By: Ted Dabrowski and John Klingner

Like most people, Steve Schildwachter was initially too busy to figure out why his property tax bills kept going up. For a while, the Park Ridge resident and marketing executive simply paid his taxes and moved on. But as his property taxes nearly doubled, Steve vowed to understand his tax bill.

“People think that appealing their property assessments solves the problem. But all that does is push the burden away from you and onto your neighbors. It doesn’t do anything to lower overall taxes or slow down spending, driven largely by school districts. The real problem is spending. Governments decide how much they want to spend and then they just give you your share of the bill.”

Steve is right. In Park Ridge, property values still haven’t recovered from the effects of the Great Recession, yet local officials continue to tax more and more, especially to pay for schools and local pensions.

School district costs

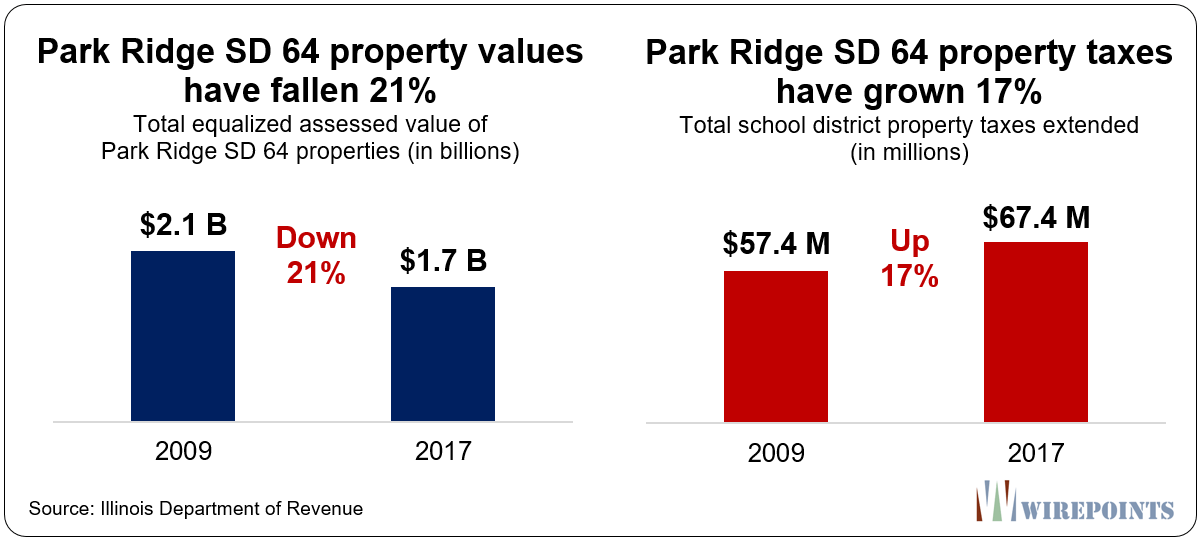

In Park Ridge School District 64, for example, property values are down 21 percent compared to 2009, yet the district has hiked taxes by more than $10 million, or 17 percent, over the same period. That hurts since taxes for schools typically make up 60 to 70 percent of a resident’s property tax bill in Illinois.

Part of those higher property taxes go to pay for increasingly expensive compensation. Forty percent of the district’s full-time employees made more than $100,000 last year. The highest paid of all were the district’s administrators. The top five all received between $140,000 and $300,000 in total compensation.

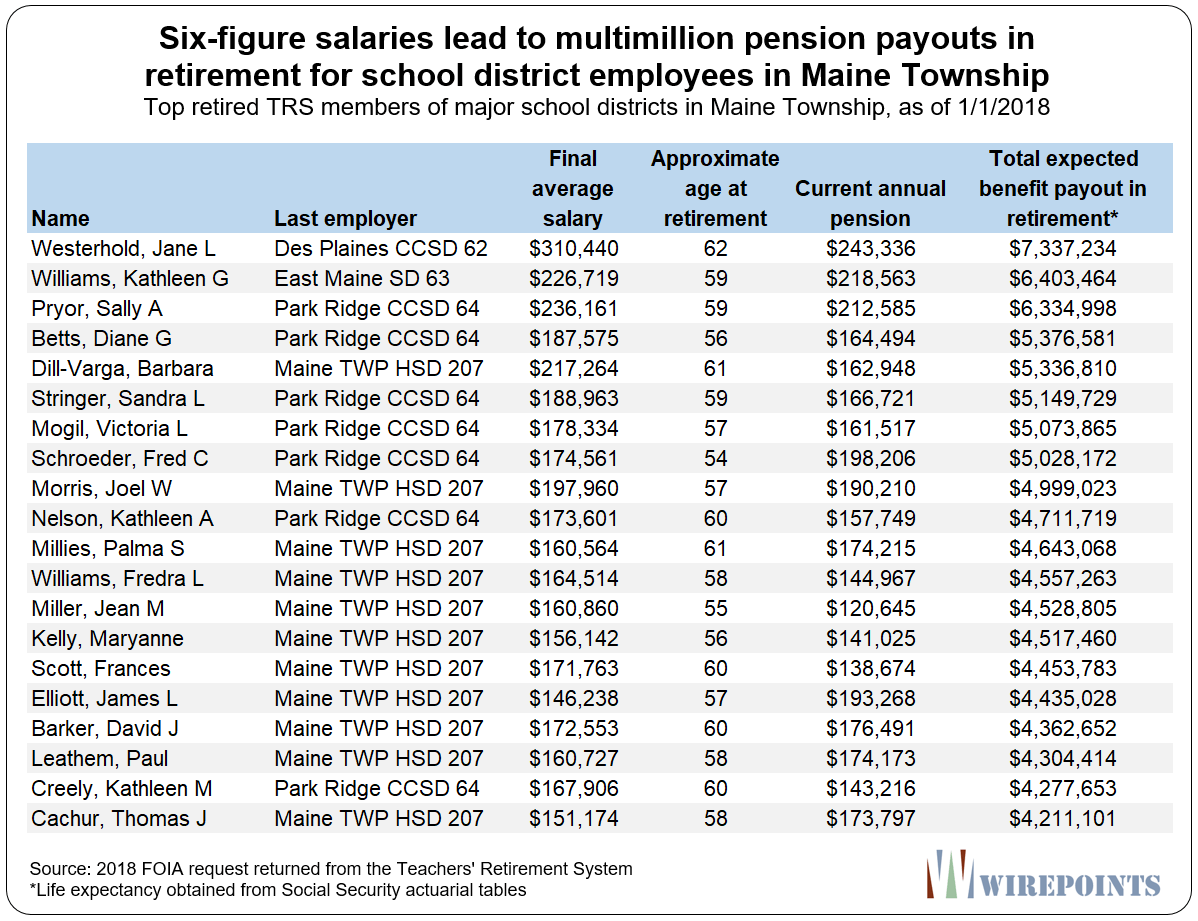

Those six-figure compensation packages will translate into multi-million dollar pensions when those bureaucrats retire, not just at Park Ridge, but also at Maine Township’s other districts.

The top 20 retirees from Maine Township’s four main school districts are below. If they live to their full life expectancy, they’ll each receive between $4 to $7 million dollars during their retirements, depending on their starting pensions.

All the above creates a vicious cycle. High salaries drive up pension costs for the state, leaving less state education funding available for classrooms. That, in turn, drives up local property taxes for education. Wirepoints covered that cycle in a special report: Administrators over kids: Seven ways Illinois’ education bureaucracy siphons money from classrooms.

Public safety pensions

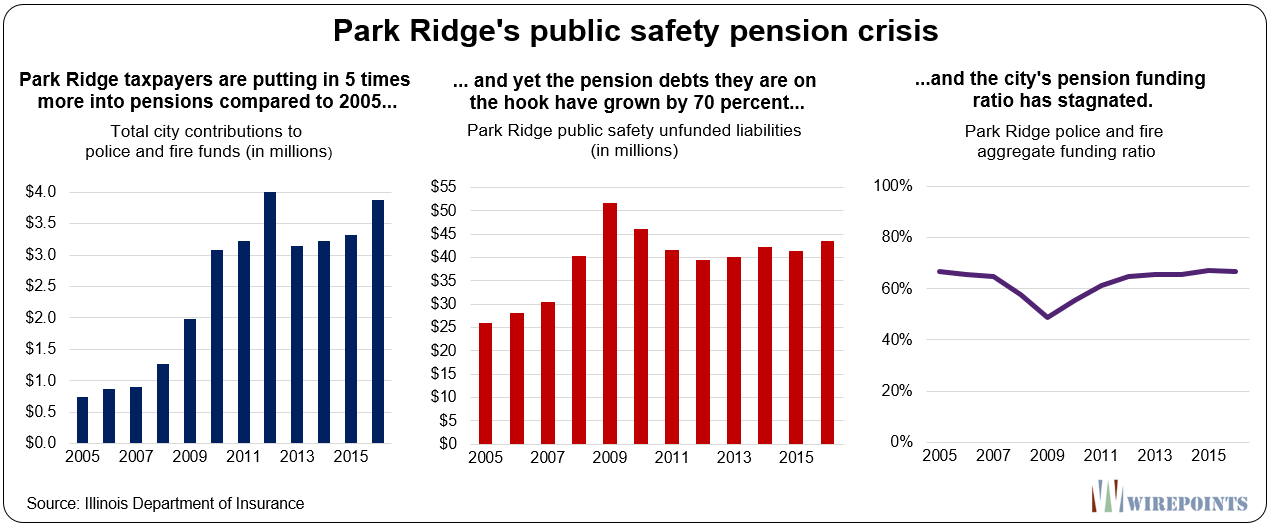

Residents of Park Ridge have also been forced to spend more on the city’s rising local public safety pension costs. Today, the city – meaning taxpayers – puts in five times more money into police and fire pensions than it did in 2005.

But the debt burden on Steve Schildwachter and other residents has grown despite all that extra funding. In 2005, the public safety pension shortfall was just $26 million. Tens of millions in taxpayer contributions later, and residents now owe more than $43 million.

All that additional money hasn’t improved the overall health of the funds, either. In 2005, Park Ridge’s public safety pension funds had just 67 cents for every dollar they needed on hand to pay out future pension benefits. Today, the funding ratio is still stuck at just 67 percent.

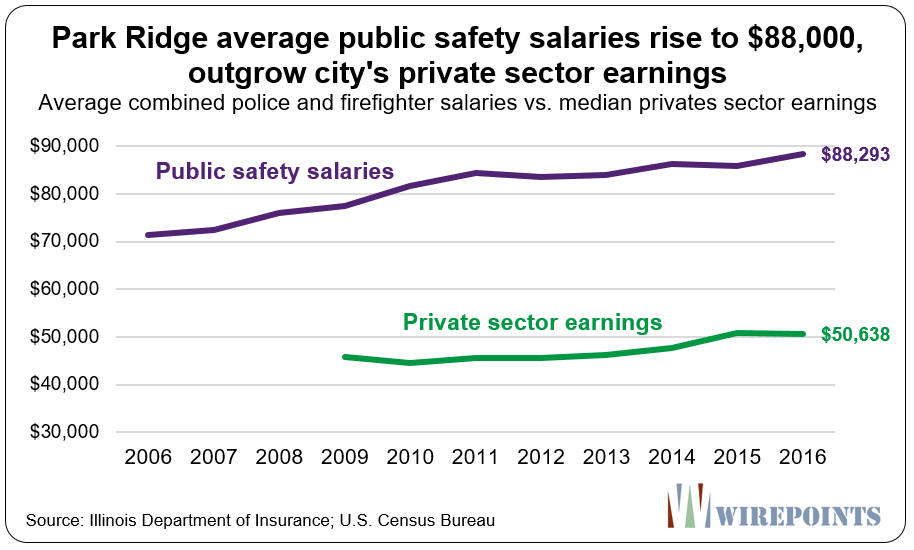

The pressure on taxpayers will only get worse as pay rises and more public safety workers hit retirement.

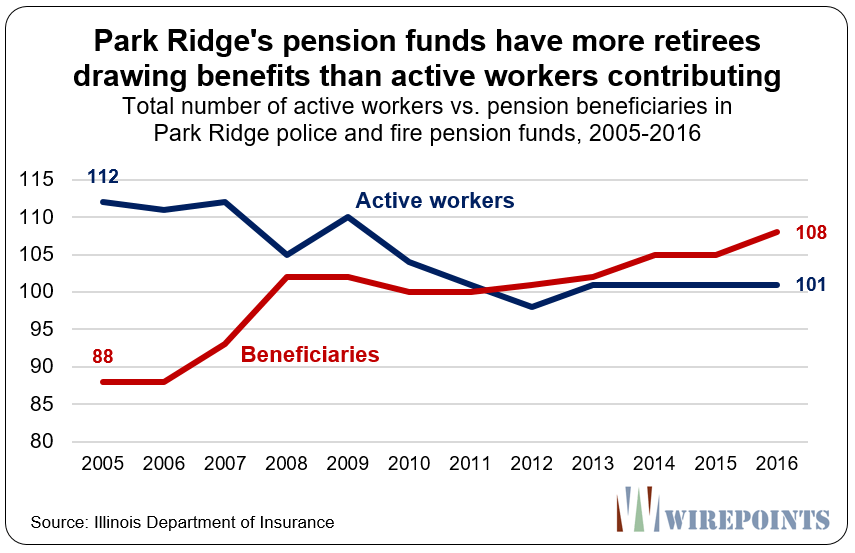

A decade ago, Park Ridge had 1.27 active members paying into the pension fund for every one beneficiary taking money out. Now, the situation is upside down – there are only 0.94 active workers for every beneficiary.

With fewer workers putting money in and more retirees drawing benefits, expect Park Ridge residents to be forced to make up the difference.

Property taxes in Maine Township and beyond

Park Ridge’s property tax problems aren’t unique. Its pension and school district spending issues are shared by its neighboring communities in Maine Township.

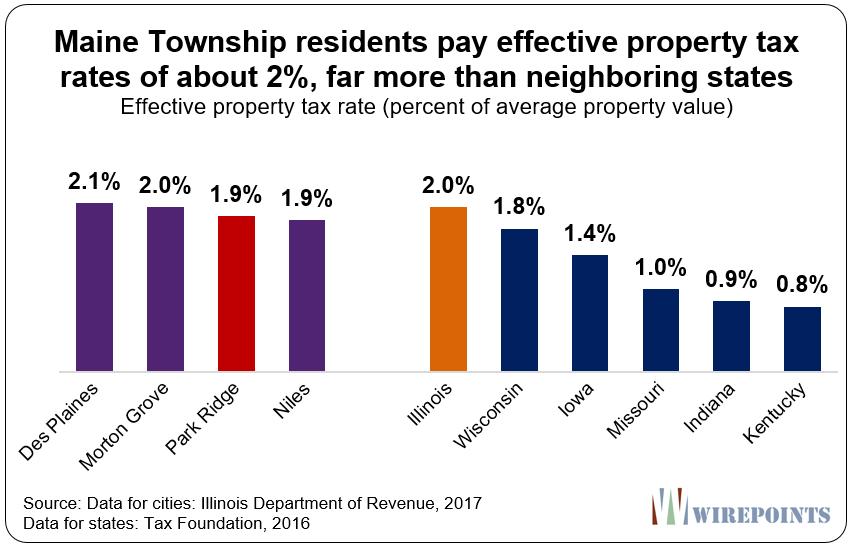

And the area’s overall property tax burden is very similar, with residents in all four major Maine Township cities paying effective property tax rates of about 2 percent.

That’s nearly identical to the state’s average effective rate, which is one of the highest in the nation, according to data from the Tax Foundation.

Residents in Park Ridge are paying property tax rates a third higher than those in Iowa and double the rates of Indiana and Kentucky. Illinois’ neighboring states do more with less, and yet there’s very little demand from residents for Illinois government to do the same.

And now there’s the sticker shock coming from new Cook County assessment process, as homeowners see their assessments jump by incredible amounts.

Steve wants to see spending reforms happen as soon as possible. And controlling spending means more than just stopping budgets from growing. Structural pension reforms, starting with a constitutional amendment, and changes to Illinois’ overly-restrictive collective bargaining rules are both needed to bring property taxes down. Local officials have long been handcuffed by state mandates that limit their ability to control costs.

Steve recognizes it took him a while to understand how the whole system works. Now he’s hoping he can help others shortcut the learning process.

“You always have a right to complain about property taxes. But you’re wasting your breath complaining until you get engaged and vote. You won’t change anything until you vote for school representatives that control spending.”

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

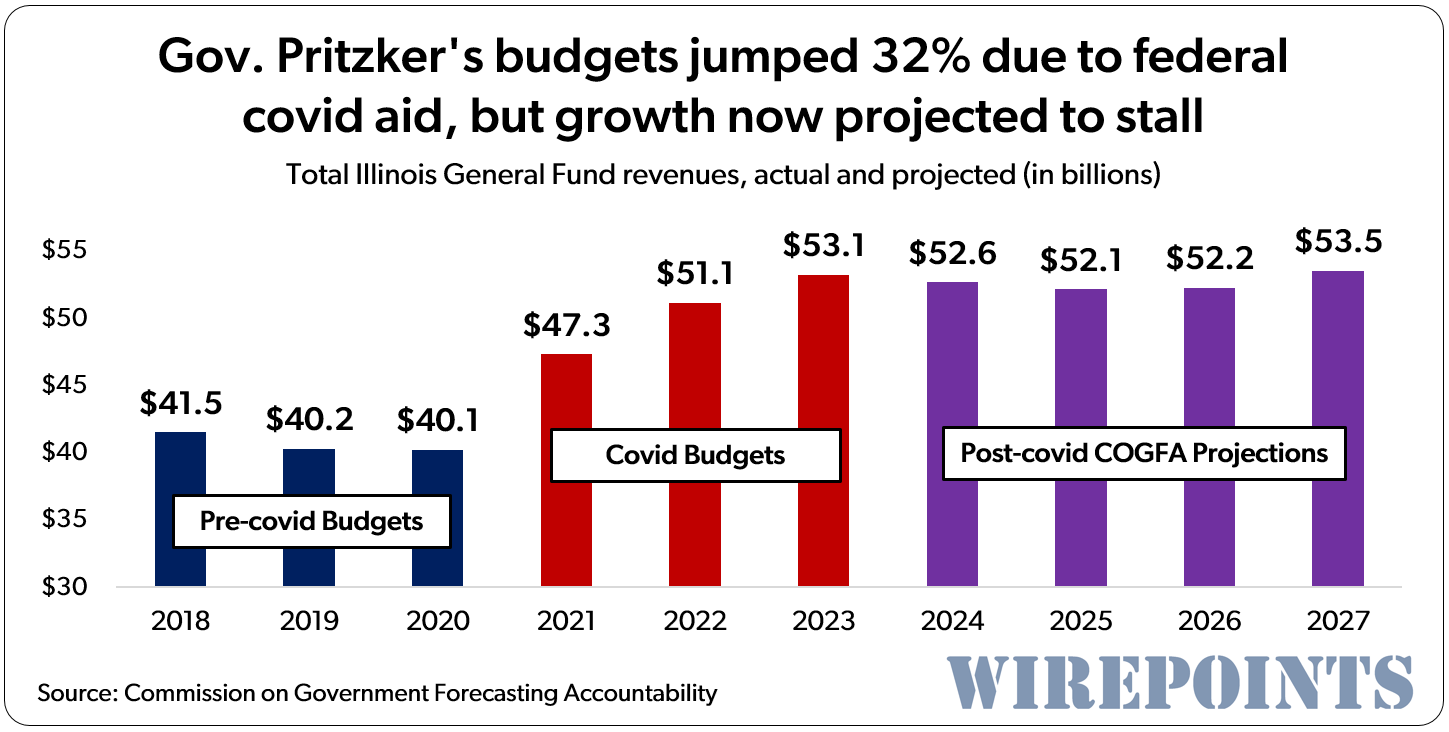

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more. Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow. Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

As part of last November’s “Blue Sewer Backup” (not blue wave) Park Ridge just elected a new slate of progressives to the school board. They are getting themselves ready to tax and spend, tax and spend. The Blue Sewer Backup also passed a $300,000,000 bond issue to fix up Maine’s three public high schools. $300,000,000!! The Blue Sewer Backup gave the progressives every penny they wanted! It’s awful, I hate this state, I hate the progressives who run this state, they’re literally the worst people. I won’t even befriend them. I spit on the ground when someone mentions their progressive… Read more »

So, when are you planning to leave? If you stay, you are supporting their agenda. (I left Illinois recently. I couldn’t stomach it any longer.)

I so wish it were so easy; hence the bitter taste in my mouth that I’m kind of stuck here. Unfortunately for me, my business interests are tied to my particular locale. My deep network of social connections built over a lifetime would be difficult to replicate elsewhere this late in my life. Yes, true, I could move to TX or UT just for the sake of moving but I’d be giving up everything I have just to live in a red state. I’m not going to let the progressives destroy my day to day life. I vote R every… Read more »

So basically, you’re fine with profiting by living in Illinois from your “business interests” but you don’t want to move to Indiana or Kentucky because you’ll make less money. You want it both ways?

Who doesn’t want it both ways? In my lifetime we’ve had a number of state wide office holders, my suburb (despite being nonpartisan) only elects fiscally responsible R’s and my cook county commissioner is one of the only R’s left too. The City, county and state may be all Democratic but I live in a little pocket of R. I’m not going to let Jabba destroy my life.

I understand leaving may be a larger financial burden/gamble than staying in your case. When you look at your situation going forward, you should hope that Illinois can continue to borrow until you retire. Then you can hopefully leave before the bill comes due. If Illinois can’t borrow any more, it’s going to go bad quickly. Putting aside the financial concerns, I also consider this as a moral situation. In my opinion, Illinois is running a scam with the help of the media. The media has failed the Illinois taxpayers by not aggressively showing how ridiculous the Illinois situation is… Read more »

I guess more complainers should have become teachers. We give our children to teachers to prepare them, educate them & guide them for 13 years. Teachers & many public employees do not receive Social Security, so teachers pension must cover implied Social Security & the equivalent of 401K’s or 403B’s.

Anyone want bottom of the barrel teachers for their kids or grandkids ?

Yes, I’ll take the ‘bottom of the barrel’. It can’t be much worse than the progressive education they’re getting right now. Instead of learning the three R’s, they’re learning about fake climate change, gender bending and common core math.

I’ll take a bottom of the barrel any day.

Yeah it’s weird how those states like Oklahoma pay their teachers the least, and then rank at the bottom of literacy and math scores. Must be a coincidence.

Exactly, the City of Chicago spends SO much per student and their outcomes are FANTASTIC. Oh wait, that’s not right….

“Complainers” ? Taxpayers whose home values have shrunk and are underwater because they’re massively overtaxed, have a responsibility to point out the egregious pay and lifetime pensions of these govt “servants” !

John: Have you tried suggesting a teacher trade their pension (including the 3% cola) for social security at age 67 (full retirement age)? I have. They laugh at you. Particularly the math teachers that can do a DCF analysis. They fully understand how their union dues have purchased an unfair advantage versus private sector employees.

I’ll trade what I’ll get from social security for a tier 1 IL teacher’s pension any day!

Switch the phraseology “don’t get” social security” to “aren’t required to pay into” social security. Lets compare that apples-to apples. Pick a private sector worker whom society professes to value, say, nurses. Nurses are forced to pay 6.2% of salary to a social security fund , with employers forced to match another 6.2%. Social security payout terms have changed and are allowed by law to change. Now considerr that most teachers i.n Illinois have their personal”pension contributions ” ‘picked up’ by taxpayers 90%. Think about that: teachers’ takehome pay is 99%, compared to nurses’ takehome pay of 93.5%, when mandatory… Read more »

Susan – Imagine investing 12.4% (the amount you and your employers contribute to social security) of your lifetime salary into an IRA S&P index fund instead of SSI. This would be ON TOP OF the amount you already contribute into a 401k and your employer match. For some people, this would be the equivalent of 20-30% of their lifetime salary. You could make a very nice annuity out of that.

Susan/Well said. If you check out Dupage Watchdog.com and search “pensions explained” first then later click drop down box on pensions.(this is from July 12,2014) they have a lot of info on S.S. vs pensions and salary spikin. We are in much worse shape now than in 2014

When a teachers pension is based on earnings over time as opposed to the spiked earnings gimmicks, and it starts getting paid out at 66 years old, and it increases the same way as social security then you can make that argument. If you have a $1,000,000 401K you can conservatively earn $35K a year plus the maximum social security benefit of $35K puts you at $70K a year. Of course you’ll have to wait til your 66 years old to receive it.

Teacher average pensions are 2.5X the average SS. In Illinois they pay no income tax on pensions. SS is taxed in some instances Don’t forget teachers also cash in up to 100 days unused sick days for cash upon retirement and they only work 8 months a year. . Which would You want?

Ya, good luck trying to elect school representatives that are willing to control spending. As soon as you have credible school board candidates that are willing to consider controlling spending, the local teachers union will jump election with financial support from the IEA(state teacher’s union) and do everything possible to make sure that their own personally selected rubber stamp candidates get elected. You try to talk to the rubber stamp candidates about finances and they say they are losing money if they don’t increases taxes by the CPI every year, blame it on the state not funding them enough and… Read more »

The entire northern portion of the state went blue in November. All of it. At every level of government. because they hate Trump and they want to spend on progressive issues. It’s the worst, I literally hate this state.

Thats why its time to get out of Illinois and move to Indiana.

I’ve considered it but NW Indy is not that great of a place either. Way too blue.

How about Alabama? I hear they’re looking for people who can read to help out the current residents of the state.

Your racist comment has been flagged and reported.

Wow! Pensions of 80% of Final Avg Pay that increase with inflation and are paid at age 58 , are nothing less than legalized theft on a massive scale from taxpayers. And so are the salaries !!

actually they increase 3% every year it is not a factor of inflation like social security which is tied to inflation. actually some qualify for pensions at age 53