By: Mark Glennon*

What’s worse than central planning? Autocratic central planning. What’s worse than autocratic central planning? Autocratic central planning that pours hundreds of millions of dollars into a failing effort.

But that’s exactly what the Illinois General Assembly just authorized for Gov. JB Pritzker.

Under new legislation, Illinois will deposit up to $400 million over the next six months, upon Pritzker’s request, into a newly created “Large Business Attraction Fund.” The Pritzker Administration says it will be used to “provide the state with flexibility to tailor development packages to each unique situation.” The legislation passed in the Senate Sunday evening. It was earlier passed by the House and awaits Pritzker’s signature.

Pritzker first floated the idea in an October interview with Crain’s, indicating the fund would be a means to rescue his floundering efforts to lure electric vehicle makers to Illinois — his “Reimagining Electric Vehicles” plan. Crain’s and Wirepoints have written several times about that failing effort.

“But with Illinois not yet luring big facilities such as those recently announced in Michigan, Indiana, Ohio and other states, Crain’s wrote, “Illinois could use a big deal-closing fund, Pritzker said—essentially a pot of money the governor is empowered to dip into to sweeten economic development deals when the competition with other states is tight.”

The fund will be administered by the Illinois Department of Commerce and Economic Opportunity, which means it will be run at Pritzker’s direction with no further action needed by lawmakers.

Guidelines for the new fund are vague. The money will be used for loans to “large firms,” which is undefined, that are considering locating a plant in Illinois. Those loans assuredly will be on below-market terms, otherwise the firms could get the loans in the market.

Targeted companies for the program needn’t necessarily be in the EV industry, but “shall primarily consist of established industrial and service companies with proven records of earnings that will sell their product to markets beyond Illinois and have proven multistate location options,” says the legislation.

If Illinois truly has the cash available for this kind of thing, it should be used to help all employers through some direct means such as a reduction in withholding or other taxes. Government is particularly bad at picking winners and losers or looking into the future. It’s better to let the private sector take the losses gambling on that, as we see things, and the private sector is more likely to get it right.

Related columns from Wirepoints:

- Did Illinois politicians crush their ‘EV hub’ dreams by outlawing Right-To-Work?

- Belvidere auto plant closing looks like another blow to Illinois ‘reimagining electric vehicles’ industrial policy

- Electric Vehicle Makers ask Pritzker To Outlaw Their Competition

- Rivian stock price collapse, potential brownouts, highlight the danger of Illinois lawmakers picking winners and losers.

- The special interest smorgasbord inside Illinois lawmakers’ 800-page-plus green energy behemoth

- More Signs That Illinois’ Green ‘Industrial Policy’ Is Failing

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans. Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it. When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

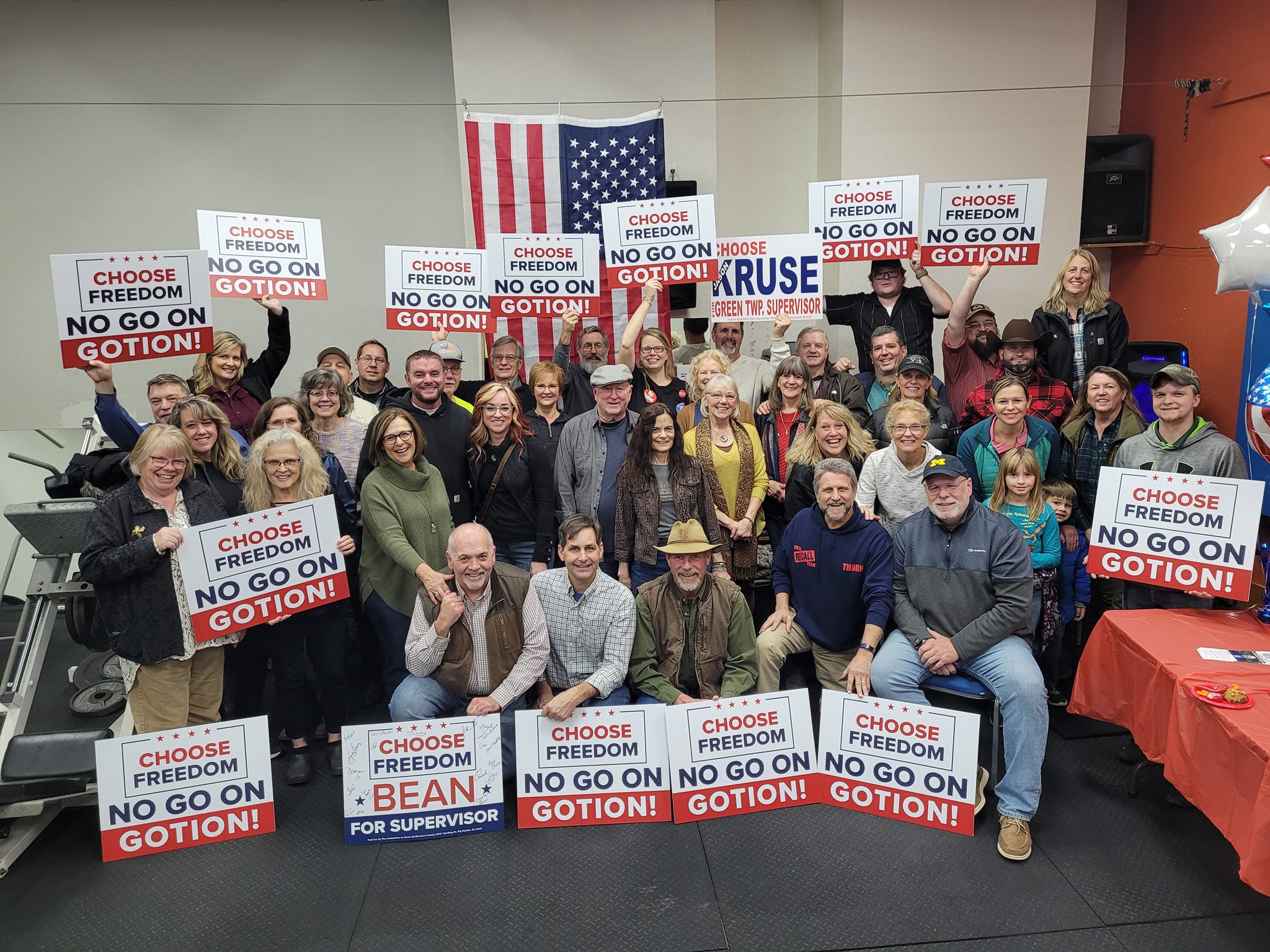

When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

Because lowering taxes, cutting regulations, and making neighborhoods safe for families is too difficult for the one-party rulers in Illinois.

Hmm, this could be the Solyndra sequel

…

TIFs are a nationwide phenomena that amount to giving tax breaks to companies because the local taxes are too high. I hear so often complaints of socialism creeping in and, to me, this is an example of the creep. Businesses that become more or less joined with political powers are a great example of how socialism works. Be careful of what you wish for because you ight just get it.

TIF Districts are used as a crutch to prop up a noncompetitive business environment. My property tax bill is not transparent. I have no idea how much diverted from the taxing bodies on my real estate bill.

Civic Lab has done some work on this and you might be able to get some transparency by going to https://www.civiclab.us/tif_illumination_project/

Well, I’d say that because of this we can count on being at the top of the “where should we locate?” list for every unionized private sector company whose owners, managers and bargaining unit employees don’t care how high their business and personal taxes are, so long as they can live in a state that’s so successful at all of the things that Illinois does so well.

I’m just sure that there are a bunch of companies like that out there…..

Illinois’ business hostile climate is poison to any industry

OK, Illinois passes Amendment 1 killing RTW and passes a zillion other anti manufacturing/ pro union bills and now turns around and creates $400 mil taxpayer funded slush fund as bribe for large manufactures only (i.e. with unionized workforce) to overlook Amend 1 and everything else? Brilliant—or other words the $400 mil is a taxpayer handout to big labor.

Once again, after passing Amendment 1 and killing RTW its going to look really bad for jb, uaw, unions, Biden admin if ZERO manufactures choose to locate in Illinois or flee like the citizenry.

Illinois may be ostracized by big business for killing the possibility of RTW.

Amendment 1 was never meant to attract new business. They know the bill is anti-competitive and gives union too much power. They’re just trying to squeeze the taxpayer and consumer out as much as they can before all the business leaves the state. It’s the same logic as raising prices when business is slow on captive customers to keep revenue up.

What could go wrong?

To most of the country, Illinois is tainted and becoming toxic. People and businesses in other states will increasingly want nothing to do with it.

Seems like my whole life I’ve read about governments giving some kind of financial package (like tax breaks) to lure new business. The real story hasn’t happened yet. Undoubtably, Pritzker will mismanage the slush fund in some corrupt or idiotic manner. Say what you want about the man, he’s consistent.

Like a drug dealer, the first factory is free.