By: Ted Dabrowski and Cody Holt

$3.75 per gallon. That’s the price of regular gas today just a few blocks away from Wirepoints’ office in Evanston, Illinois. The price reflects this year’s annual tax hike that took place on July 1st, part of the annual increase legislators cemented into law in 2019 when they doubled the gas tax in Illinois.

Mindful that many Illinoisans struggle under the third-highest gas taxes in the nation, the Wirepoints’ team reached out to friends and family, mostly in the South, to see how our gas prices compare to some other states. They sent us pictures, which we include below.

The difference is significant. One friend in Colony, Texas, a suburb of Dallas, pays $2.83 per gallon. Another in the metro Atlanta pays just $2.99.

And Paul Serwatka, a former Illinois mayor of Lakewood who left Illinois for Huntsville, Alabama, pays $2.79, nearly one dollar less than what Evanston residents pay. (Read Serwatka’s Leaving Illinois story here.)

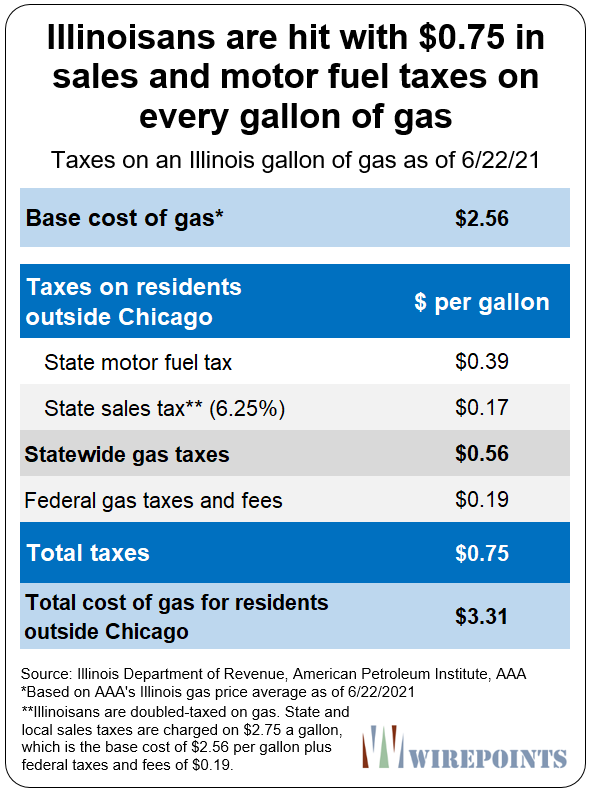

“Filling up in Illinois I always felt like a sucker. Especially knowing a substantial amount of what we were paying were the state’s multiple gas taxes,” he told us. In addition to paying a state motor fuel tax, Illinoisans also pay a 6.25 percent state sales tax on gasoline purchases. Many residents also pay additional city and county sales taxes. Illinois is only one of seven states to hit consumers with its general sales tax at the gas pump.

A dollar difference per gallon means about $500 in annual savings for a guy like Serwatka versus an Evanstonian. Most Illinoisans who drive to vacation down South can’t help but notice how much cheaper gas is down there.

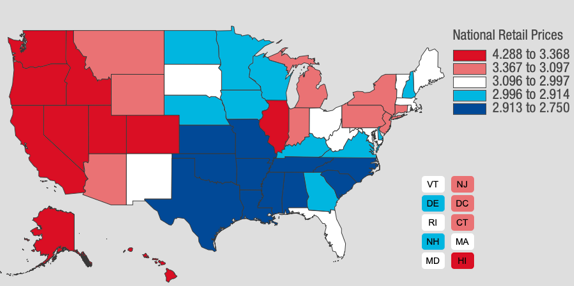

Overall, average Illinois gas prices today are about 25 cents per gallon higher than the national average. Remarkably, Illinois has the nation’s highest prices east of the Rockies. See the AAA map here to compare prices across the country.

Closer to home, Wisconsin, Kentucky and Iowa’s prices are about 40 cents lower, while Missouri’s prices are about 55 cents cheaper. Indiana’s prices are a quarter of a dollar lower.

Closer to home, Wisconsin, Kentucky and Iowa’s prices are about 40 cents lower, while Missouri’s prices are about 55 cents cheaper. Indiana’s prices are a quarter of a dollar lower.

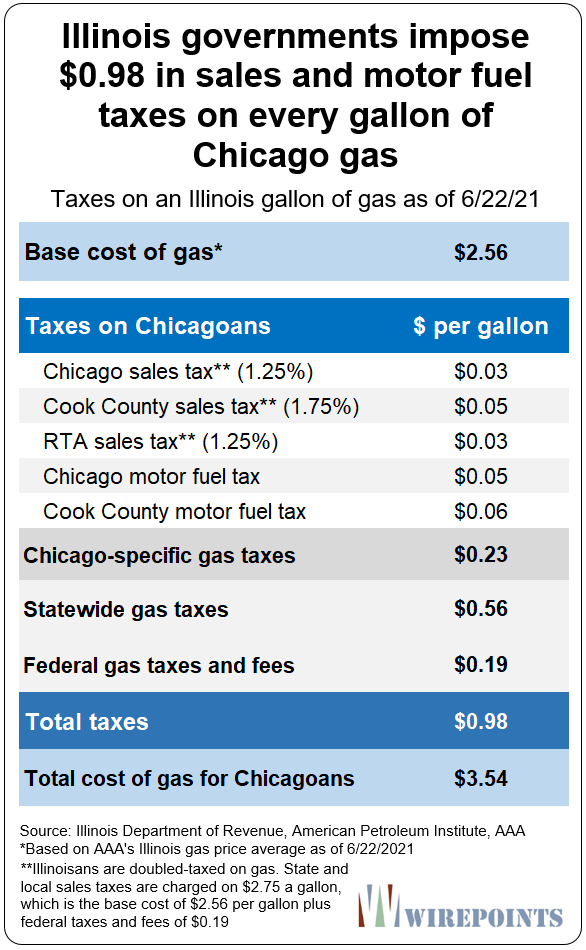

Illinois’ high price versus many parts of the country is impacted heavily by the 75 cents per gallon in taxes most Illinoisans pay. Chicago drivers end up paying even more in taxes: about 98 cents per gallon.

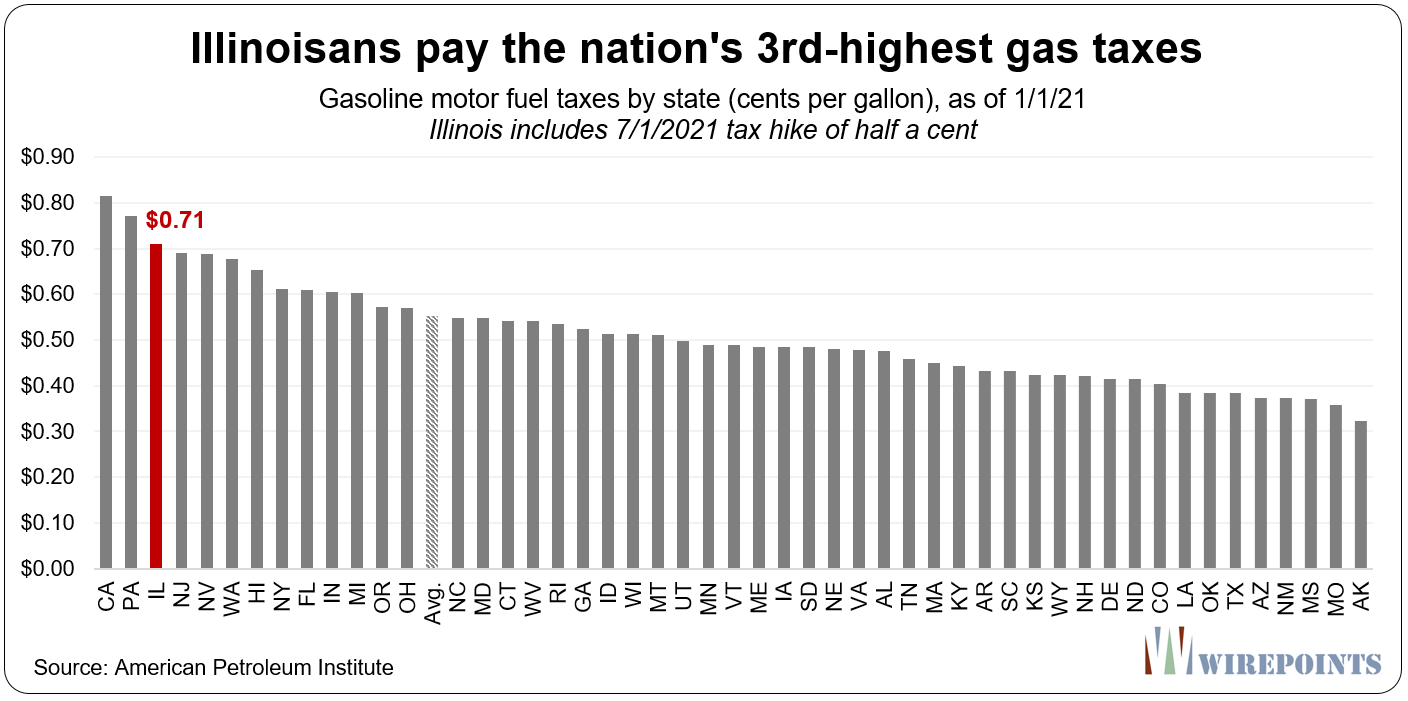

Overall, Illinoisans pay the third-highest gas taxes in the nation. Only residents in California and Pennsylvania hit their residents harder.

Overall, Illinoisans pay the third-highest gas taxes in the nation. Only residents in California and Pennsylvania hit their residents harder.

Maybe Illinoisans wouldn’t complain so much about the state’s high gas taxes if the other state and local taxes they paid were reasonable. The problem is, they’re not. Illinoisans are stuck with the nation’s tenth-highest state/local tax burden – including the nation’s second-highest property taxes.

Maybe Illinoisans wouldn’t complain so much about the state’s high gas taxes if the other state and local taxes they paid were reasonable. The problem is, they’re not. Illinoisans are stuck with the nation’s tenth-highest state/local tax burden – including the nation’s second-highest property taxes.

Expect Illinoisans to feel the pain at the pump this weekend as they travel during the Independence Day weekend. For those traveling out of state, you can be sure most will fill up before coming back into Illinois.

Read more about Illinois taxes and their impact:

- Expect anger at the pump as Illinoisans begin paying nation’s 3rd-highest gas tax

- WalletHub, Tax Foundation confirm what Illinoisans already know: they’re overtaxed

- Leaving Illinois: How simple math chased away a village mayor and his family

Appendix: Gas taxes in Chicago

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level. Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Yeah, but according to the Whitehouse, the Biden/Harris administration saved the American people .16 cents on hot dogs for the 4th, so….

Keep voting democrat Illinois fools!!!

Put the extra 16 cents that you’re saving towards the over dollar a gallon since the beginning of the year rise.

My liberal friends and family do not wish to discuss gas prices.

I believe Trump Gas was $1.99. I wonder why?

I own stonks in the major oil & gas corporations, have done for years. This is the way I hedge this corruption.

Yes I pay more at the pumps but my dividends remain safe and in some cases increase along with the stonk price.

The Official Government Workers Party aka Freddie and his cronies are playing marbles while I play chess.

But expect gas prices to drop before the mid-terms. People will then forget.

Rinse & repeat.

You make yourself sound like you’re the Bobby Fischer of energy stonks whilst the rest of us are a bunch of Len Smiths (the most prolific marble champion in history).

Not Bobby at all.

Just a guy getting by best one can off the back of an AGI of $36k last year.

And get by I will.

Well, thanks for letting us know.

The best is yet to come….

I’ll be watching.

Look at the bright side-according to the White House tweet of a couple days ago you saved 16 cents on your 4th of July barbeque.

So call it a dollar tax on the total at the pump of $3.50.

Thus the gallon would cost $2.50 before tax, and the $1 tax makes the

tax on gas a FORTY PERCENT TAX. That’s highway robbery by the govt entities.

I’ll make a wild guess and posit that the Stamp Act Tax by England on the colonies that led to the Revolutionary War, was less than 40%.

Our governing bodies have gone completely out of control and irresponsible….by dozens of reckless and outrageously large degrees of taxation.

My question is, why is Wirepoints located in a Hell hole like Evanston?

If I remember right, the targeted price under obama was $7.00 per gallon but with the biden inflation rate, it will have to go up much higher than that to achieve their stated goal.

YEP, YEP just like under those idiots Biden and Obama back in the day before we were set free from tyranny by President Donald J Trump I can believe that $4.00 plus per gallon is coming soon because democrats want you to ride buses and public transportation thus becoming more and more dependent upon government and less mobile and free.

When electric cars are prevalent we’re going to see this same crap going on with our electricity except on a more massive scale. Hopefully there wont be enough child enslaved labor to mine all the lithium, cobalt, nickel, copper etc. needed. And hopefully the greenies and NIMBY’s will figure out that they might actually need nuclear energy to support a gasoline-less world, shattering their dreams of everyone only being able to drive 200 miles at a time. And hopefully when the greenies see the countries with lithium hording it they will stop their madness. Charging a battery wastes just as… Read more »

Their so called Vaccines will create a barrenness of the womb therefore massive global depopulation and soon less to dig in their communist mines.

I’m heading across the state line tonight to watch fireworks and gas up. It will be a very pleasurable evening till I have to return to illinois with the exception of the gasoline that will put a smile on my face for a longer period.

Bought $5.00 worth a couple days ago,just enough to get me back to Indiana.

Indiana the FREE state. Free at last, Free at Last. Thank God almighty for Indiana

and all the other RED states. Ya BABEE

Another example of how extreme an outlier Illinois is, AZ is getting rid of it’s progressive income tax (top rate 4.5%) for a 2.5% flat income tax. The thinking in Illinois is ALL bad.

Illinois predatory government and their stormtroopers at SEIU, IFT, CTU and SEIU don’t care. Pay up and shut up youze chumbolones. Lead criminal Jussie Sharkey has an electric car paid by his wife’s trust fund so he certainly doesn’t care.

We’re looking at buying an RV, ouch.

Remember a couple years ago when state lawmakers gave counties surrounding Cook the ability to either double their existing gas tax or enact a new one? Welp, as of July 1, fuel tax doubled to 8 cents per gallon in DuPage and Lake County now has a 4 cent gas tax. Will County’s 4 cent gas tax was enacted last year.

The danger of surrounding counties levying or increasing their gas tax rate is that it now gives Cook County more breathing room to eventually raise their gas tax. Which is what they intended all along.

I believe AAA and GasBuddy are warning travelers to not gas up in Illinois – should help surrounding states a lot.

I live in Cook but very close to Will County where gas is always 20 to 30 cents less.

Aberrant Gas tax rates drive all prices higher. Commuters, contractors, landscapers must all pass along those costs to employers/consumers.

Aberrant property tax rates (3.5% in Woodstock IL) drive local economies ,lower. Landlords charge higher rents, homeowners must divert household income toward taxes rather than simulative discretionary savings/spending.

Winners: political class (those with defined benefit pensions/free health insurance at ~age 55, and those who bribe such organism\s to get preferential contract awards).

Losers: non-political class who decline supralegal compensations from political class.

Illinois is run by the biggest MOB (AKA the Democrat and Republican Party) in any state. Your either in the MOB or a slave to it. And honestly I don’t think taxes in Illinois are high enough….you still have people living there that are not in on the scam. So it must not be that bad. There are still a ton of people that want to be there, so I am not sure why this is even a story.

Dumb comment. Not worth refuting the falsehoods.

In Ohio the internet gas search site lists prices from $2.80+ to $2.99. With a gas card @gallon discount that can be brought down by .05. Gas stations in less populous areas charge a lower rate. Always wise to fill up before a holiday, especially if driving is involved.

Stop complaining, this is a good thing it will help pay to fix the roads in the wealthy and most connected neighborhoods. The rest of the surfs just stop whining and be excited that the government will help you live your life the way they see fit. It was never your money in the first place.

More of above. Get serious.

You are a fool if you believe that!

Hate to tell everyone, but just bought gas on a trip to South Carolina for almost $1/gallon less than that. And you know what, the roads are in great shape too.

Daughter lives in North Carolina 2.65 a gallon.

$2.99 at the border in Wisconsin, and most station 25 miles in. Poor station owners on the Illinois side of the border. Maybe they can sell the State’s preferred drug – marijuana with a 40% plus tax rate as a kicker,