Violent crime is up in Chicago…and released repeat offenders are likely involved – Wirepoints on with WJOL’s Scott Slocum

Ted joined Scott Slocum to talk about the huge potential cost to taxpayers for the Bear’s proposed new stadium, why the economics of publicly-funded sporting arenas don’t work, what the latest criminal justice statistics tell us about the SAFE-T Act’s impact so far, the latest developments on Chicago’s ongoing migrant crisis, and more.

Ted joined Scott Slocum to talk about the huge potential cost to taxpayers for the Bear’s proposed new stadium, why the economics of publicly-funded sporting arenas don’t work, what the latest criminal justice statistics tell us about the SAFE-T Act’s impact so far, the latest developments on Chicago’s ongoing migrant crisis, and more.

The fund that pays fire pensions to 95 families had been in jeopardy because so little money remained, but has accepted a deal from the city government to put $4.5 million into the pension fund by the end of May. The Police Pension Board has asked Illinois Comptroller Susana Mendoza to seize state money allocated to the city and use it to help pay for police pensions.

The fund that pays fire pensions to 95 families had been in jeopardy because so little money remained, but has accepted a deal from the city government to put $4.5 million into the pension fund by the end of May. The Police Pension Board has asked Illinois Comptroller Susana Mendoza to seize state money allocated to the city and use it to help pay for police pensions.  We’re supposed to worry that climate change itself is to blame for Illinois’ failing climate policy, but far bigger problems are obvious.

We’re supposed to worry that climate change itself is to blame for Illinois’ failing climate policy, but far bigger problems are obvious. Traumatizing robberies and violent crime continue to go up in Chicago this year, hitting a six-year high compared to the same time last year. It’s crime in neighborhoods perceived as safe, sometimes taking place in broad daylight, that’s driving the increased fear among Chicagoans and suburbanites.

Traumatizing robberies and violent crime continue to go up in Chicago this year, hitting a six-year high compared to the same time last year. It’s crime in neighborhoods perceived as safe, sometimes taking place in broad daylight, that’s driving the increased fear among Chicagoans and suburbanites. Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

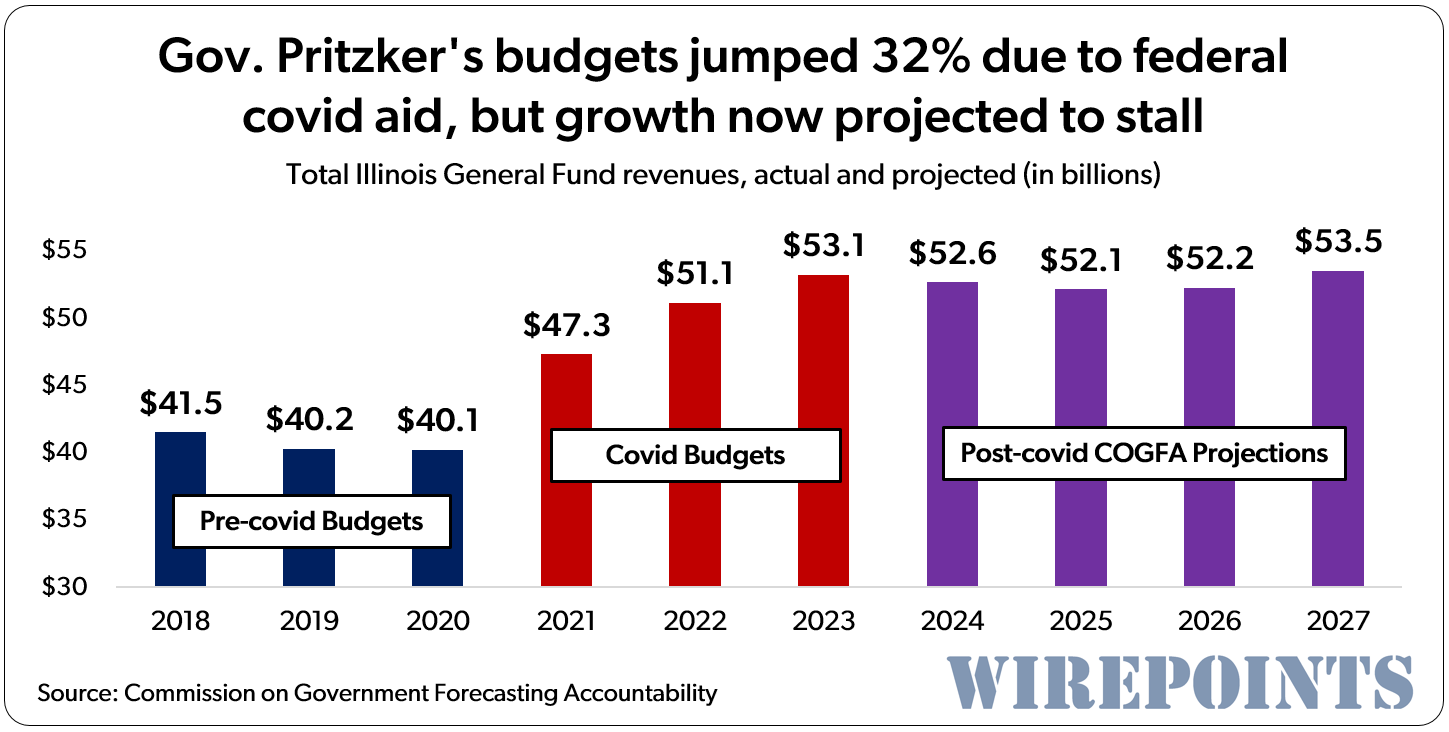

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more. Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

obviously, the planet of esl has not been paying attention for several years, the FD will be absorbed into the common fund of the state, and the local board will not be allowed to make investments, etc, maybe the pol’s thought when the state created IPPOPIF thaat they were going to make the fund solvent for them?

East St. Louis has almost 200 municipal employees and more than 100 fleet vehicles. Time for them to start cutting expenses and pay their debts. If they won’t do it voluntarily than intercept their state funds. The only mistake was not starting the intercept process earlier.

I think, per the article, the Police are proceeding with their intercept process. I look to see much more of this in the future as municipalities stubbornly refuse to fund their obligations choosing to fund vote buying niceties instead. I should add that a neighboring community of East St Louis recently sold its waste water treatment plant while another sold its fresh water supply plant to fund pensions. In my mind I wonder if all of the sales proceeds went to the pensions are were some of the funds diverted to other goodies meaning in a few years it will… Read more »

Yes, the police are rightfully proceeding with the intercept. The town has been stalling both unions for awhile and the police are wise to force the ESL to get its act together.

Yes you have a point, 200 municipal employees seems like friends and family have their hands in the cookie jar and they’re looting the city, legally. But they can’t afford the legacy pension costs of 95 firefighters, likely the same or more police officers and an unknown number of retired city staff. They might be paying more retired former employees NOT to work than current employees on the payroll. At some point in the near future, most cities in IL will have more retired employees getting paid their full salaries plus 3% than current employees. It’s a recipe for disaster… Read more »

Following the next recession, this will be every city in Illinois: bankruptcy because of legacy pensioners.

WHO TOOK AN OATH, SWORE TO UPHOLD LAW AND CONSTITUTION OF THE STATE? SHAME ON THEM FOR HAVING BANKRUPT PENSIONS….

Without political reform we will never have pension reform. The pensioners are not to blame as most of therm worked hard and counted on that money. We need to educate the public as to the numbers, how this came about, and the politicians and union officials who either conceived of the plan, endorsed it, or sat by and let it happen. This issue can be resolved with leadership. The pensions and benefits of all elected officials going forward need to be slashed first. Also, ALL existing pensions must be capped at 100,000 max. With a COLA, 100 grand is a… Read more »

They grifted the money. There’s other place in society – other than the California & Illinois governments, an employee can work for 30 years at above market rates, retire, and then collect you full pay for 30 more years + 3% COLA per year, with spousal death benefits, guaranteed by the constitution. They all knew they are in on the grift. The pensioners all know the gravy train is going to stop some day and many of the higher paid ones know deep down that their pensions will be cut. The pensioners are 100% in on the grift too, that’s… Read more »

Many of the teachers I know are actually too dumb to realize how outrageous the benefits are.

“Also, ALL existing pensions must be capped at 100,000 max. With a COLA, 100 grand is a decent pension. The average recipient will still come out way ahead. It’s an only fair to cut first before going to the taxpayers.” Your suggestions are not legal. You can’t cap someone’s pension at some arbitrary number when they have already earned those benefits or are still working under their current tier that allows them to earn those benefits. It’s. only fair that taxpayers are required to pay for the services they utilized and the state agreed to pay. There will be no… Read more »

The same Supreme Court that had to recuse itself from suspended convicted felon Ald. Ed Burke’s law license? That Supreme Court? Yeah. The law of the land my butt…

Your opinion on the matter has absolutely no relevance. Your opinion about the Supreme Court has no relevance. It is the law of the land and proposing changes to pensions that violate the law will not be allowed. But keep playing pretend about possible pension cuts. I will admit that it is entertaining.

What is entertaining is whether the status quo is viable.Dolton for example can’t pay contractors for legitimate work done. Who knows the size of its debts at this point. Now Dolton is a usually corrupt situation even for Illinois (a strong attorney general would have fixed this problem already). Even a pension intercept suit may not work out well, although sales tax receipts will in the short run get dumped into pensions. But how can Dolton realistically raise taxes? Properties there are not worth much, and incomes are limited. Overriding the pension issue in the state is that all too… Read more »

Agree that Dolton is a mess. Along with Harvey and ESL. It will be interesting if the state lets those cities ever declare bankruptcy but it sure doesn’t look like it from recent history. Harvey just stopped paying its bills but pensions are still paid. Bondholders got pennies on the dollar while the state didn’t step in and allow them to file bankruptcy. The state seems fine letting these towns screw over others while pensioners continue to get paid. The pension intercept law highlights that very point. I have always maintained that someday may come where pensioners receive a cut… Read more »

So is the Magna Carta. Who will enforce the law of the land? Most laws are ignored AND unenforced. Who will pay for the pensions and health benefits? What is the “fair share” of whom? By what “due process” will that share be extracted? You can stamp your foot or pound sand but remember:

… the queen asked: “Are you called Rumpelstiltskin perhaps?” The little man got so angry then, that he started to stamp his feet so hard that he disappeared so deep into the ground that he never came back.

Remember your words when the state raises your taxes or the courts force payment of pensions before other spending. Stamp your feet all that you want but those pensions will continue to be paid.

Sorry this doesn’t work with me. I live miles from Illinois and own nothing there that can be taxed. However, I will continue to watch the accelerating economic and social decline of the state and the erstwhile fortunes of its current and retired public “servants.”

General Custer was heard to mutter “never say die” just before he died.

I suggest further reading on hope vs. delusion: https://thoughttherapy.info/delusion-and-illusion-difference/

Good for you. Make sure you continue to watch Illinois pensioners continue to cash their checks and live a good life. I’ll probably move to Tennessee (or some other state) in a few years and won’t be dealing with Illinois any more either. The difference is I won’t spend my time commenting about issues for a state where I no longer live. To each his own.

Brush up on your Hank Williams and reflect on Hemingway:

His 1926 novel The Sun Also Rises, following snippet of dialogue:

\”How did you go bankrupt?\” Bill asked.

\”Two ways,\” Mike said. \”Gradually and then suddenly.\”

Perhaps a train wreck at the bottom of the hill is a better way to go. Living Life in the no-spin zone. Avoiding nuance seems to have worked for George Bush II and he ain’t lookin’ back.

Nah. Instead I’ll read Forbes that discusses a 36 billion dollar bailout of the central states private pension fund. Josh Gotbaum, a guest scholar at the Brookings Institution and a former director of the Pension Benefit Guaranty Corporation, told Forbes. “This isn’t really about bailing out private pensions. What this is saying is that the U.S. government, which guarantees against a whole host of things like floods, hurricanes and crops, isn’t going to renege on its commitment to pensions.”“If you look at the financial crisis, banks got money, but they had to change how they operated,” Naughton told Forbes. Banks are now required… Read more »