Actuary Mary Pat Campbell: Chicago Pensions: Drowning, Not Waving – Stump

“Exactly how screwed up are Chicago pension? I’m glad you asked.”

“Exactly how screwed up are Chicago pension? I’m glad you asked.”

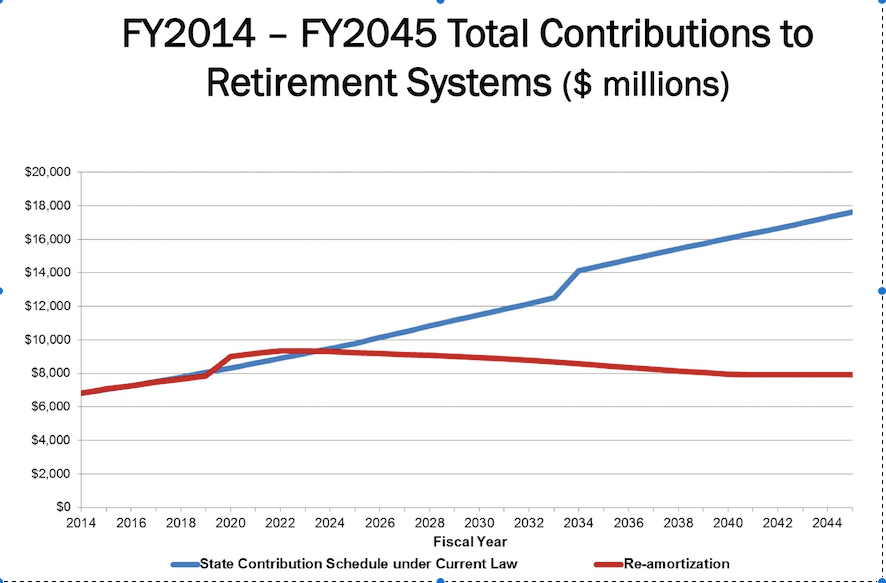

“When the assets run out, Lightfoot is going to be super-happy to know she lost last Tuesday’s race…Maybe she thought the state would run to her rescue. The contributions have been extremely inadequate.”

By actuary Mary Pat Campbell.

When does corruption end your pension? Actuary Mary Pat Campbell takes a look.

Actuary Mary Pat Campbell: You are more likely to get money from aliens to make Chicago solvent than to do it from either Illinois or the Feds.

Actuary Mary Pat Campbell: “So that’s the scatterplot highlighting the Chicago plans only … and yeah, they’re about the worst.”

Actuary Mary Pat Campbell: “I’m willing to bet Vallas will be very happy in about a year when he sees the hideous financial mess he will not have to deal with. To be sure, he’s been through some of this before, but I am not sure he really understands how nasty it is. I am sure Johnson really has no idea how nasty the situation he’s going to be in. He and his union buddies may think there is a big pot of money they can grab at…. I have a feeling they will be corrected in their belief.

Actuary Mary Pat Campbell: “Wirepoints has several features, and the best part is the daily email. Wirepoints has helped give me more detail on the players, and the specific tactics being tried out so I don’t look like a complete ass from the East Coast when I write about the Midwest. So if you want to know about one of the most

Actuary Mary Pat Campbell: “Wirepoints has several features, and the best part is the daily email. Wirepoints has helped give me more detail on the players, and the specific tactics being tried out so I don’t look like a complete ass from the East Coast when I write about the Midwest. So if you want to know about one of the most

Actuary Mary Pat Campbell: “The actual public finance behavior of Illinois for decades is what I’m basing my remarks on. I have yet to see any stomach for any actual reform of the promise, promise, promise and not actually pay for their promises.”

Actuary Mary Pat Campbell: Some teachers unions, such as in Chicago, are pushing for remote schooling as omicron cases of Covid spread. There is a longer-term danger to teachers’ pensions, as many of these are underfunded and depend on growing tax bases. We’ve seen many of these places lose population due to people simply moving (not just dying). Teachers and their union representatives need to think longer-term — they may minorly reduce a short-term risk of a disease most of them (vaccinated) can deal with, while greatly increase the risk of undermining the future of their pension funds.

We’ve written for years about why government budgets and claims of “balanced budgets” are fraudulent. The problem is that budgets count borrowed money and asset sales as if they are income, and ignore growing debts like pension liabilities.

Testimony has been taken recently on this issue by the Governmental Accounting Standards Board, which is finally focused on it. Lots of Illinoisans and big names testified to the same criticisms we have.

Video is linked here. You can view the individual testimony at the time links here– 0:00 Sheila Weinberg, 34:45 Bill

By actuary Mary Pat Campbell.

By actuary Mary Pat Campbell.

By actuary Mary Pat Campbell.

Actuary Mary Pat Campbell: One of the biggest “waiting for a bailout” offenders is Chicago and, of course, the legislature of Illinois. They’ve never made a difficult decision, and they’re waiting to see if the suckers, um, I mean, voters, take the bait and vote in the “we’ll keep defining ‘rich’ down til we get enough dough” state constitutional amendment.”

For math wonks, from actuary Mary Pat Campbell.

Comment: About 1/3 way down, actuary Mary Pat Campbell puts the infection fatality rate for COVID that we recently wrote about into context by comparing it, for older individuals, to their expected mortality from other causes.

By actuary Mary Pat Campbell.

By actuary Mary Pat Campbell on a persistent myth about pensions. Note two of the repeat offenders — Ralph Martire of the Center for Tax and Budget Accountability and Greg Hinz of Crain’s.

For number wonks, from actuary Mary Pat Campbell.

By actuary Mary Pat Campbell.

An actuary’s perspective — Mary Pat Campbell.

A detailed look by an actuary, Mary Pat Campbell.

By actuary Mary Pat Campbell

By actuary Mary Pat Campbell.

From an actuary, Mary Pat Campbell: “Shamtacular, one may say. And the shammiest of shamtaculars is what happened with pensions.

The perspective of actuary and numbers wonk Mary Pat Campbell.

A roundup through the lens of quant queen Mary Pat Campbell.

Comment: I like disagreement from people I respect, as Mary Pat Campbell does here. However, she didn’t answer the challenge at the end of my article, which is to describe a solution that doesn’t include bankruptcy. Further, I’ve always made clear bankruptcy is a bad option. That’s not the question. It’s about whether it’s the only option. As for whether the rest of the country should support bankruptcy for Illinois, I’m fine with letting them vote in their own self-interest. Illinois is a drag on the national economy and on safety net programs. What’s going to cost the country less?

By actuary Mary Pat Campbell.

“When one sees politicians raising taxes and then turning around to give public employees a raise, the suckers, I mean taxpayers, will realize they’re being had.

So what’s it gonna be, Illinois? What’s it gonna be, Chicago?

The shadow of Detroit and Puerto Rico overcasts you.”

Comment: Nice look at some data, as usual from actuary Mary Pat Campbell, especially on the Chicago Teachers Pension. And we’ll overlook where she sort of disagrees with us here, and takes a poke at Chicago.

There’s a lesson here not only about Illinois pensions but about how easily the press will let Gov. JB Pritzker thumb his nose at crisis.

There’s a lesson here not only about Illinois pensions but about how easily the press will let Gov. JB Pritzker thumb his nose at crisis.

Excess deaths are now more frequently being attributed to “deaths of despair.” A new study projected that excess deaths resulting from the economic strain of the pandemic will amount to 900,000 over the next 15 years.

Pritzker should have added something else to what he thinks isn’t politically feasible in Illinois: honesty.

Told ya.

More misuse of phony government “budget” numbers.

With effective property tax rates already 5.7%, Harvey is a bloodless turnip. Where else will the courts order higher taxes?

A wrap-up from the perspective of an actuary and numbers wonk, Mary Pat Campbell.

By actuary Mary Pat Campbell.

By actuary Mary Pat Campbell.

The fog of misunderstanding about Illinois’ crisis remains thick.

The Municipal Employees’ Annuity and Benefit Fund of Chicago will run out of money by the year 2024, according to a model developed by actuary Mary Pat Campbell.

A look at one of Chicago’s pensions, the Municipal fund, by actuary Mary Pat Campbell.

From actuary Mary Pat Campbell.

“Very,” says actuary Mary Pat Campbell.

By actuary Mary Pat Campbell.

For fellow number wonks, a collection of posts by actuary Mary Pat Campbell on Chicago’s crisis.

Of the state-to-state moves involving Illinois handled by suburban St. Louis-based United Van Lines in 2016, 62.9 percent of the moves were out of the state, while 37.1 percent were for moves into Illinois. The company said it handled 8,782 moves in Illinois last year, and 5,521 of them were for customers moving out of state. “Not as bad as New Jersey,” as our friend Mary Pat Campbell likes to say.

Comment: The “80% funding myth” is the idea that pensions with an 80% funded level — or even 90% — are considered sound. That’s fake news propagated by politicians trying to hide the mess they created and reporters too sloppy to catch it. Only 100% is generally considered sound. Author Mary Pat Campbell, an actuary, tracks the culprits.

Comment: We’ve hesitated before to publish some of these technical pieces by actuary Mary Pat Campbell, but our readers love them and they get lots of pageviews. Nice to have readers who aren’t afraid of a little math.

Stump (Mary Pat Campbell) is an honest actuary who writes about pensions.

Mary Pat Campbell, an actuary, looks at the the numbers: “I come here to bury Chicago, not to join in the party.”

A thorough look by actuary Mary Pat Campbell.

Actuary and numbers wonk Mary Pat Campbell takes a comprehensive look. “It’s not at all clear that Chicago can pay for this contract for more than a year, if that,” she says.

A detailed look at lots of number by an actuary, Mary Pat Campbell.

By Mary Pat Campbell, an honest actuary who writes about pensions.

From Mary Pat Campbell, an honest actuary who writes about pensions: “I hope the authors can rewrite the paper well enough to avoid any legal action on the part of the SOA or AAA.” Comment: Oh, hell, somebody please just leak it to us.

The author, Mary Pat Campbell, is an actuary in New York who writes about pensions.

From Mary Pat Campbell, an actuary who understands numbers: “Here’s a prediction: you’re not even going to get to 90% in 40 years. Because Chicago will have gone bankrupt in the interim.” Ditto on that prediction. She goes on to ridicule the “thinkers” in our press.

Actuary Mary Pat Campbell writes about a major book on the Detroit bankruptcy.

Author Mary Pat Campbell is an actuary who writes about pensions. Comment: She’s absolutely right that readers want facts, not opinions. We see that here. Our most viewed article in the past year, for example, was on south suburban Chicago property tax rates. Most conventional news sources would reject it as far too long and too jammed with data. Wrong.

Author Mary Pat Campbell is an actuary focused on the realities of math for government.

Author Mary Pat Campbell is an actuary who writes about pensions.

Mary Pat Campbell, the author, is an actuary who writes about pensions. Next time you hear a politician say Illinois is making “full pension contributions” or “what the actuaries require” tell them they’re lying. Same for almost all local pensions.

By: Mark Glennon* The Center for Tax and Budget Accountability today released a report titled, Public Pensions: Frequently Asked Questions. The “average” annual pension benefit for Illinois statewide pensions is just $45,832, says the report. Sounds pretty reasonable, which is why “averages” like that have been central to public unions’ messaging about pensions for years. It’s bunk. While it might be true in a very literal sense, it’s so misleading and incomplete that it can only be described as dishonest. Here’s why: “Average” pensions include those who work only part of their careers in the system providing the pension.

Author Mary Pat Campbell is an actuary who writes about pensions and local fiscal issues.

By: Mark Glennon* Look, maybe it would be reasonable to argue that solving only part of our pension crisis is the best we can possibly do. But it’s another thing entirely to start the discussion simply by defining away a large percentage of the problem. Unbelievably, that’s routine. The latest culprit is an important reporter, Karen Pierog, who covers pensions for Reuters. Her columns are widely reprinted. Yesterday, in an article about the portion of an Illinois pension’s liability that’s funded, she said it’s “still far below the 80 percent level considered healthy.” No, 80% is not considered healthy. That’s

“Seems that not all recent Illinois governors end up in prison, but perhaps they should be jailed for this crap.” –Actuary Mary Pat Campbell By: Mark Glennon* Former Illinois Governor Jim Edgar is getting lots of attention for his recent comments that Governor Rauner should give in to Democrat and public union positions to resolve the state’s budget impasse. Rauner shouldn’t “hold the budget hostage” by demanding reforms as a precondition to the tax increases that budget resolution necessarily entails, Edgar said. Here’s why he has no credibility on that. Keep in mind that during most

By: Mark Glennon* Crain’s Chicago Business’ editorial board today endorsed Rahm’s budget proposal under the headline, “Chicago’s road to reality paved with pain and politics.” Chicago is finally dealing with reality, they say. “The city of Chicago no longer can afford to put off the inevitable—it must cover its obligations” to pensions, they say. “We must pay. The time to reckon with that reality is now.” Their only concerns about Rahm’s proposal are the burden it puts on commercial property owners and the omission of further spending cuts, though they offered no suggestions on that. Springfield should authorize the

And a ‘get well’ wish to author Mary Pat Campbell. We need honest actuaries like her at full capacity.

Author Mary Pat Campbell is an actuary who writes about pensions.

By Mary Pat Campbell, an actuary.

Mary Pat Campbell, an actuary, takes a detailed look at the reasons for out-migration.

Author Mary Pat Campbell is an actuary who writes about pensions.

Mary Pat Campbell, the author, is an actuary who writes about pensions.

Stump is Mary Pat Campbell, an actuary who writes about public pensions.

Latest in a series about each of Illinois’ statewide pensions from Mary Pat Campbell, an actuary.

Author Mary Pat Campbell is an actuary who has been going through each of the five state level pensions for Illinois. This is the latest in her series.

Author Mary Pat Campbell is an actuary who writes about pensions.

Author Mary Pat Campbell is an honest actuary who blogs about pensions.

From an actuary who blogs about pensions, Mary Pat Campbell: “For the country as a whole, the ARC seems to be growing fairly slowly compared to revenue, so that’s not too concerning… but Illinois? Holy crap.” Comment: Remember this when you hear Illinois legislators claim they have been fully funding pensions in recent years.

http://stump.marypat.org/article/207/80-percent-funding-hall-of-shame-february-2015-round-up Author Mary Pat Campbell is an actuary who blogs on pensions, who ridicules politicians who claim that 80% or 90% funding is a proper goal for pensions. That’s like saying that having 80% or 90% of the gas you need to get home is enough; it’s just arbitrarily defining part of the problem away. Former Governor Jim Edgar is on her list.

Mary Pat Campbell at Stump is an honest actuary who blogs on pensions. Her take on our recent court decision: “Employees of Illinois: save as much cash up as you can, and follow the taxpayers out of Illinois as well…. All it means is that the end of your sweet benefits are just that much closer. Thinking that you’ll always get yours means that you will not make the deals that need to be made before catastrophe occurs.” via STUMP » Articles » Public Pension Watch: Illinois Reform Goes Down (as Expected) » 23 November 2014, 08:28.

After the disastrous one-term tenure of outgoing Mayor Lori Lightfoot, Chicago has landed hard at an urgent turning point. The city is wracked by disarray and dysfunction of epic scope. It’s moral decay that’s driving corrosive crime and failing schools – from which black and brown Chicagoans suffer worst. If Chicago can’t muster the courage to torpedo its underlying moral decay, the city’s troubling predicament will worsen even further.

After the disastrous one-term tenure of outgoing Mayor Lori Lightfoot, Chicago has landed hard at an urgent turning point. The city is wracked by disarray and dysfunction of epic scope. It’s moral decay that’s driving corrosive crime and failing schools – from which black and brown Chicagoans suffer worst. If Chicago can’t muster the courage to torpedo its underlying moral decay, the city’s troubling predicament will worsen even further.

SIGN UP HERE FOR OUR FREE WIREPOINTS DAILY NEWSLETTER