By: Ted Dabrowski and John Klingner

The stock market’s nearly 30 percent collapse will create significant problems for many of Illinois’ 665 state and local public pension funds.

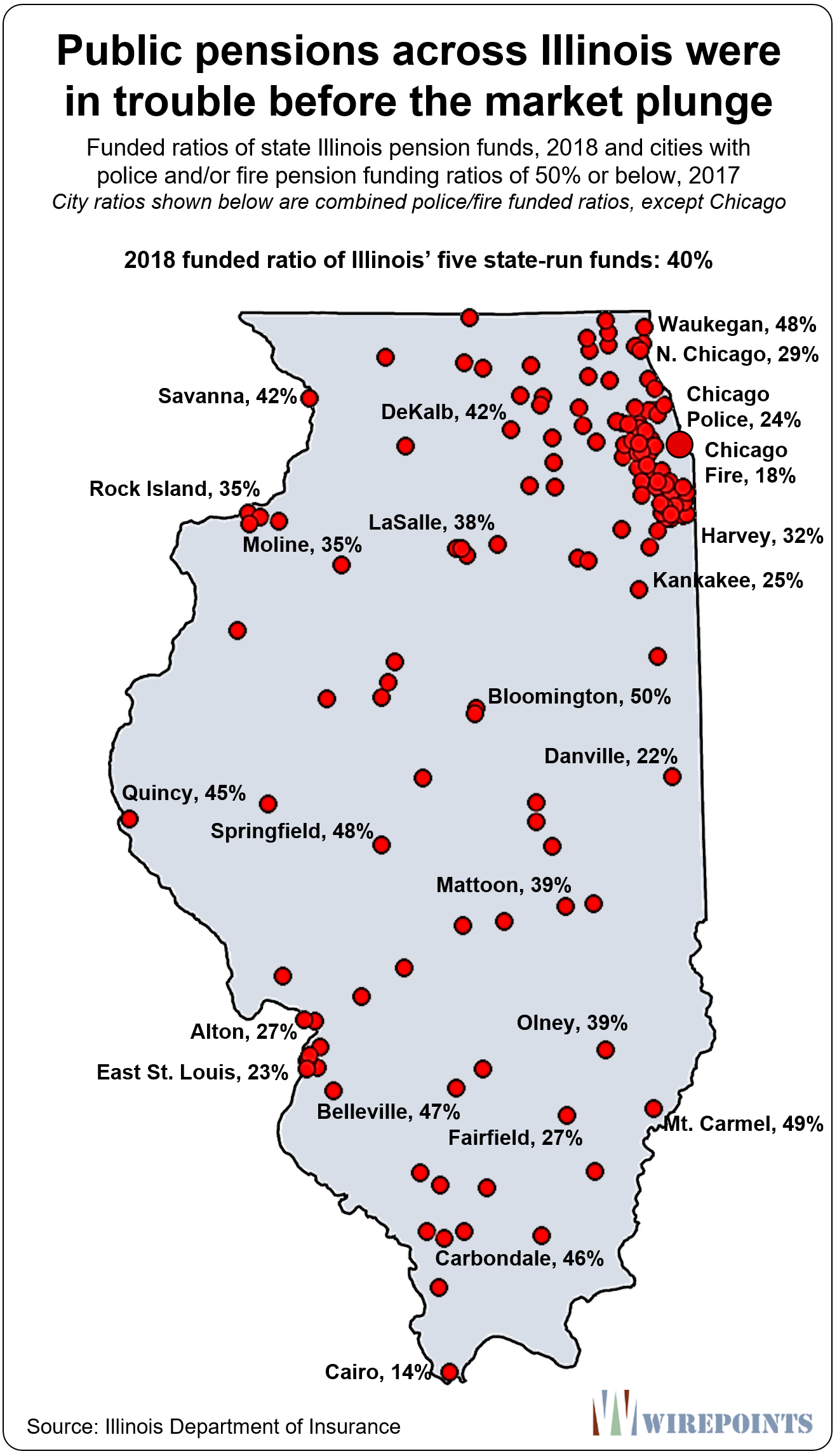

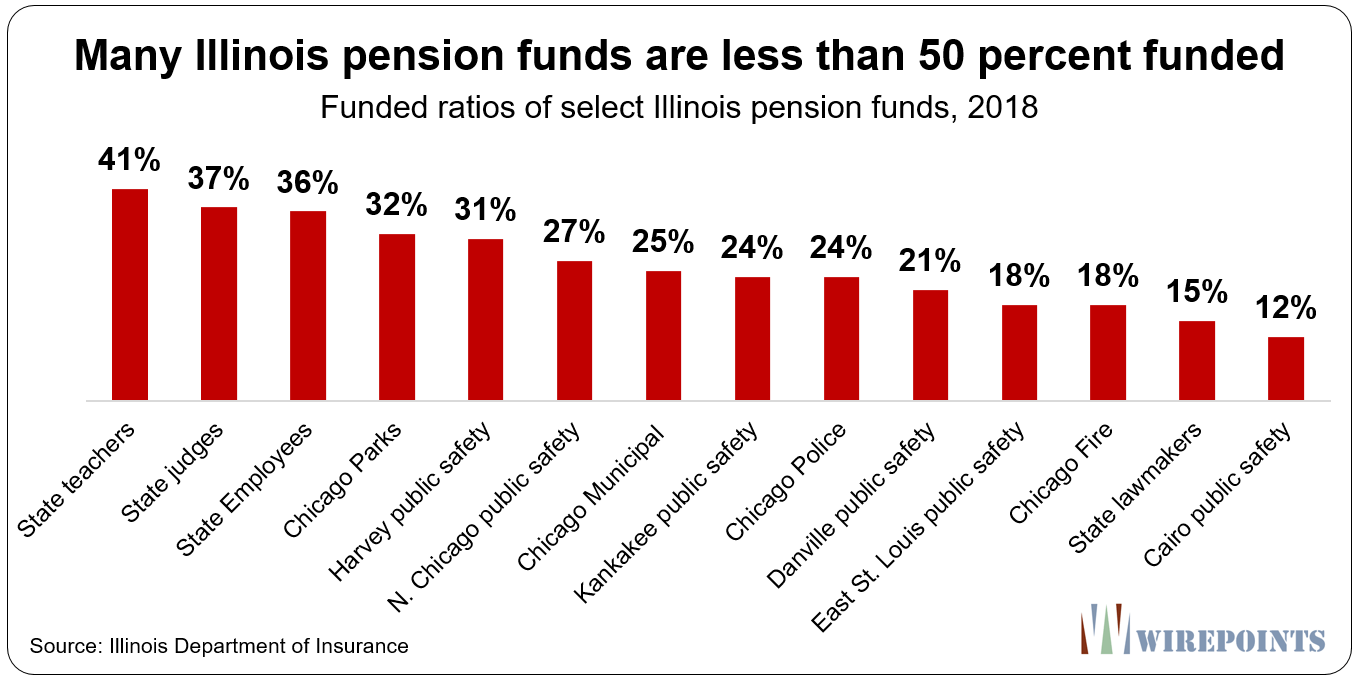

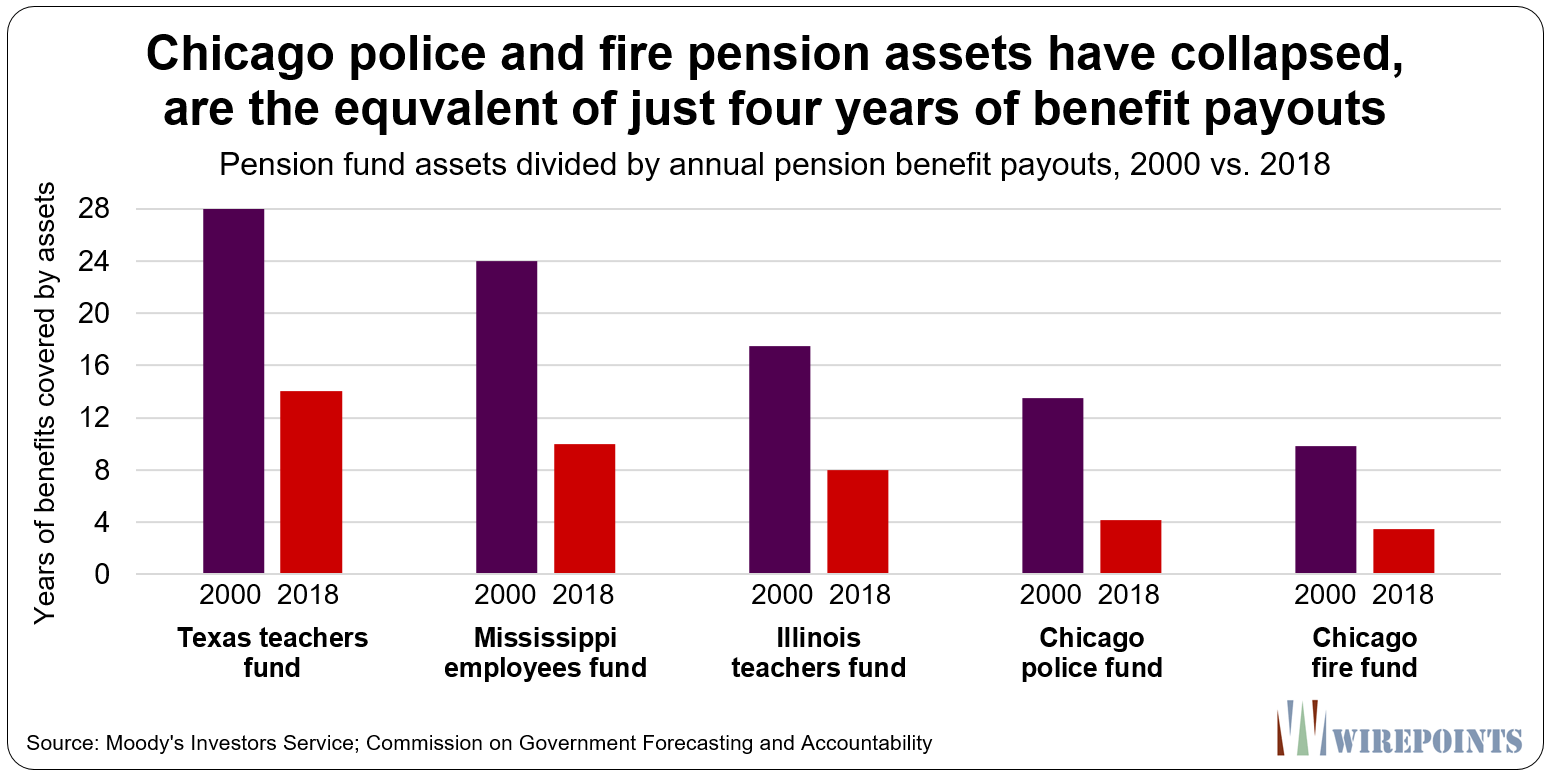

Even before the recent market plunge, the funded ratios of many Illinois plans – including the five state-run plans – had collapsed to 40 percent and below, with several falling into the teens. Some, like the Chicago’s police pension plan, were so underfunded that their assets were equivalent to only four years of future pension payouts.

Now the drop in the stock market and the collapse in bond yields – if they are sustained – threaten the solvency of those plans. Many have little room to maneuver and can’t afford more losses. And with bond rates now below 1 percent, the funds will have a hard time making money if they play it safe. With limited ability to earn investment income, the risk of a liquidity crunch for Illinois’ struggling pension funds has jumped.

That’s the predicament many Illinois funds find themselves in, especially if the crisis becomes a full-fledged recession. We highlight the challenges Chicago’s police pension fund faces as an example below.

Illinois’ pension plans failed to benefit from the nation’s 11-year bull market, its longest ever. Shortfalls rose by the billions across the state, despite a tripling of the stock markets. Illinois’ five state-run pension funds alone saw their shortfall increase by $56 billion, or 72%, from 2009 to 2018. The city of Chicago’s shortfall jumped by more than $16 billion, or 130 percent over the same period. And downstate and suburban public safety pension shortfalls grew by nearly $5 billion, or 70 percent.

Those shortfalls have left many Illinois funds unprepared to weather what has quickly become one of the nastiest market drops in recent history.

Illinois’ unhealthy funds can be found at every level of government. The state legislators’ pension plan is just 15 percent funded. Chicago firefighter pensions are at 18 percent. East St. Louis’ public safety funds are also at 18 percent. The Chicago municipal workers fund is at 23 percent. Kankakee’s public safety funds are at 24 percent. And the fund for state employees is just 36 percent funded. Every one of them is already technically insolvent and trapped in a downward spiral – one that will accelerate if current market conditions persist for too long.

Chicago’s police fund has few options

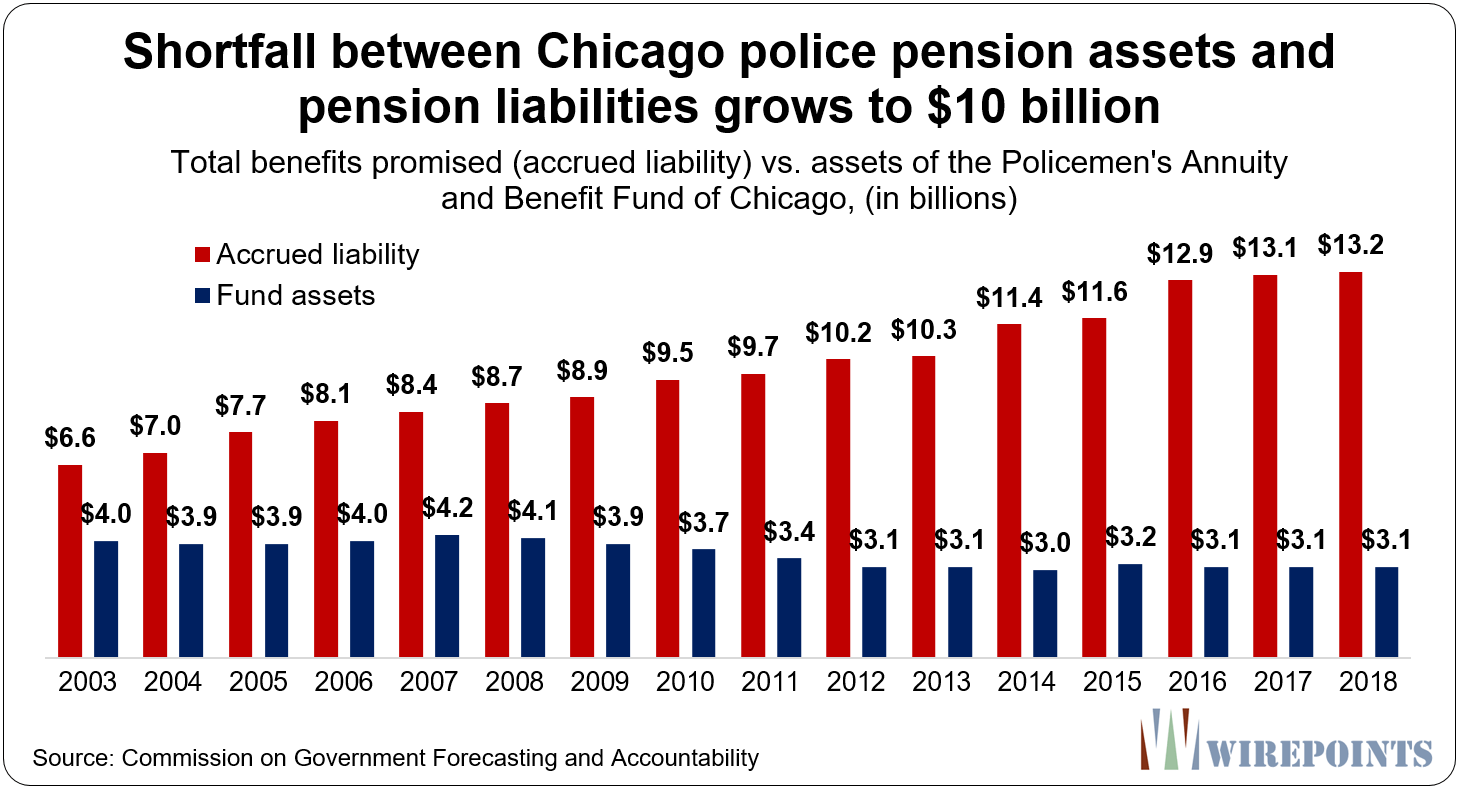

One of those “trapped” plans is the Chicago Police Pension Fund. As of Dec. 2018, the latest full year of data available, the fund should have had $13.2 billion in assets on hand to ensure the retirement security of the city’s active and retired policemen. The fund pays out about $760 million in pension benefits to members each year.

Unfortunately, the plan had just $3.1 billion set aside, less than a quarter of the money it needed. That’s a $10 billion shortfall.

With so few assets, the fund can’t afford to make any investment mistakes. The $3.1 billion in assets is equivalent to only four years’ worth of pension benefit payouts.

Being underfunded to such an extent has put the Chicago police plan in a predicament – whether to grow assets by investing in riskier markets or to protect what little money the fund has left by playing it safe.

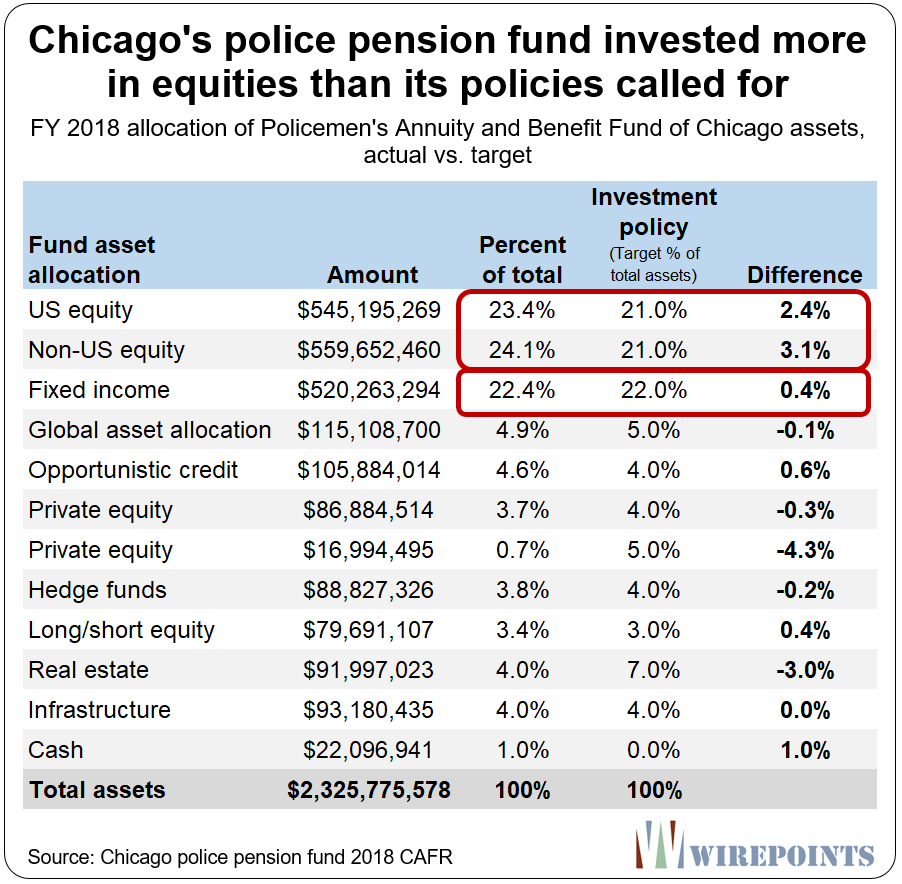

On the one hand, the police fund must grow what assets it has if it wants to get out of the hole it’s in. And that means investing in the stock market.

But that can lead to serious losses. In 2018, for example, the police fund ended with full-year investment losses of $128 million after the markets crashed in December, the result of its large equity holdings. The end result was a bigger hole for a fund already in deep trouble.

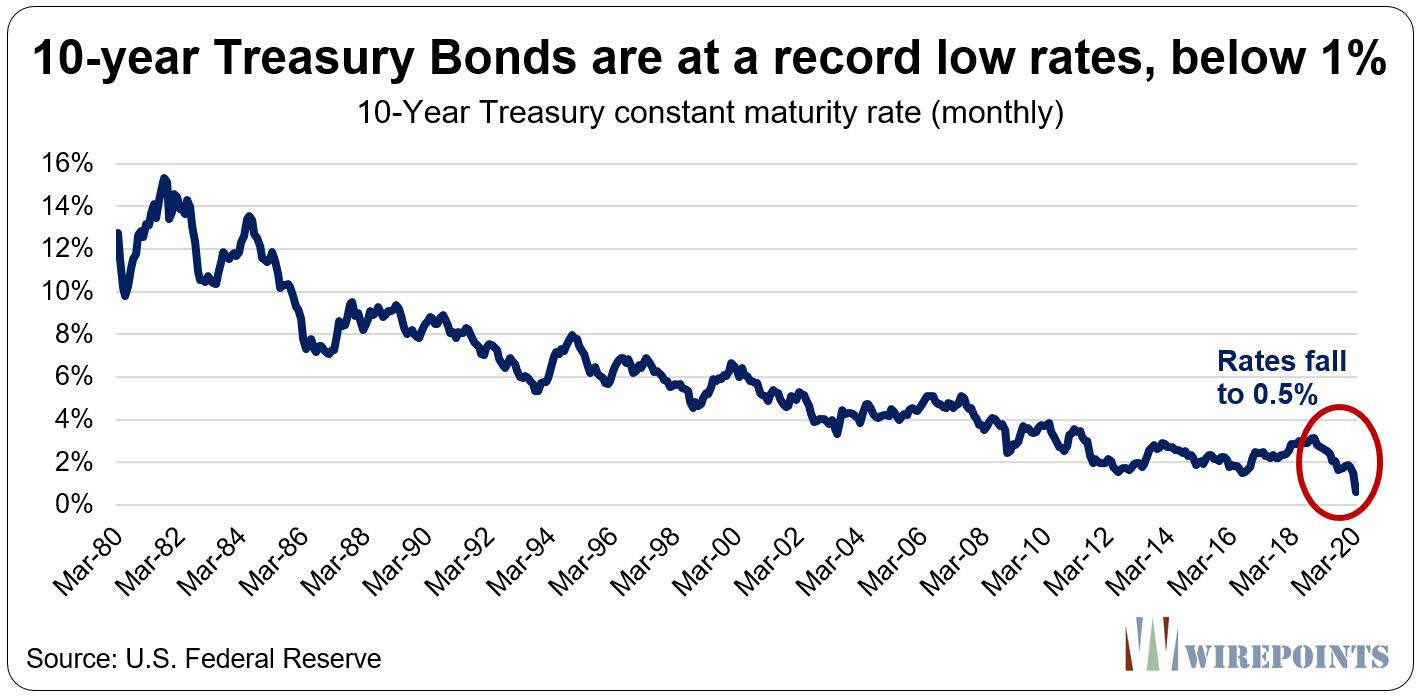

On the other hand, avoiding stock market risk comes with problems of its own. Rates on U.S. Treasury bonds have collapsed in recent years, meaning safe but meaningful investment returns have all but disappeared. The police fund invests a fifth of its assets in fixed income bonds, including Treasuries.

Pension funds nationwide used to rely on U.S. Treasuries to help reach their yearly investment targets. In the early 2000s, 10-year bonds paid as much as 6 percent annually and 30 years ago they paid more than 8 percent.

But recently, those 10-year bond rates have collapsed to record-low rates of 0.38 percent.

The collapse in both stocks and bond yields is a real problem considering the police fund still assumes it will make average annual returns of 7.25 percent over the next three decades.

The results of 2018 provide a good example of what happens when poorly-funded plans don’t achieve their assumed returns.

In 2018, the police fund received employer and employee contributions of $695 million, but lost $128 million on its investments. In all, the fund’s inflows totaled $568 million. But because the fund had to pay $784 million to its pensioners, the plan’s assets shrunk by more than $200 million that year.

For a well-funded plan, losing assets in one year is not a big deal. But for a plan that’s less than 25 percent funded, it makes insolvency all the more likely.

*******

Nobody is certain about the duration of the market impact of the Coronavirus or the subsequent impact on Illinois’ pension plans. What’s clear, however, is that ordinary Illinoisans are on the hook for whatever the losses turn out to be. They’re the ones who’ll bear the cost of plunging returns on the pensions’ fixed income investments for as long as they persist, as well as any lasting damage the virus inflicts on stock valuations.

For decades, Illinois’ political class ignored the retirement crisis. This crash is a reminder that their negligence has negative consequences, not just for taxpayers, but pensioners as well.

Read more about Illinois’ pension crisis:

- Chicagoans, pensioners: Beware a stock market shock

- Collapsing interest rates are devastating for Illinois’ troubled pensions

- US stock markets up 200%, yet Illinois pension hole deepens 75%

- Illinoisans overwhelmed by a ‘shadow mortgage’ of pension debts

- Illinois’ financial decay spreads to cities across the state

- Illinois state pensions: Overpromised, not underfunded

Cover image credit: Christoph Scholz

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans. Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

As Trump says it is all Fake News.

Morons that stay will find out first hand.

Many people from Illinois are embarrassed to tell anyone out of state where they live.

Poor taxpayer, I hate to tell you what “some people are saying,” but get a little more creative, please. Your messages are starting to be like the old broken record stuck on forever repeats, something more irritating than not. Put some thought into it! The basic idea has merit, but the delivery of it is truly ”old news” by now.

James, Move to Wisconsin before it is too late.

Getting rid of Herpes is going to be easy compared to selling in Illinois.

No one wants to live there, NO ONE!!!

“I gotta get outta here” is the most common thing she said she hears in her office from desperate taxpayers. “We hear it constantly in Polish, Spanish, English, Chinese, Korean, you name it. On a scale from one to 10 this is a 20. People are fuming!” Her employees in the Treasurer’s office have become like psychological counselors, she said, bombarded by endless numbers of depressed or enraged homeowners unable to pay their property tax bills. “They come into our office with their electric bills, parking bills, food bills and all the rest, and show us how much they make.… Read more »

The fruits of your labor belong to Greedy Cops, Teachers, and firemen who live in luxury homes in Florida at young ages. They have nice cars and boats. They support the Florida economy with your money.

Illinois residents are mentally challenged.

Question: I thought that when stocks tumble, investors go to government bonds as a safe haven. The logic on it being that bonds are less of a return, but also less of a risk. Shouldn’t this higher demand (and lower interest rates) mean governments get better “deals” on borrowing or refinancing?

Douglas, not quite. All bond prices have increased with the crash for the reasons you said, which lowers interest rates. Insofar as the pensions hold longer term bonds, say ten-year bonds, the pensions would actually benefit — on paper at least — because the values would be marked up (though the cash interest on them remains fixed_. However, they don’t hold proportionately much of that, so that good news is very limited. They hold short term bonds and notes to cover near term obligations. Those have to be rolled over regularly, or they sell longer term assets to convert them… Read more »

If this virus situation continues for years, which it could, then the entire world economy will collapse. The world economy is limping along with tons of unsustainable, unpayable debt, just like Illinois. It will take down everything if that happens, so it won’t matter what state you are in. Enjoy.

Let’s hope that summer stops this and allows time for vaccine/treatment to be perfected. As a libertarian, I do think this is an area for government in giving big money to whoever can develop a vaccine. I think that when the numbers come out in manufacturing, retail etc it’s going to be baaaaadddd. I’ve actually noticed fewer people out.

Doesn’t matter what state you are in? False

Well enjoy our safety, stability and fiscally responsible government in Indiana while you enjoy the Puerto Rico type of suffering in Illinois.

You think Indiana will still function if the world economy collapses? Idiot! The USA will be in meltdown.

Don’t forget people, out of the collapse that was the Roman Empire, from disease (the Justinian plagues), the invasions, the wars, the hoards at the gates, came feudalism. Prepare to be your neighborhood overlord, fight battles, consolidate power, destroy your enemies. It’s like a mobile video game! The good news in all of this, if there is any, is that A LOT of fat, unhealthy and aged pensioners are gonna die in the next few weeks. That alone might save our pensions. Not sure if you’ve ever been to a government office but it’s full of unhealthy overweight people with… Read more »

See there’s hope, after all!

Ironically when the roman empire fell a good chunk of it lived on in the East Roman/Byzantine Empire.

So yes Indiana will weather the storm quite well. Unlike Illinois.

No, it won’t. You are an idiot and/or in denial. If the global economy collapses, we all die, including your ugly ass.There is no storm to weather when it is game over for everyone.

They have excellent health care plans so in many ways they can better the storm as can the free stuff army that have the no deductible no copay insurance coverage that we all pay for. In other word they might survive while the rest of us perish.

Let me repeat it for all the delusional idiots on this board, which is now is rivaling Cap Fax for dumb posters: IF THE GLOBAL ECONOMY TOTALLY COLLAPSES, WE ALL DIE. Indiana will collapse, because so will all other 50 states, since the UNITED STATES will have also collapsed. You people are idiots.

This is why logic would say, pensions are based on performance of things and you don’t put in a guaranteed annual interest every yr and you don’t boost someones salary 20% each yr in the last couple years of his employment to arrive at an exaggerated unmanageable pension. You wouldn’t do that running your household and only crooks would do it for pensions.

Yes, I agree, but don’t forget the salient point that likely every time one of these egregious acts was committed someone—and usually several people—had to agree in a supervisory way before it could happen. In the case of the “Pension Clause” it was approved by the general public with the adoption of a new IL state constitution in 1970. In the case of egregious raises it almost always requires a board at large to agree or a set of supervisory managers to agree. Blame the immediate beneficiary/ies if you wish as most here are inclined to do, but in my… Read more »

” it was approved by the general public with the adoption of a new IL state constitution in 1970. ”

I WASN’T ALIVE IN 1970! Talk about generation inequity – younger generations today are paying for the services provided to prior generations. I am required to pay higher taxes to the state to pay for the pensions of employees who retired from state employment long before I was even old enough to how. HOW ON EARTH IS THIS EQUITABLE?

Because it is the will of the Illinois voters.

Corrupt incestuous deals between unions and elected officials (with ocesns of money passing between) COULD NOT OCCUR without the ‘by-your-leave” of those empowering the unions/contracts/special deals to occur and fund elections of complicit ‘supervisors’. Can Illinois teachers not understand the simple math that outlines the mortal burden they have placed on their own communities–taking from children, without providing any commensurate value over national standards, an added amount of household budget that in any other State would allow parents to keep a household pet and save for child’s college education? And if they do understand simple math, they cannot be called… Read more »

Exactly, do they go on strike to insure that their pensions are better funded? No they ask for more benefits, more money, and more union employees which puts more strain on their failing pension plans.

How does a local teacher, firefighter, or police officer strike or negotiate a contract that requires more pension funding? The local authorities that negotiate contracts have no authority to change pension funding. The courts have also ruled that union members have no right to a set funding level. So the unions negotiate for what they can control which are wages and benefits. Keep in mind that pensions have been underfunded dating back over 100 years. Should employees/unions not be allowed to negotiate for raises because the states behind on its’ bills for the last 100 years? If these positions are… Read more »

If this is so great for the tax paying public then why do unions have to donate millions upon millions of dollars from dues to the very politicians they are negotiating these same contracts . See a problem with that? Probably not The way you explain it lets just give unions everything and turn out the lights on the very public they are supposed to serve . No one represents the taxpayer that is point . When money or people paying runs out wont matter what your contract says your owed ….your contract wont be worth the paper it is… Read more »

Social Security and Medicare and federal pensions aren’t really funded either. One assumes that benefits will be cut or taxes increased up to a point and then (beyond that point) the federal government will find a way to “print money” to pay these entitlements. I don’t know how this happens or what statutes apply to create money, but while they are at it the Teamsters and state & municipal employees will be in line demanding that their pensions be protected. Unless a pandemic intervenes, the ratio of retired people to working people will grow and most of the burden will… Read more »

Truth Hurts, you said it all in your last sentence: “If these positions are so lucrative I don’t understand why we are having a teacher shortage.” Everyone who is an adult here presumably had the chance to be a public employee and eventual retiree but chose not to do so. They also had the opportunity to steer their children to do that, but again most likely chose not to do so. Yet, they complain, complain and complain some more about the people who do such work to include negative comments about their intelligence, their work ethic, and the costs associated… Read more »

If there is a teacher shortage in Chicago it is in the low income areas and science and math classes. There is no teacher shortage at new Trier or hinsdale schools. So stop with the teacher shortage BS

The Truth Hurts isn’t always speaking truth to power, but rather, union propaganda.

The Truth is painful for some to hear. I am not a union supporter nor do I bash them. The comment about a teacher shortage came from Illinois Senate Republican Steve McClure. “Right now, for a teacher to switch from a private school to a public school, they fear their years of private teaching are lost, at least in terms of their retirement credit,” McClure said. “This creates another challenge for our public schools who are already struggling to recruit good teachers in the midst of a statewide teacher shortage.” Frankly I haven’t dug into the data to see where… Read more »

YES. Government employee unions should not be donating to the very same politicians with whom they have to negotiate pay raises, whether that’s a school board, mayor or other local politician. Collective bargaining of government employees should be illegal or severely curtailed.

can you guess why it still exists in Illinois?

Charlotte, that’s your idea of a sample size and demographics for your analysis? To me it’s an example of cherry picking to verify an established mindset and not anything close to what you’d surely find in a much larger, wider, statistically sound sample.

Let’s assume it’s true that Hinsdale and New Trier don’t have a teacher shortage. What would that tell you? Maybe their strong pay/benefits along with a high performing student body is better able to attract and retain quality teachers. Wouldn’t that just prove the point that you need to offer more money in other districts that don’t pay as well? Maybe more teachers prefer to teach these students rather than go to tougher neighborhoods. That still wouldn’t change the fact that not enough teachers are available within the state to meet demands.

My personal opinion is that the teacher shortage is manufactured. We have some of the highest property taxes in the nation and in most communities, more than half of that tax bill goes towards ‘education’. My tax bill is 66% allocated towards ‘education’. Where is all the money going? Why can’t they hire enough teacher with this kind of, quite frankly, crazy money? Districts just need to make do with less and stop paying superintendents and other administrators more than six figures a year plus benefits. Do we *really* need these teachers? Or are the positions not really necessary and… Read more »

There is no shortage unless you are in a low income neighborhood.

No, in chicago the shortage is in the low income areas only … But according to new reporting from WBEZ, that shortfall does not impact all schools and students equally.

Education reporter Sarah Karp and her colleague Paula Friedrich found that schools serving low-income and black students were often the hardest hit and were twice as likely to have a teacher vacancy for an entire year. Majority-white schools had no yearlong vacancies.

“Since (the 1999-2000 school year), staffing challenges have lessened but remain in math and special education, but since 2003-04 staffing challenges in science have failed to improve. Colleges in many states are overproducing candidates with expertise in already-staffed, low-demand subjects such as elementary education and under-producing candidates with expertise in understaffed, high-demand subjects such as science and math,” the Education Commission of the States report said. Florida is not unique in its struggle to find science and math teachers. Forty-eight states reported math teachers shortages and 43 states reported science teacher shortages for the 2017-18 school year, according to U.S.… Read more »

Pretty simple, they can retire at 55. If we counted all the retired teachers aged 56-62 and told them they had to go back to work there’d be no teacher shortage. I don’t have a problem paying teachers more money but their benefits should be scaled if they retire at 62 and receive full benefits at 67. But of course that’s not likely so teacher shortages will continue.

Teacher shortage? I’ll repeat: The student/teacher ratio in public schools is about as low as its ever been. Stats from NCES:

1970 = 22.3

1985 = 17.9

1995 = 17.3

2008 = 15.3

2015 = 16.0

Keep in mind folks were complaining about teacher shortages back in the 70’s and decades prior when class sizes were much larger.

As far as some are considered, unless there is at least one teacher and two assistants for 10 students, there is a teacher shortage.

Those who stand and fight in Illinois do so in order to not be doubly victimized: our property values are being crammed down in order that the political class may purchase our real estate at panic sale prices (using borrowed, leveraged taxpayer-guaranteed OPM). While I understand the argument in favor of abandoning this breeding ground of humanoid filth, it doesn’t address the impact of enabling the filth to thrive and proliferate. Good quote by one such organism who oughtta know: ‘…you keep snakes in your backyard, you can’t expect them to only bite your neighbors ‘. I recommend ‘Positron’ tactics:… Read more »

Yes, I get the picture you are painting, but the artistry is flawed considerably by what you have portrayed as “factual” in your third paragraph. I’m not inclined to spend at least 30 minutes refuting it point by point because you likely wouldn’t care anyway, I think. Let‘s just say much of your logic is askew and leading you astray as a result. I could say more, but it’s a wasted effort on my part to bother. You need some education on those assertions.

I’m not understanding your gibberish

Dont understand your point.

At least reference what it is you assert as factually inaccurate?

Sounded on target to me

Staying and fighting for Illinois is just asking for your life to be ruined.

I agree. There’s no glory in being a martyr by staying a resident of IL and waiting for the turnaround which may take many years or may never happen. If you have 90 more years of your life remaining, that’s too much suffering to stay. If you have nine more years, ditto.

Totally Agree. My wife being a nurse is on the front line of every disease known especially when she travels on medical missions and now also stateside. There is never a thought about a “White Coat Strike” to demand more and more every year. No short or long term contracts with benefits galore. Patients needs come first. Compensation for medical professionals are based on individual performance not as a group. Imagine the litigation that would ensue if doctors and nurses would strike or refuse care to anyone especially if they are employed by the state. Yet teachers and unions constantly… Read more »

Agree 100% my youngest daughter left Illinois and now is a traveling nurse doing much much better outside Illinois. My oldest girl is a firefighter paramedic, and yes they are exposed to almost every know diseases, on top of that people who have absolutely no RESPECT for them and there intentions to help and save there lives. And they both work more than 180 days a year, 12 hour days and 24hr days away from there families. Teachers you and your unions, and politicians have destroyed Illinois.

Excellent post…despite its accuracy many still do not read it and get the picture

Just another reason to leave Illinois as fast as you can.

Your 401K will drop in half. You will be taxed by the state of Illinois when you take it out.

Greedy cops, teachers and Firemen will get a 3% increase every year and NOT PAY ANY ILLINOIS INCOME TAX.

Your taxes will double or go even higher to pay for all the losses and Luxury homes in Florida for them

Feel like you are getting SCREWED? You should be, because you are.

Call a mover or get a U Haul and KISS ILLINOIS GOOD BYE.

Dear broken record, saying the same thing posting after posting makes the basic premise no more interesting than watching the same TV commercial fifty times. After awhile people just ignore it. We “get it.”

Then stay & enjoy having your life ruined in Illinois.

No more sympathy for your pain & suffering

Stay and Pay, Pay, Pay. While the young retired cops, teachers and firemen play, play, play. They live in Florida in large home on your money sucker.

Make some sense “ cops ? Firemen? Teachers ?

That’s who you blame ?

Who is this MIKE MADIGAN ?

It’s the POLITICIANS !!!!!!

The politicians retire with Life MEDICAL and

A full pension after a small handful of years.

Wake up Illinois”” and don’t listen to this FAKE NEWS bullshit politician .

Coronavirus emergency highlights a paradoxical moral dilemma of Illinois political class policy: Medical professionals are not considered worthy of “dignified retirement ” afforded by defined benefit plans, are financially drained through income and property taxes and lost home equity to pay for defined benefits for government workers and teachers, and now their lives are demanded to be put at risk during an epidemic crisis in order to lengthen the lives of those same uncaring political class predators. Illinois political class, defending viability of its defined benefit compensation system, might find this is a propotious time to design an extension of… Read more »

So, what’s already undeniably bad should be made even worse; that’s your logic here?

James I am sorry you did not understand. Let me re phrase so that you might better comprehend (unless you are deliberately trying to steer the topic away from one that threatens to disrupt your personal profit center): If defined benefit compensation of money and health insurance (and other OPEBs) are to be immutable “rights” of public employeess, and all taxpayers rights are placed secondary to those monetary entitlements to the life-threatening expense of society at large, then society at large must all seek to become public employees to capture those “rights”, or flee the State (as no survival here… Read more »

I’m not all asserting much of what you claim I am. Yes, the people who work in healthcare deserve a solid retirement. All I am saying is that adding yet another class to the alredy over-burdened IL public pension systems isn’t a good idea and particular at this. Maybe fifteen years ago that could have been done. There must be another way you can achieve your goal, don’t you think? That’s for you and others similarly situated to ponder and promote. There’s way too much time and anger spent on this website “tilting at windmills” by denigrating others rather than… Read more »

You apparently find it easy to demand of others what you seem not be willing to do yourself…or at least you are glad to demand nurses and docs stick around to serve you AND foot much of the bill for the public benefits entitlements you neglect to address. And i am so sorry you keep missing the point. The point is, if this obscenely generous entitlement to a certain class of Illinois workers is what is destroying the entire population outside of those entitled, And if their entitlements are asserted to be fiscally reasonable and sustainable by the political class,… Read more »

Susan- Ignore James….he knows exactly the situation everyone is talking about regarding IL . He is trying to be difficult to obstruct solving the problem.. probably for personal reasons like he has public pension. The problem can only be solved by pension reform period end of story. Everything else like consolidation of districts blah blah blah is window dressing. People that have vacated IL are trying to tell the ones still there the proposition is simple “pay some now and leave or pay a lot more later and stay”. nothing is saving IL until the market says so and that… Read more »

Just a quick note to the Illinois residents from a former resident.

Whenever there is talk of a federal bailout for Illinois, all of us former residents will fight it with every breath. We will make sure to tell anyone who will listen (in our new state) that Illinois brought the crisis on themselves and deserve no sympathy or help.

Exactly. Illinois can rot and totally collapse before it sees a dollar in federal bailouts.

The state has nobody to blame for its pain & suffering but itself.

Illinois residents will soon pay a heavy price for their ignorance or stupidity….choose one. For those of us who abandoned ship in recent years, while being criticized in our personal lives for over-reacting, our vindication is coming. To those of you that stayed, I have mixed emotions. I repeatedly tried to tell you that Illinois was sinking, and if you stayed you would drown, but you wouldn’t listen. You were too busy working and making sure your kids got to their activities on time. I pleaded the best thing you could do for your family was to leave Illinois. For… Read more »

We save money like mad,sense we left illinois.Sleep better, Life is so much easier with out all ways worred about the thieves that run the state.

Hey, dude—chill out. The world doesn’t revolve around you! Even Jesus had a world full of doubters full of their own arguments. Learn to be patient.

Invoking Jesus to try and defend/justify your silly save Illinois fight?

lololol We’ve seen it all now.