By: Ted Dabrowski and John Klingner

Many pension funds across Illinois were running out of cash even before the Coronavirus reared its ugly head. Some funds were even on the brink of becoming pay-as-you-go plans, where pensioners are forced to rely directly on employer operating budgets, and not pension fund assets, to get their retirement checks.

The proof is in the collapsing asset-to-payout ratios of most Illinois pensions. That ratio – which is one of the statistics Moody’s Investors Service uses to measure pension health – compares a fund’s total assets to how much it pays out in benefits each year. In other words, it measures how many years a pension plan can make benefit payouts before it runs out of money, assuming no new contributions or investment income.

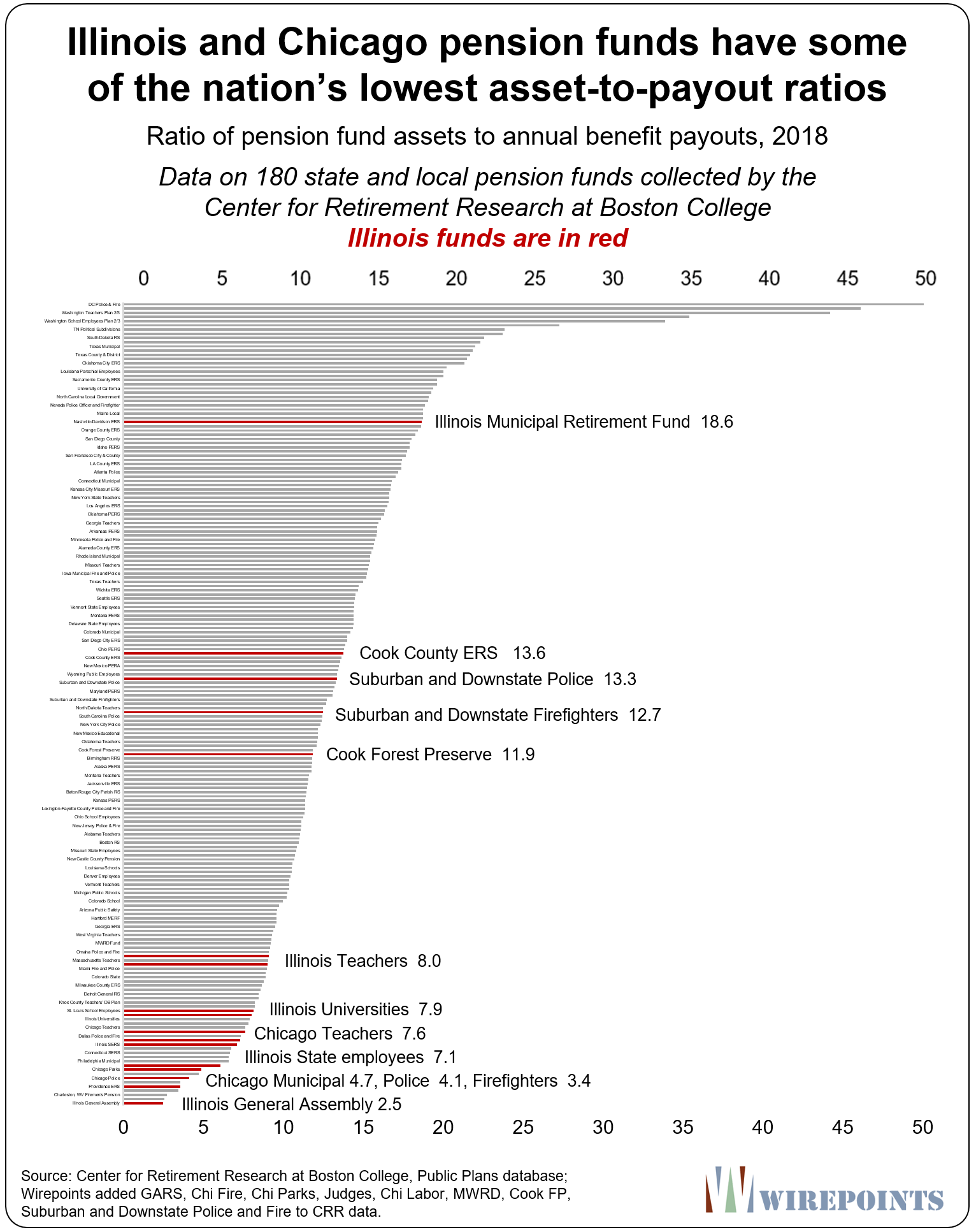

Illinois’ worst-off funds only had two to five year’s worth of payouts left in 2018. They were among the most insolvent in the country. The COVID-19 market meltdown will have only shrunk their assets further.

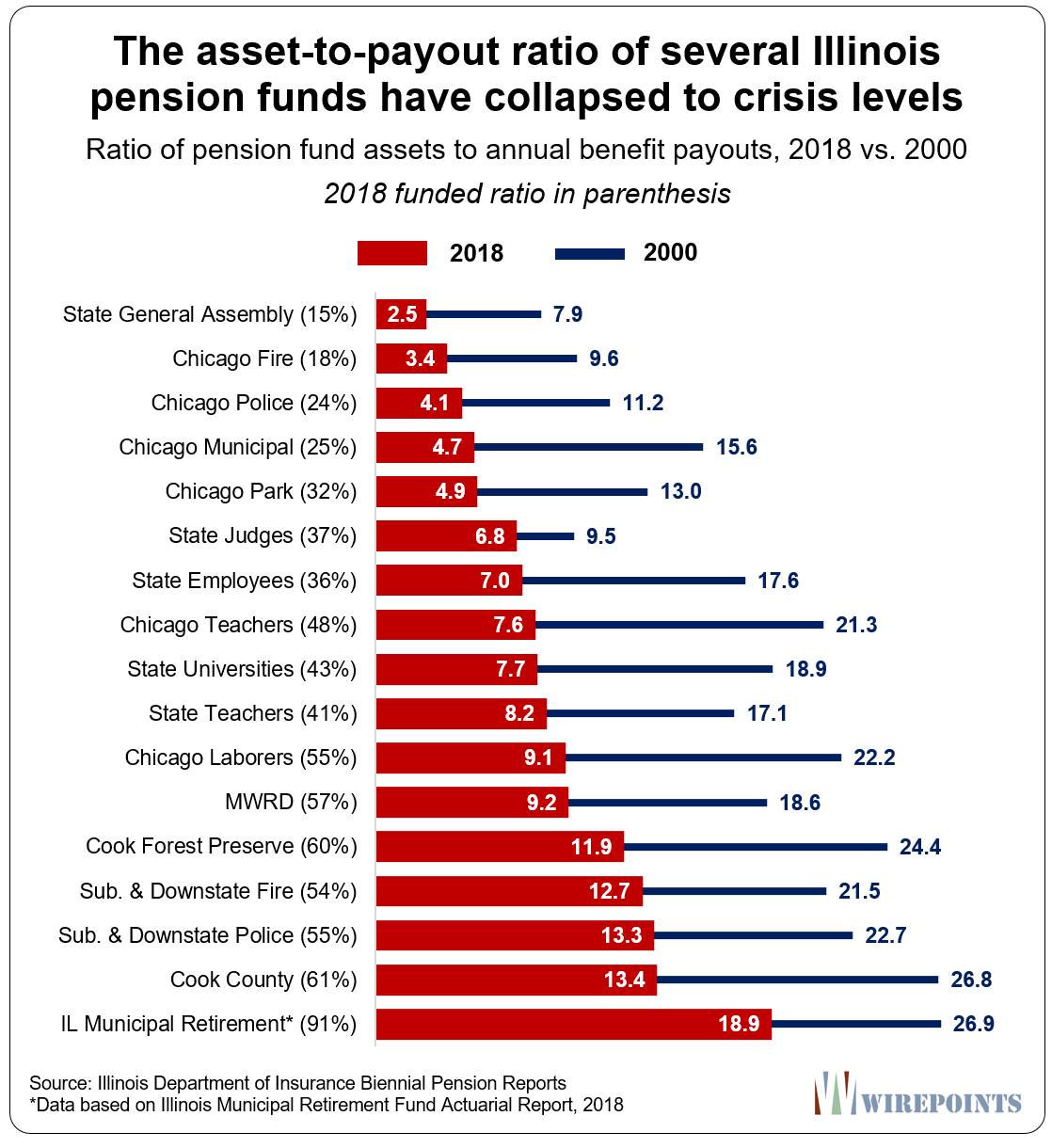

Take, for example, the Chicago firefighter fund. In 2018, its total assets were $1.1 billion and its pension payout for that year was $330 million. That means it had about 3 years’ worth of payouts on hand – an asset-to-payout ratio of 3.4. There are just a handful of funds in the nation with lower ratios than that.

By comparison, the plan’s assets amounted to nearly 10 years’ worth of payouts in 2000.

Chicago’s firefighter plan is now dangerously close to becoming a pay-as-you-go pension plan. That would make firefighters dependent on the city – which is already junk rated and effectively bankrupt – for their retirement checks.

It’s not just the firefighters’ fund that’s in trouble. It’s the same thing for Chicago police. Their funds’ ratio was just 4.1 in 2018. Chicago municipal had a ratio of 4.7 years. With the markets and bond yields down significantly, Chicago’s funds are now in a precarious position.

The state’s funds are only slightly better off. Illinois’ biggest fund, the state Teachers’ Retirement Fund, had a ratio of just 8.2 in 2018. At the turn of the century, it had 17 years’ worth of payouts.

The State Employees Retirement System had a ratio of only 7 years.

Worst of all is the Illinois lawmakers’ fund, which had just 2.5 years worth of payouts.

Of Illinois’ major state and local funds, only the Illinois Municipal Retirement Fund (IMRF) is healthy. Its asset-to-payout ratio was almost at 19 before the crisis. But its ratio is high only because Illinois law forces cities to fund IMRF prior to funding all other core government services, including public safety.

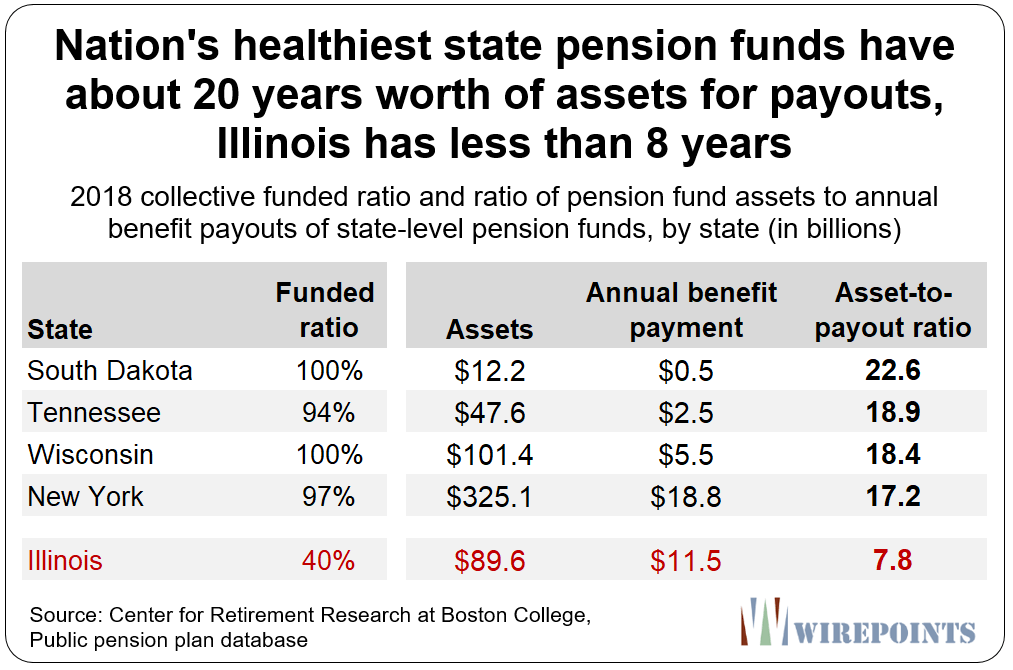

To understand how dire Illinois’ situation really is, look at its pensions compared to the healthiest funds in the nation.

In 2018, the nation’s healthy funds had assets equivalent to about 20 times their benefit payouts. South Dakota’s state plan had a ratio of 22.6, while Tennessee’s was at 18.9. Same goes for Wisconsin, at 18.4.

In 2018, the nation’s healthy funds had assets equivalent to about 20 times their benefit payouts. South Dakota’s state plan had a ratio of 22.6, while Tennessee’s was at 18.9. Same goes for Wisconsin, at 18.4.

In contrast, Illinois’ five state plans collectively had just 7.8 years worth of payouts.

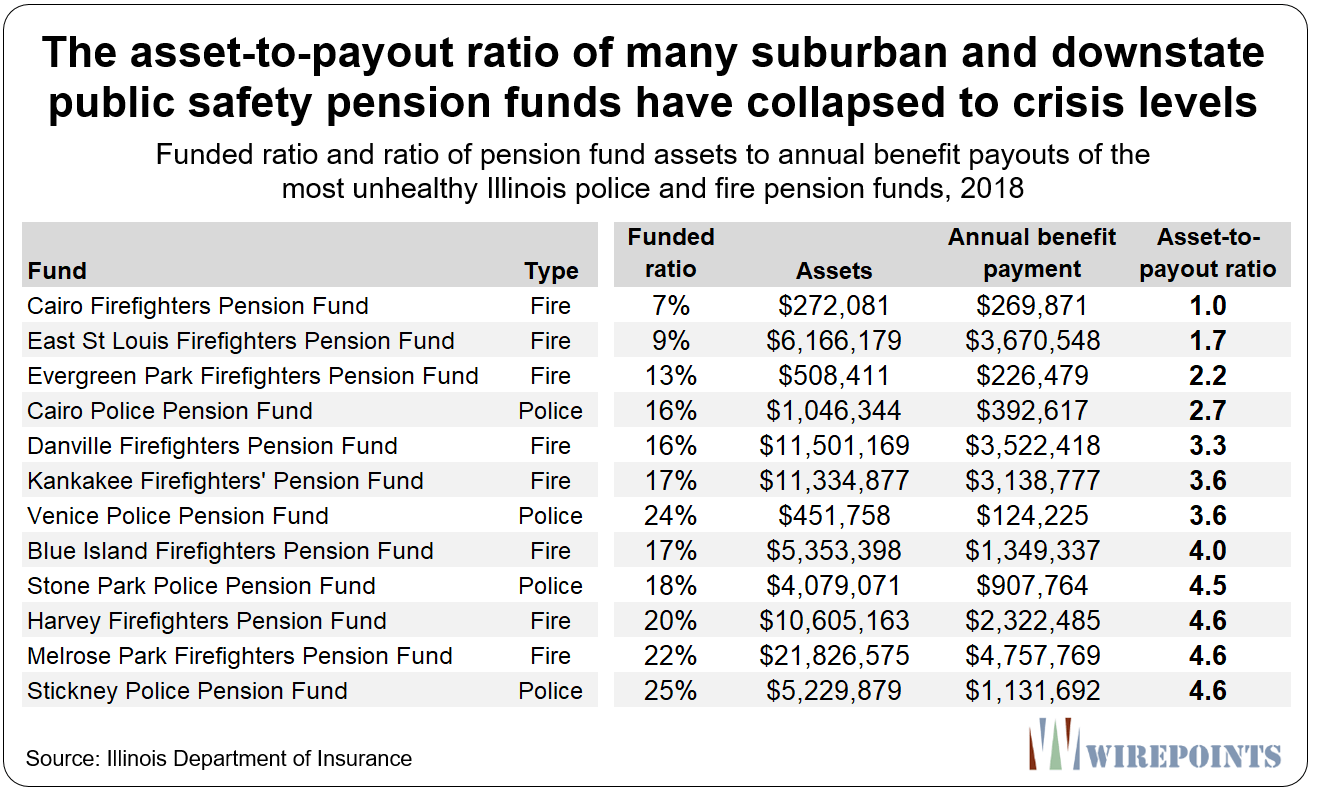

The situation is equally bad for many suburban and downstate public safety funds, too.

East St. Louis’ fire fund has just two years’ worth of assets. Danville’s firefighter fund has just three years. Ditto Cairo’s police fund, Harvey’s firefighter fund and dozens more across the state.

No choice left but reforms

Don’t mistake the coronavirus as the cause of Illinois’ pension collapse. Long before COVID-19, Illinois had a near-junk rating and the nation’s worst shortfalls, the result of decades of overpromising.

If the market meltdown persists for much longer, expect the city of Chicago’s rating to fall further and for the state’s to end up in junk. The consequences of both would be huge. But so far, Gov. J.B. Pritzker and Mayor Lori Lightfoot continue to reject an amendment to Illinois’ pension protection clause.

But soon, they may be forced to choose between either chaos or reforms. Barring state bankruptcy, pension reform is the only way to cut Illinois’ strangling debts and to keep pension fund asset-to-payout ratios from plunging straight to zero.

Read more about Illinois’ pension crisis and the impact the Coronavirus is having:

- Coronavirus impact may push Illinois state pension debt to over $300 billion

- Pension bailouts are not the answer for Chicago and Illinois — even during a pandemic

- Don’t Let States Rob COVID-19 Funds to Bail Out Pensions – RealClear Politics

- Stock market meltdown, collapsing bond rates will wreak havoc on Illinois’ weakest pension plans

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Much of the problem with the drastic rise in unfunded pensions is created by elected officials granting “early retirement” to the public employees who work under them These schemes are a way for politicians to garner votes and the employees who retire get to leave employment at age 50. Stopping this and loading years of unused vacation and other time off drastically raise ones pension, all these practices should be outlawed.

Can you say “PONZI” scheme.

Feel like you are being screwed?

It is because your are.

The only hope for an honest hard working taxpayer is to move ASAP.

Do not look book, just go somewhere else.

There is one self- defense mechanism available to a significant population of Illinois. TIF-FOR-ALL. That is: 1 incorporate a municipality. 2. Declare the entire municipality blighted and within TIF district boundaries 3. Municipal charter having required equal treatment of all similarly situated properties, administer TIF by rebating, pro rata, any tax increment payment directly back to each property owner. For 23 years. That way, risk of development is directed back on the property owner who will enjoy rewards of successful development (rather than burdening taxpayers with bonded debt to reward a speculative developer in advance). 4. Will property tax rates… Read more »

One has to wonder how pension funds can be 10 to 20% funded. How can anybody running a pension fund be that stupid? The best explanation is “Crane’s business,the illinois pension disaster,what went wrong?” Or perhaps it’s a series of screw-ups–a series of little things going wrong that accumulate. (the Titanic, or the Tenerife plane crash) The Disney company is in a nearly equivalent financial disaster, having just borrowed around $10 billion to keep the lights on. They paid too much for 20th Century Fox, screwed up Star Wars, and are totally failing with Disney+. The stock is down around… Read more »

because its a massive FRAUD upon the people of IL is why….and they will try to keep the pyramid scheme going…with yet ever increasing taxes ! IL NEEDS TO THROW OUT ALL THESE CORRUPT DEMS !

Wirepoints offers solutions to the state’s problems apparently still believing the state can be fixed. They are more knowledgeable about the state than myself so I’ll assume they are correct. By providing solutions, they offer hope, which can be either good or bad. If the hope is realistically achievable, then the hope is warranted, otherwise the term “false hope” applies. I’m not worried about the more analytical, thorough reader of Wirepoints. They will not be fooled by false hope. The casual reader however is at risk. Hope provides them justification for doing nothing. Also, Wirepoints will not recommend leaving Illinois,… Read more »

Our enemies are Democrats and their voters. They alone are the obstacle to change and reform. There are millions of people in the state who will vote Democrat reflexively every election. They see Republicans and reformers as the enemy and treat us accordingly in their tweets, in their memes, in their emails, in their personal conversations, and with their bigoted “hate has no home here” signs. We all need to recognize that Democrats are the enemy of democracy, and treat them as the enemy. Only then can true reform occur. Pension and fiscal reform is not a bipartisan issue, it’s… Read more »

We’ve known for decades what the problem is. Defined benefit pension plans are failing. No one seems to be detailing exactly how “reform” is going to fix the problem.

Reform can fix the problem by freezing the existing DB plans, replacing them going forward with a defined contribution plan similar to that offered by SURS, and cutting certain benefits in the old DB plan, particularly the automatic COLA.

Not trying to argue with you, Mark, but here are two ‘debate points’ within your reform suggestions. (1) If the existing plan is “frozen” (i.e., nor more employer contributions), doesn’t that kill the ponzi scheme even sooner? (2) If you cut the automatic COLA, aren’t you going to be sued for breach of contract?

No, you’d have to have a constitutional amendment, of course, to allow for the contract modifications. Whatever benefits were earned under the old plan would be frozen but reduced to a serviceable level. We will have to shelve further discussion until we lay out details, which we will be doing in the not too distant future.

Mark, with all of your ideas implemented, I still don’t think it will be enough to save Illinois. I think the hard truth is that Illinois filing some sort of bankruptcy is the ONLY thing, that will save Illinois from this democrat induced financial doomsday. (There’s a snowball’s chance in Hell that Illinois will be able to pay for those ridiculous and obscene pensions, and deliver adequate State services at the same time.) Of course, there will have to be new Federal Legislation needed to allow States to file for Bankruptcy. But, with the prospect of Trump winning a 2nd… Read more »

You certainly may be right. When we see the full impact of this recession on government budgets I would not be at all surprised if it becomes indisputable that bankruptcy is the only answer. We will be watching bankruptcy-for-states efforts closely at the federal level, which I expect will come. The driver may well be NJ, CN or some other state besides IL. On you other question, it would take a few years for a typical teacher to get to that point. Their initial pension is around 66% of final years’ salary average with 30 years service, but it compounds… Read more »

How much does lifetime healthcare for teacher and spouse [in their later less-healthy years] add to the burden? This information may not be readily available and I’m not looking for an answer but it has to be a large number. I expect the costs of both pensions and health are paid indirectly by the school districts as a % of their active payroll. Ultimately, of course, it all comes from revenues paid by taxpayers.

search dabrowski and health benefits with our search tool and you will see all the research he has done on that

Defined benefit plans will never work as long as 1+1=2

It’s April 14th, the day the Titanic sank (14th-15th). Illinois proves that being complacent never goes away. Ignoring warning signs and thinking everything will be fine, because it was before leads to disaster.

The plan Illinois politicians are planning their hopes on is,”Too Big to Fail!” If enough people are covered by broken pension systems it is the hope of Illinois politicians that the feds will come and bail out their mismanagement.

I agree with you, but the “too big to fail” modus operandi is creating a tremendous moral hazard that is unduly influencing too much of our economy and way of life. For our economic system to survive, this moral hazard must be eradicated, and it must be in every leader’s mind–both public and private–that this will not save the day. Without “too big to fail,” firms would not be buying back stock with leverage, and municipalities would be smarter about their spending and public union contracts. The economy would be more fairly balanced as appropriate to resource levels. Instead we… Read more »

Yeah the virus stimulus will already stress the fed too much without it having to suddenly cover something totally unrelated to the virus, like a pension bailout. If every state got its pensions bailed the nations money would become more worthless, massive inflation, which is an even bigger problem than a local unions members not getting their pension checks. Bailing out a Ponzi scheme in Illinois only moves the Ponzi scheme to Washington, it’s still a Ponzi.

I believe the Democrats would wait until they control all three branches of governments. But well-managed states will reject the idea of subsidizing other states with poorly managed finances.