Given where Chicago is right now this new stadium proposal is a bad idea and a bad deal – Wirepoints on The Chicago Way with John Kass

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

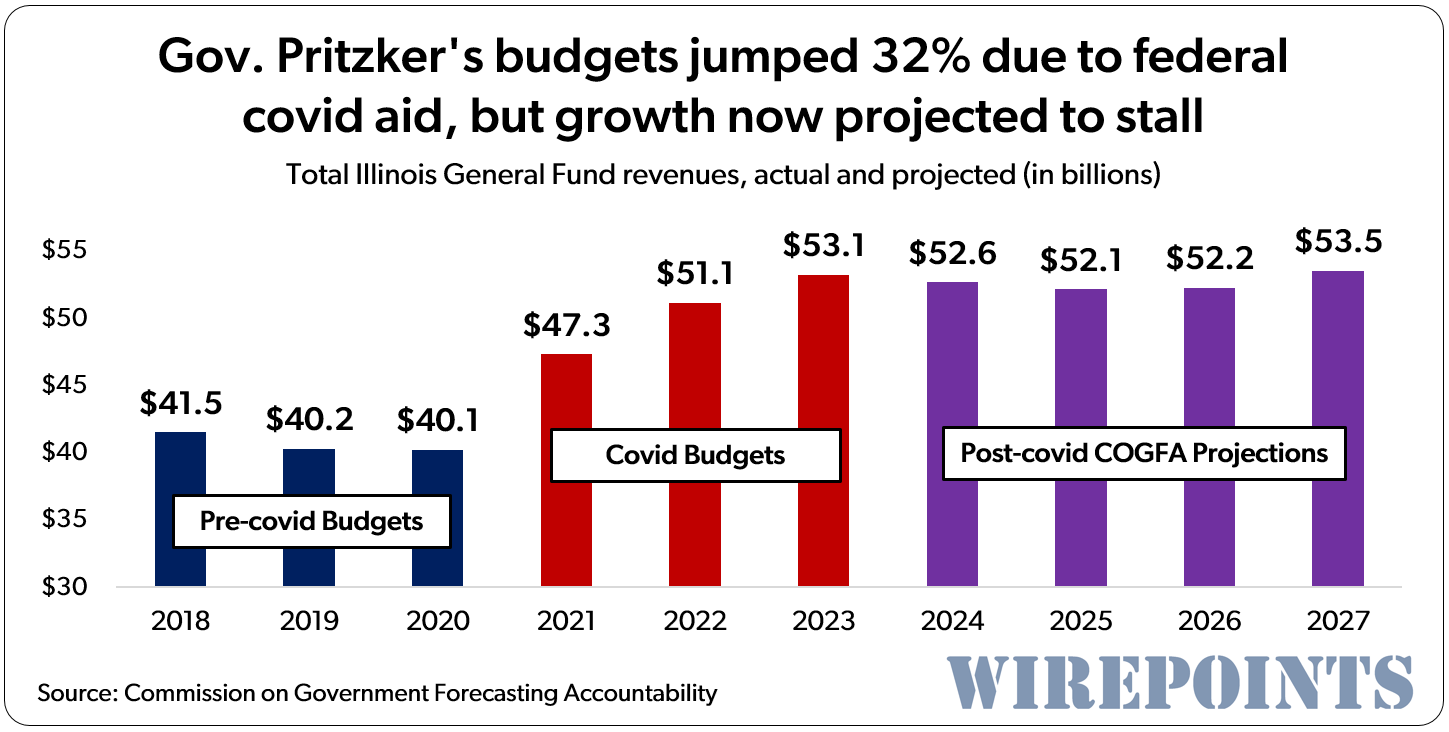

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow. Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

How about no more raises and there will be MORE funding for pensions or getting raises but that will not count to increasing pensions. The raises would be put in a separate 401K. It’s either one or the other but not both. All the money that was given to raises instead of funding pensions should be counted towards the total funding levels of pensions. For instance if 30% raises were given over a period of time add that to whatever the funding level is. 30% + 46% funding=76% compensation/pension funded and have a yearly limit on how much could be… Read more »

Pension promises are deferred compensation. That the underlying “firm” in question never had the means to deliver that deferred compensation was never faced. To me, this is the equivalent of hiring someone to do a job, and fraudulently promising them future payments for today’s work, knowing full well that the promises are lies. As far as I’m concerned, EVERYONE is to blame for this. We all lived like we could eat cake now and still have it delivered next week. The problems of public pensions are worse, but on the same continuum as are promises to pay for unlimited medical… Read more »

Astonished et al, Pension promises are what they have always been: unsecured promises to pay or provide something for life. The promises are written down in trust agreements and union contracts and they have been declared to be “contract rights.” Some funds have been dedicated to keeping these promises but those set-asides are grossly inadequate to meet the promises. As far as I know, nobody sued the municipality for contributions in prior years when they were not actuarially sufficient. Perhaps the statute of limitations has expired for those years. The contracts are “impossible” of performance based on the financial condition… Read more »

Your last paragraph is what keeps me awake at night, as I concur. Looking at the world, continent, nation, state and local situation, I cannot escape the belief that what’s coming is The Great Depression + French Revolution/Terror + World Wars I and II all rolled together and raised to an exponent. Never in recorded history has a populace been so set-up for a catastrophic collapse in expectations. Poor people can handle hardship, but those who live and believe themselves rich, when thrown head-first into harshness and poverty will no doubt go Full Postal. Everyone high and low in the… Read more »

PS: A monetary system based on debt growth axiomatically (inevitably) turns into “burn-the-seed-corn” capital consumption. Our system has literally destroyed the economic production system on which future debt service depends. It’s not just that “the aquifer is dry,” it’s that the river filling the aquifer was diverted to Mexico and China. This is what people do when they embrace a collective delusion of unlimited resources. I argue strongly that this is a direct effect of our “consumer economy” (as opposed to a producer economy.) This is also why the first lie told in Econ 101 is the inversion of Say’s… Read more »