By Ted Dabrowski and John Klingner

The argument that “nothing is going to happen in Illinois until things blow up” got a major boost this week when the governor of the nation’s most fiscally upside down state said no to pension reform. Gov. J.B. Pritzker once again rejected calls to put a pension amendment on the ballot in 2020. Illinois’ constitution currently prohibits any reforms that “diminish or impair” pensions.

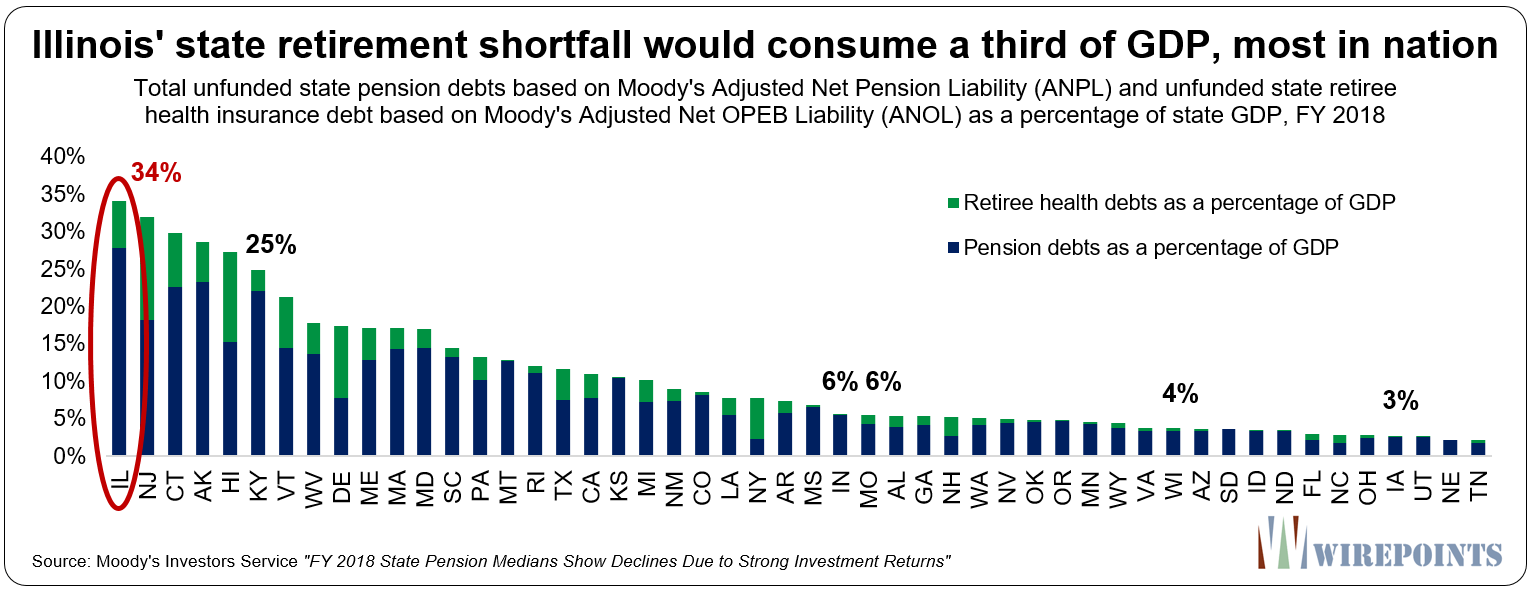

Never mind that Illinois has been in a credit rating free fall for more than a decade and is now just one notch from a junk rating. Or that Illinois is the nation’s extreme outlier when it comes to public sector retirement debts. Or that Chicago, Illinois’ economic heart, is in even worse shape.

A rejection of pension reform by Pritzker means Illinois will continue its slide toward insolvency.

Illinois’ retirement debts are already one-third of the state’s annual economy – the worst in the nation.

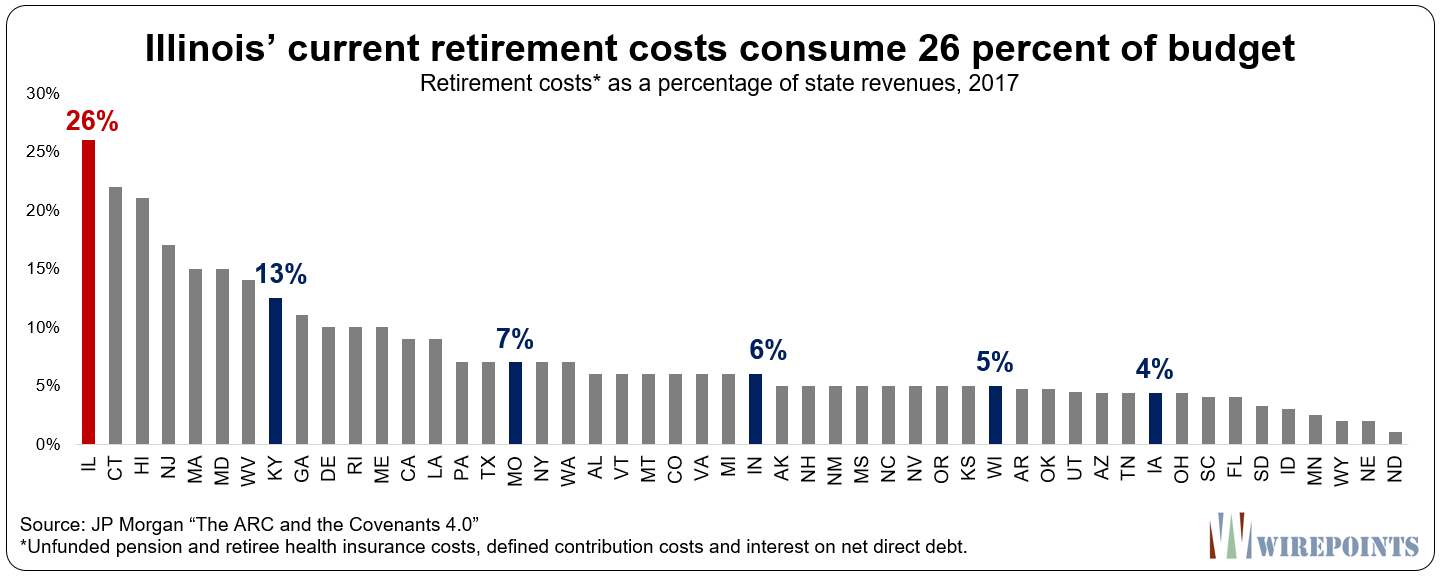

Ditto retirement costs as a percentage of budget. No state consumes more of its budget for pensions like Illinois does. At 26 percent of budget, Illinois’ pension burden dwarfs those of its neighboring states. Pension costs are crowding out everything in its way.

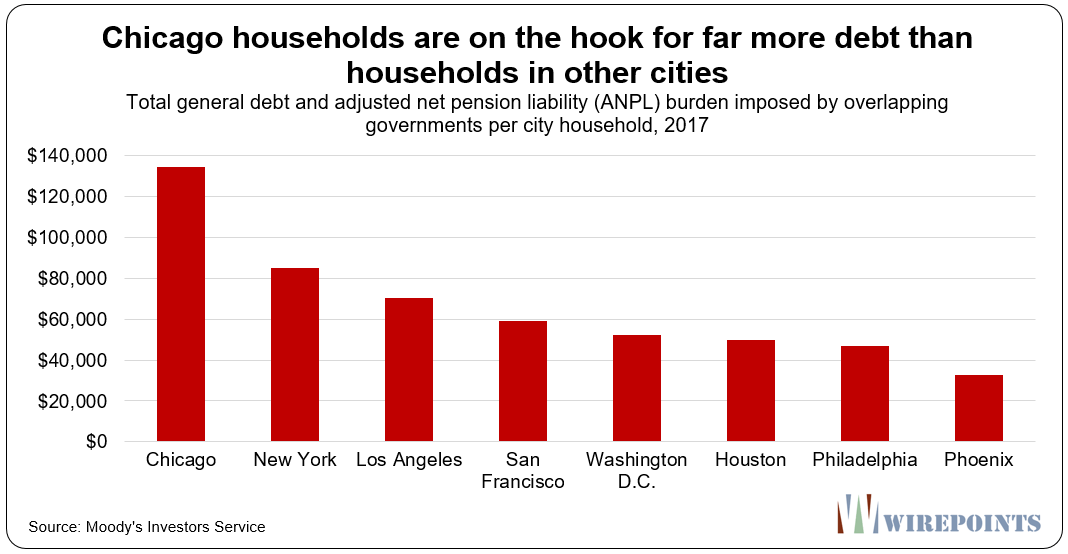

And Chicagoans are already drowning in pension debts – more so than residents in any other major city. According to Moody’s, each Chicago household is on the hook for nearly $140,000 in overlapping state and local pension debts.

Expect more Chicagoans to flee as tax rates jump to help pay for those debts.

Pritzker’s alternative to real reform is to simply pretend that tiny changes will somehow help the crisis. “There are a lot of other ways to address pensions, and we’re going to go after each and every one of them,” he said.

But Pritzker’s “lots of other ways” – which include buyouts and pension consolidation – will do little to nothing.

For example, Illinois’ pension buyout scheme, where workers give up future pension benefits in exchange for immediate payouts, has been an absolute failure. Illinois politicians originally projected buyouts would save the state save over $400 million in 2019. Actual results showed savings of just $13 million.

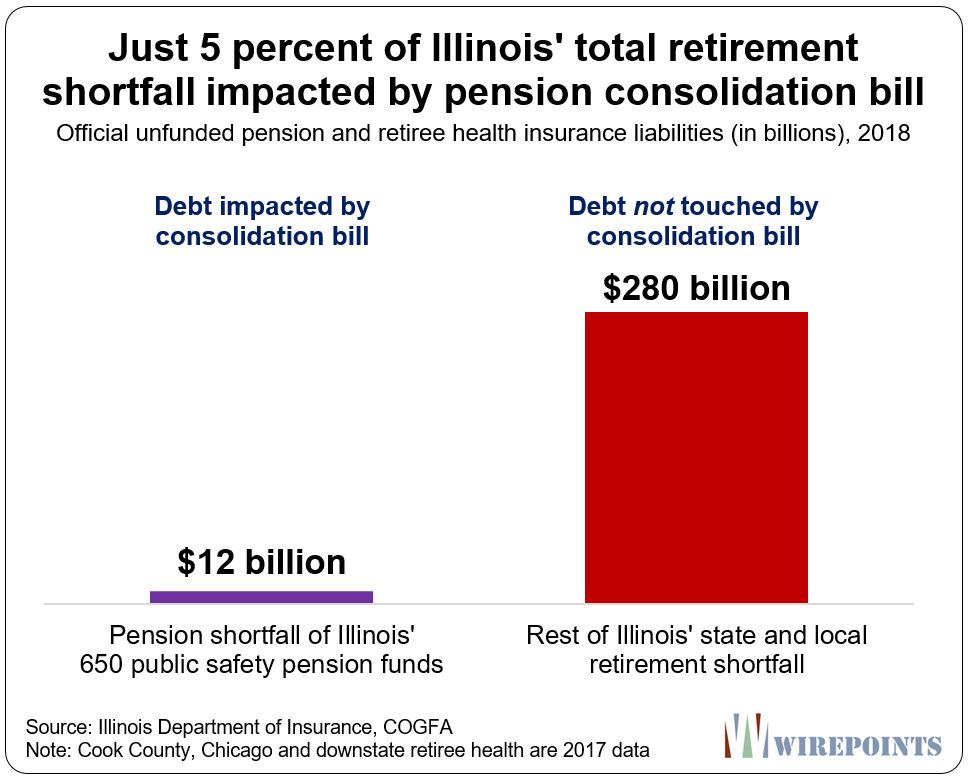

And while Pritzker calls his recent pension consolidation bill “momentous” – it’s anything but. The consolidation of assets for Illinois’ 650 downstate and suburban public safety pension funds only impacts $12 billion of Illinois’ $280 billion in official pension debts. That’s less than 5 percent of the total official retirement shortfall Illinoisans are on the hook for.

Pritzker says there is “no silver bullet” to fix the pension crisis, though he’s touted his progressive tax proposal as the solution for all the state’s problems.

If you were hoping for some sort of sense from the governor in light of recent events – Lightfoot’s request for a state takeover of city pensions and his own consolidation commission’s warning about Tier 2 – any chance of that is clearly dashed.

Illinois path toward insolvency just got steeper.

Read more about Illinois’ worst-in-nation pension crisis:

- US stock markets up 200%, yet Illinois pension hole deepens 75%

- New 2019 pension reports: Illinois’ shortfall worsens to record $137 billion, pension costs exceed $10 billion for the first time

- Moody’s new report shows Illinois is nation’s extreme outlier when it comes to pension debts

- “Wealthy” Chicago households on the hook for up to $2 million in debt each under progressive approach to pension crisis

- Why Chicago’s Lightfoot should push for a pension amendment, not tax hikes

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

The best day of your life is the day you move out of Illinois. A U-Haul will solve the problem. Call a mover today and start a better life for you and your family. Illinois is DOA, no hope. Even the cops, firemen and teachers with the HUGE PENSIONS are running out of Illinois.

Last man standing will be a dead man. 83 Degrees and Sunny in South Florida, NO state income taxes. Freeze you a$$ of in poverty or start a great new life.

Amen.

It is Immoral to continue living in Illinois and funding this vile corrupt state & the people who run it.

At the moment the State has enough particular assets to encumber to get plenty of new loans in Pritzker’s and Madigan’s life expediencies so why would they do anything to change the system? Daily’s selling the parking meters is a good example of how things are working to kick the can down the road today. The day of reckoning will be the next person’s problem and not theirs. Life is good for the Illinois incumbent Democrats.

Of course it must end in crisis. No politician who wishes to succeed in IL will do anything but kick the can until the can hits a brick wall.

The state is full of idiots, morons and crooks. The Democrats in this state get the corrupt government they deserve. It’s a tyranny of the majority. It sours me on democracy, to be honest.

Best day of my life was the day I moved out of Illinois and started to become RICH.

Reform comes in two ways, voluntary and involuntary. Reform is coming but may not be what pensioners had in mind.

It’s all about the specifics. When the USSR collapsed, pensioners got completely stiffed (IIRC.) I hope that’s not the “solution” coming to IL.

Those fools think the feds are going to bail them out. Wrongo, Bucko. The Federal Government is already bankrupt to the tune of 23 trillion dollars. It’s not possible to drink your way to sobriety or spend your way out of bankruptcy. Plus, 98 Senators do not want to face their constituents if they vote for a national solution to a local problem.

Did I miss something?

I thought there was no provision in Illinois law for a municipality to declare bankruptcy?

Please someone fill me in if I am wrong.

Those debts will and are a mortgage on every piece of real estate in Illinois.

Hopefully I am wrong…but thinking here I am not.

You didn’t miss anything. They would need to get approval from the state.

He must have had dinner with Moody’s and S&P on how best to collude toghether in screwing over the taxpayers for another can kick. He said… “Hey Moody’s how hard should I put the squeeze on the taxpayers to earn a really good bond rating? We’re going to be market makers together, ok? I have collateral, millions of stupid taxpayers.” Then Moody’s said… “Yeah stick it to em, we have investors chomping at the bit to get their hands on their wallets, and you need to buy some votes right?”

From the minute I saw his first idiotic campaign ad 2 years ago, I knew this oxygen thief would get elected. (This is the state that reelected Blago, after all)

I also knew then that this is exactly the sort of useles public official Illinois would end up with. This state has essentially made a fat male Paris Hilton its governor. May the exodus continue.

J,b governor of Illinois is a fun ass he the problem and Mike madigan when I get done cleaning the swamp up in Illinois them two going to jail too ride along with the rest of the Goonies from Illinois ripping off the taxpayers nothing’s going to change we need a revolution in the state of Illinois we need about everyone out who’s done anything negative Dick durbin he needs to retire you getting too old to do anyting once you go find yourself a nursing home where you belong

I don t think that consolidated management of the investments is necessarily a bad idea. Frankly, one should manage investments differently for fully-funded plans versus deeply underfunded plans. But I doubt that these plans were doing much in the way of asset-liability matching or any strategy other than try to maximize their returns under a specific risk appetite.

I plan to survive in part (for a while) on my wife’s teacher pension. To say we have skin in this game is a massive understatement. Unlike most of her colleagues, my wife understands that the pension system is a predicament; problems have solutions, but predicaments really don’t. Someone is going to get shafted. Know this: the pension “crisis” is not an isolated condition. Schools are spiraling the drain due to utterly insane policies (including a flood of foreign-language “students” and the notion that putting kids across four standard deviations of ability into a single classroom is a good idea.)… Read more »

This and your prior postings have me on the phone with my IRA investment manager. My sense is that investment professionals make their recommendations based on a market “atmosphere” that includes runaway federal and state debt. I expect the FDIC would print money to cover bank balances within the insurance limit. Similarly the PBGC. All under some moral obligation theory since the insurance funds would be insufficient. Real estate would be taxed to the max even though few would have resources to purchase it. But really there is no way of knowing how how surviving governments would deal with this.… Read more »

I readily admit I’m the last person you should ask your financial questions. My track record is so abysmal that doing the opposite of what I believed wise would have been the ideal approach. I do not think the last 40-60 years’ trends are sustainable, but I didn’t think they’d continue back in 1995 and here we are. I learned the hard way that it really is all about debt (bonds.) For 38 years, if anyone borrowed $10 and spent it, the net result was $10 of “GDP-producing” wealth bouncing around the economy PLUS another $10 counted on the lender’s… Read more »

“When in Rome …”

Or, “What are you going to do if everyone else goes and jumps in the lake?” The answer is, “prepare to get wet, because they’ll DRAG YOU ALONG WITH THEM.” The crowd dictates conditions.

I don’t know why anybody would be surprised by this. Unless their hand is forced by cashflows seizing up, they will simply continue to do just enough to maintain the status quo. And I think the only thing that can shock the system that bad is a severe recession/depression. Pick your poison.

Watch the bond market (interest rates.) As long as rates are very, very low (as now), the game of kicking the can down the road will work. Once rates begin to rise in earnest (AKA when this nearly forty year bull market for debt is truly over), all that worked before won’t work at all.

It will be an entirely different world. Most people have no idea just how large an avalanche has built above our heads.

I have told the one teacher pensioner I know, who retired at 53 and gets over $6000.00 per month to save her money. But she is a profligate spender and had a bankruptcy. It would seemed pritz wants to drain the cow’s blood until it dies as opposed to a controlled bloodletting. I savor this-the greedy pols are getting nothing either-that means Richie Daley’s $50,000+ per month

In 10 years her pension will be over $8,000 per month. Even if Illinois were to enact Rhode Island style pension reform her pension would be over $6,800 per month in 10 years. She will be just fine.

She’ll be fine, unless this Long Boom ends. Maybe we really are in a world of limitless resources, now.

When the state doesn’t have enough money to cover all their bills who do you think decides who gets paid first? The comptroller and ultimately the ILSC. I wonder how the courts will decide who gets paid? Pensioners and Bondholders? Resources are not limitless but I have a feeling the “teacher pensioner” will be getting paid first. The taxpayers will feel the pain. Less services and more taxes are on the menu for our future.

I don’t know the future, but I figure the politicians (and their cronies & campaign financiers) will be paid first. It’s a club, and neither you nor I are in it. When the death spiral finally arrives, and the state can choose to either make property in the entire state worthless (because of too-high taxes) or still pay retired teachers, I figure the retirees will get stiffed. I just don’t know if that’s in 2023, 2033 or 2053 (and by 2053 my actuarial likelihood of caring will be low, but since I have kids who own homes in IL, it’s… Read more »

The structure of Illinois debt is composed mainly of pension liabilities. Bond debt very minimal. Pensioners will take a haircut.

Connie c, that’s an important point to remember. Illinois bonded debt is less than $40B. Pension plus pensioner healthcare debt is officially $200B, though much higher with realistic numbers.

Are the $40B bonded debt & $200B pensions + retiree healthcare (aka OPEB) debt state figures, or state + local?

Just state. Don’t know offhand about local bond total.

Per the Governments Division of US Census Bureau, December 2010, from the 2007 Census of Governments.

Total $116,525,919,000.

State: 54,535,159,000.

Local: 61,990,760,000.

https://www2.census.gov/govs/pubs/state_snapshot/gov07-il.pdf

Not sure if that is principal only.

They do respond to inquiries.

They might have something more current.

http://www.census.gov/govs

Check debt structure. Illinois has few bonds.

With impeachment in the air, perhaps it is already time to impeach Pritzker before he leads the state into total destruction. Too bad Article IV, Section 14 in the Illinois Constitution puts the sole power of impeachment in the complicit General Assembly that has the same conflict of interest. Of course, he may instead be aiming for the distinction of the other four Governors who forgot whose interests they were sworn to represent.

IL’s political process is poisoned beyond cure. The state is corrupt from top to bottom.

I think the word ‘bankruptcy’ is going to appear more often on Mayor Lighthead’s lips in 2020. The blame game will start between the Mayor and the Governor. I’m gonna enjoy watching this from my new non Illinois home….and if it takes a couple years to reach a climax, even better!!!!

Does she understand the consequences of declaring bankruptcy? Like never being able to get financing at reasonable terms ever again. And by screwing over retirees relying on bonds that the city pays interest on? Does she even care, or is she a moron who doesn’t understand the simple concept?

chiraq is bk already-all that’s left is calling the vespers.

“Like never being able to get financing at reasonable terms ever again. ”

That’s not true; new lenders will come out of the woodwork to lend to Chicago because they know that Chicago’s finances are in better shape. We’re paying higher interest rates now because of our high debt loads.

As for the retirees relying on Chicago bonds…well, there is a thing in finance called ‘risk’ and if you’re a retiree dumb enough to invest in Chicago municipal bonds for that higher interest rate….Oh well.

Dave, not true. Check the bond ratings for Detroit, Stockton, GM and others that have gone through bankruptcy. Existing lenders prior to bankruptcy routinely say “you’ll never get financing again,” but after bankruptcy they line up to lend against a clean balance sheet.

Mark, you’re right…for the past. But would this still be the case if long-term interest rates were overall headed higher, such that debt is in a secular bear market again, like it was prior to 1981? I suggest that for 38 straight years (and counting) the intangible asset called debt was in a bull market, and “investors'” (lenders’) behavior obeyed bull market rules. I love to ask: Are interest rates near-zero and going lower permanently? Show me a macro trend like that has lasted forever…literally forever. Nothing will change…NOTHING…not the Contagious Pandemic called Leftist dogma nor IL’s head-first dive into… Read more »

Mark – you are of course right re Stockton, Detroit, et. al. And a true fresh start is the best argument for bankruptcy. I am watching Puerto Rico and the PROMESA proceedings, however, and I wonder who will lend to Puerto Rico in the future. The quest for high yields may save Puerto Rico, but I can’t see anyone rational lending PR money, even post PROMESA. Admttedly, PR is in a world of its own in terms of corruption, spending, lack of productivity (some of it not all their fault), and education (their NAEP scores are unbelievably bad, making Detroit… Read more »

You have to admit, when one exits bankruptcy they pretty much have a clean balance sheet so why wouldn’t they, as you point out, be able to get another loan?

It’s all about the debt market. Right now, people (almost entirely fund managers) want to own debt. It’s the definition of a bull market. But when this market does finally roll into a bear phase, the willingness to lend to known deadbeats should be pretty much gone. No one lends money intending to obtain a guaranteed loss. People lend money (buy debt) because today they think the value of the debt will rise (AKA interest rates will decline.)

No one today expects to hold long term debt to maturity. It’s a vast game of hot potato.

While it’s not held to maturity, it does pay interest, and it often has some degree of tax exemptions to it. There’s a lot of money just floating around out there in the world, it has to be parked somewhere. You can’t just park $100,000,000 in a bank, or under your mattress, the investors buy investments, some better than others, some with more risk than others.

Righer, riverbender. It’s not like personal bankruptcy, which does indeed stain your credit, because lenders to some degree view it as a blemish on character. With corporations, management will likely have changed, too, after bankruptcy, aside from cleaning up the balance sheet. Of course, if the incumbents who broke a municipality remained in charge after its bankruptcy, well, that’s a problem.

If she were smart she would do that, begin bankruptcy actions. When that happens yabba and all of Springfield will move heaven and earth to give her all the money she wants.

She can’t do that until Springfield allows that to happen. You appear to be confused as to the tools that are available to the mayor.

Illinois is spitting up blood. Dr. Pritzker is treating it with aspirin. Nurse Media just watches and yawns. Treatment is due to continue as is until the heart stops. Nurse Media will then act surprised and Dr. Pritzker will retire.

“Nurse Media just watches…” Certainly true regarding the electronic media, which lacks reporters with intelligence and savvy to analyze the pension crisis. But the print and onhline media, led by the Tribune, Crain’s and Wirepoints, are doing an excellent job of framing the challenge of pension reform and more importantly, keeping the issue in front of readers.

The problem with discussion pension is that virtually everyone in the state knows someone who receives a pension or will receive one – your kids’ school teachers, your local municipal employee, your neighbors. So in the abstract, yeah, pensions are a huge problem; but to the guy on the block, he doesn’t want to tell Deborah the retired city clerk down the block that her pension needs to be cut in half.

I read the Tribune for the first time in four years only because someone left a paper laying at McDonald’s. It has become a rabid left wing rag, Kass is the only thing good about it.

We the taxpayers are just defibrillators to be used as a life saving measure at their leisure as long as we have breath in our bodies and money in our pockets. Every time we are used the voltage (tax’s) go up to try to save a rotting corpse. That is unless we move!

Mayor Lori Lightfoot acknowledged Friday she will have no choice but to raise property taxes — which were more than doubled by former Mayor Rahm Emanuel — if her agenda falls flat in the General Assembly’s fall veto session.

do it lighthead and watch everything get perfect-hahaha

The city and state have already raised taxes and the pension problem is worse

The shocking news of pension problems in the Netherlands is hard to believe. They try to use realistic investment assumptions in Europe and retirees have to share some of the risk, but I guess there’s no getting around NIRP bonds in an investment portfolio. “60 Minutes” had a good segment on Brexit and there’s a great video on you-tube “Deplorables”.

https://www.express.co.uk/news/world/1206436/EU-news-european-union-netherlands-latest-news-european-union-pension-crisis

Pensions are just promises of future cash flows…in other words, IOU’s. For decades, a worldwide contagion called a Bull Market for DEBT was in force. Bonds are intangible assets, and Econ 101 supply-demand price models do NOT apply to intangible asset markets. As prices rise, instead of quantity demanded declining (as would be the case for cars, land, beanie babies, etc.), the quantity demanded in the market actually rises…for as long as the bull market lasts. This was the mechanism by which a veritable ocean of debt was issued. Everyone counts the debt they OWN as an asset, it is… Read more »