By: Ted Dabrowski and John Klingner

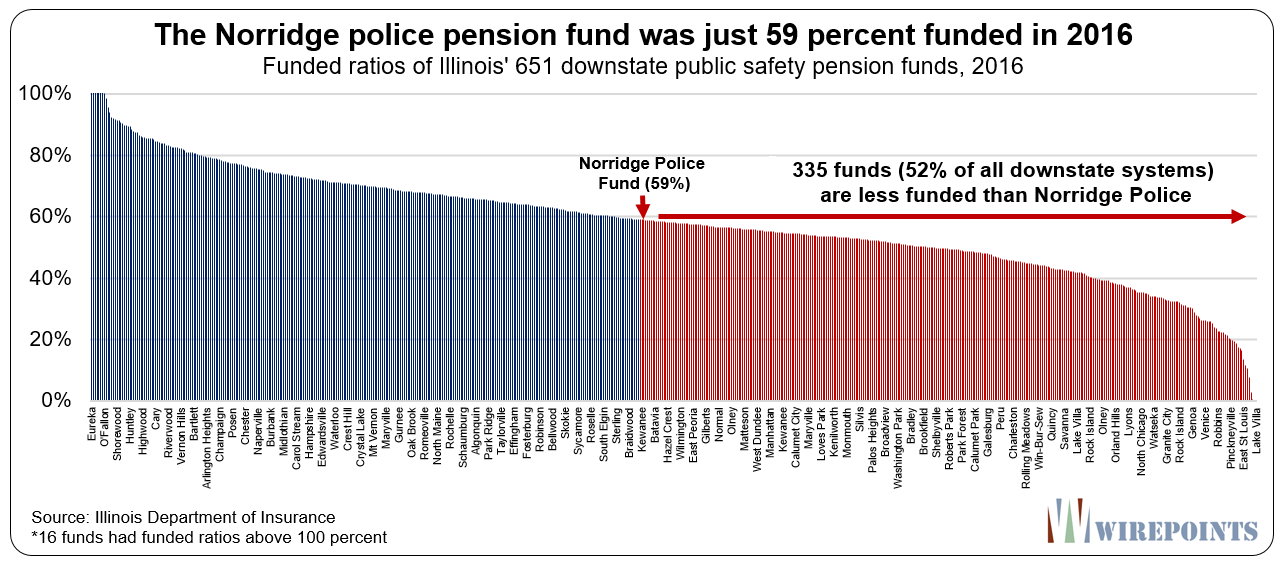

The small Illinois village of Norridge just announced a municipal tax hike of 35 percent so it can make its required police pension payment. At just 59 percent funded, the city felt it had no other option but to raise taxes. For residents, it’s another hit to their home values.

It’s the same hit that’s befallen the residents of Danville and Carterville and Rockford and Mundelein. All have significantly raised property taxes and/or other fees to pay for their police and fire pensions. And all those hikes come on top of the highest average property tax rates in the nation.

Norridge’s pension problem is unfortunately the norm in Illinois. 335 of Illinois’ 650 public safety funds are less funded than Norridge’s police fund.

That’s half of all downstate police and fire funds. Downstate pensions are a mess that’s only going to get messier.

Norridge is just the next city to realize that something must give. Unfortunately, officials have decided what will “give” is taxpayer’s wallets. Other cities like Rockford and Peoria have resorted to cuts police and fire services to make their pension payments.

Cities are raising more money and cutting active workers because the state now requires all public safety pension funds to be 90 percent funded by 2040. And if cities don’t put in the required money, their pension funds can demand that the state intercept the city’s revenues and give them to the pension funds.

To read more about the pension intercept in Illinois, read:

- Harvey, the first domino in Illinois: Data shows 400 other pension funds could trigger garnishment

- Beyond Harvey: Many Illinois municipalities running out of options

- Second domino falls in Illinois: North Chicago revenues garnished for pensions

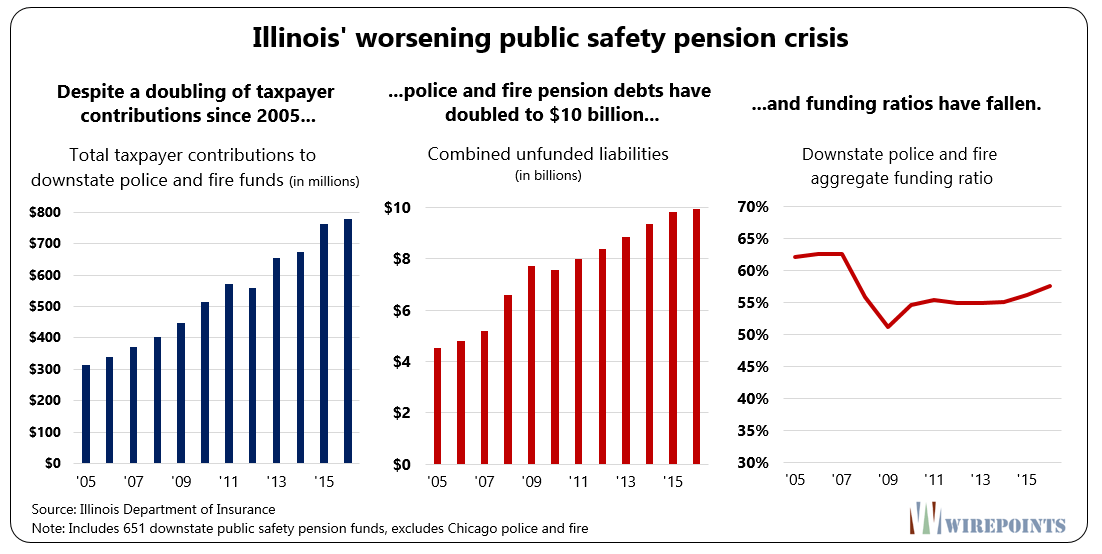

Pouring more money into pensions isn’t going to solve many cities’ funding problems. Taxpayers in have been putting more and more money into pensions over the past decade, only to watch the pension crisis get worse.

Taxpayer contributions to public safety pensions have doubled since 2005, yet police and fire pension debts have also doubled – to $10 billion – instead of shrinking. Collectively, public safety pensions are just 57 percent funded.

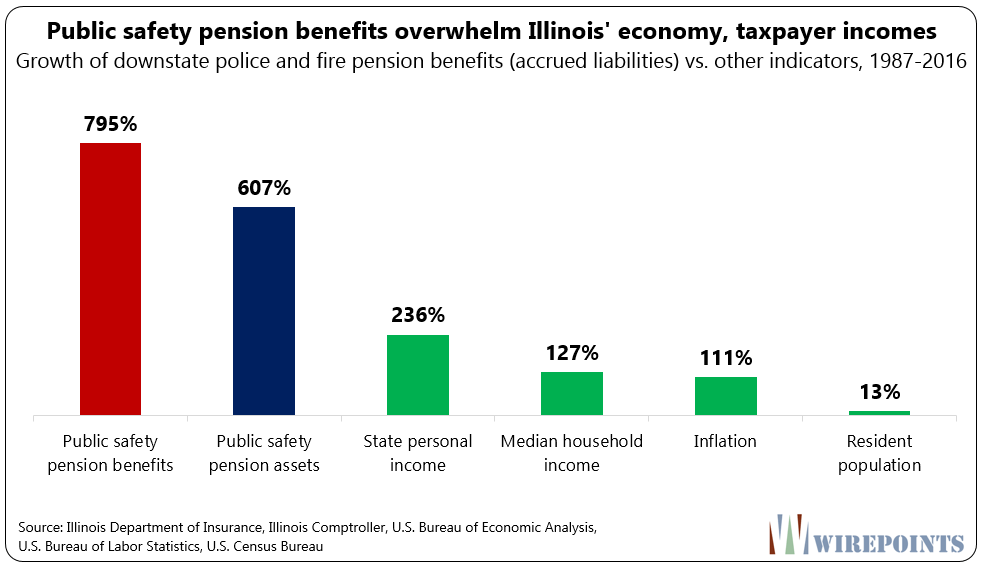

Don’t be too quick to blame the growing contributions and the tax hikes that go with them on underfunding. The reality is that total pension benefits (accrued liabilities) have been growing far faster than cities or local residents can afford.

In 1987, municipalities owed a total of $2.6 billion in benefits to public safety workers and retirees across the state. Today, that number has jumped to $23.4 billion. That’s nearly an 800 percent increase.

Taxpayers payments can’t catch up with the state’s out-of-control benefits. And cities have few ways of cutting their benefit burdens.

The state not only decides the pension benefits that cities have to provide, but it controls the rules for collective bargaining as well – leaving the rules heavily biased in favor of local unions. That means cities have little control over the salary and benefits that help drive up pension benefits.

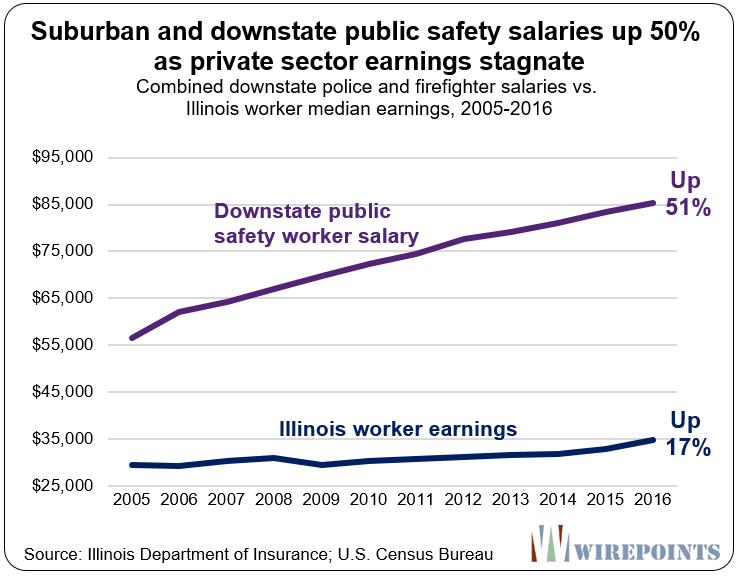

Salaries are one of the pension crises’ big cost-drivers. Between 2005 and 2016, public safety salaries collectively rose more than 50 percent. Today, the average downstate public safety worker makes more than $85,000 a year.

That salary growth is all the more unaffordable considering private sector worker earnings in Illinois have only grown 17 percent over the same time period.

Overwhelming communities

The tax hike in Norridge is a preview of what’s to come for hundreds of communities across Illinois. Higher taxes and fewer services will be the norm as pension costs swallow more localities’ budgets.

The equity in people’s homes will be further destroyed by Illinois’ impossibly high property taxes, forcing a growing number of residents to flee.

Until workers’ overgrown benefits are rolled back, Illinois’ excessive units of local government are cut, local governments are given full control over the contracts they sign, and municipal bankruptcy becomes an option for insolvent communities to manage their debts, the pension crisis for our towns and cities, as well as the state, is only going to worsen.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more. Chicago Public Schools is failing its students in almost every way. What can be done to save the educational futures of Chicago’s children? Join Wirepoints’ Ted Dabrowski as he participates in an education roundtable discussion hosted by Seeking Educational Excellence (SEE).

Chicago Public Schools is failing its students in almost every way. What can be done to save the educational futures of Chicago’s children? Join Wirepoints’ Ted Dabrowski as he participates in an education roundtable discussion hosted by Seeking Educational Excellence (SEE).

Illinois is toast, run for your economic life.

The only way to solve the pension crisis is with a U-Haul truck.

Exactly. The time to fight has past. The taxpayer lost. It’s best to accept defeat and walk away. Someday we will hear about Illinois home values crashing and all the special interests fighting it out in court. That’s when we get to smile.

I am FROM Illinois not to Illinois.

Live in South Florida, 80 and sunny.

No State income taxes and average property taxes and sales taxes.

Home value up 4% to 6% annually. Jobs are just as good as up north.

Flee Illinois if you are smart and love your family.

My bank account is at least 99% underfunded any many other taxpayers because of excessive property taxes ($6,900 on a $157K home) higher sales taxes-utility taxes and a myriad of other taxes. I have to sacrifice my retirement and bank account to make sure some public employee coffers should be funded at 90% because of back room behind closed door contracts never open to any public scrutiny whatsoever. Most of the taxes that are appropriated to pensions are and were “Diverted” to higher salaries or political pet projects yet taxpayers are on the hook for any and all shortfalls. Many… Read more »

This is exactly how the argument should be framed: diminishing your retirement and property to the benefit of another’s. Let the public sector keep their pension protection. Just extend it to all Illinois citizens and their retirement plans.

14th Amendment, baby: No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws.

Nixit -Well said. In the Illinois Constitution Article 1 Section 1 is the protection of property clause. Many believe it is the right from intruders but should also be interpreted protection from the taxman(woman). You can do everything right to protect your home but if you cannot pay excessive taxes you lose your home. Paying partial taxes are not allowed. I also believe that excessive taxes reduce value (equity) which should be considered theft but is not. If someone hacks into your bank account and takes out 7 or 8 thousand per year that is criminal but if taxes reduce… Read more »

You really make it seem really easy with your presentation however I to

find this matter to be actually something that I feel I would never understand.

It kind of feels too complicated and very extensive for me.

I’m taking a look ahead on your next submit, I will attempt to

get the hold of it!

I suppose this is good news for communities bordering Norridge. Now they can raise their local tax rate.

No problem. The Dems will fix it.