By Ted Dabrowski and John Klingner

Illinois’ combined state and local pensioner debts have reached absurd levels. When divvied up between Illinois’ households, the “shadow mortgage” each one is on the hook for now totals hundreds of thousands of dollars per household, if not more, depending on who politicians target to repay those debts.

As Gov. J.B. Pritzker and other lawmakers try to extract that kind of money from Illinoisans, they’ll fail, for the simple reason that the amounts have become overwhelming. Too many households don’t have the means, while others won’t stick around to pay for it. They’ll just leave.

And as Illinoisans leave, the shadow mortgage on those who remain will jump. The crisis will only deepen.

The shadow mortgage

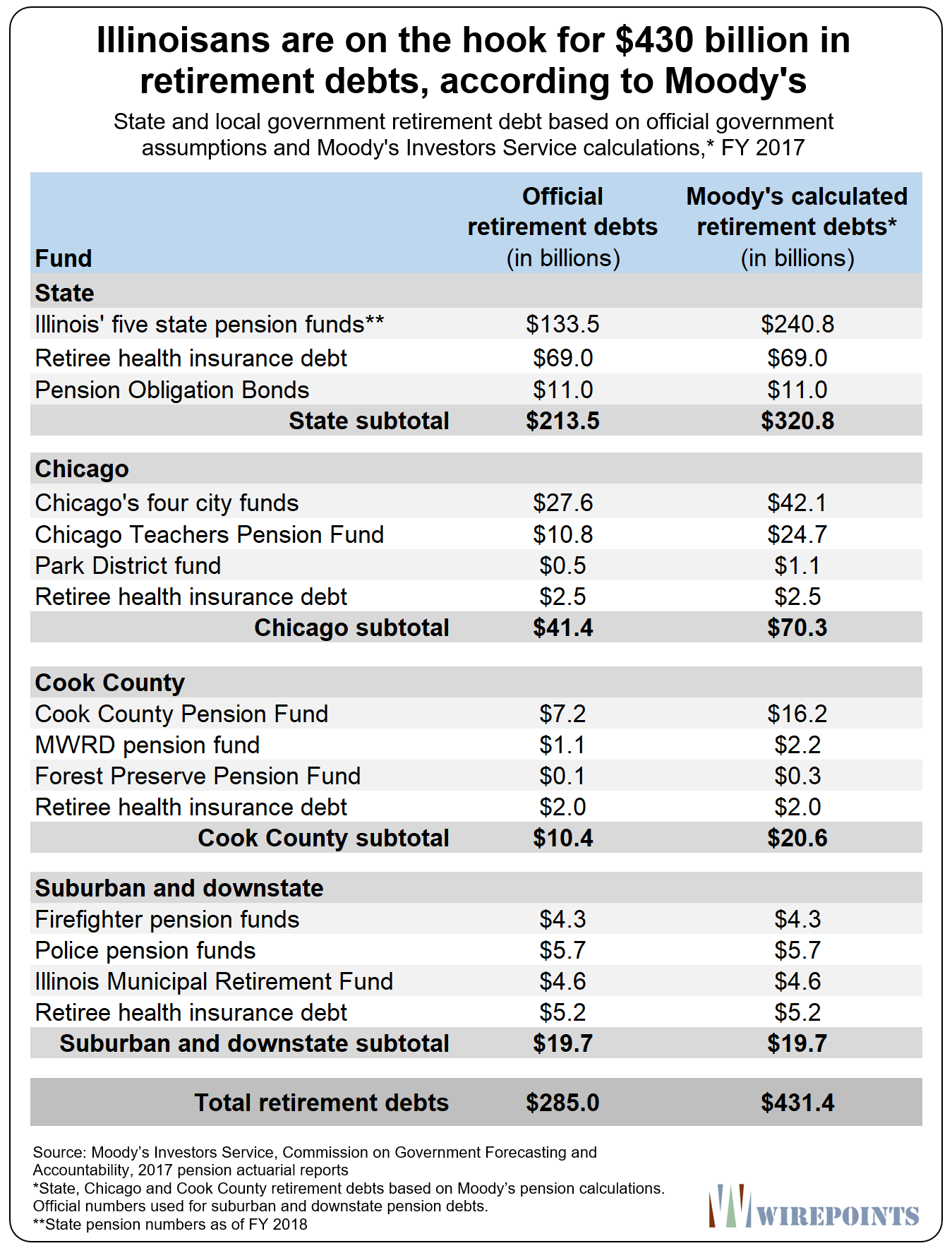

A simple calculation based on Moody’s state and local retirement debts puts the shadow mortgage each Illinois household is on the hook for at $90,000. That’s what you get when you divide Illinois’ $430 billion in retirement debts (see appendix) by the state’s 4.8 million households.

But $90,000 is not a real number. Too many families in Illinois don’t have the means to take on that kind of debt. So the real burden on households with the means to pay is much higher.

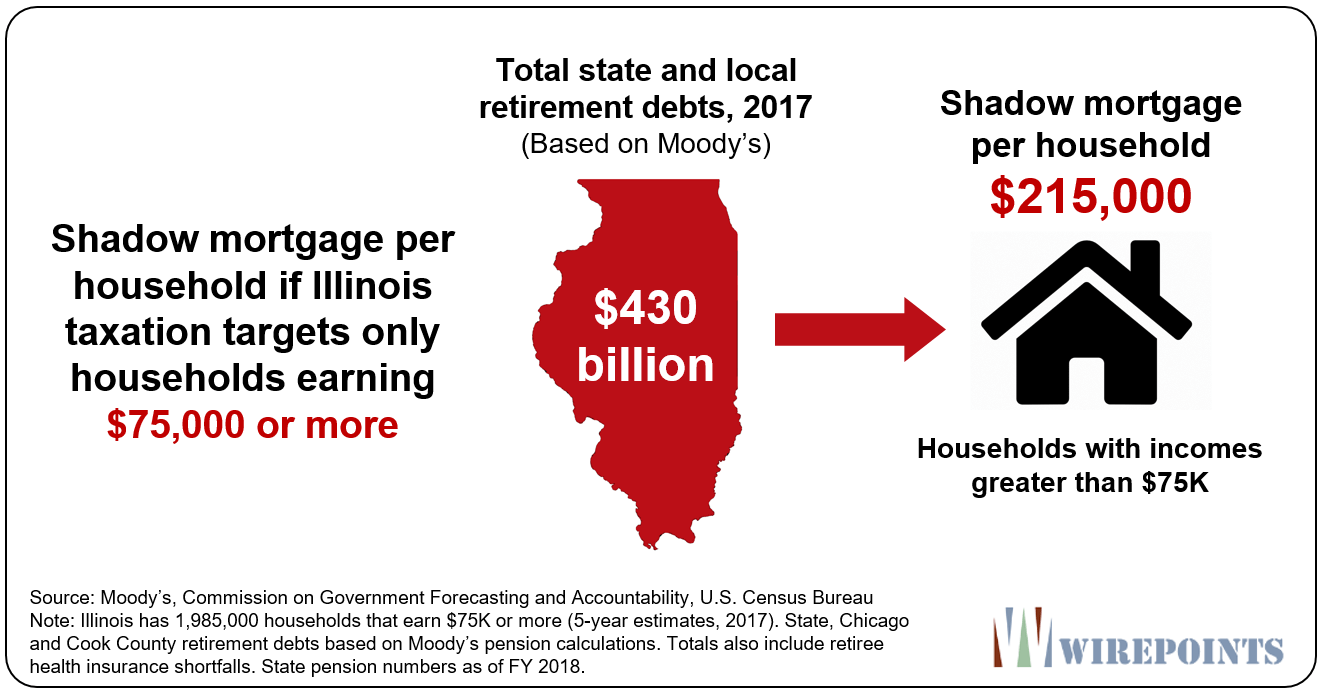

Maybe the more “realistic” shadow mortgage amount is $215,000 per household, which is what you get when you impose the $430 billion only on those households with incomes of $75,000 or more. Does Pritzker really think those households could pay down an additional mortgage of $215,000, even if they were willing to?

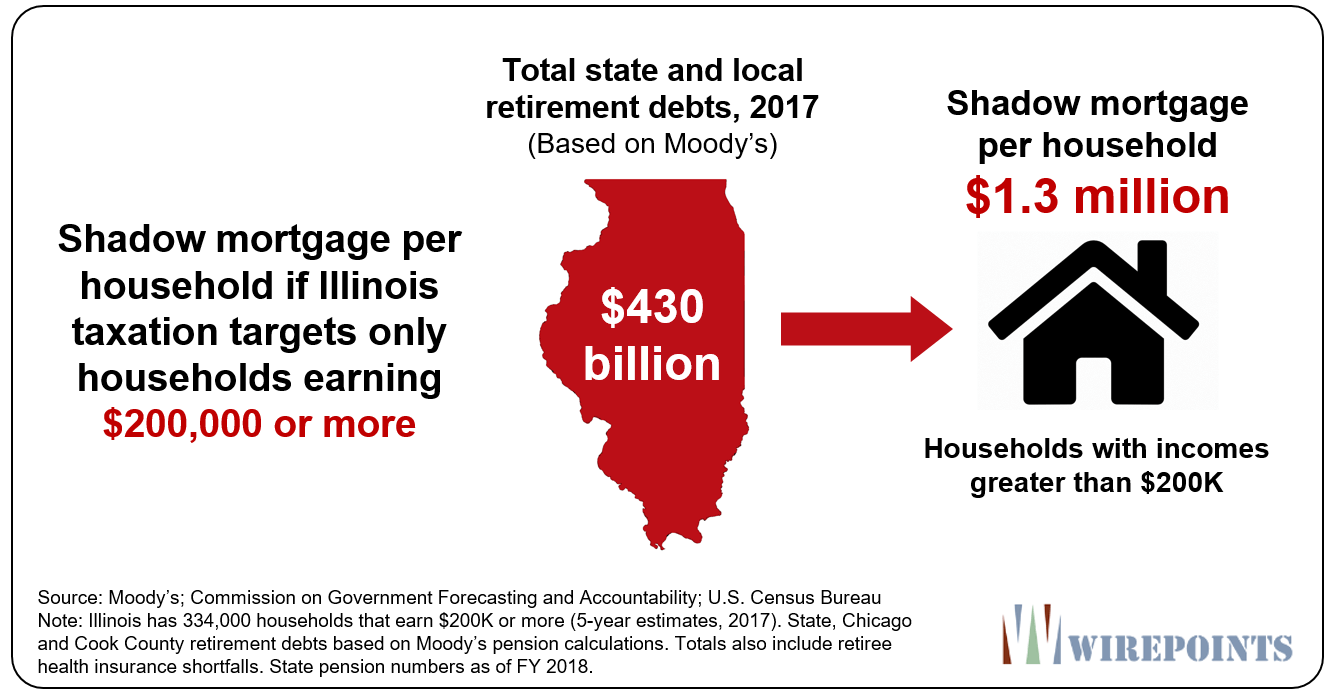

So what then? Go after only those households with incomes of $200,000 or more, like Pritzker does in his proposed progressive tax plan? Then the shadow mortgage on those 330,000 households jumps to $1.3 million each. The amounts get crazy.

The amounts become even more overwhelming when you look at what Chicago households are on the hook for. There, the overlapping pensioner debts based on Moody’s calculations total $150 billion. Wirepoints covered what those shadow mortgages look like here.

The tax hikes are only beginning

The reality is most Illinoisans have no idea what a shadow mortgage is or how much it will cost them over time.

But it would be foolish to think ordinary Illinoisans don’t feel its presence every day. They already pay the nation’s second-highest property taxes, whether it’s through home ownership or rent. And when it comes to the total state and local tax burden for Illinoisans, the Tax Foundation says Illinoisans face the fifth-highest rates in the country. Others, like Kiplinger, calculate Illinois is the least tax-friendly state in the nation.

The real problem is, most Illinois governments, including the state, haven’t even begun to tax the full amounts needed to begin paying down Illinois’ pension debts. Some are only starting.

Peoria has recently added a public safety pension fee and new stormwater fees as pensions eat up the tax base. That’s on top of the property taxes Peorians already pay. Ditto in Danville, where it, too, added a dedicated pension fee. Aurora just hiked its property taxes by 6.6 percent to help pay for pensions.

And Springfield says it needs $269 million over and above what the city expects to put in to its police and fire pension plans over the next 20 years. Local pension costs in Springfield already consume 100 percent of the city’s property tax revenues.

It’s even worse in places like Harvey and East St. Louis, where the state has begun intercepting city revenues to ensure local pension costs get paid. That’s forcing these cities to cut core services since they can no longer afford to pay their active workers and pensioners at the same time.

Like adjustable rate mortgage payments before the Great Recession, the situation will only get worse as the payments toward the shadow mortgages rise uncontrollably.

There’s simply too much debt

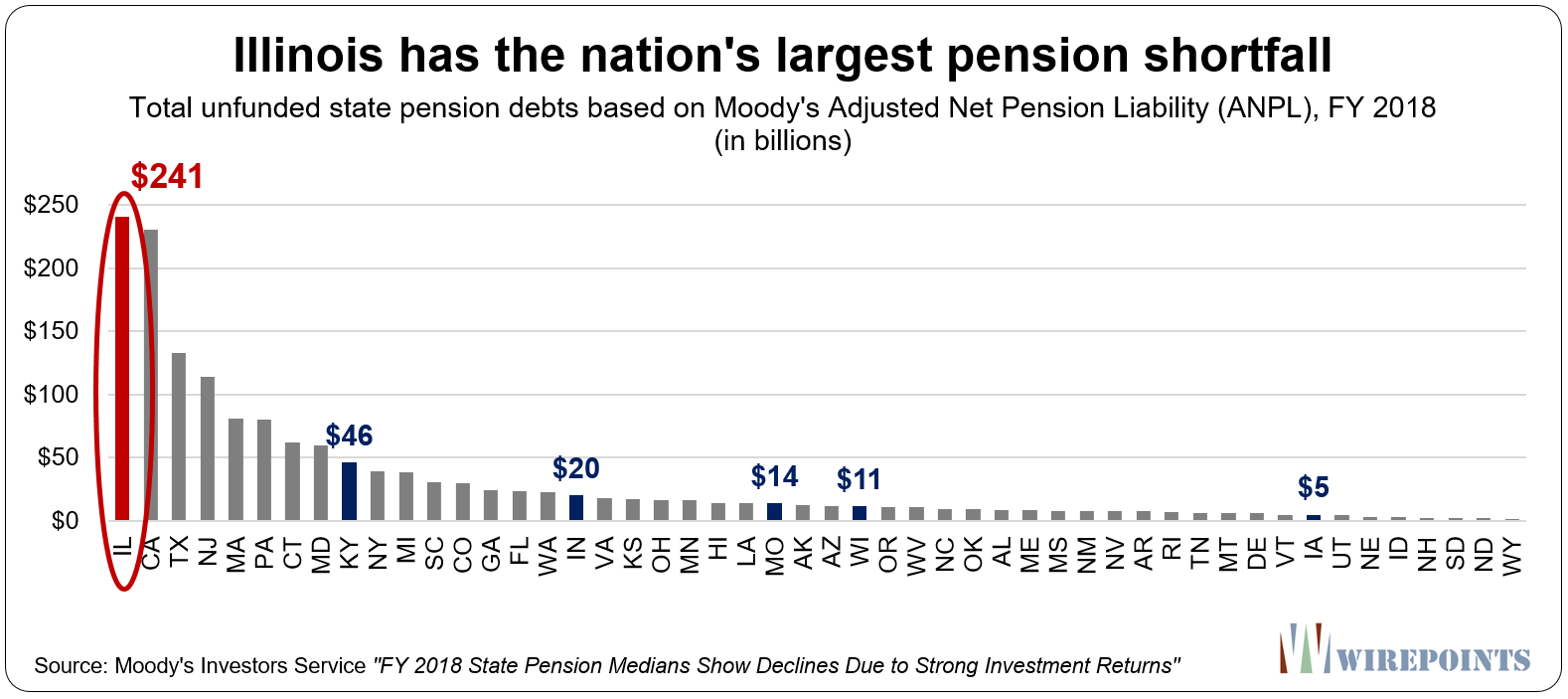

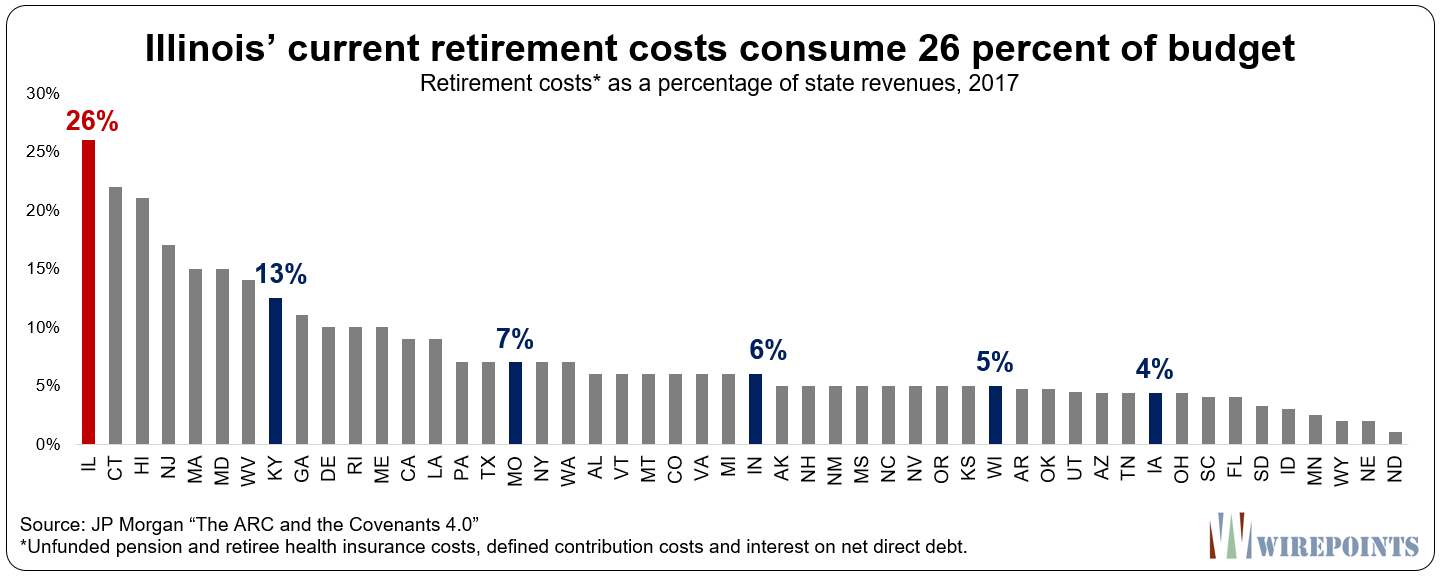

That there’s too much pensioner debt in Illinois is not just obvious at the household level. It’s also obvious when you compare across states. Illinois is the national outlier when it comes to these debts – and an extreme outlier when you compare the state to its neighbors.

Moody’s calculates that Illinois has the nation’s largest pension shortfall. The $241 billion dwarfs the debts in much larger states like Florida, Texas and New York.

And pensioner debts already consume more of the Illinois budget than anywhere else in the country. State government projections show that these debts will consume at least a quarter of the budget for the next 25 years – and that’s under their rosy scenario.

The evidence is overwhelming that there’s more pensioner debt than can ever be taxed. If Pritzker continues to reject the need for a pension amendment – and the need for a reduction in pension debts – then he’s simply ignoring the evidence.

Which means that if he doesn’t want to fix pensions, he’s going to have to go hog-wild with tax increases to get the money needed to pay down all that debt.

Expect the exodus to increase as Illinoisans finally figure that out.

For more on Illinois’ growing “shadow mortgage,” see:

- “Wealthy” Chicago households on the hook for up to $2 million in debt each under progressive approach to pension crisis

- Every Illinoisan Must See These Two Charts In The Wall Street Journal

- Moody’s vs. Illinois politicians: $100 billion difference in pension debts

- A booming market can’t save Illinois pensions

- Rhode Island Supreme Court Shows Illinois The Way On Pension Reform

- New IRS data reveals winners and losers of wealth migration across 50 states

Appendix

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

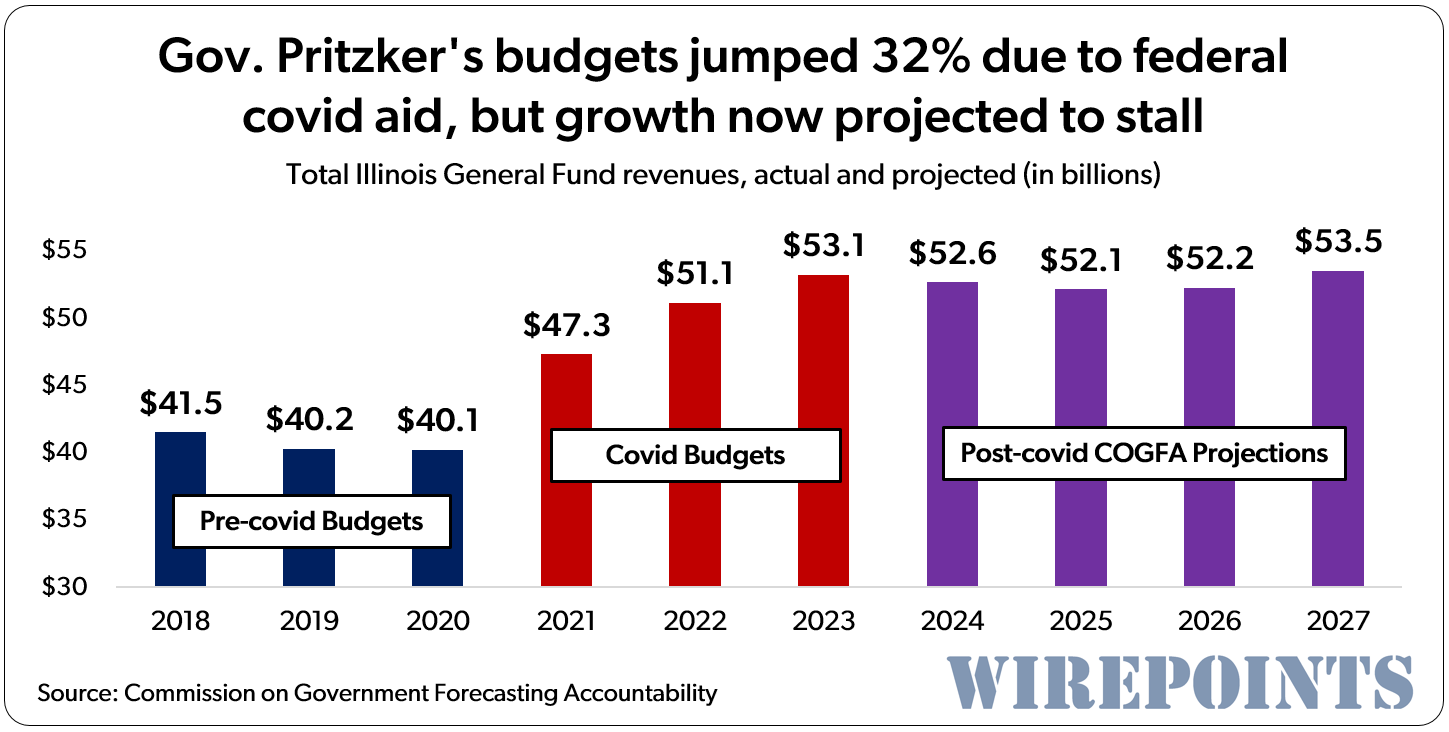

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more. Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow. Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Thinking about this. It seems like we have 3 mortgages. The 1st is the mortgage on your property for principal and interest. The 2nd are the property tax’s like here in Rockford where I pay in property tax’s in 23 years what the home is valued at today or another 1.4 times the home mortgage over 30 years. The 3rd mortgage is long term debt incurred in this article we somehow are responsible for without ever agreeing for it. We know the details for the 1st because we signed papers. The 2nd and 3rd who knows. What are the interest… Read more »

They don’t need an amendment and a pension reduction, they need to tax the pensions themselves, probably progressively. Take no surtax from pensions less than 24k/yr, 10% from 24k to 48k/year 20% of amounts 48k to 60k/yr, and 30% of 60k to 90k/yr, and 50% of anything above that. The government workers are planning on hosing everyone else to keep themselves high on the hog…taxpayers need to push it back onto the unreasonable pensions. The pensions are a pretax commitment, so give it to them pretax, then tax the crap out of them to get it back to reasonable. After… Read more »

Unfortunately, that would violate the pension protection clause as our courts have interpreted it. You couldn’t single out government pensions for a special level of taxation.

And what group of people is likely going to be more quickly enticed to move to another state with your plan? The wealthier retirees who are not so place-bound, of course—the ones who then no longer would provide any tax revenue at all to the state nor act as a wealthier set of consumers who help keep the economy in IL afloat. That in total makes your progressive tax plan a non-starter and especially so in that the tax rates you’ve proposed are aimed at being confiscatory to them in particular rather than the citizenry at large with similar incomes.… Read more »

wealthier retirees who are not so place-bound – grandchildren have a way of keeping those people around. tax rates you’ve proposed are aimed at being confiscatory – have to agree with that. How about a tax on pensions for the ones double dipping. I believe we do something similar to that with certain types of public assistance. You can make up to $x.xx amount and not lose your public assistance benefits. If you’re collecting a pension at 55 then pick up another job that pays greater than $x.xx then perhaps there should be some sort of tax on that pension… Read more »

How about the simple idea of taxing retiree pension whether public or private except giving an exemption to entice retirees not to move. I suggest any of the following as exemptions: (1) 1/2 of any 1099 type of income (all of which is currently exempt in IL), a “generous” flat standard deduction which has to be GENEROUS as wealthier retiree would see it or (3) giving an exemption equivalent to the annually-upgraded maximum SS retiree benefit one could receive at age 70 (currently roughly $45,000 per individual), effectively excluding any SS income from taxation. Again, that last proposed exemption would… Read more »

If someone asked me how to tax retirement income – and they’re not – here’s what I’d do:

1) All Social Security is exempt, regardless of income. Because people already paid taxes on those wages while working.

2) Minimum age of 62 for tax exemption eligibility. Anyone retiring before then (typically govt workers) would have to pay full tax.

3) $60,000 exemption (basically the state median income) that is reduced by $1 for every dollar over that amount. For example, if you’re non-SS retirement income were $100,000, you’d only get a $20,000 exemption.

Start throwing rocks…

In regards to your #3 idea you—like most others surely—are seeking more to penalize the wealthier retirees than entice them to do the “right” thing, share their relative prosperity. Do you really think that $100,000 retiree in your example is going to want to stay in IL under your proposal? I think not; you’re encouraging him/her to leave. How does that benefit the state’s tax revenues? Clearly if enough take that point of view it doesn’t. To them your plan “stinks to high heaven.” Put yourself in their shoes, and you’ll see things as they do. I have no quarrel… Read more »

In Wisconsin if I’m not mistaken the law was changed by then Gov. Walker that if you receive a pension and decide you will go back to work you must suspend the pension except for about 7,000 who are grandfathered in. Here in Illinois you can do both without penalty. This a another definition of double-dippers. School supers when collecting a pension can move to another state and get a similar job and start a new pension. Please correct me if this is wrong.

The current employees and pensioners have a contract to have their pension calculated based on their first day of employment. Any changes to that including limiting when you are going to pay them would be considered an impairment and likely unconstitutional. You could apply this to all new hires going forward.

My School District 34(Glenview) is trying to get a $119 million referendum passed. In 2017 the District’s total liabilities were $37 million today they are $78 million (now inclusive of unfunded pension liabilities). What is interesting is that the taxpayers do not believe they are on the hook for all of the debt – Discussion focuses on ‘that is the state’s problem’. If the referendum passes total District liabilities will be $197 million. I cannot believe Moody’s can favorably rate a bond issue when the District has this dramatic increase in debt – without an equivalent increase in revenues. When… Read more »

Is there any push back from the taxpayers?

The debt service on Glenview CCSD 34’s $119M referendum bonds seems to be $174,367,250 to be paid over 23 years, resulting in interest of $55,367,250. The $174,367.250 figure is found on page 2 of a 3 page memo attached to the December 16, 2019 board agenda. The direct URL is here: https://go.boarddocs.com/il/gsd34/Board.nsf/files/BJWLE455F235/$file/Referendum%20Update%20Memo%2012%2016%2019.pdf The path is here: https://go.boarddocs.com/il/gsd34/Board.nsf/Public# > Meetings > 2019 > Dec 16, 2019 (Mon) Board of Education Regular Meeting (the first of the two such meetings listed) > View the Agenda > G. Consideration of Other Resolutions > 3. 20-47 Resolution providing for and requiring the submission of… Read more »

The ballot initiative is called “Citizens in Support of Glenview School” and has already received $5,000 from the Glenview Education Foundation, which is a 501(c)3. Wonder if there might be a conflict of interest here.

https://www.elections.il.gov/CampaignDisclosure/CommitteeDetail.aspx?ID=IyetSsSMCEPda3N1LF3ixQ%3d%3d

“The Board reduced this referendum from $139 million to $119 million by: Increasing the District’s contribution of fund balance (savings)” which is $20 million. In other words, they took tax dollars today to reduce the need for tax dollars tomorrow but attempted to sell it like there’s some savings there. There are no savings, the district overtaxed you.

https://www.glenview34.org/building-future

What I can’t understand is that part of the school tax money is supposed to go to refreshing the infrastructure. If you build a new building today, expect to rebuild again in 30 years. Why is there never enough money in the building and maintenance fund to do this? why do schools always need more money for these projects? If I had to take a guess, the teachers see a surplus and immediately believe it’s for them and higher wages

The Chicago Fed 1% property tax hike proposal was based on paying off a $129B liability.

So the 1% property tax hike just went to 3%+.

Some more notes on extrapolating the Chicago Fed 1% property tax hike to fund the $129B state pension unfunded liability, to cover state & local unfunded pensions + unfunded OPEB. 1% property tax hike to pay off $129B unfunded state & local pension + OPEB liability. 2% property tax hike to pay off $258B unfunded state & local pension + OPEB liability (roughly). 3% property tax hike to pay off $387B unfunded state & local pension + OPEB liability (roughly). Government calculates $288.6B unfunded state & local pension + OPEB liability. Moody’s turns the $288.6B into $424.1B by using a… Read more »

Most if not all of my neighbors have no idea what their real estate taxes are. Their mind is programmed to fit in with the “how much a month is my house payment” crowd. Provide them with a TIF financed new restaurant or two and they are in heaven and could care less about Illinois taxes. Someday when they figure it all out they will be first in line to say “there ought to be a law against” whatever they encounter when the reality hits but in the meantime its eat drink and be merry…life is wonderful in Illinois.

What is the risk of staying in Illinois, perhaps just another year, or two, or three? Well, at a minimum you can expect your home will fail to appreciate in value, and your real estate taxes will increase. So many will basically be paying between 5 and 15 thousands dollars a year (depending of home value) for the privilege of living in a home for which they already paid. If the U.S. economy finally hits it’s overdue recession, you can expect to be paying between 5 and 15 thousands dollars a year for the privilege of living in a home… Read more »

I know that your “live in your car” idea is tongue-in-cheek, but it’s not that far off from how some IL residents are thinking. Why not move to a more modest abode? That way, they can still live in IL but pay lower property taxes. Here’s the flaw in that logic: why sacrifice in that manner just to keep the six-figure-pension and free-health-care money machine going for the state retirees, while, at the same time, they can live in nicer abodes? There are very few family, friend, or business situations that should justify staying in IL. This state is incredibly… Read more »

Think what will happen to home prices if and when interest rates rise. Even with these low interest rates homes are still losing value. Check out Boulder,Co on Zillow and their average price vs property tax’s. 0.6% on total value. My uncle moved to Centennial,Co a number of years ago from Woodstock,Il. (tax’s $12K) . Tax’s about $1,700 on a $400K home there with senior freeze,homestead,senior ded. Appreciation every year. Should have listened to him earlier.

Same thing applies to southern Tennessee. A friend of mine moved down there last year, and the yearly property taxes on his house, valued at $175K, are $1470 a year. And no state income tax either. You pay sales tax on everything, even food, but he’s way ahead of the game. He and wife sold house and moved due to JB’s fair tax proposal.

I like that suggestion- you can live in your car but you can’t drive your house…

I agree with Susan. Here in Rockford tax’s are mostly higher than the mortgage. On my home I will pay approx $210K in tax’s in 30 years on a home value based at $157K. Values are up 6% with the latest assessment but will not get tax bill for a few months but tax’s will be the same but rate may go down. These insane tax’s are deterring any real home appreciation. My monthly tax’s at almost $600 at 4% interest could buy me a $166K home with 20% down ($130K mortgage) more than my value today. Most here are… Read more »

I feel your pain, because I have similar pain.

And, have come to realize that nobody is going to help us, no matter who is elected, the political industry gets paid (with COLA) and we get devoured as their prey.

My novel solutions are: incorporate most of Illinois as TIF-for-All villages,and,

A website providing micro funding for hyper-local bounty rewards for evidence of government malfeasance.

Tax rate capitalization is a commonly accepted component of analysis of property values. Tax rate capitalization involves incorporating property tax rates which are higher or lower than comparable regions’ mean and median, and applying that percentage of negative or positive value to the property annually. In McHenry County Illinois, more than one taxpayer district has dropped from near 5% to hover near 4% of fair market values, and nearly all others exceed 3%. And our homes sink in calue in relative and nominal amounts annually. (High percentage of investor owned rental properties put an artificial floor below prices, at least… Read more »