simultaneously offering overall tax relief to the less affluent at least. More thought should be given to that idea.

Does the law allow individuals or corporations to make voluntary contributions to the IL treasury? That way all those who believe that they need to pay more taxes can make a contribution that aligns with their idea of the proper tax rate. The current tax system remains in place for everyone else. Win-win, right?

But that’s not really what you want, is it?

PensionsPaidFirst – most of the tax increases that will be enacted will be regressive. State pensioners are a protected Mandarin class, so making it more difficult for the lower middle class and middle class is of little consequence to the political union industrial complex. There are, whether agrees with them or not, reasonable arguments for a progressive tax on the top 1 or 2 percent. But as the recent vote reflects, that is hard to get passed. There are not enough rich people, and given the horrid way Illinois politicians manage money, the middle class and upper middle class –… Read more »

That is a good idea in part. In Indiana that is what they did. In exchange for reducing property taxes the counties enacted a local income tax anywhere from 1% to 3%. Most counties are in the 1 to 1.5%. I believe Jasper county is 3%. What started that movement was some jurisdictions taxed property on insurance replacement costs not fair market value which in turn skyrocketed tax bills. They voted out many pols which can’t be done here and reworked the system. I think an affluent suburb of Indianapolis started it when taxes went from $9 or $10K on… Read more »

And that’s the way it is all over IL. Maybe you need to think about moving. Complaining might make you feel better for the moment, but it doesn’t do much to solve the issues unless massive amounts of the citizens here do likewise.

Living in my home for 30 years I am now faced with being pushed out of Illinois away from my family and friends and businesses I trust because the rising taxes are just not sustainable

Exactly… I feelam being forced out of my home of 35 years, leaving friends and family and businesses I trust because these increasing property taxes are not sustainable… And now there’s this!! A Bill passed by almost all representatives in the illinois house and senate, is either signed or waiting to be signed by pritzger, Bill 508—when taxes are reassessed from all, businesses etc, the cost of what is refunded or revised will be passed on to all other taxpayers! Do you see the abuse that will occur with this? Simply overcharge (even more) all taxpayers, and then when challenged… Read more »

This may be a way for taxing bodies to circumvent Ptell rules. We in Ptell counties already have higher tax rates because anyone getting an abatement or wins their assessment appeal or even the homeowners deductions increases the tax rate to compensate. This seems to me that because the taxing bodies are limited to 5% increases that this is a way to go around the rules. With rising home values they are limited to 5% max even though they still get what was levied (not billed or collected) the year before. So if our homes double they can only get… Read more »