Given where Chicago is right now this new stadium proposal is a bad idea and a bad deal – Wirepoints on The Chicago Way with John Kass

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

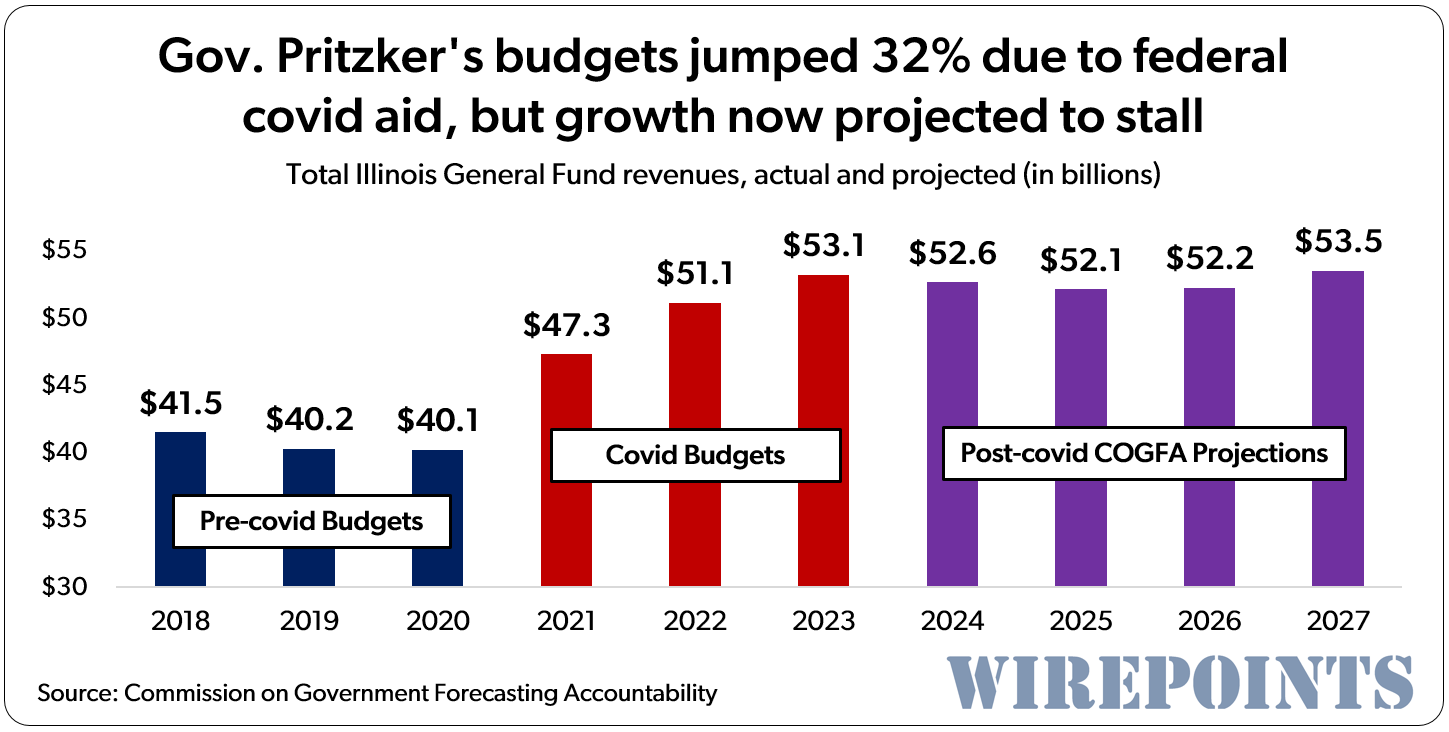

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow. Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

That’s only the state getting our money in the future. If you can’t pay them now then compounding the problem won’t help. I’d rather get a home equity loan and do what I want with the money now. This is an outright trap.

People need to remember that the amounts demanded by each taxing body on their property tax bill are paid by someone. When tax payers avoid all or a portion of their bill, that portion is passed around to other tax payers.

This is the “Please don’t move to Florida!” bill

IF I MADE THAT KIND OF MONEY I WOULD NOT NEED THE FREEZE…….WHAT’S REALLY GOING ON HERE

Taxes on a 1960’s era split level in northwest suburban Buffalo Grove can approach $10,000 a year or more. A retired household on a fixed income of $70,000 a year, which is higher than the current limit, is certainly going to feel the pain of a $10,000+ a year tax bill.

Not sure I like the way this is worded. If I can defer my real estate taxes up to $7,500 per year that means I will have to pay the taxes later if I sell my home or if I die then my estate will have to pay the taxes plus interest. So is there an interest rate and what is the rate on the deferral amount? Also in Ptell counties the frozen assessment will raise the property tax rate “if” there is appreciation but if values go down you are stuck at the freeze level but only for that… Read more »