A dramatic rise in pension benefits – not funding shortfalls – caused Illinois’ state pension crisis

By: Ted Dabrowski and John Klingner

View the report’s key findings

Introduction

There’s little argument that Illinois politicians are to blame for the state’s massive pension crisis.

However, how politicians caused the crisis has long been misunderstood. Critics on both sides of the aisle typically accuse politicians – and by extension, taxpayers – of shortchanging pensions.

But a Wirepoints analysis reveals that too little money into pensions hasn’t been the issue. Instead, it’s the dramatic growth in total pension benefits promised by politicians that’s been bankrupting Illinois.

Wirepoints analyzed Illinois pension and economic data stretching back to 1987 and also compared pension plans across the country from 2003-2015, using data from the Illinois Department of Insurance and Pew Charitable Trusts.

Wirepoints found that total pension benefits have grown exponentially over the past 30 years.

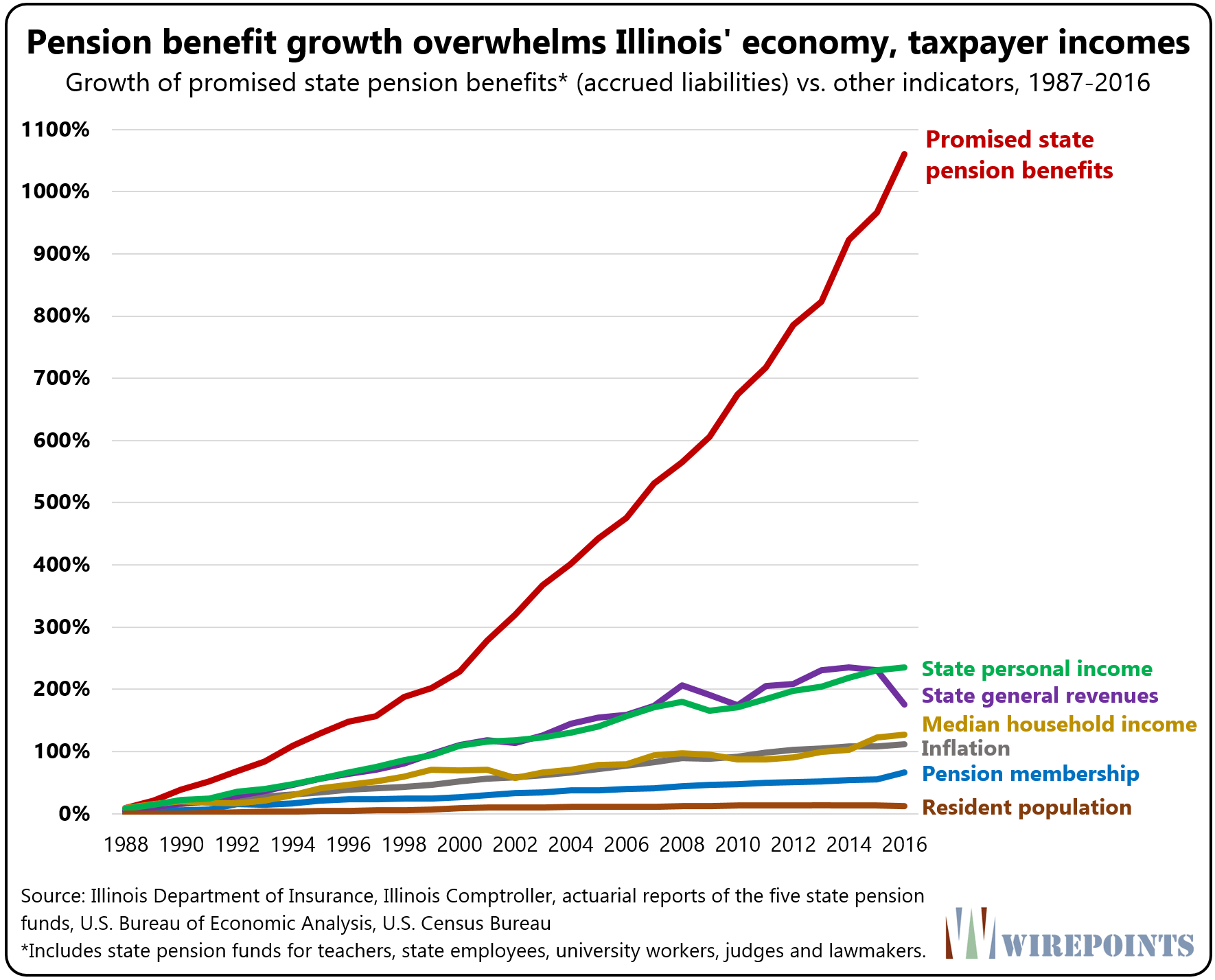

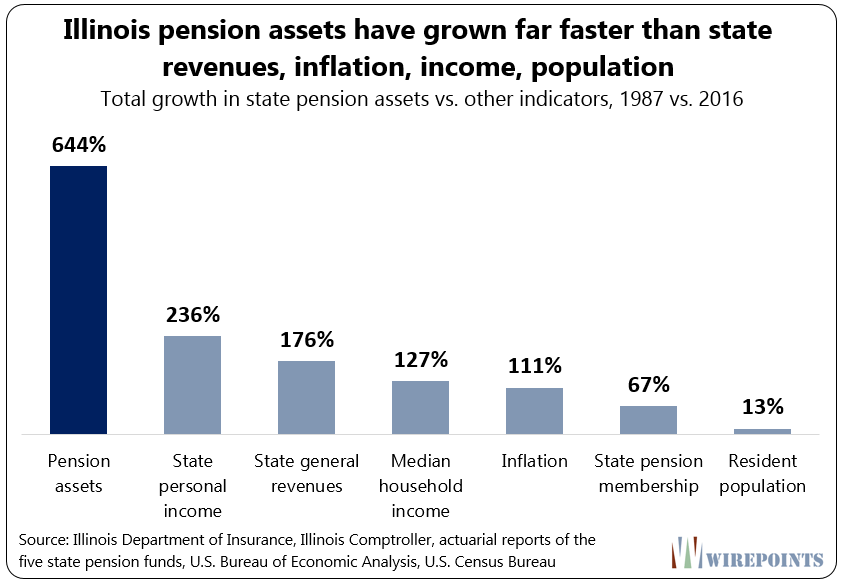

Promised pension benefits in 2016 were 1,000 percent higher than they were three decades ago. As the below graphic shows, no other measure of Illinois’ economy comes even remotely close to matching the growth in promised benefits.

Those benefits are overwhelming the state’s economy and taxpayers’ ability to pay for them.

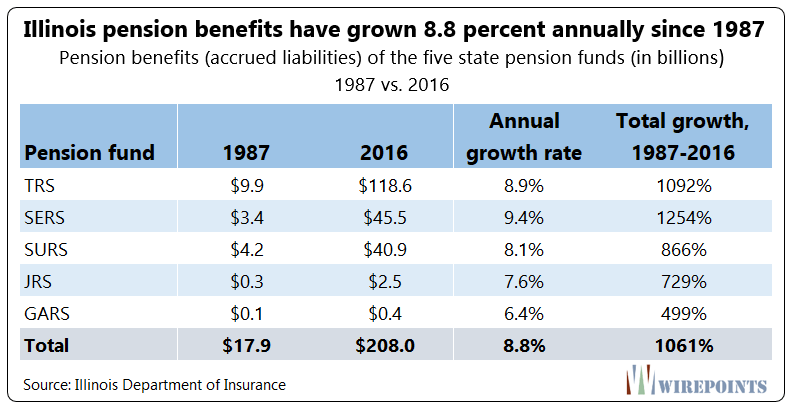

Total pension benefits have grown at an annually compounded rate of 8.8 percent over the past three decades. Compared to 1987, benefits have grown 1,061 percent.

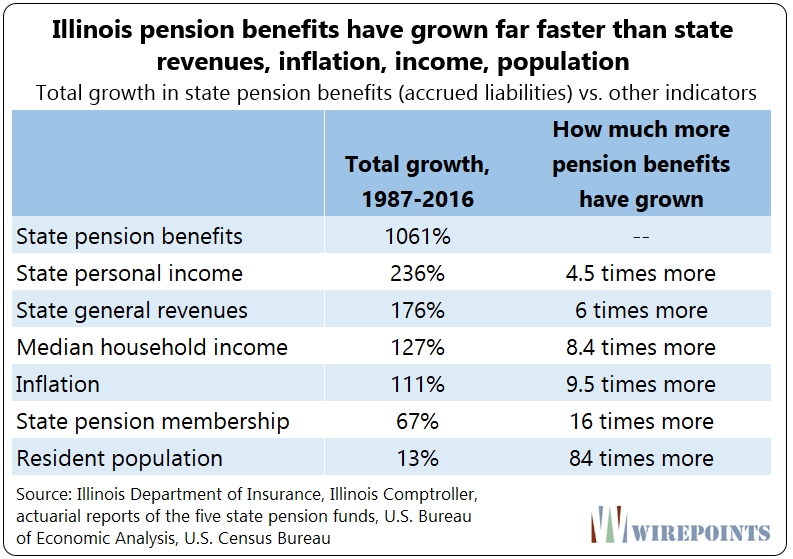

That growth is six times more than total state general revenue growth (176 percent) over the same time period; eight times more than median household income growth (127 percent); and nearly ten times more than inflation (111 percent).

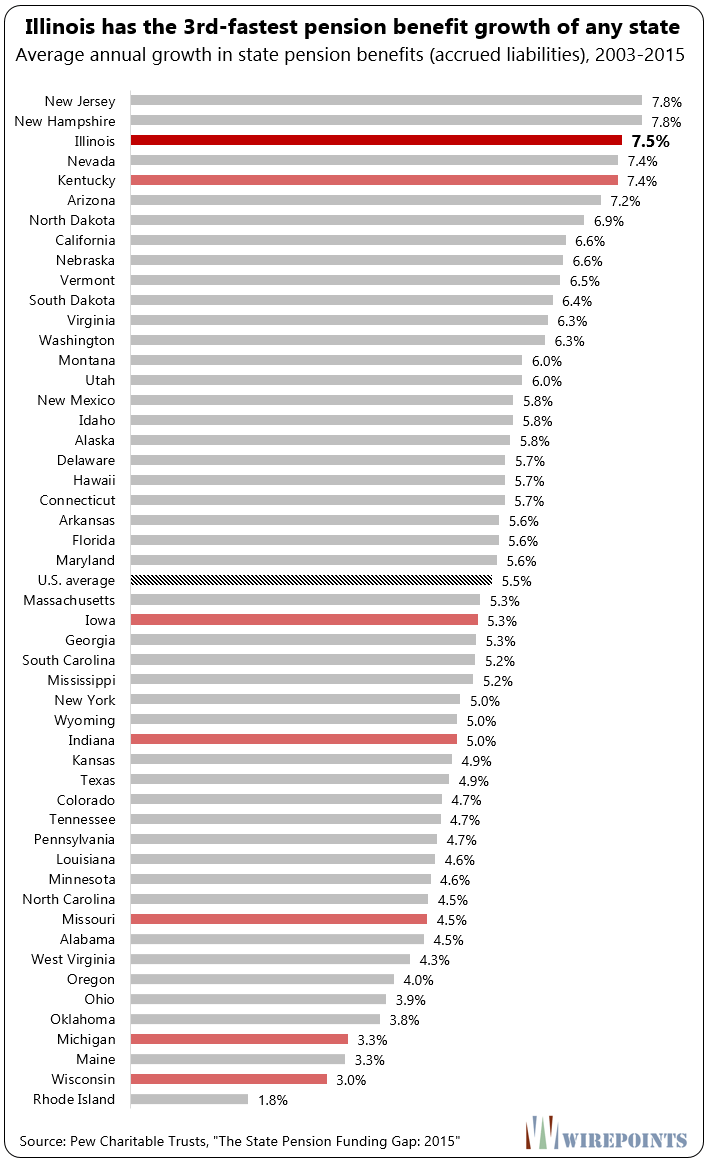

In fact, Illinois’ pension benefits grew faster than in every other state in the nation except New Jersey and New Hampshire between 2003 and 2015, according to Wirepoints’ analysis of Pew data.

By any measure, the pension promises made by Illinois politicians have been extreme and unsustainable.

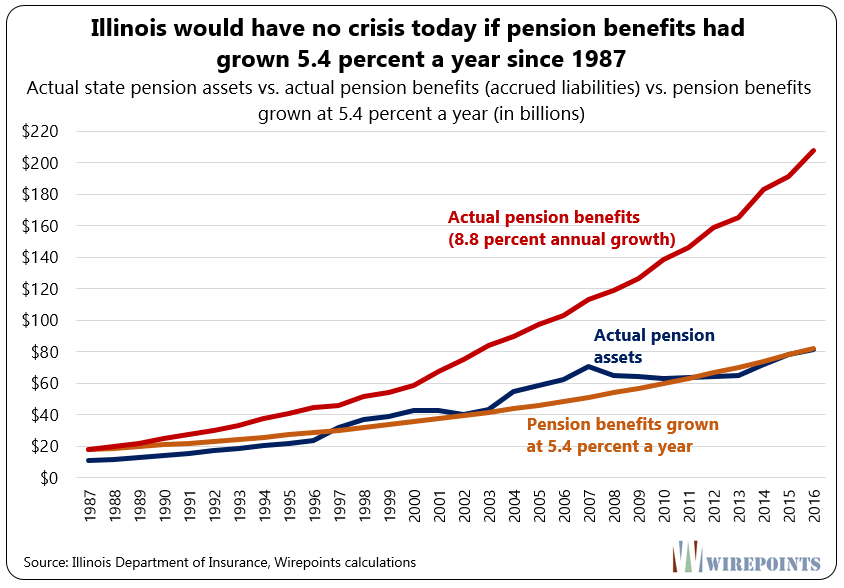

Wirepoints’ findings also dispel the claim that too little money in the pension plans caused the current crisis – state pension assets, buoyed by taxpayer contributions, have also grown exponentially since 1987.

Pension assets are seven times higher in 2016 than they were 30 years ago. They’ve grown five times more than household incomes over the entire period and nearly six times more than inflation.

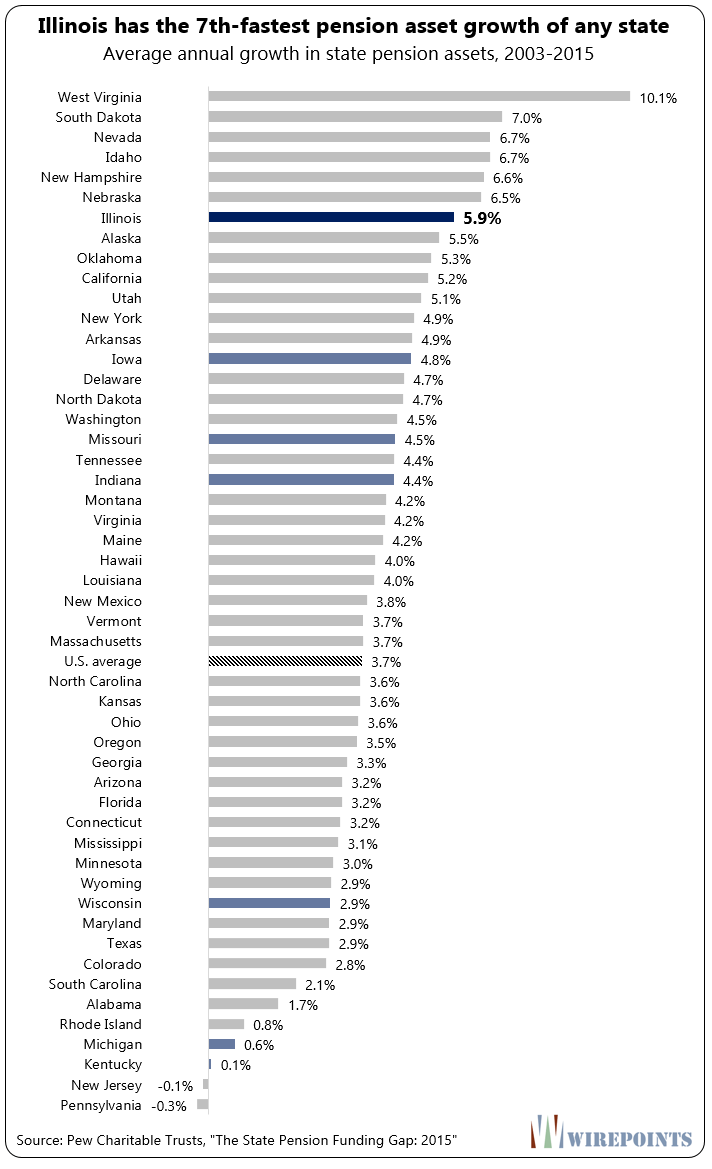

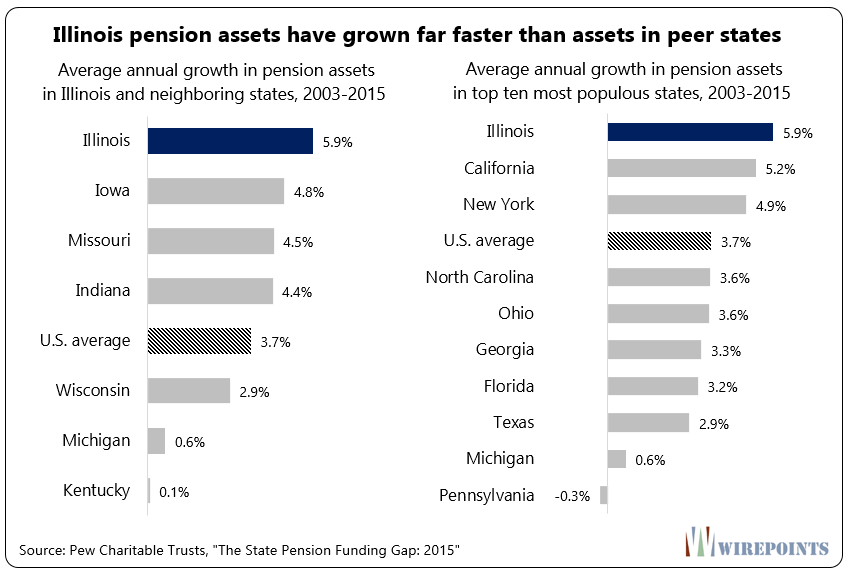

And in the 2003-2015 period, Illinois assets grew the seventh-fastest of any state in the nation.

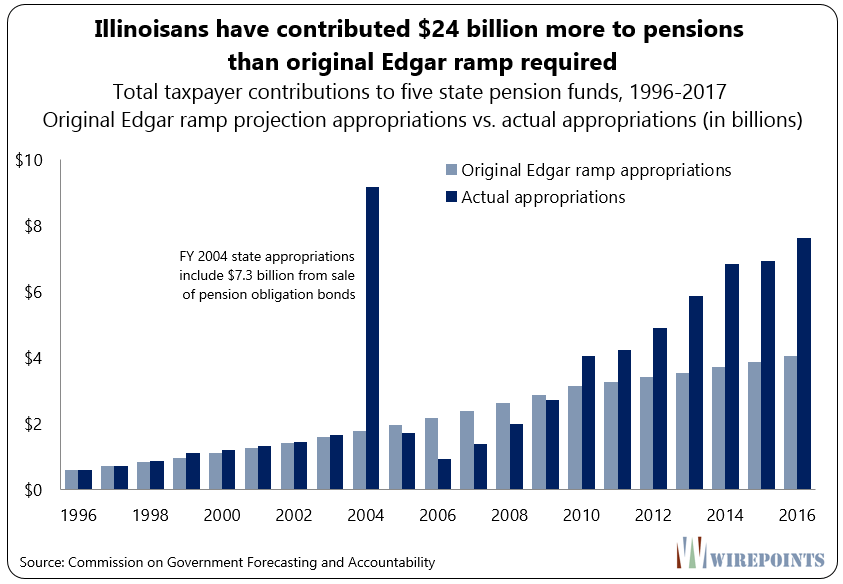

Illinois, and by extension, its taxpayers, have made more than their fair share of contributions to state pensions. Illinoisans have so far contributed $24 billion more to pensions than what Governor Jim Edgar’s 1996 contribution schedule – the “Edgar ramp” – originally asked for.

Illinois’ out-of-control pension crisis wasn’t inevitable. In fact, if state pension benefits had simply grown at the more moderate pace of its neighbors since 2003, the state’s unfunded pension liability would be $40 billion to $85 billion lower today.

And if pension benefits had grown at the rate of 5.4 percent from 1987 on – still a rapid growth rate – Illinois pensions would be fully funded today. There would be no crisis.

Wirepoints’ analysis shows the common narrative surrounding Illinois’ pension crisis – that pensions have suffered from underfunding – is false. The problem is, and always has been, the enormous growth in benefits that politicians have promised to workers.

Politicians should stop guilting Illinois residents into thinking that the only way to fix pensions is through tax hikes and bigger pension contributions.

Instead, lawmakers should pull every lever they can to get the state’s excessive growth in pension benefits under control.

Pension benefits have grown multiple times faster than the economy

The growth in pension benefits accumulated by Illinois government workers and retirees over the past three decades has been unsustainable.

Promised state pension benefits have grown at an average pace of 8.8 percent annually since 1987. In total, that’s a 1,061 percent increase – far greater than any major measure of the state’s economy over the same period.

Total pension benefits equaled $208 billion in 2016. That’s up from just $18 billion in 1987, the earliest year for which the Illinois Department of Insurance provides Illinois pension data.

In 1987, Illinois households were on the hook for $4,300 in promised pension benefits. By 2016 that amount had swelled to over $43,000 per household.

All of the state’s five pension systems – the Teachers’ Retirement System (TRS), State Employees Retirement System (SERS), State Universities Retirement System (SURS), Judges Retirement System (JRS) and General Assembly Retirement System (GARS) – have experienced a massive growth in benefits (accrued liabilities) since 1987.

TRS pension benefits, which make up more than half of the state’s total accrued liabilities, grew almost 1,100 percent between 1987 and 2016. SURS benefits on average grew 8.1 percent annually, or nearly 870 percent in total.

And SERS experienced the largest increase of any of the funds – over 1,250 percent over the past three decades.

That outsized growth in pensions becomes more apparent when it’s compared to major measures of the state’s economy.

Since 1987, pension benefits have grown 6 times more than state revenues, 8.4 times more than household incomes and 9.5 times more than inflation.

No business or government can remain solvent with such rapidly growing obligations, especially when that growth overwhelms any ability to pay for it.

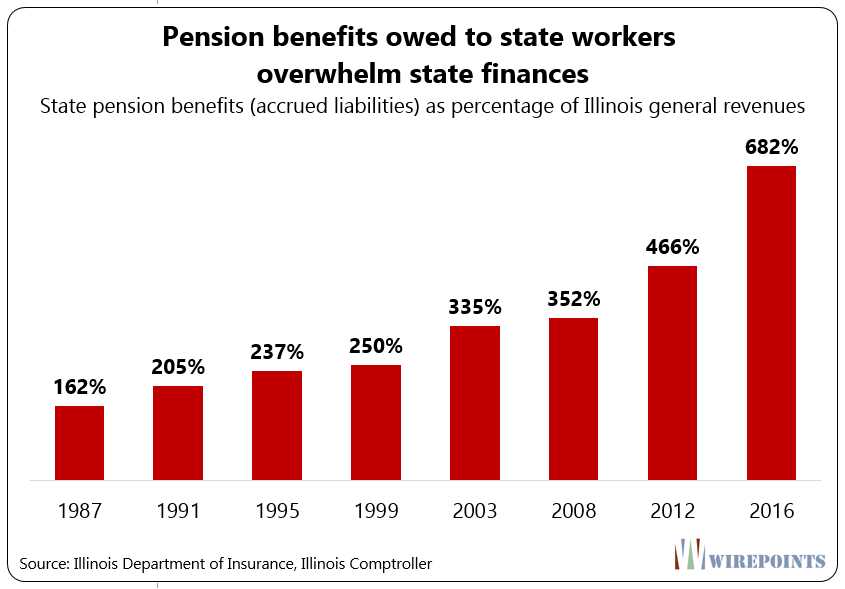

Another way to measure the rise of pension benefits is to compare them to the state’s financial resources. Liabilities that grow significantly compared to revenues will usually spell trouble over time.

In 1987, total pension benefits owed to workers were already 1.6 times more than the state’s general fund revenues. By 2016, benefits grew to nearly seven times more than general fund revenues.

With pension benefits outpacing every measure of Illinoisans’ ability to pay for them, it’s no wonder Illinois is in crisis, its taxpayers are fatigued and core government services are being slashed.

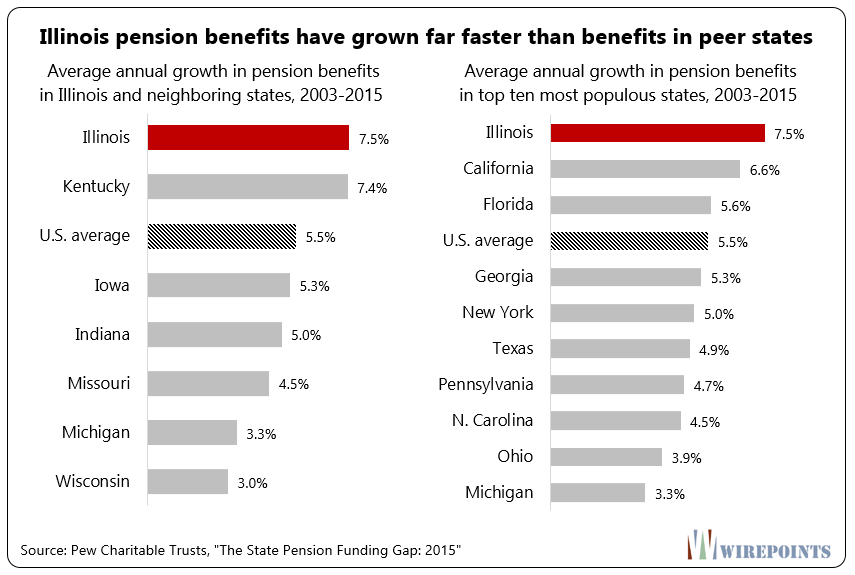

Illinois had the third-highest pension benefit growth in the nation

The growth in Illinois’ state pension benefits hasn’t just been overwhelming when compared to the state’s economy. Illinois’ pension benefits have also grown rapidly in comparison to other pension systems in states across the country.

In fact, Illinois pension benefits grew the third-fastest in the nation between 2003 and 2015.

The state’s benefit growth outpaced every one of its neighbors and the nation’s largest states, according to a Wirepoints analysis of Pew Charitable Trusts pension data.

Nationally, only New Jersey and New Hampshire had faster growing pension benefits than Illinois.

In all, Illinois pension benefits grew 7.5 percent annually between 2003 and 2015. The 50-state average was 5.5 percent per year over the same period.

In contrast, Illinois’ neighboring states had much slower pension-benefit growth.

Wisconsin’s accrued benefits grew 3 percent annually between 2003 and 2015. Michigan’s, 3.3 percent. Missouri’s, 4.5 percent.

Kentucky, which is suffering a massive pension crisis of its own, was the only nearby state with pension growth similar to Illinois. Its benefits grew 7.4 percent annually between 2003 and 2015.

Illinois’ annual pension growth rate was also far greater than that in the nation’s largest states. California’s annual growth rate was the closest to Illinois at 6.6 percent. Florida’s pensions grew 5.6 percent. New York’s, 5 percent. Texas’s, 4.9 percent.

The slowest pension growth of the ten-largest states was in Michigan, which grew at just 3.3 percent annually.

Remarkably, Illinois’ pension benefits grew even faster prior to 2003, the first year of Pew’s dataset. From 1987 to 2003, pension benefits in Illinois grew at an uncontrollable 10.1 percent a year.

Illinois pension benefit growth has been extreme no matter the time period.

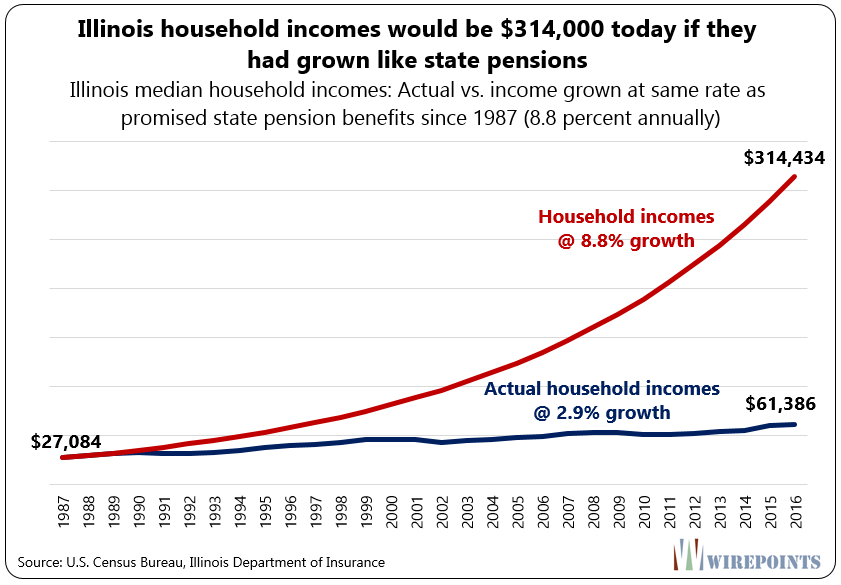

What an 8.8 percent annual growth rate means

It’s important to understand the tremendous impact that differences in growth rates – for example, the difference between a 5 percent and 9 percent – can have over a 30-year period. That variance can make the difference between a crisis and a stable situation. That’s certainly been the case when it comes to Illinois pensions.

To understand how incredibly fast the state’s pension benefits growth rate is, consider what that 8.8 annual growth rate would do to something more tangible, say household incomes, over a 30-year period.

In 1987, the median household income in Illinois was $27,084.

By 2016, the median household income had grown to $61,386. That translates to an average growth rate of 2.9 percent a year.

But if household incomes had grown at the same rate as state pension benefits they would have grown to $314,000 by 2016.

This case helps illustrate the problem the state faces with pension benefits. Pensions have grown at an unsustainable pace for a long period of time – way faster than taxpayer incomes. That’s what has dragged Illinois into crisis.

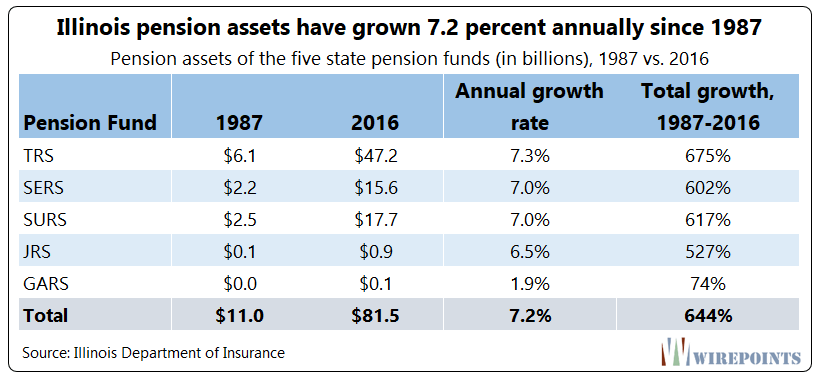

Pension assets have grown multiple times faster than the economy

Contrary to most assumptions, Illinois’ pension assets – buoyed by taxpayer contributions – have grown rapidly over the past three decades. Just like pension benefits, assets have grown far faster than any major measure of the state’s economy.

The state’s pension assets have grown 7.2 percent annually since 1987, increasing from just $11 billion in 1987 to nearly $82 billion today.

The largest three of the state’s five pension systems have, on average, experienced asset growth of 7 percent or more since 1987.

TRS, which makes up more than half of the state’s asset total, experienced the largest increase. On average, teachers’ assets grew 7.3 percent annually, or 675 percent in total between 1987 and 2016.

That asset growth has been far greater compared to any major measure of the state’s economy.

Over the past three decades, pension assets have grown by over 644 percent.

In contrast, state general revenues grew just 176 percent, state median household incomes grew 127 percent and inflation only grew 111 percent.

The only thing that’s grown more rapidly than pension assets has been the pension benefits the state promised to workers.

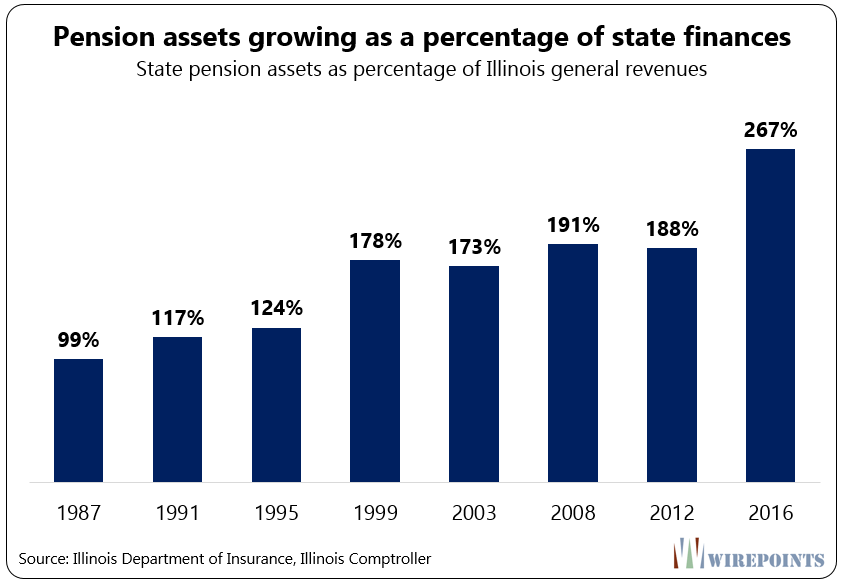

Another way to measure the growth of pension assets is to compare them to the state’s financial resources. Over time, pension assets have grown as a percentage of the state’s revenues despite the worsening of the pension crisis.

In 1987, total pension assets equaled the state’s general fund revenues. By 2016, assets had grown to be 2.7 times the size of revenues.

In sum, Illinois’ pension asset growth has been stellar relative to its economy. Unfortunately, pension benefits have been growing even faster.

Illinois had the seventh-highest pension asset growth in the nation

If Illinois’ pension crisis was due to a lack of money, one would expect Illinois’ pension assets to have grown poorly when compared to other states. But state-by-state pension data collected by Pew Charitable Trusts shows that’s not the case.

Illinois’ pension assets grew 5.9 percent a year between 2003 and 2015, the seventh-fastest in the nation. The 50-state average was a much lower 3.7 percent.

Illinois’ rapid asset growth has also outpaced all of its neighbors.

Iowa’s assets grew 4.8 percent annually between 2003 and 2015, Indiana’s grew 4.4 percent and Michigan’s grew just 0.6 percent.

Kentucky, another state suffering from a massive pension crisis, saw its assets grow a scant 0.1 percent annually since 2003.

Illinois’ asset growth was also unmatched by the other highly populated states in the nation.

Of the top 10 biggest states, California’s asset growth was the closest to Illinois at 5.2 percent. New York’s grew 4.9 percent. Texas, just 2.9 percent.

Several of Illinois’ peer states had terrible returns over the 12-year period.

Michigan and Kentucky’s assets didn’t even grow one percent a year. And Pennsylvania actually experienced negative asset growth.

Illinois’ pension assets experienced even faster growth in the years before Pew’s analysis. Between 1987 and 2003, assets grew 9 percent annually.

That remarkably fast growth was only outpaced by benefits, which grew at an uncontrollable 10.1 percent a year in the same period.

Clearly, the real problem is that Illinois’ pension assets simply haven’t been able to keep pace with state’s overwhelming pension benefit growth.

Taxpayers have paid more than their fair share into pensions

Illinois’ high pension asset growth has been largely paid for by taxpayer contributions into the pension plans.

Most notable is the amount of funding put in by taxpayers since the implementation of the 1996 Edgar ramp – the pension funding plan introduced by Gov. Jim Edgar.

The original ramp called for taxpayers to pay $52 billion into the pension systems from 1996 through 2017.

But taxpayers have ended up contributing far more than that. Between 1996 and 2017, taxpayers put $75 billion into the pension funds, or $24 billion more than the original ramp called for. In 2017 alone, taxpayers will contribute nearly $4 billion more than the ramp required.

It’s those taxpayer contributions, in particular those from 2003 onward, that helped pension assets grow 5.9 percent a year during the 2003-2015 period – the seventh-fastest growth in the nation.

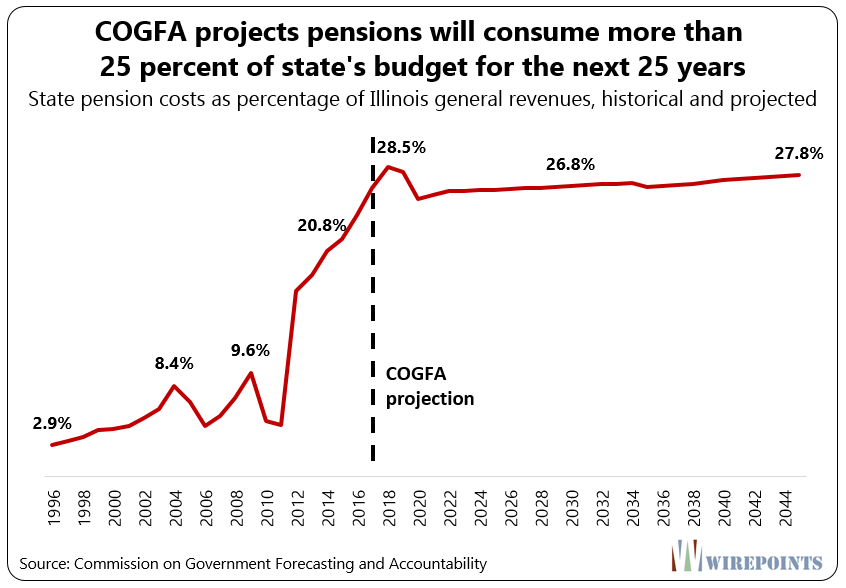

However, that growth in assets has come at a cost. Illinois’ contributions to the pension funds have become so large that they now consume more than a quarter of the state’s annual budget. That’s left less funding available for other vital programs and social services.

Illinois wouldn’t have a crisis today if benefits had grown at a more reasonable pace

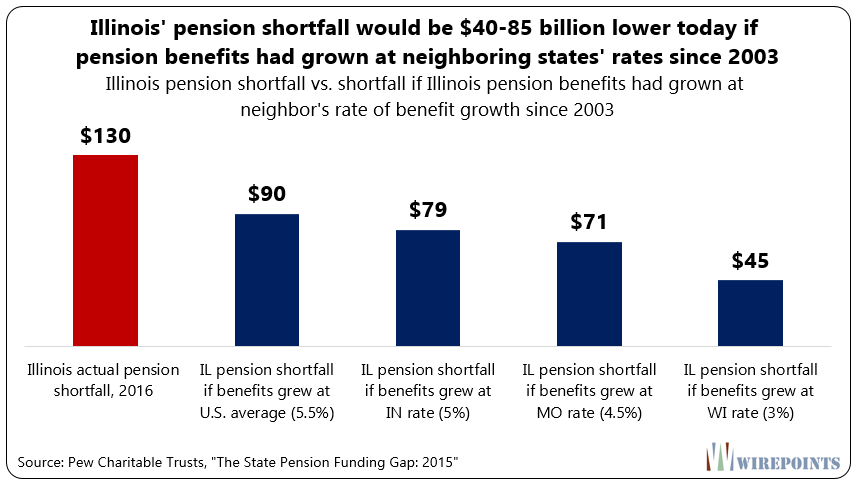

In 2003, Illinois’ pension shortfall – its unfunded liability – reached $43 billion.

Lawmakers had a choice. They could enact real pension reform to get the crisis under control, or simply kick the can down the road.

Unfortunately, politicians chose the kick and authorized a $10 billion pension bond. With no reforms in place, Illinois’ accrued pension benefits grew the third fastest in the nation over the next 12 years.

That benefit growth fueled an ever-bigger hole in the pension fund. As a result, the state’s pension shortfall tripled, growing to $130 billion by 2016.

Illinois’ $130 billion pension shortfall would look dramatically different today if Illinois politicians had reformed pensions and slowed the growth in benefits more than a decade ago.

Wirepoints calculated what the state’s unfunded liabilities would have been if the state’s pension benefit growth matched the slower rates of Illinois’ neighboring states in the 2003-2015 period.

Not surprisingly, the state’s pension debt drops significantly under those scenarios.

If lawmakers had passed reforms that limited benefit growth to Indiana’s rate of 5 percent, Illinois’ pension shortfall would be $79 billion today.

And if politicians had reformed pensions to match Wisconsin’s growth rate of 3 percent, Illinois’ shortfall would total just $45 billion.

The point is, Illinois’ out-of-control pension crisis was not inevitable.

In fact, if politicians had slowed the growth of pension benefits to 5.4 percent annually beginning in 1987, Illinois’ pensions would be 100 percent funded today.

A 5.4 percent growth rate would still have been rapid when compared to Illinois’ economy and taxpayers’ ability to pay. But any moderation in pension benefit growth would have significantly reduced the severity of the crisis, if not ended it entirely.

The generous pension rules that drive benefit growth

Illinois’ dramatic pension benefit growth has been driven by two key factors: sweetened pension rules and failed actuarial assumptions.

First, Illinois’ already-generous pension benefits were repeatedly sweetened over the past 30 years.

Since 1987, politicians have grown pension obligations through perks that:

- Add compounding to a retiree’s 3 percent cost-of-living adjustment. That doubles a retiree’s annual pension benefits after 25 years.

- Significantly increased the pension benefit formulas for the Teachers’ Retirement System, or TRS, and the State Employees’ Retirement System, or SERS.

- Provided lucrative early retirement options.

- Allow workers to boost their service credit by up to two years using accumulated unpaid sick leave.

- Grant automatic salary bumps to workers who earn masters and other graduate degrees.

- Allow spiking of end-of-career salaries.

Those benefits have resulted in the following:

- 60 percent of current state pensioners began drawing pensions in their 50s, many with full benefits.

- The average state pensioner who worked 30 years or more receives $66,800 in annual pension benefits and will collect over $2 million in total benefits over the course of his or her retirement.

- That average career pensioner will see his or her pension payments double to more than $130,000 in retirement.

- Career pensioners will get back their direct employee contributions after just two years in retirement.

On top of the sweeteners, failed actuarial assumptions continue to reveal to taxpayers the true costs of pension benefits. Changes in mortality, investment rates and benefits have all led to unexpected jumps in the cost of total pension benefits promised to workers. In 2016 alone, assumption changes contributed to a $17 billion jump in promised benefits.

State workers have done nothing wrong in receiving these pension benefits. They’ve benefited from lucrative contracts negotiated by their unions and granted by politicians who didn’t care about the costs to taxpayers.

However, it’s clear that such benefits are not affordable. Politicians have made promises they can’t keep and that Illinois taxpayers can’t afford to fund.

Tier 2 is not a solution to the state’s pension crisis

Some lawmakers and others may claim the state’s adoption of the Tier 2 benefit structure for new workers will “fix” the future growth in pension benefits. All new workers hired after Jan 1, 2011 are part of Tier 2 and will receive pension benefits that are far less generous than their Tier 1 counterparts.

But Tier 2 doesn’t solve the state’s accrued benefit problem for several reasons.

First, Tier 2 doesn’t change the fact that Illinois is still struggling to pay for the Tier 1 benefits it owes.

The Commission on Government Forecasting and Accountability estimates pension costs will continue to consume more than a quarter of Illinois’ general budget for the next 25 years – even with the reduced costs of Tier 2 in effect.

Worse, the related chart only depicts the “rosy” scenario. If assumptions are changed or another recession hits, pension costs could grow to consume even more of the budget.

Second, Tier 2 could be dismantled sometime in the future. TRS officials have argued that the courts should overturn the benefit structure because it discriminates against new workers.

Tier 2 members of TRS provide a net subsidy to the state pension plans. New teachers contribute 9 percent of their annual salary to their pension fund. But the benefits they accrue are only worth 7 percent of their salary annually. That 2 percent loss is in effect a tax on Tier 2 members. It’s that “tax” that’s helping fund Tier 1 pensions.

A rollback of Tier 2 would significantly increase the state’s pension obligations.

Even if Tier 2 isn’t overturned, the IRS might force the state to increase Tier 2 benefits in line with the agency’s minimum retirement requirements. Or politicians may be pressured to increase benefits as Tier 2 members become a larger share of the state’s workforce.

If any of that happens, the subsidy provided by Tier 2 members would end and the pension funds’ owed benefits would jump dramatically.

Third, the subsidies provided by Tier 2 may not be enough to compensate for other drivers of accrued pension benefits. Tier 2 does nothing to slow the benefit growth that may occur due to the fund’s actuarial and other assumption changes.

Take what happened after Tier 2 was passed. In 2011, total promised pension benefits were projected to grow to $189 billion in 2017. But benefits actually ended up much higher than that. In 2017 they exceed $214 billion, $25 billion more than projected.

Those who argue for inaction on pensions – to allow the effects of Tier 2 to play out – risk sending the pension funds into further insolvency. Illinois has to act now to bring the size of its accrued pension benefits under control.

Conclusion

Illinois pension benefit growth must be reined in if the state is to avoid insolvency and a further exodus of its tax base. Illinois has lost population four years in a row and is one of the nation’s leaders in outmigration.

But with the General Assembly handcuffed by an inflexible constitutional clause and recalcitrant unions, lawmakers must employ a new set of tactics.

Pension benefits themselves are untouchable, but lawmakers can freeze salaries, cut the subjects of collective bargaining and reduce headcounts in order to reduce future payouts.

Illinois’ government unions will then have a choice. They can either negotiate with lawmakers to restore those cuts in consideration for a reduction in pension benefits, or they can live with the changes.

However, those changes alone won’t end the crisis. Irresponsible increases in benefits leave no choice but to cut benefits further, which will require either a constitutional amendment or a negotiated federal bankruptcy law. And to stop accruing future pension benefits, lawmakers must create 401(k)-style plans for new workers going forward.

Illinoisans shouldn’t be guilted into paying more into pensions through higher taxes. It’s time to end the narrative that forces ordinary Illinoisans to shoulder the entire burden of fixing the pension crisis.

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

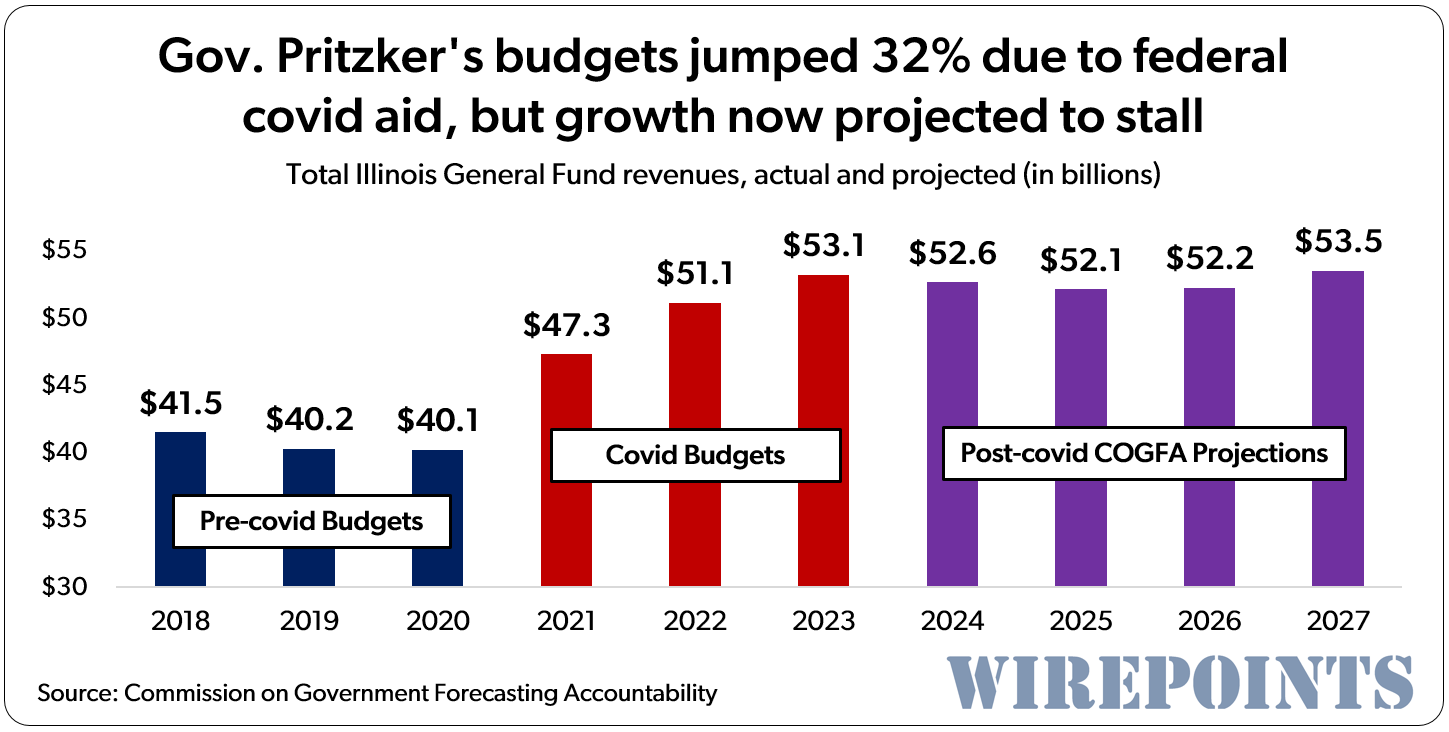

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more. Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow. Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Why should anyone ever think any part of government would ever keep his promise it has never happen in the history of the world, governments are made up of thieves.

From Detroit Free Press Feb 2017: How did the bankruptcy change Detroit’s pension plans? The city’s two pension systems — one for general workers and another for police and fire workers — stopped accepting new employees into pension plans that existed prior to the bankruptcy. The city moved newer workers into a so-called hybrid plan with features similar to a 401(k). Underfunding of the city’s pension funds and the magnitude of pension and health care benefits owed to Detroit workers and retirees was a driving factor behind the city’s historic bankruptcy, which resulted in 4.5% cuts and other reductions for… Read more »

Math and reality say yes for sure. There is NO other option. It WILL happen.

I just sent the following message to Fred Klonsky. I will let you know if he prints it: Fred, Your latest reply is premised on the allegation that the state failed to raise adequate revenue. This is disputed with economic analysis and data by Wirepoints which is much persuasive than your ipse dixit or the data I have read on this site for the past five years. Repetition of false facts got Trump elected, of course, so there is much to be said in favor of your strategy when you have an axe to grind. This was the favored tactic… Read more »

Ah, Klonsky. My favorite radical. Haven’t checked in on him lately. Ten bucks says he responds with an ad hominem. Maybe, vulture capitalist, pension thief, fake news, libertarian, whatever.

Thus far he hasn’t posted the message, let alone respond. This is in keeping with his past performance: Rather than let his readers see real “data” (as in “just looking at the data”) he simply declines to post messages that he is unable to dismiss. Of course it’s possible he’s away on Spring Break on one of his several annual travel jaunts — normally reported as a virtue-signaling leftist missionary trip to a place that is in all ways superior to the quotidian state whose taxpayers keep him his personal travel budget in the black.

He blocked my comments there and on Twitter long ago. The modern left. How they’ve disgraced liberalism.

As I told Mark a couple of years ago, Mark reminds me of Steve Eisman from The Big Short. “Lenders-“You’re wrong, Your data’s wrong.” Eisman-“It’s YOUR f****** data!” Wirepoints uses data from the official reports. If this came from “Madigan 2018” or “Rauner for Governor”, I’d be suspicious of it. But this comes from the CAFR’s, COGFA reports et al. I learned so much just by reading the bond offerings from MuniOS it convinced me it was time to leave the state. The info about the inevitability of what’s to come is already out there.

Flattering, because Eisman is indeed a hero of mine.

Think of the Klonsky blog as a vapid layer within the movie Inception, an echo chamber for teachers beneath an echo chamber for higher taxes (CTBA) beneath an echo chamber for all public sector workers (capitolfax).

At first glance, a cumulative increase of 1,061% in aggregate promised pension benefits since 1987 appears excessive, even if it does not necessarily mean that the average retiree now is receiving a benefit that is 1,061% higher than the average retiree did in 1987. However, as a finance prof allow me to add some perspective here. According to the well-respected Ibbotson and Associates data, an annually re-balanced portfolio structured similarly to that of a typical defined benefit pension fund, i.e. consisting of 70 percent large cap stocks (S&P 500) and 30% high-grade corporate bonds (20 years to maturity, AA rating),… Read more »

If the state had made sufficient contributions to cover normal costs since 1987, everyone would have received smaller raises every year since 1987 because there wouldn’t have been enough cash left over to pay them. So take every salary increase ever given over the past 30 years and cut each one by, say, 25%. Now how much is your fully funded pension? Would you have been happier?

I hope I have your story in my mind correctly, but there seems to be logical disconnect. Most IL citizens surely know that local property taxes are the primary source on average for the funding of public K-12 schools in IL with the state government generally contributing far lesser amounts. So, here we have the conundrum of the matter at hand in your argument. Local property taxes are heavily burdened by school funding while the state is not by comparison. Yet, the public employee pension funds for teachers are paid by state taxes rather than local taxes (except in Chicago… Read more »

The same reasoning applies to teachers. If the state made full payments into TRS, there would be less money sent to each school district for operating expenses (salaries). Less state money would definitely impact the salaries being offered in 99% of school districts, except maybe the most wealthy ones that get virtually no state funding.

My point remains the same for all pension funding in all government sectors: Fulling funding the pensions of tomorrow directly impacts the money that can be spent on compensation of today.

Well, we can agree that there is a correlation between state spending on one item (school funding in this case) and its adverse effect upon another, related item (teacher pensions here). Its just not a perfect correlation, always subject to the political priorities of the moment rather than taking the longer view of what’s likely to happen as the years pass. That’s all most politicians really want to consider as their chief concern, the political priority of the moment.

There’s a great book on Amazon “The Illinois Pension Scam.” Also the LA Times had a great article on SB400, which hiked pensions 50% in Calif. CalPERS lied when it said SB400 wouldn’t cost taxpayers a dime. Recently they admitted that they lied. Those recent fiascos in Calif. regarding retirees who got their pensions slashed because their cities didn’t make their CalPERS payments (Loyalton, LA Works, etc.) ends the idea of “shared risk” in a pension fund.

http://www.latimes.com/projects/la-me-pension-crisis-davis-deal/

This leaves out a major component to the growth in pension payments. For decades, state leaders used early retirement incentives to get workers off the payroll. They did so in a short sighted move to cut current year costs and kick the can down the road. They lauded their cost savings as good for the taxpayers. Instead, the politicians were just robbing Peter to pay Paul. Between flawed actuarial assumptions, missed payments, and shortsighted early retirement incentives, the pension system has spiraled out of control. It may suck that past administrations left us with a big bill to pay, but… Read more »

Retiring early is a benefit hike. The first chapter in Illinois Pension Scam by Bill Zettler, released April 2012, is titled, “How Did We Get Here? Excessive pension benefits lead the way.” Section 1.1 is titled, “IL Pensions: More than 130 benefit increases since 1970 are the major cause of the unfunded liability.” Section 1.2 – ERO (Early Retirement Option): How Benefit Enhancements Drive Up Pension Costs. Section 1.3 – ERO (Early Retirement Option): How the IEA + Politicians Plunder Taxpayers for $1 Billion. Note, ERO was for public school teachers and administrators. ERO was in effect from June 1,… Read more »

Then YOU stay and sign up to pay it. Those who can’t leave are trapped and will continue to be unfairly and obscenely raped by taxing bodies and will live greatly diminished lives because of it.

Are Illinois benefits excessive? “Everyone knows” that pensions and benefits for public sector workers are a greater percentage of pay than for private sector workers, on average. According to BLS, in Dec. 2017, for private sector workers, wages on average were 69.6% of total compensation, while benefits were the remaining 30.4%. For public workers, wages were 62.6% and benefits were 37.4%. Please pardon my pitiful source. I have been recommending this study since it was released in 2014. There is plenty of room for debate. I have my doubts about some of their conclusions myself. The data is up to… Read more »

“A dramatic rise in pension benefits caused Illinois’ state pension crisis” “Total pension benefits have grown at an annually compounded rate of 8.8 percent over the past three decades. Compared to 1987, benefits have grown 1,061 percent.” ————————————————— John Klingner: “The point of this report is not to compare individual pension benefit levels, even though that factors into our argument.” Thanks for …almost… clearing that up for us, John. That’s not what the headline looks like to me, and apparently not to Josh and/or countless other readers. Illinois pension dynamics, I realize, are way to complex to discuss in one… Read more »

SDouglas: Klingner says in several places that it’s the growth of the Accrued Liability of the Pension Bfts, but that Liability is directly caused by the Pension Bft of each participant !

Don’t be SO dense. It IS the pension bfts that have grown to ginormous levels, and paid WAY too soon which makes the LIabilities of the value of pens bfts HUGE. A $90,000 annual pension with COLA paid at age 57 is MUCH larger than one paid at age 65.

You are splitting hairs and not seeing the plain and quite obvious truth.

Actually, he did not say it was “directly caused” by individual benefits, he said it “factors in”.. “Total owed pension benefits have grown 1061 percent since 1987, but that doesn’t mean the average benefits of individual workers have done the same.” And… “The point of this report is not to compare individual pension benefit levels, even though that factors into our argument.” More to the point, his “analysis” says that “too little money into pensions hasn’t been the issue.” Balderdash. There is some case to be made that Illinois and most other public pension systems should have had a more… Read more »

No. Klingner says it’s the growth of the Accrued Liability. And I SAY THAT THAT is a direct result of the growth of the actual individual, and total, pension bfts. Actually, Klingner says that too. Geez dude ! The pensions are too darn big, paid too darn early, and get COLA which they shouldn’t. The totality of the entire DB pension plans for govt ees, as written in the plan provisions, is and have been, UNAFFORDABLE to the taxpayers. You can argue that if the taxpayers had been sufficiently raped and plundered over the last 30 years, then there wouldn’t… Read more »

“the fact remains that the pension plans are in negative funding positions that are now impossible to get out of…” There I can agree with you. As Leo Durocher said, “You’ve got third base so screwed up nobody can play it! …” But it needn’t have been that way. It is not I, but you who wants to “hem and haw about the what-ifs over the last 20 years.” Political decisions were made, and the path of least resistance was taken. Other states with equally high, or higher, pension benefits and employee costs are in a very bad funded position,… Read more »

The important thing to understand about guaranteed government pensions — “defined benefit” plans — is that almost every plan EVERYWHERE is underfunded/over-promised. EVERYWHERE — local, state, national AND international. Even the few pension plans that claim to be nearly fully funded achieve that goal by using unrealistic assumptions — rate or return, the size of pensions and life expectancy. Public employee labor unions work 24/7 to sweeten the pension pot — one piece at a time. And the sweeteners are often RETROACTIVE — with no retroactive funding to pay for the increased benefits. It’s pressure politicians simply cannot resist —… Read more »

Richard, we welcome your perspectives from California!

Richard: Fantastic points ! Even that wouldn’t be enough, however. Because if all the current govt ee pension plans in Illinois were frozen, that would just mean zero Normal Cost for future years. The current unfunded Accrued Liability is still SO gigantic, that interest and principal to amortize that underfunding would be roughly 50% of Payroll. Then if you add some Govt ‘Er contribution to a 401(k)-type plan for all the Ees…….you still get 60% or so, of Payroll. Which is still insanely high. The only answer is to freeze the DB pension plans (no add’l future accrual for Active… Read more »

The Only way your solution happens is by way of a federal administrator. Bankruptcy without a fed administer keeps the existing political powers in too much control of the bankruptcy. Dontcha need to cut the existing State and local political structure out of the process to get where ya want? ( like 30-40 cents on the dollar for retirees) Otherwise the Dems have too much controll of the bankruptcy process. We couldnt have that could we? The only way your solution happens is if the people of Illinois rellinquish thier autonomy…..or its stolen or taken from them. Good luck with… Read more »

Where are the politician pensions, funny they weren’t part of the comparison, only “state workers”.

They are state workers. There’s a retirement system for the General Assembly (GARS), for Judges (JRS), and I believe the elected officials on the municipal, township, and county level (plus the 100s of other Illinois governments) are entitled to SARS benefits.

Hmm… Three kinds of lies: A) Lies B) Damn Lies C) Statistics Looks like there are several factors being combined to come up with these statistics. By comparison the DOW was around 2000 in 1987. Its around 24,000 today. That’s more than an 1,100% return. I believe that there are demographic factors at play which are compounding some of the distortion here as well. I believe that there are far more retirees supported by and nearing retirement now than in 1987. I also believe that there was a decades long period of time during which public payrolls were increased (perhaps… Read more »

Hmm…. Josh anchors on stock market returns to attempt to justify the pension payouts. Why not the average increase in wages like the non-public union workers in this state have received? The entitled mentality is over the top. I am sure the stock market benchmark won’t be used to justify reductions in pensions the next time the market crashes. Great article Wirepoints.

Quoting Art… “Why not the average increase in wages like the non-public union workers in this state have received?” Did you read this part, Art? Quoting Josh… “Why not show the statistic as the annual amount owed per retiree?” “These statistics inaccurately make it appear that the retiree’s individual pension benefit is increasing at a rate far in excess of the comparative factors.” “The statistics appear to have been presented in this way to bolster a position as opposed to providing clarity for the reader.” ———————————————- The authors’ statement… ” it’s the dramatic growth in pension benefits promised by politicians… Read more »

Stephen and Josh, The point of this report is not to compare individual pension benefit levels, even though that factors into our argument. It’s about the massive growth in what the state owes in “total” benefits. Our point is that total pension benefits owed are overwhelming the incomes of the people that are forced to pay those benefits.

Please see endnote nine for more detail on your per capita concerns. In short, total liabilities have still grown far faster than Illinoisans ability to pay even when you account for the growth in pension membership.

Josh be carefull.

Such thoughtfull analysis that challenges the echo chamber here most often times draws fire.

There is NO DOUBT the demographics of the baby boomers puts particular distortion upon this analysis.

I was very impressed with your summation final sentence. So I am gonna repeat what you said…

“The statistics appear to have been presented in this way to bolster a position as opposed to providing clarity for the reader.”

Well said!

How do you define “promised pension benefits”? The COLA for TRS benefits is no where near 8.8%.

Our report looks at the state’s accrued liability. The accrued liability, which as of 2017 was $214 billion, is the present value of the total amount state workers are owed in pension benefits over the next 30 years.

In other words, its the amount the state should have on hand – right now – to pay out all its promised benefits in the future.

For more, see endnote five of the report.

Not helpful, Mr. Klingner, In your statements: “By 2016, the median household income had grown to $61,386. That translates to an average growth rate of 2.9 percent a year. But if household incomes had grown at the same rate as state pension benefits they would have grown to $314,000 by 2016.” The clear inference is that benefits for the average individual state worker increased by 1,000 percent. Were that the case, I would jump right up there on your bandwagon. If that is what you believe, I would suggest you request a refund of your tuition at Hillsdale College. What… Read more »

SD: What you’re concluding is absolutely false. And Mr. Klingner is correct. I’ve been a pension actuary for 38 years and the egregiously large govt ‘ee pensions are WAY too large, and paid WAY too early, and increase WAY too much (they shouldn’t even get COLAs on their pensions). A husband and wife police-force married couple, have a net worth of about $5Million by the time they can retire ~ age 50 and get huge pensions and health-care bfts. And their pay wasn’t too shabby either, around $90,000 each before retiring.

Semantics. No one reasonably disputes that benefit formulas and other features have increased. Police and fire do have more generous benefits than non-safety workers. Are you implying that that policeman’s benefits have increased 1,000 percent in the last 30 years? Or that the benefits of the average Illinois public worker has increased 1,000 percent? Meanwhile, “the median household income had grown to $61,386. That translates to an average growth rate of 2.9 percent a year.” Growth in the “promised pension benefits” or “the state’s accrued liability” whatever that is, cannot be compared to growth of the median household income. I… Read more »

Mary Pat Campbell,

I apologize if I misinterpreted or misapplied your comments.

Quoting Dr. Lee again, “There’s something wrong here.”

And I admit to being incapable of unraveling the fallacy.

http://blog.gauffin.org/wp-content/uploads/2013/04/albert-einstein-if-you-cant-explain-it-simply-you-dont-understand-it-well-enough.png

That’s me. But I don’t think I am the only one who doesn’t understand it well enough. And John Klingner ain’t helping.

Stephen, our comparison of the growth in total pension benefits owed to household incomes does not imply the average pension benefit of a state workers has grown at the rate of 8.8 percent a year. It is meant to help illustrate the problem taxpayers face with paying for the total pension benefits the state now owes. Our point is that total pension liabilities – the present value of all the pension benefits taxpayers have to pay in the future – have grown a total 1,061 percent since 1987, far faster than Illinoisans ability to pay for them. Household incomes only… Read more »

Quoting Dr. Lee: “There’s Something Wrong Here”… I will look again, but I don’t see a clear definition of “pension benefits” here. According to Andrew Biggs (AEI, 2014), for Illinois State workers, the combined DB, DC, and Social Security pension compensation is 27% of salary, just slightly above average for all states. (New York state is 36%) “Total fringe benefits” for Illinois workers is 75% of wages. (84% for New York state) “Total compensation advantage” (wages plus benefits) compared to private sector workers is 26% in Illinois. 34% in New York. So why, according to Pew, in 2015, was the… Read more »

You can find our definition of pension benefits in endnote five of the report: This report covers the growth in total pension benefits owed to state workers, also known as the state’s accrued liabilities. The accrued liabilities as of 2017 were $214 billion. That amount should not be confused with the state’s unfunded liability, which is the total shortfall in the state’s pension plans. The unfunded liability, at $129 billion, is the difference between the present value of what the state owes its pensioners, $214 billion, and the assets it has set aside today against those obligations: $85 billion. Hope… Read more »

For one, NY teachers have to work 43 years to reach 75% vesting, not 34. That’s even 5 years longer than the previous and less generous IL TRS service year formula that expired in 1998. So imagine the impact of removing 8-9 years of pension withdrawals from EVERY fully vested pensioner and reducing every single pension in the system today by thousands of dollars.

Second, NY state pension systems are already on their 6th tier, so they have a habit of re-calibrating their pension systems more often than IL: https://www.nystrs.org/Benefits/Service-Retirement

You’re right, maybe there is something wrong here…

SDouglas: It’s not our task to prove it and explain it so perfectly to you, so that you get it. That may not be possible. Suffice it to say that the annual cash contributions necessary to fund the egregiously large (and early) pensions, have been unaffordable for many many years. And now it’s pretty much hopeless, no matter how much more the govt entities wish to increasingly overtax the private sector taxpayers.

“It’s not our task to prove it and explain it so perfectly to you, so that you get it.”

Also not your task to imply something that is not true.

I think the title, and the “report” are misleading.

Josh apparently believes it is misleading.

As does babyboomer.

Why?

Stephen Douglas – is your point that underfunding, rather than the increase in benefits, is the cause of the problem? I don’t know where you are going when this. Politicians underfunded the plans because it was convenient to do so, deferring obligations to buy votes and labor peace. No matter how you look at the problem – historical underfunding – which none of us can fix now – or excessive benefits – which absent a bankruptcy event, politically can’t be modified – the real problem is that Illinois hasn’t been run by adults for years. There is no fix absent… Read more »

Can we file a class action suit on behalf of Illinois taxpayers for executive malpractice, fraud,fiduciary, misrepresentation, etc?

Great article, by the way.

When you make more in a your pension, than while working in your entire career, that model is busted!

That information is very persuasive.

When erroneous political information is asserted, it often takes 4 times the data in order to properly and completely refute the misinformation.

Move everyone to Social Security

Here’s my solution:

https://drive.google.com/file/d/0B90sU3A85q46OE9BZHJFSWEzbGM/view?usp=drivesdk

Thoughts?

Had the state made a SS contribution for each employee as opposed to the making the pension payment it would have cost the state much more. Pensions contributions from the employer are less than employer SS contributions. The state made the choice to merely promise the lower pension payments, but made neither a pension or SS contribution…which ion the short run was cheaper. I guess that they had uses for those funds that were going to return more for the state than the obligation accrual was costing them. The pensions were so concerned about this, they required a constitutional amendment… Read more »

Social security is actually FOUR programs, whereas a government pension is ONE program. SS is: 1. A pension program 2. A life insurance program 3. A disability program 4. A medical program SS is in even worse shape than most state and local government pensions. It’s a giant Ponzi scheme. It is NOT guaranteed — it’s a “social contract” that can be changed annually at the whim of the government. It’s inevitable that it becomes more and more a “means tested” redistribution system. Moreover, all the “invested assets” in SS are really I.O.U.’s that must be paid off by taxpayers.… Read more »

Not necessarily. State employees on social security and a pension accrue service credits at a lower rate than those on just a pension alone. They need to work 10 extra years to fully vest. That’s 10 less years of pension withdrawals.

And if you’re wondering where the money went that should have gone into pensions, it went into many things, most notably paying raises and increased health benefits for employees. Unless compensation has been frozen for decades. Was it?

I haven’t read the article yet, so I’m just commenting on the headline, but I’ve long believed that elected and appointed officials had little understanding of how costly the benefits the promised really were. I suspect few of those decision makers are still in Springfield, but one who is, is Mike Madigan.

Additionally, it is glaringly obvious that politicians don’t have anywhere close to the expertise needed to make decisions on complex actuarial issues.

Most folks forget the large impact the “2.2 formula” had on pensions. Under the old service years formula, teachers had to work several years longer to vest full benefits. For a mere 1% contribution increase (and the ability to buy into the new formula for benefits earned under the old formula), pension benefits were enhanced 15-25%: 20 years of service = 35% multiplier before vs 44% multiplier today 25 years = 46% vs 55% 30 years = 57% vs 66% Even if you buy into the average pension argument and assume pensions are $40,000, the new formula adds $3,000+ to… Read more »

One point of contention regarding: “Career pensioners will get back their direct employee contributions after just two years in retirement.” That doesn’t include the interest earned on the employee contributions. My math shows that it takes 6-7 years when you include interest. Still not very long.

Excluding police and fire, the average retirement age for public workers in general (don’t know about Illinois specifically) is 60-62, and life expectancy is 20 years, 6-7 years would not be unreasonable. (Though I suspect your calculations are on the high side.)

Okay, I’ll stop feeling guilty about having underfunded their pensions (sarc). Great analysis in this article. I hope other media outlets pick it up. The 30 year analytical time frame just happens to coincide with the Democrats super majority in the State House. No coincidence there.

Hmm… Three kinds of lies: A) Lies B) Damn Lies C) Statistics Looks like there are several factors being combined to come up with these statistics. By comparison the DOW was around 2000 in 1987. Its around 24,000 today. That’s more than an 1,100% return. I believe that there are demographic factors at play which are compounding some of the distortion here as well. I believe that there are far more retirees supported by and nearing retirement now than in 1987. I also believe that there was a decades long period of time during which public payrolls were increased (perhaps… Read more »

30% or more of a pension fund usually is invested in bonds or other fixed assets. Not in “the Dow.” Hasn’t gone well.

The growth in the average benefits of pensioners and total owed pension benefits are not the same thing. Total owed pension benefits have grown 1061 percent since 1987, but that doesn’t mean the average benefits of individual workers have done the same.

The point of this report is simply to show how the total pension benefits owed by the state – that Illinois taxpayers have to pay for – have grown far faster than taxpayer incomes and other economic indicators.

As salaries have increased with inflation & negotiated contractual provisions, payments into the pension systems did not increase proportionately. Don’t forget that pensions are based on the average of the best 4 or 5 years of salary, that means generally the highest level.

25 years ago, the UNIVERSITY PENSIONS WERE 93% FUNDED. tHEN CAME THE DROUGHT OF FUNDING & THE PARTIAL REMOVAL OF THE CASH FROM THE PENSION FUNDS.

John, what’s most amazing about all this is how fast pension benefits have grown compared to the incomes of the people who have to pay for those benefits. SURS total benefits from 1987-2016 were up 866% vs. household incomes up just 127%.

But the other side of the equation is just as interesting. Asset growth, buoyed by taxpayers contributions, was also up a staggering 617% – still multiple times people’s income growth. Contrary to the narrative, taxpayers have put in their share, and more.

Simply, politicians have made too many promises to too many people.

So when do the pensions collapse? They will because math and reality say so. They cannot be paid in full.

Still haven’t seen a clear definition of “pension benefits”. Pension benefits paid to Illinois workers are good, but by no means the best in the nation. But the unfunded liability IS the worst, or a close second. I think there is some confusion in this article. And I don’t think it is unintentional.

This report is about total pension benefits owed by the state. Total owed pension benefits, also known as accrued liabilities, are the present value of all the pension benefit the funds will have to pay out to members in the future. Please see endnote five for more info regarding the difference between total owed benefits and the state’s $130 billion pension shortfall. Please note that the growth in the average benefits of pensioners and total owed pension benefits are not the same thing. Total owed pension benefits have grown 1061 percent since 1987, but that doesn’t mean the average benefits… Read more »

Brilliant analysis. This report will have implications beyond the state of IL.

I got an Idea. Lets have an election for Governor….we can elect reps to springfield too. One side can advocate pensions are a promise. The other can advocate to gut pensions. Then will see who wins. Then we the people will live with our choice. Wont we? We wont and cant ask for a redo on that election choice, and the resulting enacted laws years later. Right? We will live with OUR choice right? We could hold a constitutional convention and “Inshrine” those benifits into State Law? Or we could remove them too. But regardless, we would accept the “will”… Read more »

If you include realistic cost in a flat income tax manner so it isn’t “someone else’s money” which was likely the intent to keep control…..both the flat income tax and balanced budget clauses were added with the pension clause….then I’m for that.

Unfortunately true costs were hidden in so called balanced budgets…..balanced by undercontribtions for the promises and borrowing. As a result there is no way to tax sufficiently to meet promises.

Good luck. If it gets too bad I’m leaving and we will see how well they can pick dollars off the magic money tree.

I think the union PR slogan needs a little tweaking. How about: Pensions are a PAYOFF.