By: Ted Dabrowski and John Klingner

Illinois, New York and California continued their streak as the nation’s biggest losers of residents and their wealth to other states, according to a Wirepoints analysis of newly-released Internal Revenue Service migration data.

Texas and Florida continued to be the nation’s big winners.

The latest IRS state-by-state migration data is based on tax returns filed in 2020 and 2021, covering taxpayers (tax filers and their dependents) who moved from one state to another between 2019 and 2020 (see appendix for changes in our reporting methodology).

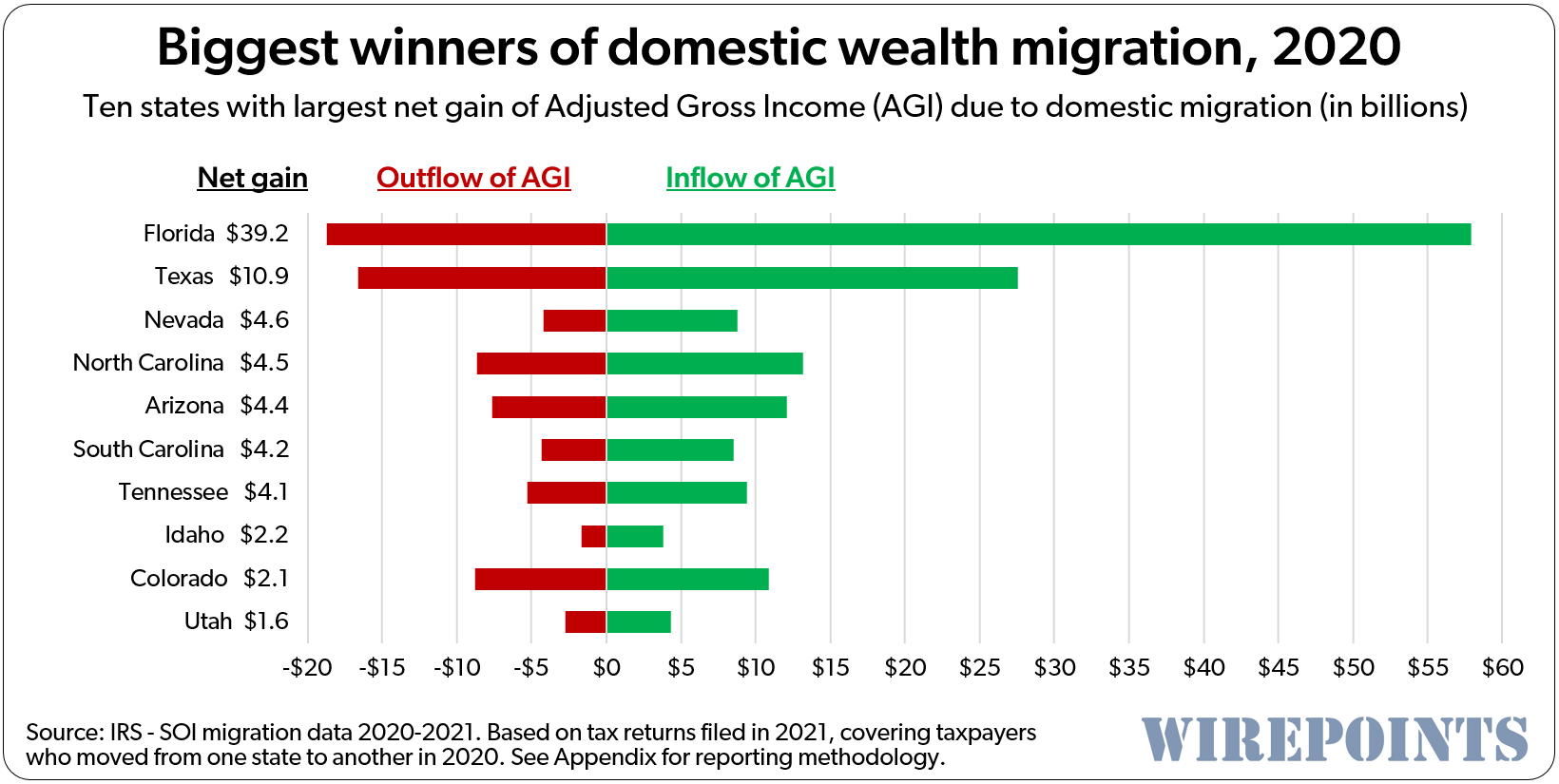

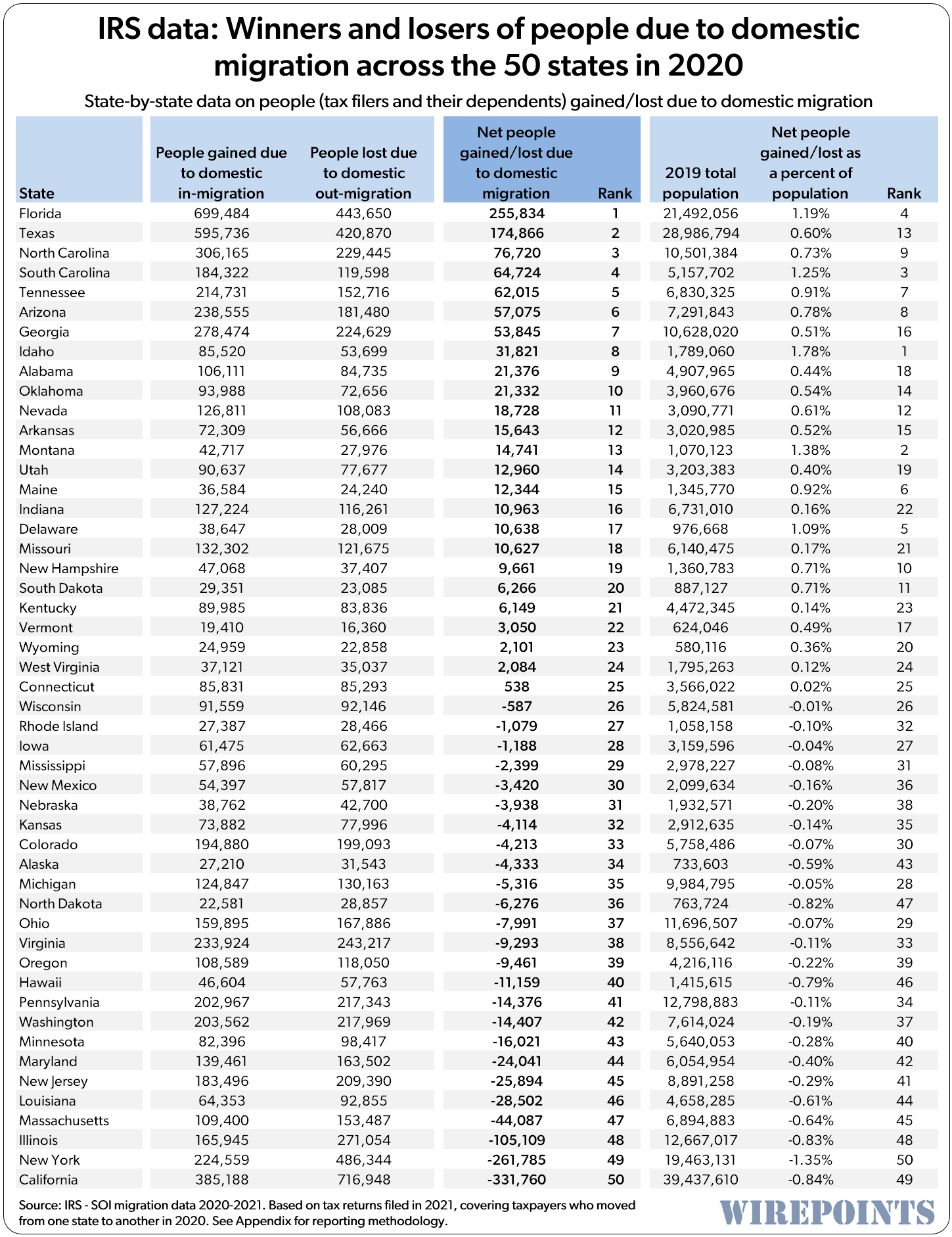

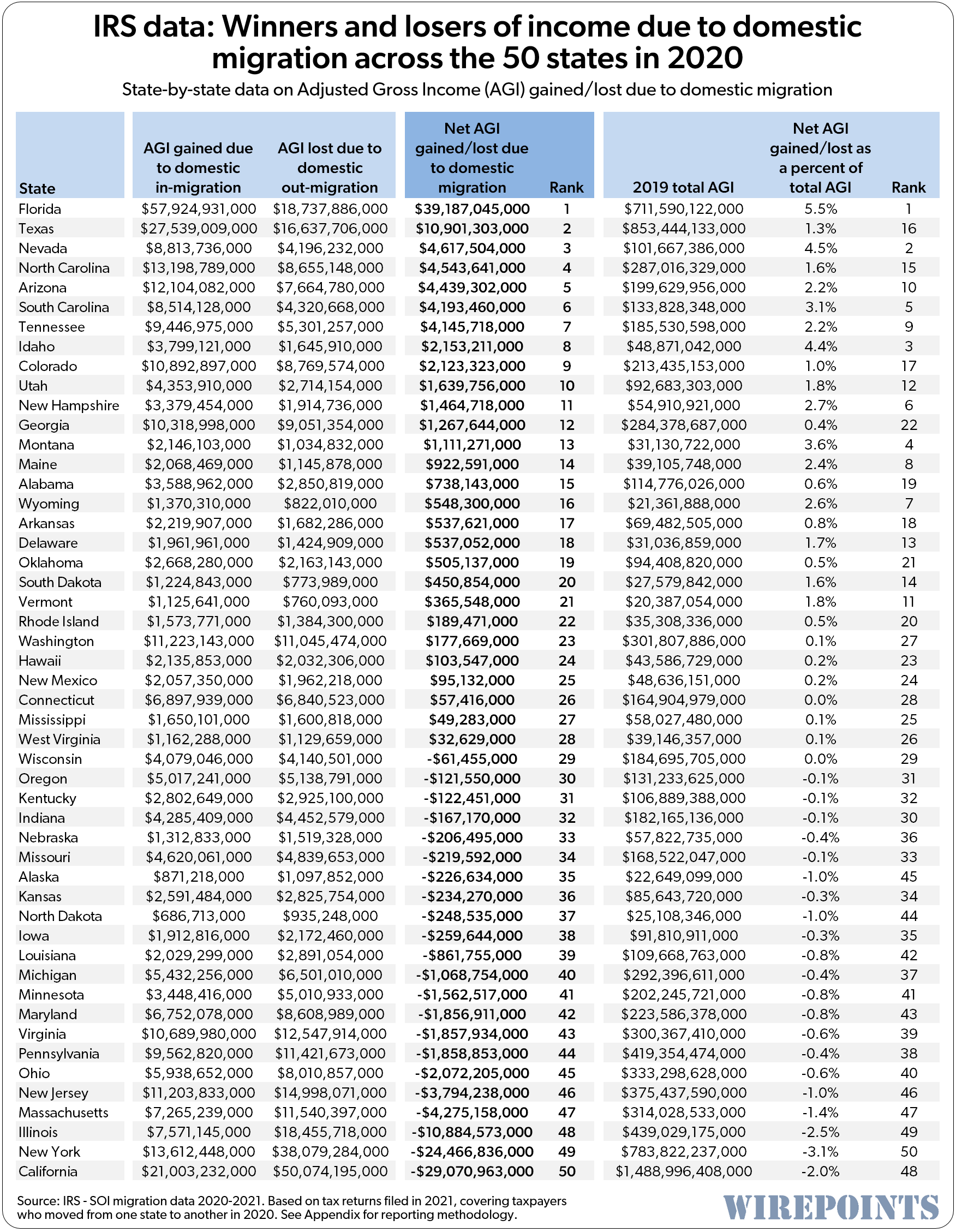

Florida, the nation’s perennial winner, gained in 2020 the most net people, 256,000, and the most net Adjusted Gross Income (AGI), $39 billion. Texas followed with a gain of 175,000 people and $10.9 billion in AGI.

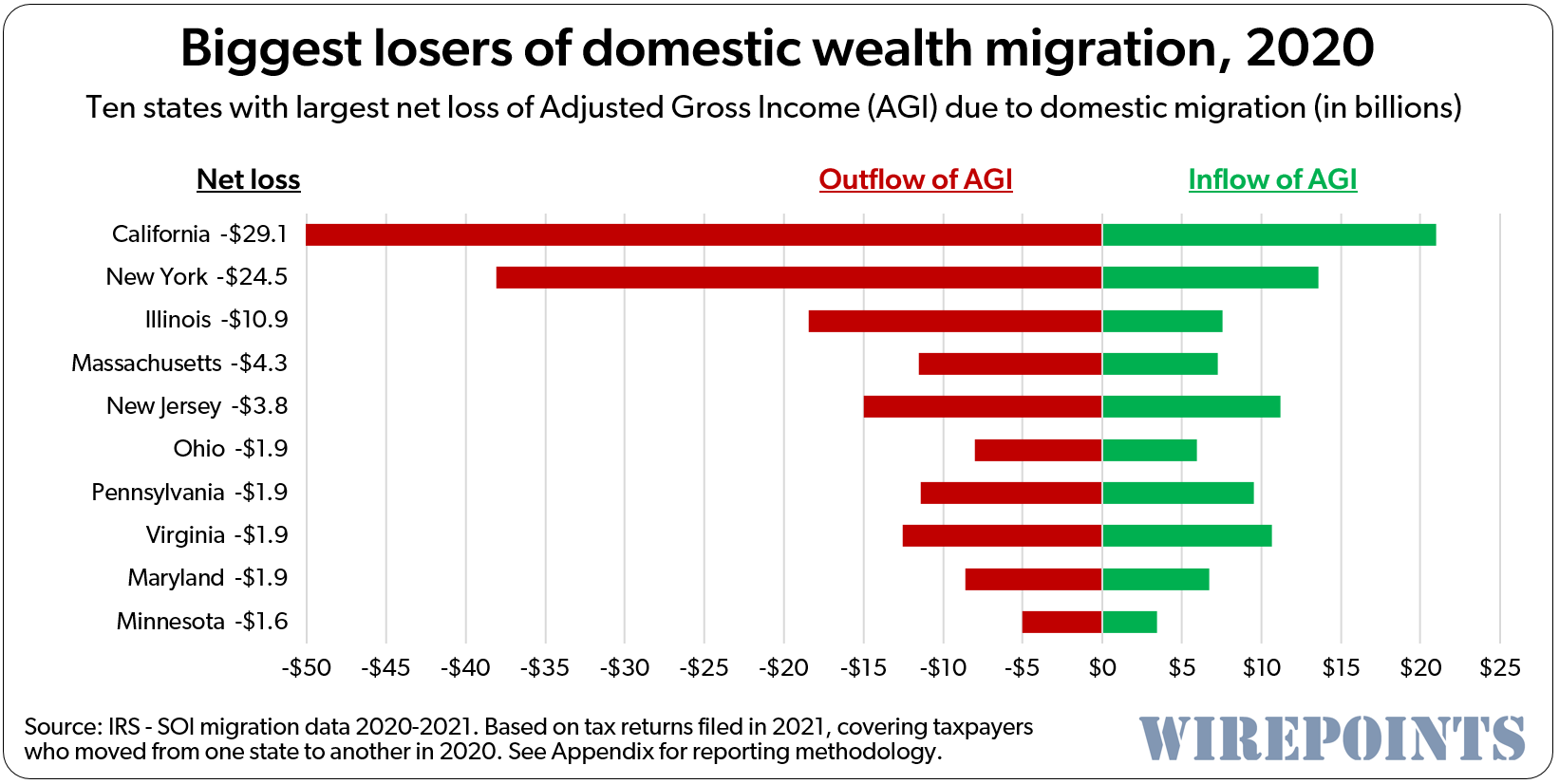

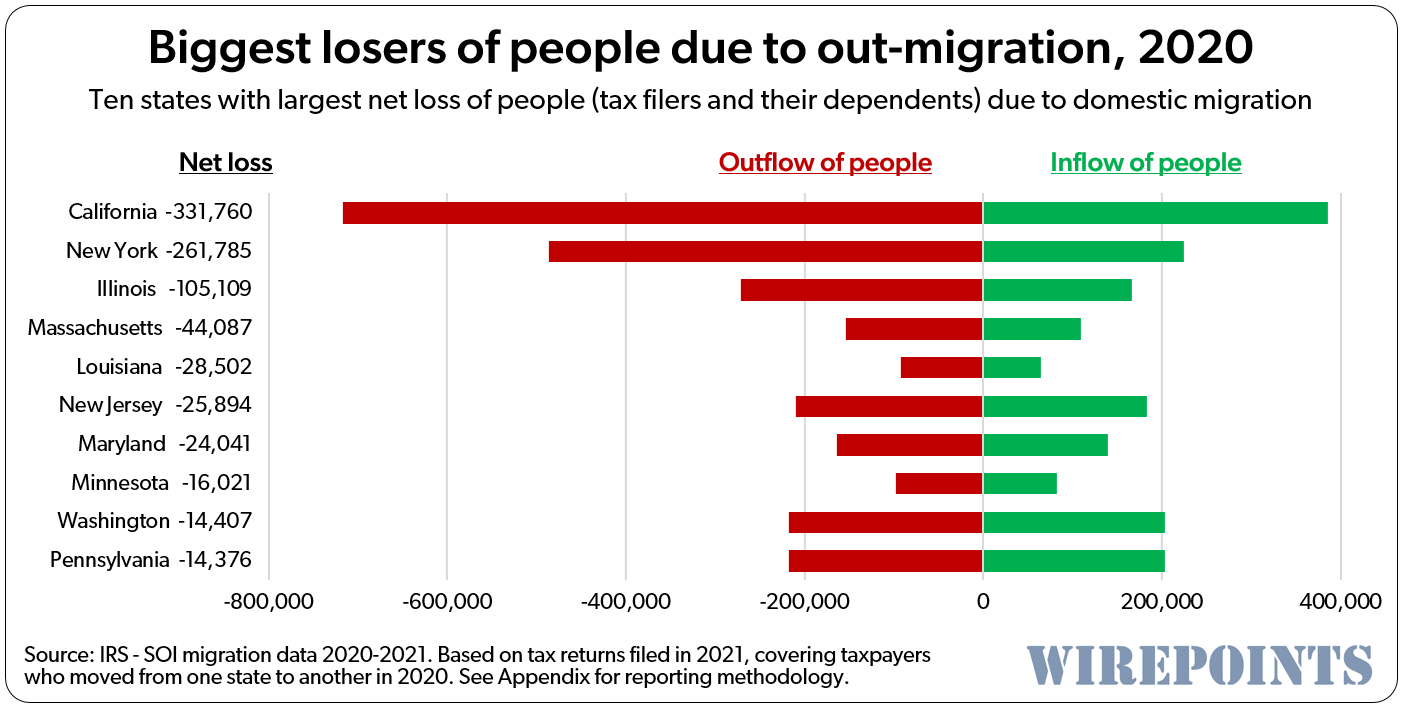

In contrast, states like California, New York and Illinois once again experienced some of the nation’s biggest losses. California lost more people than any other state, with more than 332,000 net movers taking $29 billion to other states.

Wirepoints’ accompanying Illinois analysis includes a long-term look at out-migration from the state.

The IRS migration report provides hard, indisputable data on the movement of Americans between states. The agency reviews tax returns annually to track when and where tax filers and their dependents move. It also aggregates the ages, income brackets and adjusted gross incomes of filers.

Winners and losers

The Sunshine State attracted over $57.9 billion in Adjusted Gross Income (AGI) from 699,000 new residents (tax filers and their dependents) that moved into Florida in 2020. On the flip side, Florida lost $18.7 billion in AGI from 443,000 people who left. On a net basis, Florida came out ahead with 256,000 net new people and $39.2 billion in net new taxable income.

That was a total gain of 3.1 percent of the state’s total AGI ($711 billion).

Texas was the runner up with an AGI income gain of $10.9 billion, followed by Nevada with $4.6 billion. North Carolina and Arizona rounded out the top five with net gains of $4.5 billion and $4.4 billion, respectively. (See Appendix for top 10 winners of people.)

On the losing side, California suffered the worst outflow of money of any state in 2020. The Golden state lost a net $29.1 billion in income, or 2.0 percent of its AGI, while a net of 332,000 residents moved out.

On the losing side, California suffered the worst outflow of money of any state in 2020. The Golden state lost a net $29.1 billion in income, or 2.0 percent of its AGI, while a net of 332,000 residents moved out.

New York was next, losing a net $24.5 billion and 262,000 people. Illinois was 3rd with a net loss of $10.9 billion and 105,000 people. Massachusetts and New Jersey were in 4th and 5th place, with $4.3 and $3.8 billion in income losses, respectively. (See Appendix for top 10 losers of people.)

Tables with each state’s ranking in migration gains/losses are provided below.

Tables with each state’s ranking in migration gains/losses are provided below.

The cumulative impact of income losses and gains

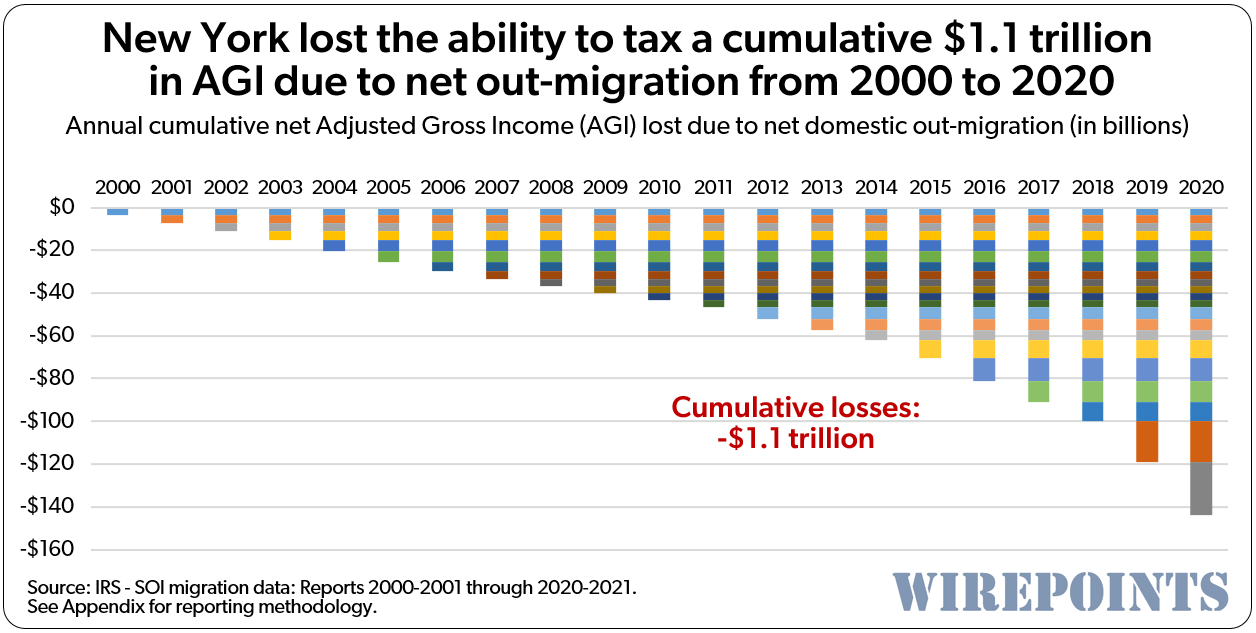

The problem with chronic outflows, like in the case of New York, is that one year’s losses don’t only affect the tax base the year they leave, but they also hurt all subsequent years. The losses pile up on top of each other, year after year. And when a state loses income to other states for 21 straight years, the numbers add up.

In 2020 alone, New York would have had nearly $144 billion more in AGI to tax had it not been for the state’s string of yearly migration losses. And when the state’s AGI losses are accumulated from 2000 to 2020, it totals $1.1 trillion in cumulative lost income that could have been taxed over the entire period.

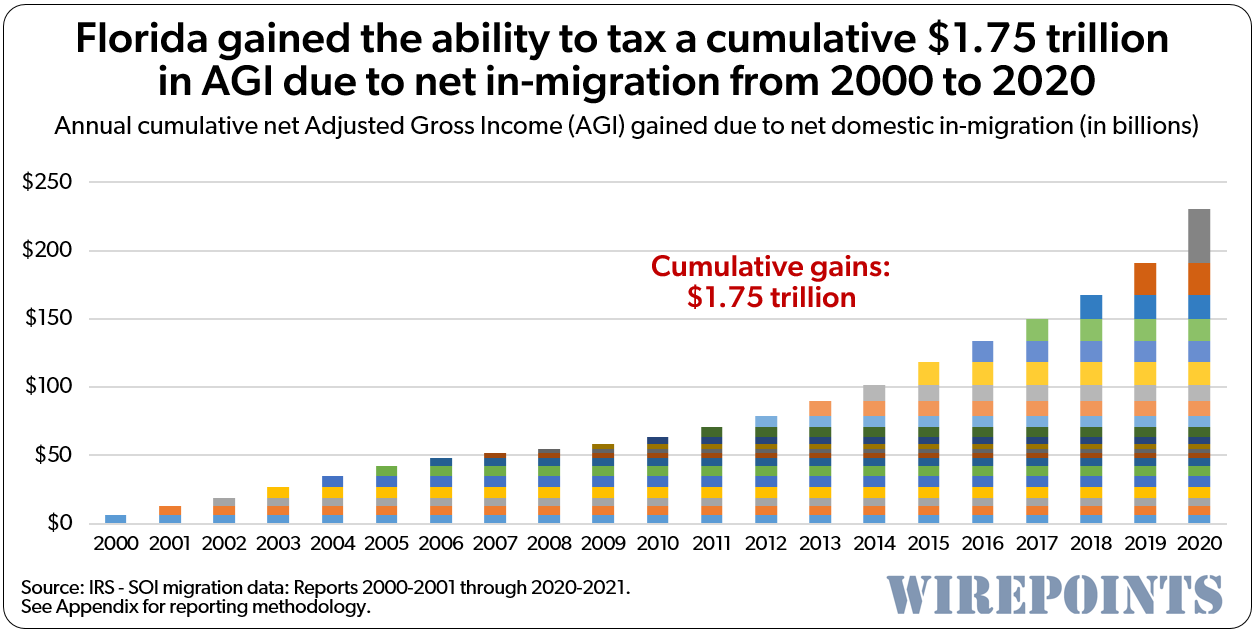

The opposite is true for migration winners like Florida. Gains in people and income pile on top of each other each year, building an ever-growing tax base. In 2020 alone, the state’s tax base was some $230 billion higher due to the 21-year string of positive income gains from net in-migration.

The opposite is true for migration winners like Florida. Gains in people and income pile on top of each other each year, building an ever-growing tax base. In 2020 alone, the state’s tax base was some $230 billion higher due to the 21-year string of positive income gains from net in-migration.

Even though Florida doesn’t tax incomes, Wirepoints also added up Florida’s cumulative AGI to make an apples-to-apples comparison with New York. When the Sunshine State’s AGI gains are accumulated from 2000 to 2020, it totals $1.75 trillion in income that could have been taxed over the entire period.

The competition for people matters

The competition for people matters

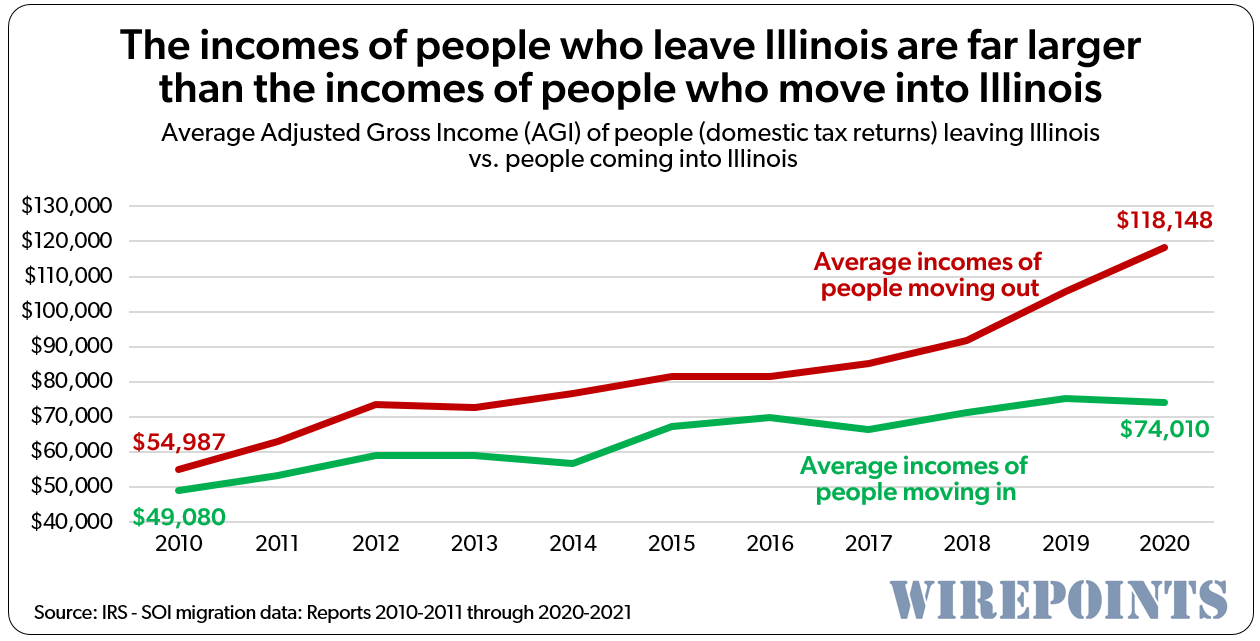

Illinois, one of the nation's other big losers, shows just how damaging being an “exit” state can be – especially when a state starts to lose its wealthier residents and they are only partially replaced by people who make less. The Illinoisans who fled in 2020 earned, on average, $44,000 more than the residents Illinois gained from other states. That’s the biggest gap since at least 2000, based on Wirepoints’ analysis of the IRS data.

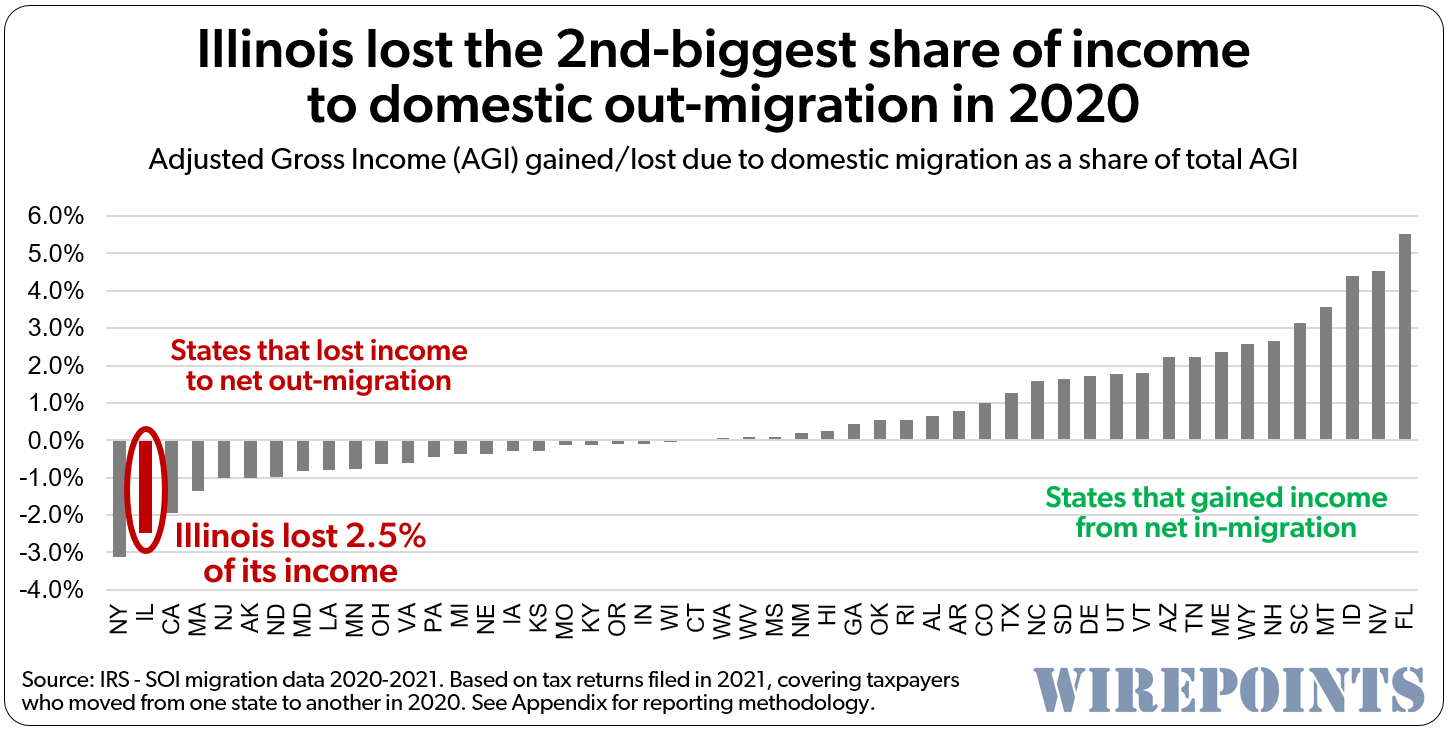

Based on a percentage of total income, Illinois ranked 2nd-worst nationally for income losses in 2020. Illinois lost 2.5 percent of its AGI. Only New York was worse, with a loss of 3.1 percent.

Based on a percentage of total income, Illinois ranked 2nd-worst nationally for income losses in 2020. Illinois lost 2.5 percent of its AGI. Only New York was worse, with a loss of 3.1 percent.

In contrast, Florida was the nation’s big winner on a percentage basis in 2020, gaining 5.5 percent of its AGI base. The nation’s top five were rounded out by Nevada, Idaho, Montana and South Carolina.

In contrast, Florida was the nation’s big winner on a percentage basis in 2020, gaining 5.5 percent of its AGI base. The nation’s top five were rounded out by Nevada, Idaho, Montana and South Carolina.

******************

The IRS data shows for yet another year Americans chose better managed, less expensive areas over larger, government-centric, high-cost cities and states. And it provides a glimpse of a demographic future in which states that prioritize an affordable, less intrusive government will dominate those that over-tax and over-regulate the lives and businesses of their residents.

Appendix

For years Wirepoints and others have reported the “taxpayer migration” year based on the IRS migration report date. Take, for example, last year’s “Migration Data 2019-2020” IRS report which is based on tax filings made in 2020. Most reports cited the migration data as 2020, which matches the IRS nomenclature.

However, the IRS explained in an email to Wirepoints that: “The 2019-2020 Migration Data refers to tax returns that were submitted to the IRS in calendar years 2019 and 2020, which corresponds to tax returns and income that was earned in 2018 and 2019, respectively."

That means the true outmigration year in the example above is 2019, and not 2020.

Wirepoints has adjusted its ‘migration year’ in this year’s report to more properly reflect this fact.

*Wirepoints originally calculated losses/gains as a percent of population based on states' 2000 populations. The data has updated to reflect the losses/gains based on 2019 populations.*

*Wirepoints originally calculated losses/gains as a percent of population based on states' 2000 populations. The data has updated to reflect the losses/gains based on 2019 populations.*

Read more from Wirepoints:

- The Great Re-Sort: New, National Survey Indicates Political Migration Will Soar

- Red states Texas, Florida crush blue New York, California and Illinois when it comes to 2022 population growth

- The Illinois Political Establishment’s Shameful Response To The Departure Of Ken Griffin And Citadel

- 13 Illinois counties among the top 50 property markets nationwide most ‘at-risk’ of a downturn

- What has Chicago done?

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Kudos on the detailed analysis. Interesting that on net, CA lost 2% of its AGI, with 322k net departures, or only .8% of CA population. But the conclusions would be even more striking using the gross departures from CA rather than netting against new migrants.

Unfortunately the F.I.B.’s have wandered into Missouri by the thousands as well. Half of the new homes being built in Eureka MO. are for the illinois refugees. Remember why you left, F.I.B.’s and vote accordingly.

Another made up story by the Wirepoint Korropt Klowns. Would use real census data if serious.

Let me know if anyone needs a ride to the airport. We need less crazies in Illinois.

Plumber Crack,

I left Taxistan 20 years ago after getting sick of the Dems and their Masters the Illinois public sector unions steal more and more from me every year.

My wise financial decision has enlarged my bank account by approx. $200K.

Da Judge

You are a troll, but I can’t help but respond…

Joe the plumbers taxes will have to be raised even more to help offset the shortfalls. He’s just too daft to understand that.

P.S Joe, the **** runs downhill and don’t bite your nails.

Lol ! Ha ha ha ha ha! Ah ha ha ha Aahhhhhh

Tell everyone how you support the democratic party’s decades long systemic racism of forcing urban children to attend failed schools, permanently impairing them. That will shut them up!

I guess IRS data doesnr work for you …lol facts are facts

Problem is that IN migration from Border Jumpers will exceed that of people leaving. There are over 2M Jumpers coming in yearly and who knows how many are not caught.Where are they headed to? Sanctuary States. Stats provided are for those who were processed but what about those who sneak across and live with relatives and many of the women are pregnant or soon will thereby making the kids legal citizens. Yes higher income people are leaving but are being replaced by low income in droves. There was a person on CSPAN a while back who said if gone unchecked… Read more »

I read that a lot of illegal Border Jumpers also come from Africa and Asia. They travel to South America, which has lax visa requirements, then travel north to the USA. Even Border Jumpers from Haiti are coming in through that well worn route, rather then a more uncertain shorter route.

I think the appropriate term should be ILLEGAL IMMIGRATION

Well, aren’t we proud to be a winner and BROKE.

If Trump builds a wall around Illinois, it will be to keep people in, not out.

Every Year the out-migration numbers will be higher, and for good reason.

The concern is that these people leaving the blue states will continue to vote the way they always did when they get to their new red state home. We’ve seen this play out in Texas and Arizona. Liberals are parasites. They kill the host states that they’re in, then move on to the next and suck it dry.

People, don’t you understand that Illinois is a paradise, an oasis, for abortions, gender affirming mutilations, social justice, education mediocrity and weed? Why are you leaving?

Don’t forget the gambling!

It’s a paradise for criminals too. There are few better places to be a criminal than Chicago.

Buh Bye Taxistan Hello a fatter bank account!!

Looks to me like the Confederacy is kicking the Union’s butt.

Let me know when you need a ride to t airport. Leaving would increase Illinois IQ and also that of your preferred Rebel state.

Oh things have come full circle. Illinois budget truthers are the new anti vaxers. So cringe !

How many people routinely compare home appreciation or tax rates between states? Does the average person make a budget or track their finances? It’s my experience that the financial intelligence of the masses is ridiculously low, however there is a smart minority of residents that do pay close attention. It’s that minority that is already moving across state lines. Others will notice eventually and follow. This migration from blue to red states should accelerate. So far, the red states have successfully absorbed the blue refugees. If however, that rate doubles, there may some degree of chaos when blue state residents… Read more »

Why budget or track finances, Biden just signed an executive order that penalizes those with good credit and rewards those with bad credit. At some point there will be executive orders that penalize people in red states and reward those in blue states. He has greatly surpassed Jimmy Carter as the worst president.

Let’s see if any of the hard hitting media raise this issue with Lord Pritzker. JB probably has Dem lackey blog CrapitolFax getting a story ready to refute the facts.

Who’s gonna tell Raja?