By: Ted Dabrowski and John Klingner

Illinois lawmakers are considering major pension boosts for Chicago police and firefighters this week even though those pension plans are effectively insolvent and among the nation’s worst-off. The police and firefighter plans are just 24 percent and 20 percent funded, respectively, based on official estimates.

The benefit increases threaten the already-tenuous retirement security of Chicago police and firefighters and create an additional burden on city taxpayers. They also risk worsening the overall financial health of the city, which already has the worst credit rating among the country’s big cities.

Two separate proposals have been circulating in Springfield. One boosts the cost-of-living adjustments (COLA) and pension formula for Chicago firefighters while the other boosts the COLAs for Chicago police. Final action on both have been delayed until the legislature’s fall session.

In sum, the “sweeteners,” as previous Chicago CFO Jennie Huang Bennett called them, could increase the city’s pension obligations by approximately $5 billion through 2055. That translates to an additional $100-plus million annually that taxpayers will have to pay to the funds, based on the CFO’s comments and Wirepoints’ estimates.

Illinois politicians apparently have no idea, or simply don’t care, how much of a pension crisis Chicago is in. They already increased COLA benefits for Chicago’s firefighters two years ago, increasing 30-year pension costs by nearly a billion dollars – and now they’re adding more costs to a near-bankrupt system.

Near insolvency…

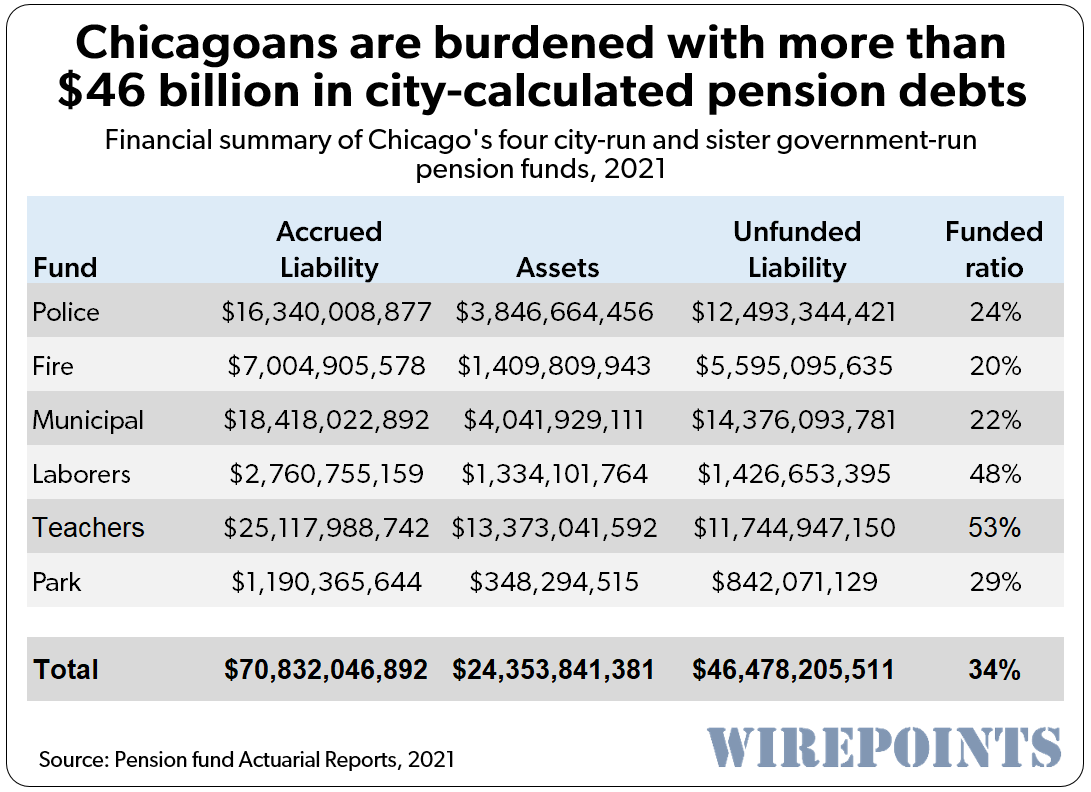

Chicagoans are already on the hook for $35 billion in city-reported pension shortfalls for the city’s four pension funds. Add in the Chicago Teachers pension shortfall of $12 billion and the total debt rises to over $46 billion.

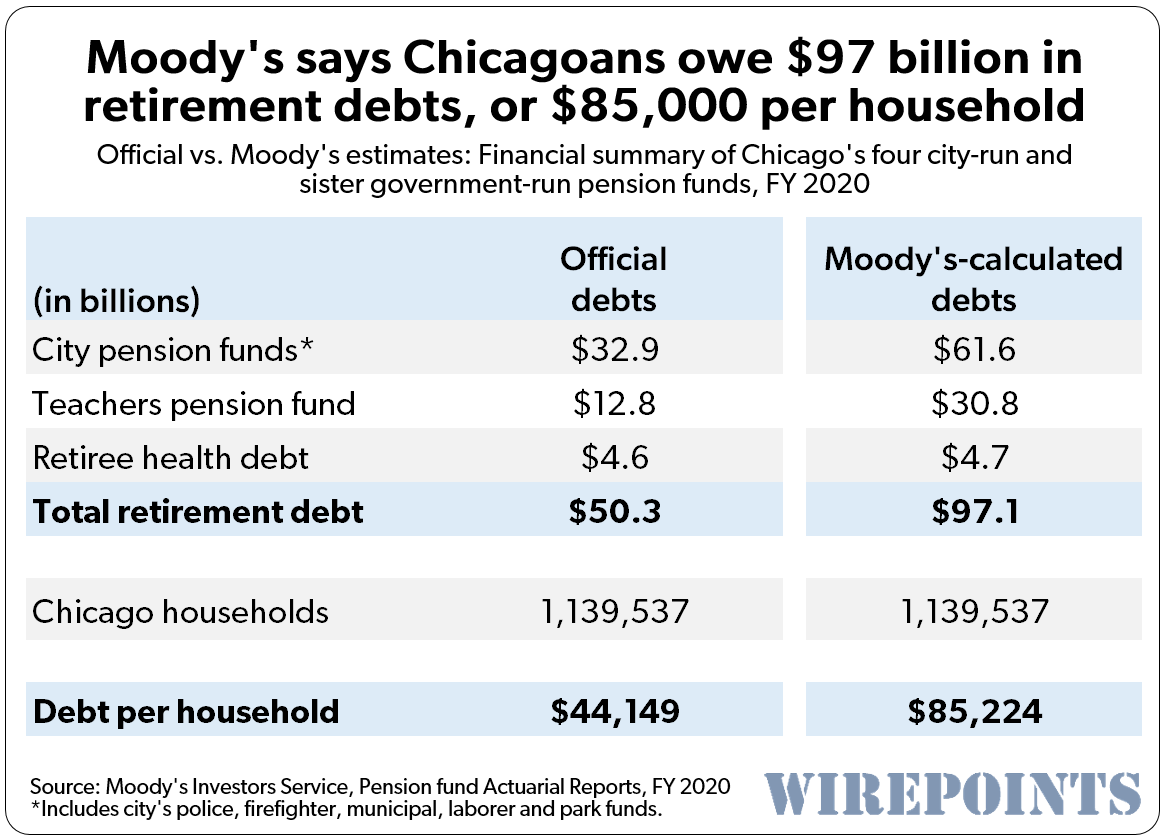

And those numbers are just the city’s rosy estimates. Add in retiree health insurance debts and Moody’s more conservative calculations and Chicagoans’ total debt rises to $97 billion – more than $85,000 per city household.

And those numbers are just the city’s rosy estimates. Add in retiree health insurance debts and Moody’s more conservative calculations and Chicagoans’ total debt rises to $97 billion – more than $85,000 per city household.

The city’s huge debts are a reflection of the pension funds’ poor health. Chicago’s pension funds are, collectively, only a third funded.

The city’s huge debts are a reflection of the pension funds’ poor health. Chicago’s pension funds are, collectively, only a third funded.

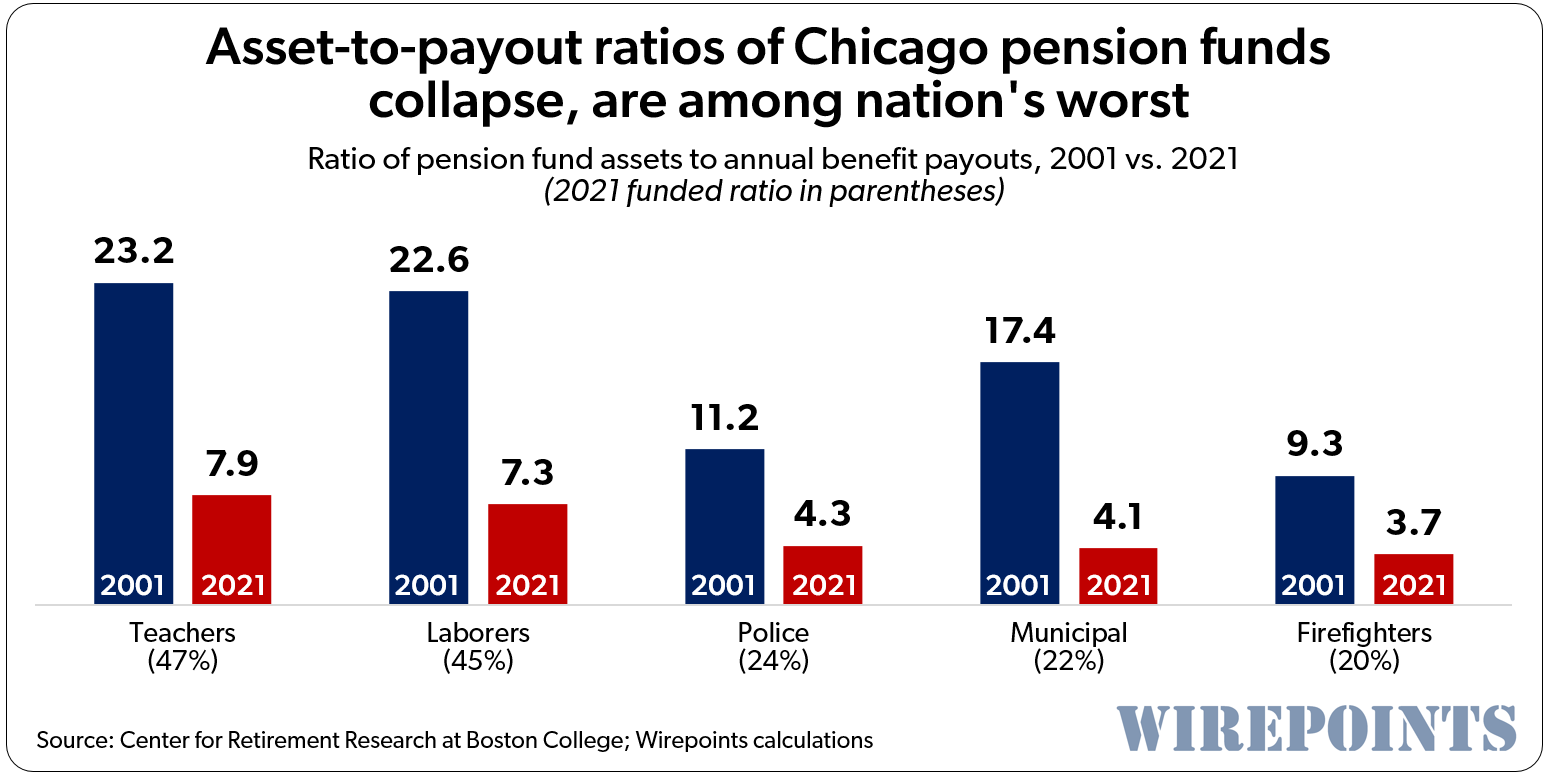

Another way to measure the health of Chicago pensions – one that Moody’s uses in its credit analyses – is to look at how much money the funds have left compared to their annual benefit payouts. That’s called an asset-to-payout ratio, which measures how many years a pension plan can make benefit payouts before it runs out of money, assuming no new contributions or investment income are added.

Two decades ago, several of Chicago’s pension funds had enough money on hand to make about 20 years worth of payouts. Today, all of them have less than eight and the firefighter’s fund has less than four.

Two decades ago, several of Chicago’s pension funds had enough money on hand to make about 20 years worth of payouts. Today, all of them have less than eight and the firefighter’s fund has less than four.

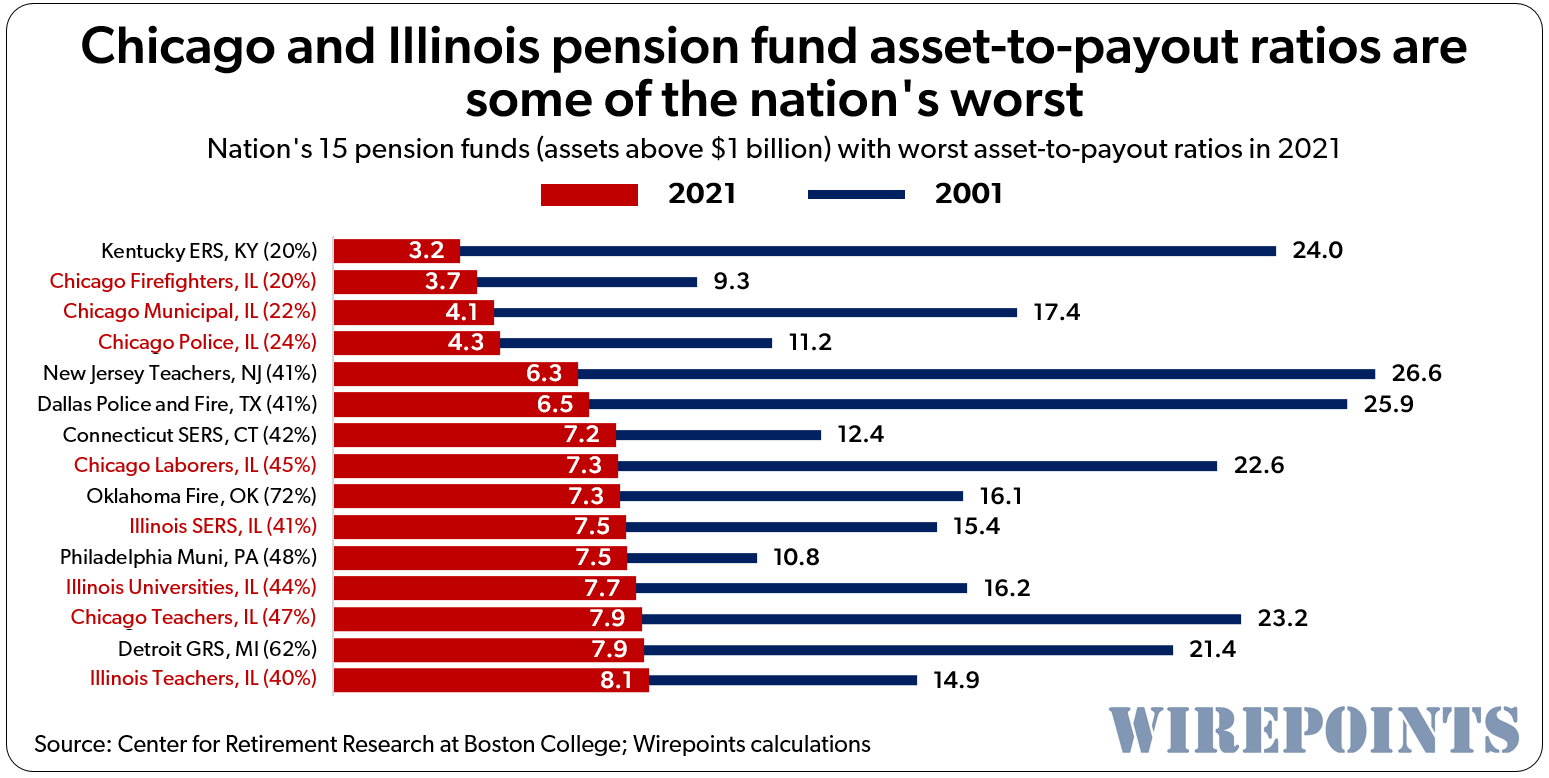

Those ratios are dismal, especially compared to other pension funds across the country. Wirepoints looked at nationwide pension data (for funds with more than $1 billion in assets) from the Center for Retirement Research of Boston College and found that Chicago’s four city-run funds are all in the top 10 worst-off in the nation.

In fact, of the 15 big funds with the worst asset-to-payout ratios, eight of them are either Chicago or Illinois pension funds.

Contrast that to pension funds like the Texas Municipal Retirement System, which has an asset-to-payout ratio of 22 years. Or the Tennessee State and Teachers’ Retirement Plan, which has enough assets to make payments for 32.5 years.

Contrast that to pension funds like the Texas Municipal Retirement System, which has an asset-to-payout ratio of 22 years. Or the Tennessee State and Teachers’ Retirement Plan, which has enough assets to make payments for 32.5 years.

…but still boosting benefits

The dismal health of Chicago’s retirement funds hasn’t stopped lawmakers from negotiating the two separate proposals that would boost pension benefits.

Boosting Police COLAs

The bill grants all Tier 1 Chicago police officers (those hired before 1/1/2011) a 3-percent simple cost-of-living adjustment (COLA) to their annual pension benefit. It’s basically identical to the firefighter sweetener that lawmakers passed two years ago.

Currently, retired Tier 1 police officers born after 1/1/1966 receive only a 1.5 percent simple COLA increase every year. The bill eliminates the birthdate restriction, giving all Tier 1 retirees a 3 percent, simple, increase.

Wirepoints is unaware of any official cost analysis done for this proposal. However, when the firefighter sweetener passed two years ago, the Lightfoot administration warned that a police version of that bill would cost the city between $57 million and $96 million in additional pension contributions a year.

Sweetening Tier 2 for firefighters

The proposal sweetens the benefits of Tier 2 Chicago firefighters (those hired after 1/1/2011).

First, it boosts COLA benefits. Today, retirees get COLAs equal to the lower of half the rate of inflation or 3 percent. The bill changes COLA to the lower of the rate of inflation or 3 percent.

Second, the proposal sweetens the firefighter pension formula. Currently, a Tier 2 firefighter’s starting annual pension benefit is based on the average of his highest 8 years of salary during his last 10 years of work. The bill changes that to the highest 4 years of salary in his last 5 years. A shorter time span means a higher final average salary and, therefore, a higher starting pension.

Chicago’s previous CFO has warned this proposal would increase overall costs by $3.2 billion and force the city to increase its contributions to the firefighter fund by $60 million a year – growing to $311 million a year by 2055.

Another burden on Chicagoans

Wirepoints has long warned that Tier 2 would run into legal problems because its members are effectively subsiding Tier 1 pensions – and are likely to run afoul of Social Security’s “safe harbor” rule which says all pension plans must offer benefits that are at least as generous as Social Security.

But as the Chicago CFO points out, the proposed firefighter boost goes overboard. The proposal is “a nearly 30% increase in pension benefits above and beyond the social security safe harbor.” That’s why she refers to it as a “pension sweetener, pure and simple.”

Tier 2 need to be fixed, but the solution isn’t to simply increase the benefits it provides. That will only increase costs and damage the retirement security of all pensioners. That’s also true for the proposed Tier 1 benefit increase for police officers.

Unfortunately, lawmakers continue to ignore reforms to dig deeper holes instead.

Read more from Wirepoints:

- Chicago’s commercial ‘doom-loop’ could result in a property tax hike on homeowners as large as 22%

- Mayor-elect Johnson’s ‘silly’ kids comments could embolden the criminal actions of Chicago teens: A look at the numbers

- Pension reform, Illinois style: Legislation to ‘fix’ the Tier 2 problem

- Illinois pension debts jump back up to $140 billion, state shortchanges its annual contribution by $4.4 billion

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

Can’t afford any of it anyway…do all the studies you want…the money only goes so far…and you can’t get blood out of turnip. Legislature is so corrupt and stupid…they will agree to anything. Time to leave…

All these Illegal Aliens coming to Chicago will soon be contributing in excess of their public charges. We’re told that we are getting their best. I suggest we earmark part of this windfall to cover any potential public employee pension impairment and fund a raise in said benefits.

Well Washington stepped in to cover all the pensions for Ukraine. We’re paying their pensions. They’ll bail out a big blue city public sector pensions in a heartbeat

I know someone who’s collecting a pension and scared to death every day. She worries If it comes time for her to go into a nursing home there won’t be any pension left to pay the fees and she’ll be out on the street. Pensions are the biggest gamble in the state of Illinois. Lottery tickets are a better investment. These people think that our tax dollars will support them until they die. Not gonna happen. Pigs get fatter, hogs get slaughtered.

How clever and so original, too!

Pensions are a gamble. I know more than a few pensioners and none of them really expect to collect their full pension for the rest of their lives. They know it’s gonna get cut even if PFF insists it will not.

She could protect herself right now by saving a large portion of her monthly pension check & working part time to replace the income.

Consolidate the plans so us downstaters will have our real estate on the hook for those Chicago unfunded pensions. Another present to the downjstaters from the money pit known as Chicago.

The Chicago fire & cop pensions are not consolidated w rest state. That’s reason why they are asking for change

Is there still a waiting list to be a Chicago firefighter?

This really good Bond Buyer article WP posted on 5/17/23 pretty much makes it clear this bill is just one of several to make Chicago fire fighter & cop pension deals compatible with statewide consolidation of cop & fire pensions that Chicago fire fighters & cops wanted to be include in but where not (not sure I understand why). But then Chicago fire & cop where “promised” they would get similar deals. And bigger “Tier II fix” will be coming in fall (CTU, for example, has an entire lobbying team working on this)…with all pension deals going through Martwick. With… Read more »

Municipal employees, Firefighters, Police and Teachers in Chicago and Cook County were not included in State pension plans because the local leaders would have to relinquish control of the money flow to the downstate hicks. Now going broke, pension money managers see those state plans as a money pool to keep their Ponzi scheme afloat.

Would anyone know the legal basis for the State of Illinois to spend $1B on migrant health care? Will the appropriation language allow those who are losing their Medicaid coverage (US citizens) to participate in the migrant health care program? Thanks.

In all probability there IS no legal basis that would be upheld by appellate courts. However the courts dockets are so congealed and the lawyers are so venal that the politicians do it. The politicians know they are likely to be immune and most of them are judgment proof when it comes to a billion dollars of illegal spending of public funds. Likely the State would plead public emergency and police power by way of defense and several years of discovery to establish the validity of their motive would be required. It’s just another example of the “slow walk” for… Read more »

It’s called an Arbuckle whim; Vote buying.

Every dime of pensions-medical (ie $0.5T liability range estimate) is secured by your homes via unlimited property taxes. No Illinois politician cares about homeowners (particularly suburban homeowners outside of vote rich Chicago) until and unless the state becomes ungovernable.

That’s not gonna happen until home values drop like ie 30-50% from current levels, property taxes ie double, and the quality of life continues to degrade as every dime of taxes is directed to public pensions-medical.

I’m not sure that there’s anything the cabal running Illinois could decide that would surprise me.

It’s as if they’ve learned that it’s not even necessary to lie well, they just need to lie a lot.

It’s really quite shocking that there isn’t more ‘out migration’ from this city ! Taxes, random crime, violence on the streets, thieving, corrupt politicians and Labor Unions all seem to be screaming… Get out while your property is worth something and you haven’t been mugged, beaten or murdered ! Anyone expecting a turnaround need visit Detroit, Baltimore or Watts ! One of these summer evenings will find a car full of criminal thugs plowing into the Viagra Triangle, in the car they just stole from a valet …at gunpoint !.

Part of the reason is Chicago Ignorance and stubbornness. It’s on a similar level to the Ignorance & Stubbornness you see from Russians.

But every human being has a breaking point and eventually the pain & suffering of living in Chicago will break you.

LOL out migration has slowed to a trickle because the market has run out of greater fools who want to buy properties in the city of chicago. Can’t move if you can’t sell! Until of course the neighborhoods are simply abandoned. Sales have tanked and prices just went negative YOY.

I actually love this stuff, both at the city and state level. That’s because I know that most of the public sector employees that keep sucking this stuff out of the citizens are going to get none of their pensions when the well runs dry. They think they can point to the Illinois constitution as protecting their pensions. Guess what? It won’t because there will be no money. Do they think the courts will make the legislature raise taxes by 500%, or force the mayor or governor to sell assets to pay the pensions? That isn’t going to happen. In… Read more »

The fools think shall, not be deminished will be honored. Youll

get nothing and like it! Judge Smails.

sils

The state brings in over $50 billion per year in revenue. Plenty of money to pay pensions. Not enough for all the other wants but plenty to pay the bondholders and pensioners. Who knows maybe some day they will get hit with a 5% Detroit style cut. lol

Once again PPF, Detroit municipal employees were lucky (or perhaps planned it that way) a Democratic president was in office.

Chicago pensioners mat not fare so well under President DeSantis.

The state of Illinois can’t go bankrupt so it doesn’t matter if Obama or Desantis is in office. Sure for a municipal bankruptcy it would help to have friends in Washington but even Detroit didn’t get that much money from the federal government. How much money did they receive? If they didn’t get it what would the cuts have been? 7%? Chicago may some day indeed make cuts through bankruptcy but pensioners will still be looking at a relative small cut. Look to Puerto Rico if you have nay doubt. Now, the state has no such option as they can… Read more »

Detroit pensions were modest in size, nothing like Chicago’s. On the other hand, when Detroit declared bankruptcy, revenue sources were shockingly slim – the casino was the biggest source. Agree with your on Puerto Rico as a precedent. The real possibility no one mentions is that Chicago may well be looking at a largely asset less bankruptcy, which means that bankruptcy may not help much and the City becomes a Harvey with scant services. A pay as you go pension situation could well bring that about.

Best of luck, you cannot get money where there is no money. The state must provide certain services, this has been ruled in the past. There will not be enough taxpayers to buy lunch soon. They will have all left the state. Just look around now, and numbers are increasing. Most everyone in the state wants out. You’ve done a great job at destroying the quality of life for millions of families.

The state must pay pensioners. This has been ruled in the past.

Expanding Medicare for illegals? Free Kindergarten for all? Not so much.

Plenty of money for pensions.

States can be insolvent and just not pay bills. I can’t find the link now, but I believe Alabama is still on some international bank’s blacklist for defaulting on a bond pre-civil war, and has never been taken off. The day will come when the state just stops paying bills entirely. And since pension claims are contracts, pensioners will have to file their claims individually in the court of claims, not in regular court.

The dynamics are not quite right, but they may be soon. Let’s watch what happens in the current “debt ceiling crisis.” Right now public employees and pensioners aren’t experiencing pain and some think there’s no risk. Union coffers are relatively robust and the lawyers are well-paid. Government entities have lawyers on the payroll and access to outside counsel using other peoples’ money to pay them. The judges are mostly bought and paid for (not bribed, necessarily, but with elections funded by unions and other contributions from their respective “constituents”.) When the pension funds are getting closer to empty, the interests… Read more »

I find it interesting that so many commentators vilify pensioners and not the politicians who agreed to the contracts, then failed to make adequate deposits.

Politicians continue to make inadequate contributions, and commentators target pensioners.

There’s a real disconnect.

Many of these commenters are just jealous.

Some commenters also look down on police, firefighters or teachers and get upset knowing these people have planned for their retirement better than they have for themselves.

Some commenters vilify pensioners to dehumanize them which also makes it easier to justify when you try to steal from them. Our great constitution is the only thing that prevents the tyranny of the majority from stealing from the minority.

PPF – Ok once you get past comments on other commenters which isn’t debate but emotionalism, what is the answer when a fund like the Chicago police or fire hits pay as you go status? The reflexive and at least in the short run accurate answer is the pensions must be paid. But what then? Pay as you go means an enormous amount of an operating budget must be paid to pensions, with a domino effect on other City pensions as sufficient actuarial payments become a pipe dream. Borrow, as in pension obligation bonds to the extent anyone would issue… Read more »

Willowglen, there is no answer, because the system as it is will continue until it all collapses. Brandon Johnson is in charge, at least nominally, and thing will keep going until they can’t, and then it will collapse. PPF has some court case from a decade ago he clings to but fiscal reality and politics will always prevail. The law is on his side now, just as the slave owner in 1859 believed that the Fugitive Slave Act protected his property that escaped to the free northern states. Or the abortion doctor in WI or TX that believed that Roe… Read more »

Public pensioners have done relatively well in insolvency proceedings to date. The unions know this, and it diminishes their already virtually non-existent desires to address the problem. One thing I do think is different about Chicago’s pensions – and let’s start there because the City pensions are the most vulnerable and Chicago has limited ways to collect increased revenue – is that Chicago pensions are large. They are a huge fixed cost and given the liens the City has given to lenders there isn’t much room to continue to carry the pensions long term. The State’s problems because they can’t… Read more »

Jealous of people who are stealing money from unborn children? Not me, you have no shame. Lack of contributions? Illinois has some of the highest taxes in the country. Just who is collecting all of tens of thousands of dollars I pay every year? Not for long though. Stay if you want sucker, but this taxpayer is leaving and not coming back.

Everyone in Illinois except for the greedy vermin public pensioners know that the public pensions are a criminal scam. For decades, the public unions bribed politicians with campaign ‘contributions’ and boots-on-the ground at election time in exchange for grossly above market wages, no-work and little-work ‘jobs’, gold plated pensions and Cadillac health plans. Period. Public unions call it “democracy’ but the rest of us know criminal collusion when we see it. When things get ugly the public pensioners will have no friends. These criminal co-conspirators won’t up destitute but their houseboats in Florida will be gone, the double and triple… Read more »

“Fact” its not. Its speculation and nothing more.

I agree it is speculation- but what the politicians in Illinois want is a federal bailout – and Tom Paine’s comments point to why that won’t be easy or perhaps even realistic.

Yes, and most of the readers here surely already know that part of the overall saga. But, we also know political winds blow in varying ways and strengths from time to time, meaning any presumed eventuality’s chances for implementation can change as well. “It ain’t over until the fat lady sings.”

Whine and squeal all you want TPG, taxes will go up before one penny is cut from a state pension. Plenty more taxes left to be raised.

Illinois just shorted the pensions by $4.2B to only $10.2B instead of the $14.4B based on actuarial tables in the latest budget. All of us one way or another made our required payments mostly thru property taxes. The money that is appropriated to pensions from our taxes are diverted to other areas like healthcare for border jumpers or whatever. Where is our hard earned money going to?

Ironic how rating companies are really in the business of determining which of many Ponzi schemes is the best Ponzi scheme. Because there is no real wealth to rate. This is why Russia, China, Brazil, India and South Africa, and many more countries to follow… are forming BRICS. Their rating agencies are to be geared to rate real tangible wealth, not debt instruments. They will rate natural resources, industrial capacity, and the educational level of its citizens in physics, engineering, math, work ethic and innovation, etc. Out of this will come some sanity in world economics, money with real value,… Read more »

We have adult children running the government(s) in Illinois. They think money grows on trees.

You’re giving them too much credit by calling them children. I call them what they are: communists.

One of your predictions making sense to me is that because our country is producing poorly-educated children who are becoming poorly-educated adults, it will continue to be less competitive with the top-tier developed countries and more dependent on them, thereby continuing to lower the standard of living here.

I wonder who is going to pay for all of this?

Not the people who flee that is for sure.

I hope the new illegal immigrants get high paying jobs.

Who is going to create the jobs? Good question as the State and Chitty are chasing them out of State. This is going to be one of the largest economic train wrecks in history.

Many of us hope and expect that the obligations will be borne by the current and future pensioners when the pension trusts are dry, the tax base diminished AND the targeted wealth-holders leave the state. Otherwise the federal bailouts will bankrupt us all.