By: Mark Glennon*

“Guaranty provisions” have been highly controversial since municipal unions first began having them inserted into pension reform legislation in 2012. The new Chicago pension bill contains a real doozy that’s been mostly overlooked.

As you probably know, the new state law requires Chicago to make payments into two of its pensions, starting at $50 million next year and increasing each year to $250 million in year five. Thereafter, the city must make payments sufficient to bring the pensions’ assets to 90% of actuarial liabilities by 2055.

If the city doesn’t pay up, the pensions can get a court order forcing the payment, subject only to a vaguely worded exception about public health and safety. But here’s the kicker: If the city doesn’t pay, the State of Illinois is required to subtract the missed payment amount from Chicago’s share of sales taxes that the state collects and remits to the city (subject to a three-year phase-in) and give it directly to the pension. That’s a big pot of money critical to Chicago — over $500 million per year.

The new law makes that set-off automatic — no court order needed, no exceptions. Even that vague exception for public health and safety does not apply. So, there’s basically a hell-or-high-water mandate to make the payments, which will be an astronomical $250 million in five years, and maybe more thereafter.

Because this is a state statute, amending it would require approval of each of the House, Senate and governor.

The public unions were particularly clever to get this. Even bankruptcy might not undue it. (If Springfield were ever to authorize Illinois cities to file bankruptcy). That’s because bankruptcy generally doesn’t modify third party arrangements like this. As with the state pension law passed last year, the union strategy has been to accept some reduction in benefits but lock down everything else in a way that cannot be undone by more serious reformers who might come later to Springfield. It’s working. As we said in that 2012 article, guaranties like this amount to carving up the government’s body parts between public pensions and bondholders.

One interesting question is the effect a set-off by Illinois against Chicago might have on Chicago’s bondholders. The new law expressly says, in connection with a court order the pensions could get forcing the city to pay up, that bond obligations are senior and get paid first. But that priority is not made clear respecting the set-off by the state. Some bonds are expressly secured by sales tax receipts, and that security interest is presumably safe. But if those secured bonds are paid, leaving some sales tax revenue unencumbered, that free cash flow would be in doubt. General obligation bondholders no doubt are taking a good look at this.

Just more “theater of the absurd,” as State Representative David McSweeney recently described Springfield.

Full text of the new law is linked here.

*Mark Glennon is founder of WirePoints and a business consultant

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

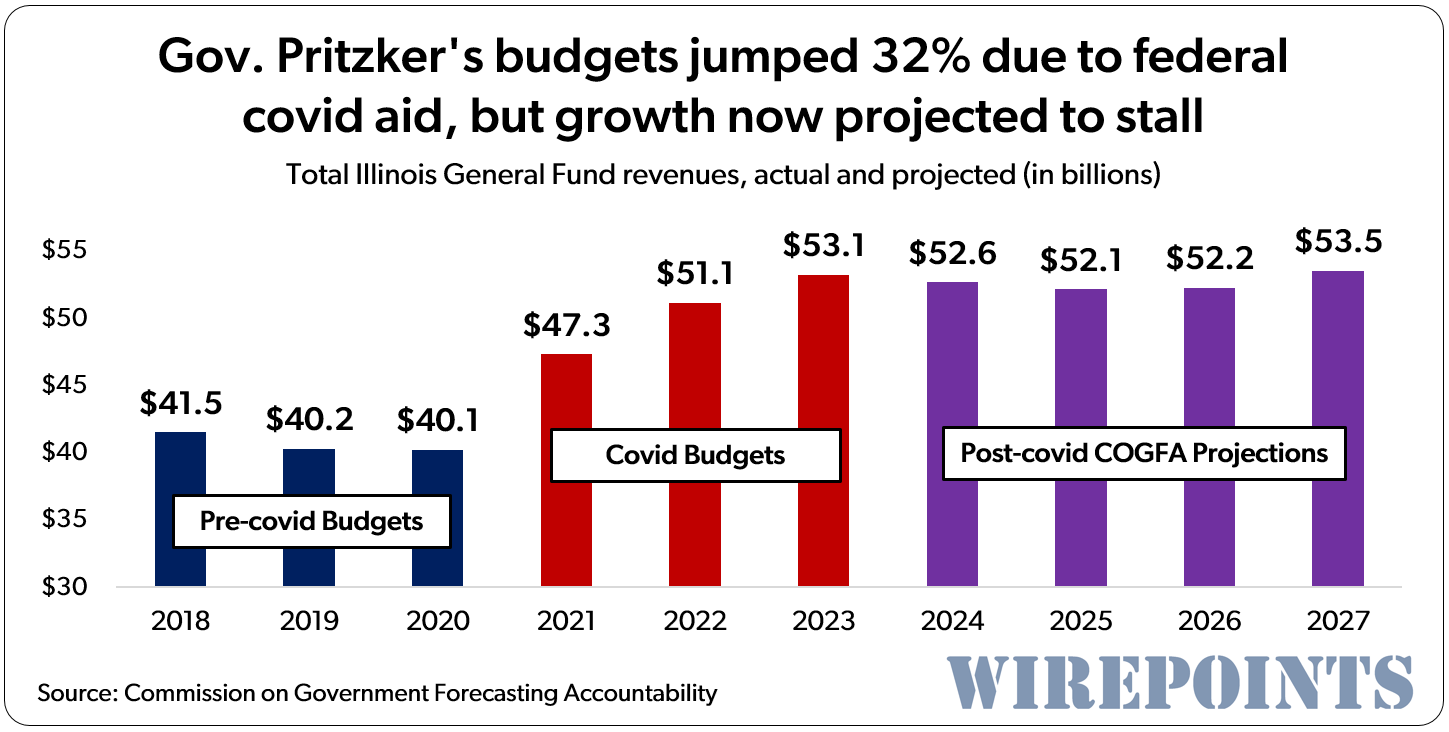

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more. Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow. Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Mark you said “Because this is a state statute”,,,

so even if the whole pension law is struck down,

the state statute’s stay in place?

No, if I understand your question correctly. If the reductions in pension benefits in this particular Illinois state statute for two Chicago pensions get struck down as a violation of the Illinois Constitution (which has a provision that may prohibit all benefit reductions) — then that whole law goes away, including the unfunded mandate. At least, that’s my quick read of a complex “severance provision” in the bill. That’s really a key, good question, because we wouldn’t want the benefit reductions struck down but the unfunded mandate left in place. Remember that the same constitutional issue is being tested for… Read more »

Thanks for your reply Mark, it is confusing. I would like to be more confident that I have the correct answer in your opinion. 1. If the Chicago pension reform is struck down then the whole package of chicago reforms go away including forced funding of chicago pensions, and the statute’s in the constitution that force that funding. ———–If I understand correctly your answer would be,,,, in Chicago the statute would be thrown out. 2. At the state level is a different statute that is also being challenged, where payments to pension funds have to be paid 2nd, after bond… Read more »

Um, you’re mostly right. But there’s no “statute” in the constitution. Statutes are the bills–the laws passed by the legislature, like the various pension “reform” laws and unfunded mandates. The state constitution, which will mean what the courts says it means, overrides these laws. But the effect of the litigation would be as you described. What you might “want,” even if don’t like these pensions, is subject to reasonable difference of opinion. Some pension critics think the smallish reforms in these bills are the best they can get, so they support them. I think they contain more harm than good.… Read more »

Thanks,

Let the pensions run dry.

P C

So why are unions suing to kill it?

Heads they win — the whole thing is struck down. Tails they don’t lose much — take the concessions they made and that’s the end of it.

Why is the state involved in this at all? Let the cities do what they want. Mandates like this are what are killing the cities and towns.