By: Ted Dabrowski and John Klingner

S&P Global Ratings just released its analysis of Illinois’ 2021 budget and when all their criticisms are highlighted, it’s a pretty scathing list. The rating firm, which currently rates Illinois just one notch short of junk, recently declared a negative outlook for the state in the wake of the COVID-19 crisis.

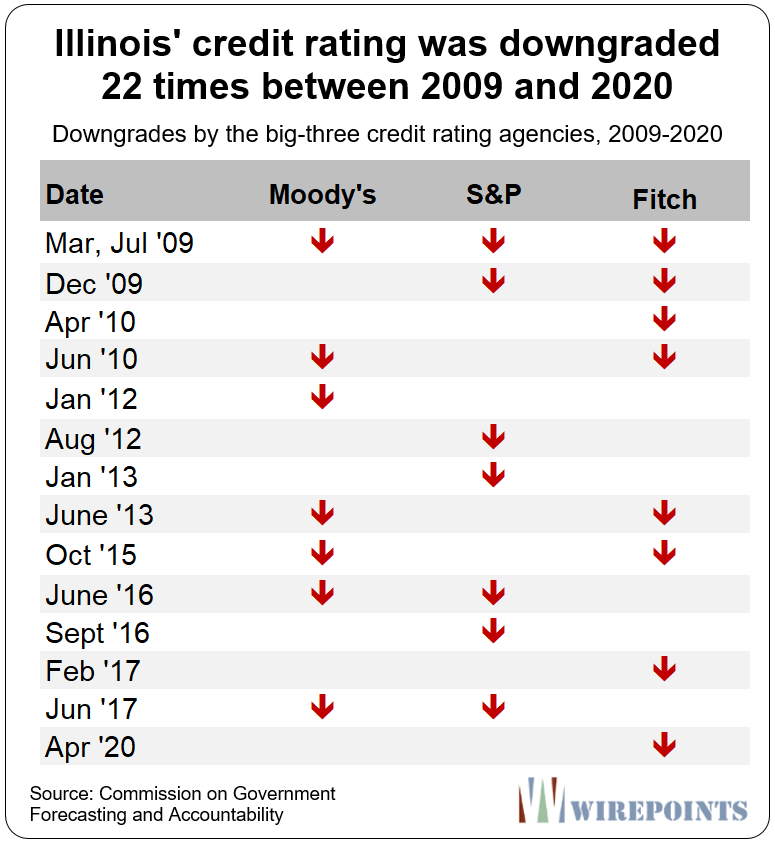

All three major ratings agencies now rate Illinois just above junk, the result of 22 downgrades in just over ten years, including 13 downgrades during Gov. Pat Quinn’s tenure, eight under Gov. Bruce Rauner, and now once during Gov. J.B. Pritzker’s term.

That makes the agencies’ opinion of Illinois’ 2021 budget extremely important. A downgrade from any of the three firms will drop Illinois to junk, which has never happened to a state before.

Here’s a quick list of S&P’s critiques:

1. Illinois’ 2021 budget is unbalanced and structurally unstable. “Illinois’ adopted budget continues to be precariously balanced, and does not include measures to meaningfully address structural instability.”

2. Illinois is still structurally under funding pensions. “We consider the fiscal 2021 budget structurally misaligned, as along with an outstanding $7.2 billion bill backlog, the pension and other post-employment benefit obligations are not funded based on actuarial recommendations.”

3. Relying on federal aid creates risk. “Whereas we believe that additional direct federal aid is possible, the amount, timing, and potential restrictions on use are unclear at this point, and so budgeting potential use introduces risk.”

4. The plan to borrow from the Federal Reserve, then pay back the loan with federal aid is a “precarious assumption.” “There is capacity in the MLF authorization legislation for an additional $5 billion from Illinois, but such a borrowing simply shifts the repayment to future budget years, and the hope for additional aid is a precarious assumption.”

5. Illinois’ past mismanagement limits its options. “Where many other states had taken advantage of the long economic expansion following the Great Recession, Illinois faced political gridlock through multiple fiscal years, built a significant bill backlog, delayed action to reduce a sizable pension obligation, and could not accumulate a rainy day fund. We consider the state’s current options available to address the pandemic to be limited, compared to those of other states.”

6. If the federal government fails to deliver aid, then the state will have to cut spending. “Should any of those not materialize as expected, the state will need to look to more significant expenditure cuts through later legislative action. We believe the state has capacity to make cuts to close a gap, as there are no cuts in the current budget.”

7. Illinoisans already have the 5th-highest debt burden in the nation. “Currently the outstanding GO debt has a relatively rapid maturity with 74% retired within the next decade, and so there is some replacement capacity, but by our calculations, Illinois already has the fifth-highest debt per capita in the nation.”

8. Illinois’ pension funding plan is weak compared to other states. “As the statutory pension funding is designed to attain a 90% funded status in 2045, this is one of the least conservative funding methodologies in the nation among state peers.”

9. If anything goes wrong with Illinois’ budget, the state will come closer to a downgrade. “As we have noted in past reports, Illinois has a history of leaving difficult fiscal choices to future budgets, and to the extent that expected federal aid does not materialize and the state does not adjust expenditures to reflect available resources, the fiscal 2021 budget could weaken the state’s credit trajectory.”

S&P only had two credit-positive takeaways from the budget. One, that Illinois met the low bar of actually paying its statutorily-required contributions to pensions. And two, that the state appropriated cash to make payments on Build Illinois and other related bonds.

If lawmakers think their actions in session last month helped the state avoid a junk rating, S&P’s analysis should make them think again.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

S&P is right.

Illinois is a piece of SCHITT, nothing but thieves.

Ratings agencies are whores.

This list is only scathing to those who have any sense of shame or responsibility. Illinois Democrat politicians have neither.

Illinois has so many voters that will not have to pay additional taxes if the increase is voted into law, that the referendum will pass

What is your point that the referendum will pass – as it does not fix the structural and systemic issues cited and does not raise sufficient funds to pay past bills and keep budget balanced?

It’s a ‘tax the rich’ bill. Didn’t you watch the protests? graffiti everywhere: ACAB – All Capitalists are Bast**ds. And “eat the rich” was everywhere too. It’s 1919 all over again except its the USA instead of the USSR. And we know that two generations of death and destruction followed the 1919 revolution.

Ronald – Do you really think that if the Pritzker graduated income tax is passed that it will only impact high income earners? Middle income (read, struggling families) will pay the piper.

Illinois has many voters who will not have to pay additional taxes YET

I think Pritzker got elected on massive new tax and spending promises. The rating agencies did not mention that. My hunch is that to have $$$ to spend on the public employee unions and Democrat pet projects, debt and pension payments will be missed or stretched way out again. No rational risk assessment would look at Illinois as more than pure junk. The risk premium should be way higher.

Dictator for Life Jabba has his rebuttal prepared: Nazis!!! White supremacists!!

“These, and all other, revenue declines are offset through an increase of $300 million in interfund borrowing, the previously mentioned $5 billion MLF borrowing or federal aid receipts, and $1.274 billion in potential new individual income taxes, should a constitutional amendment pass in November instituting a graduated income tax.

The original estimate of additional revenue receipts attributable to the graduated income tax was $1.435 billion, and so the state is reflecting a reduction caused by the recession.”

http://www.spglobal.com/ratings/en/research/articles/200601-illinois-fiscal-2021-budget-anticipates-and-needs-additional-federal-aid-11514461

Too bad the rating agency doesn’t consider “non fiscal” criticisms. For example, Illinois voters are liberal fools and the reason behind all nine “fiscal” criticisms.

IL is like the Nike store on Michigan Avenue over the last few days.

One conclusion they don’t give a damn in Springfield

Let it burn. Let it be an example for other blue states.

Point #9 – closer? Clearly the rating companies are afraid to apply a fair rating to the state – junk… It would be interesting to see the ratings agencies get sued for violating their fiduciary responsibility…

To be fair, they may be absolved from having a fiduciary responsibility in the classic sense – still, with the reliance placed on their analysis, it would still make for decent entertainment…