By: Ted Dabrowski and John Klingner

*Wirepoints originally calculated losses/gains as a percent of population based on states’ 2000 populations. The data has updated to reflect the losses/gains based on 2019 populations.*

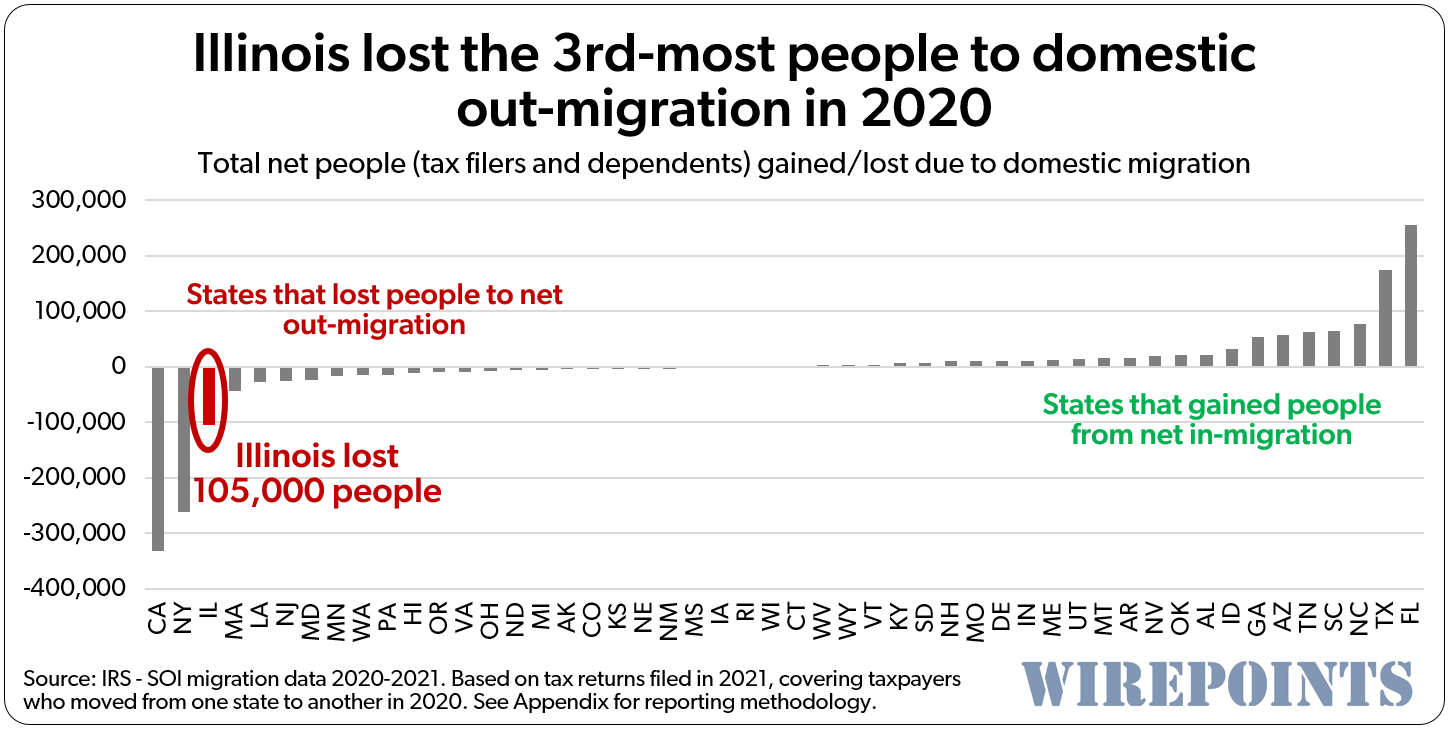

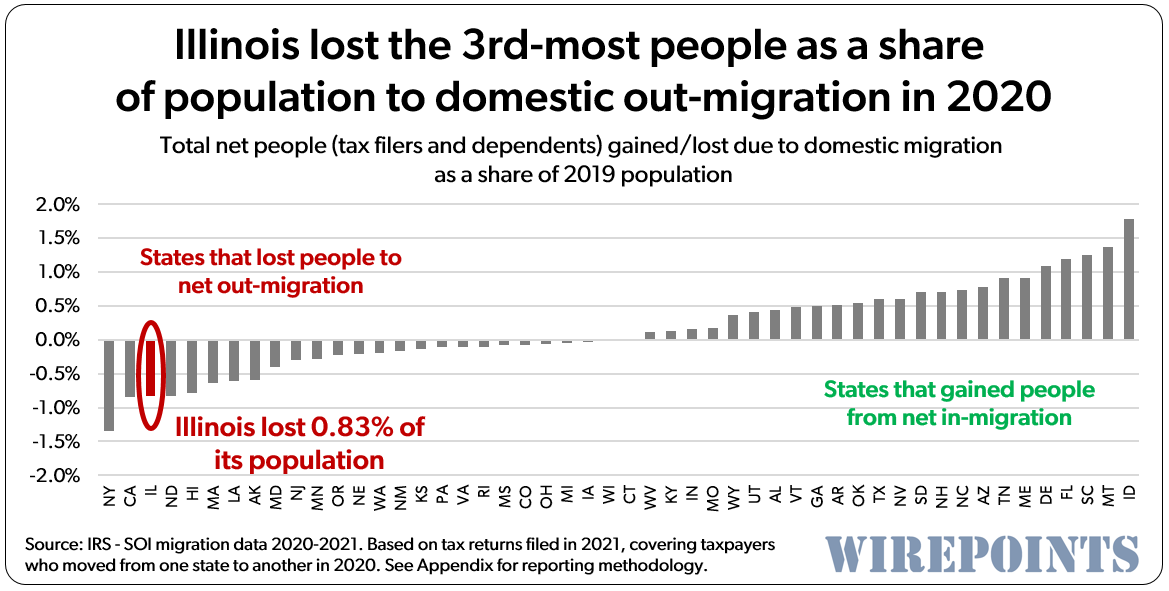

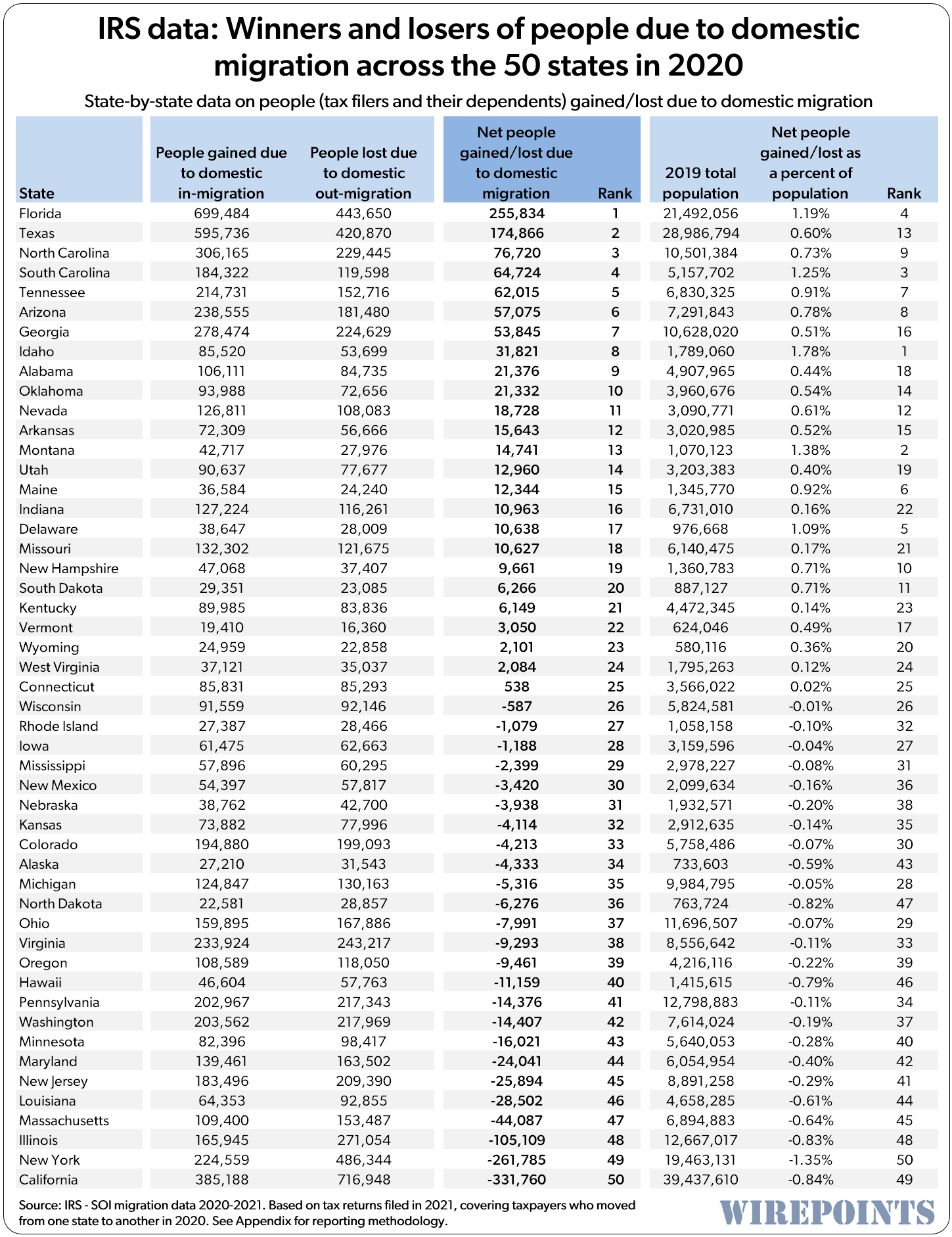

A Wirepoints analysis of the Internal Revenue Service’s just-released 2020-2021 taxpayer migration data shows Illinois lost, on net, 105,000 residents to other states in 2020. A total of 166,000 people moved into Illinois from other states in 2020, while 271,000 moved out of Illinois, resulting in that 105,000 net loss. The state ranked third-worst nationally for net resident losses.

The latest IRS state-by-state migration data is based on tax returns filed in 2020 and 2021, covering taxpayers and their dependents who moved from one state to another between 2019 and 2020 (see appendix for changes in our reporting methodology).

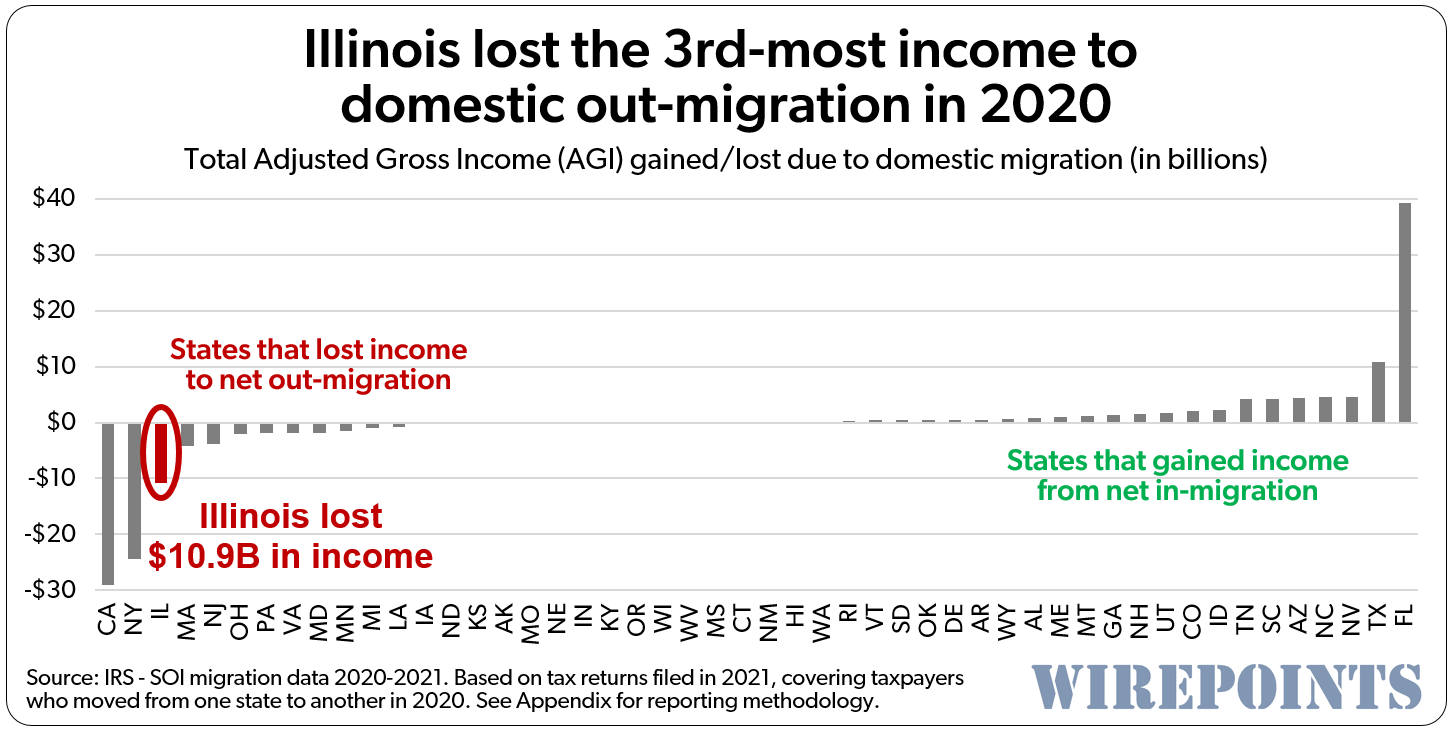

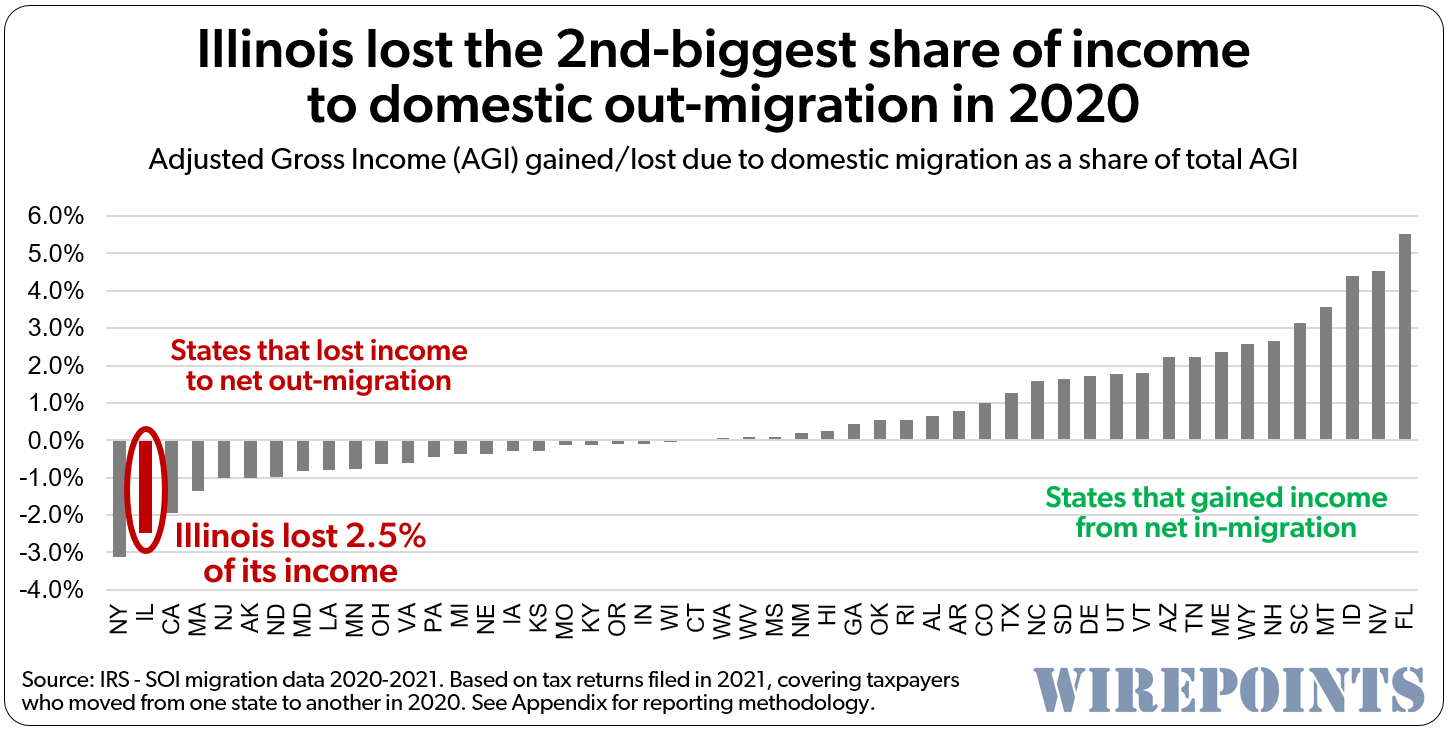

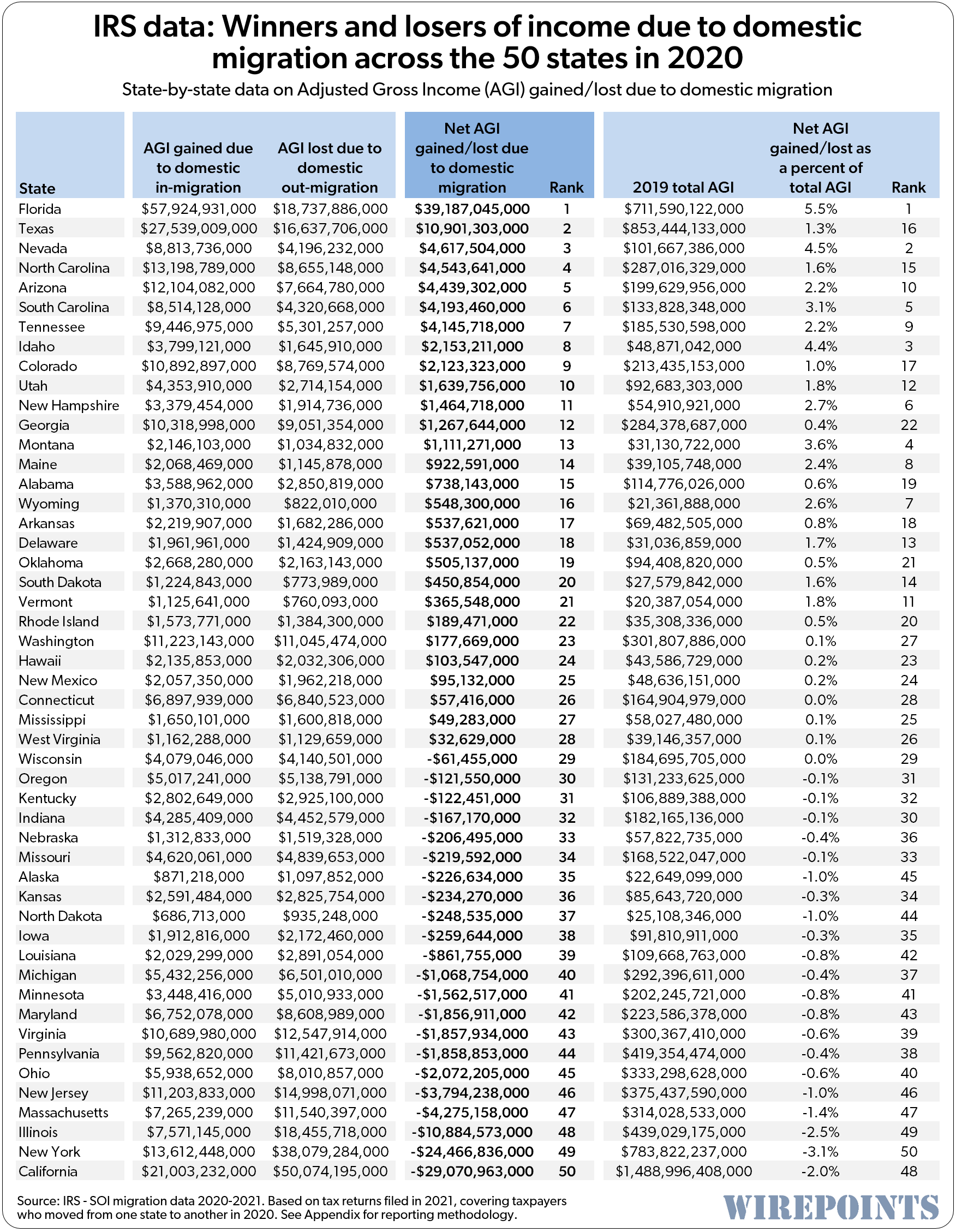

Illinois’ tax base also took a hit as a result of those residents leaving, losing a record net $10.9 billion in taxable income (AGI) to other states in 2020 – a new record. That, too, was the third-worst performance in the country.

In all, Illinois lost residents on a net basis to 45 other states in 2020.

Wirepoints’ accompanying 50-state analysis includes a long-term look at out-migration across the nation.

The IRS migration report provides hard, indisputable data on the movement of Americans between states. The department reviews tax returns annually to track when and where tax filers and their dependents move. It also aggregates the ages, income brackets and adjusted gross incomes of filers.

That data shows Illinois continued to be a national outlier in 2020 when it comes to losing people and the money they earn. Only California and New York lost more residents – 332,000 and 262,000, respectively.

On a percentage basis, Illinois ranked 3rd-worst for out-migration, with a net loss of 0.83 percent of its population. Big states New York and California fared worse, with losses of 1.35 percent and 0.84 percent of their populations, respectively.

On a percentage basis, Illinois ranked 3rd-worst for out-migration, with a net loss of 0.83 percent of its population. Big states New York and California fared worse, with losses of 1.35 percent and 0.84 percent of their populations, respectively.

Illinois’ $10.9 billion AGI losses were topped only by California and New York, which lost $29.1 billion and $24.5 billion in AGI, respectively.

But based on a percentage of total income, Illinois ranked 2nd-worst nationally for losses. Illinois lost 2.5 percent of its total AGI in 2020. New York was the worst, with a loss of 3.1 percent.

But based on a percentage of total income, Illinois ranked 2nd-worst nationally for losses. Illinois lost 2.5 percent of its total AGI in 2020. New York was the worst, with a loss of 3.1 percent.

The two biggest gainers nationally of people and their incomes in 2020 were Florida and Texas. Florida was the biggest winner by far, gaining a net 256,000 people and $39.2 billion in AGI. Texas gained 175,000 people and $10.9 billion in AGI.

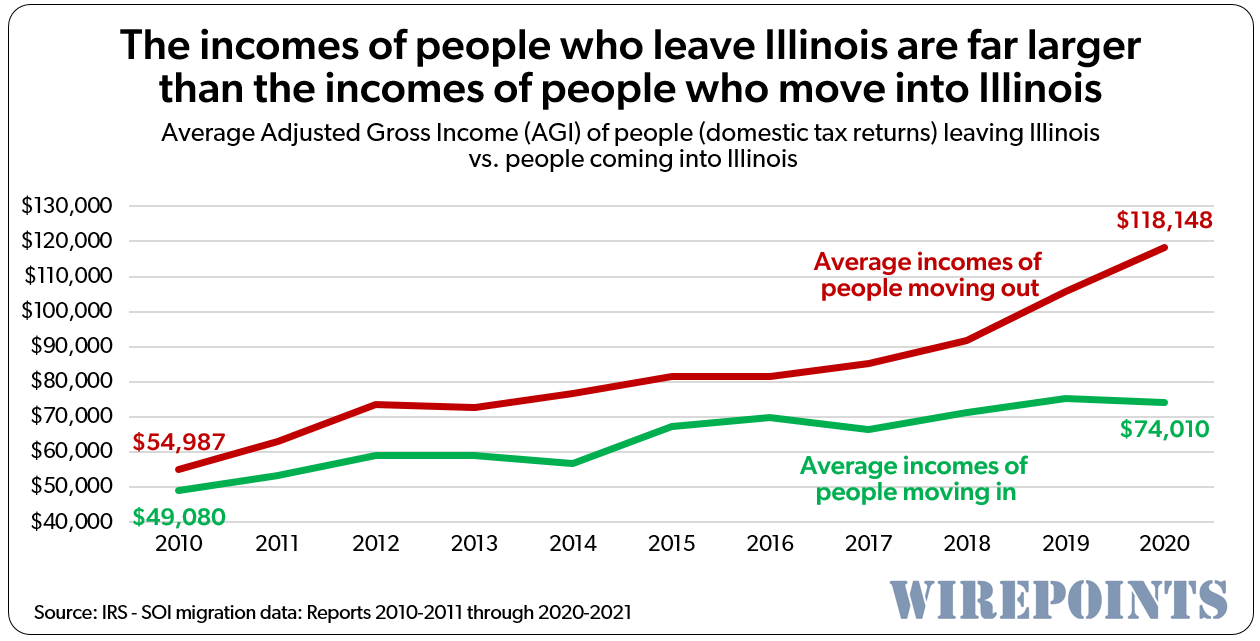

The Illinoisans who fled in 2020 earned, on average, $44,100 more than the residents Illinois gained from other states. Outgoing residents earned $118,000, while incoming residents made just $74,000. That’s the biggest gap since at least 2000, based on Wirepoints’ analysis of the IRS data.

So not only is Illinois losing people outright, but the people moving into Illinois make far less than those who are leaving.

So not only is Illinois losing people outright, but the people moving into Illinois make far less than those who are leaving.

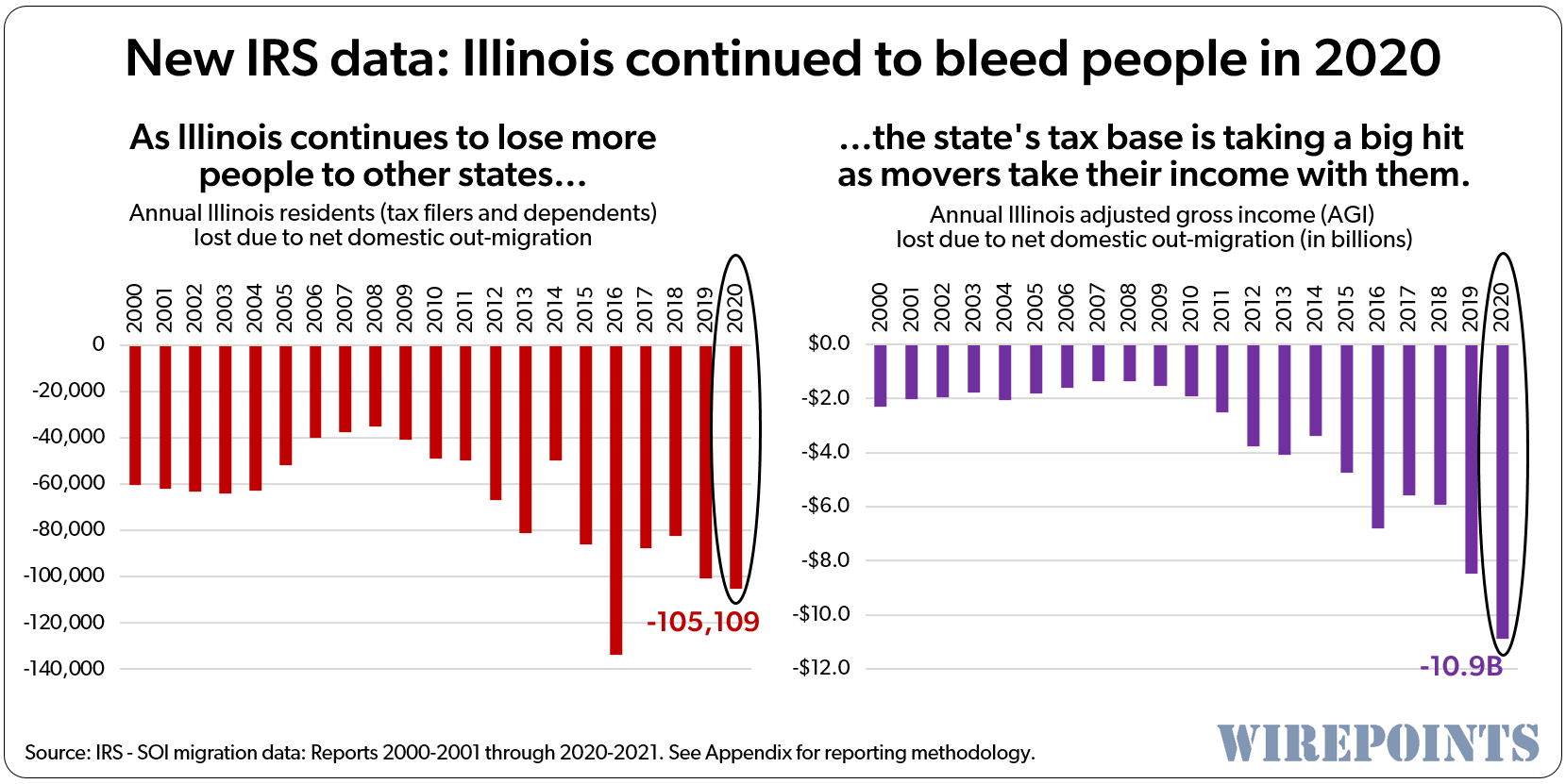

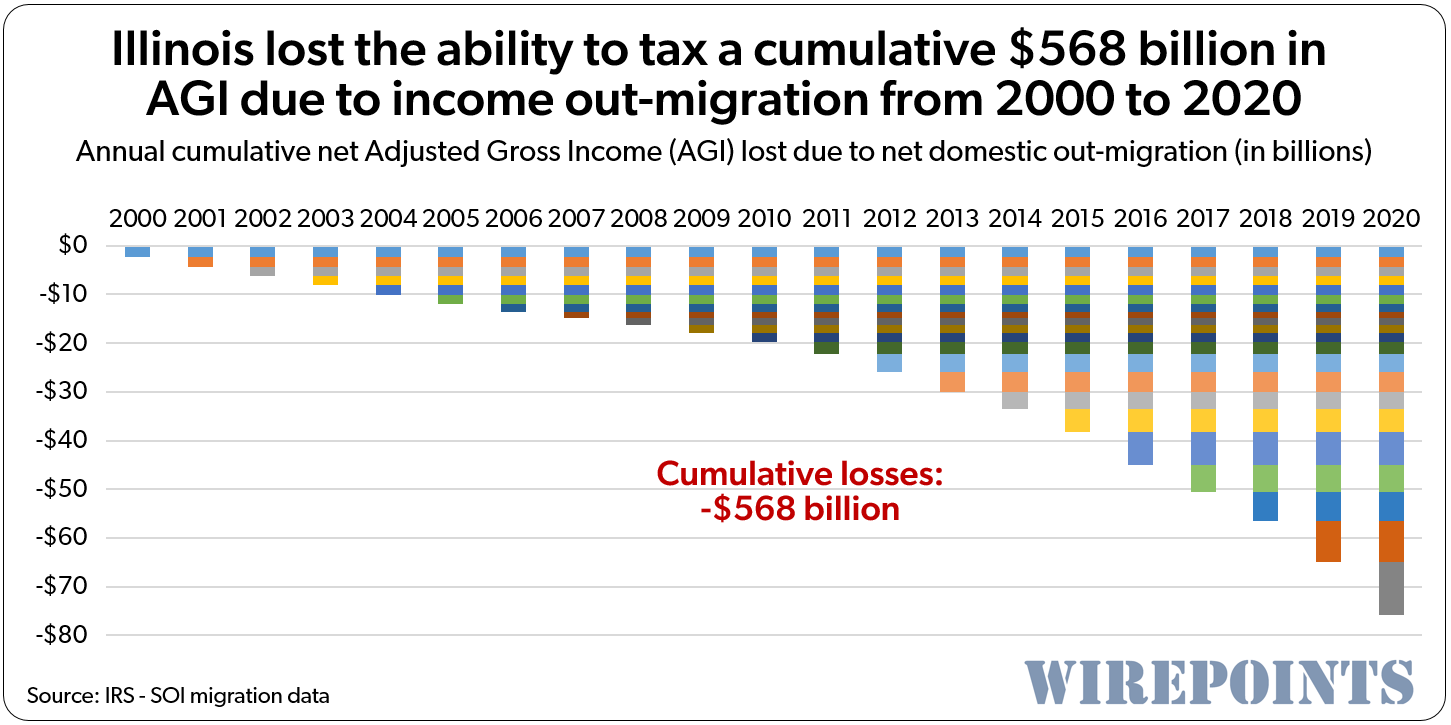

The problem with Illinois’ chronic outflows is that one year’s losses don’t only affect the tax base the year they leave, but they also hurt all subsequent years. The losses pile up on top of each other, year after year. And when you lose income to other states for 20 straight years, the numbers add up.

In 2020 alone, Illinois would have had $76 billion more in AGI to tax had it not been for the state’s string of yearly losses in income.

When Wirepoints adds up Illinois’ AGI losses since 2000, it turns out Illinois has lost a cumulative $568 billion in AGI that it could have taxed over the 2000-2020 period.

**********

Illinois is chronically losing people and their wealth to other states as Illinoisans continue to vote with their feet.

It’s no wonder why. While politicians in other states work to keep their streets safe, to improve education and to lower taxes, the Illinois legislature shows no signs of pursuing education, criminal justice and pension reforms needed to make the state competitive. Expect the exodus to continue.

Appendix

For years Wirepoints and others have reported the “taxpayer migration” year based on the IRS migration report date. Take, for example, last year’s “Migration Data 2019-2020” IRS report which is based on tax filings made in 2020. Most reports cited the migration data as 2020, which matches the IRS nomenclature.

However, the IRS explained in an email to Wirepoints that: “The 2019-2020 Migration Data refers to tax returns that were submitted to the IRS in calendar years 2019 and 2020, which corresponds to tax returns and income that was earned in 2018 and 2019, respectively.”

That means the true outmigration year in the example above is 2019, and not 2020.

Wirepoints has adjusted its ‘migration year’ in this year’s report to more properly reflect this fact.

Read more from Wirepoints:

- The Great Re-Sort: New, National Survey Indicates Political Migration Will Soar

- Red states Texas, Florida crush blue New York, California and Illinois when it comes to 2022 population growth

- The Illinois Political Establishment’s Shameful Response To The Departure Of Ken Griffin And Citadel

- 13 Illinois counties among the top 50 property markets nationwide most ‘at-risk’ of a downturn

- What has Chicago done?

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

Ummm, every comment on this thread talks about how Illinois residents are in such a dire situation! But everyone who lives in here obviously DOESN’T want to leave. All the complaints on here, all of you commenting MUST live with blinders on!!! EVERY where anyone moves, there’s crime, gun violence, and extreme weather. Yes, Illinois has it’s issues, but what state doesn’t. When Conservatives ran this state; if you don’t remember because it’s easier to blame, people were leaving then, too. But it’s always a good warm fuzzy feeling to point out those Liberals shortcomings! As an Independent, I LOVE… Read more »

Please remind me when conservatives ran the state? Looking on Ballotpedia, it shows that Republicans had a trifecta in state government (gov., senate, house) in 1995 and 1996 which coincided with the nationwide wave election with Newt Gengrich’s Contract for America. Democrats have had a trifecta in IL gov. since 2003 except for the four years Rauner held office, and he admitted that he was basically neutered because the entirety of state gov. bureaucracy was Democrats who sabotaged his initiatives. The state grew by 1,000,000 people in the 1990’s when republicans were in charge. In the 2000’s growth slowed a… Read more »

Fat Fredo and BLM BJ don’t care about what’s right or wrong. They’re Democrats. They owe their political lives to public sector unions, the biggest being the teachers union. They’re not going to go against their meal ticket. More proof of why Illinois is doomed.

A guy on YouTube, Chris Harden, has made a series of vids about downstate Illinois – I knew it was bad, but these videos are horrific – and also fascinating to watch. Only Bloomington/Normal and Champaign/Urbana are “bright spots”. Even the smaller towns are drug – infested poverty – ridden dumps – even Macomb has lost 20% of it’s population in the last 20 years. He mentions high taxes as a reason for the dire straits Illinois is in: https://www.youtube.com/playlist?list=PLkAKbwTlGHeKoOBxconpFSyUSO32NKREy Here are some titles: One Of The Nations Fastest Shrinking Cities: Decatur, Illinois Illinois’ Forgotten Ghetto, The 61605: Peoria, Illinois’… Read more »

The reduction in state population is all coming from southern Illinois, where the conservatives are getting out fast. There’s no population decline in Chicagoland.

The chicagoans who are leaving they City are turning our collar counties blue. They are leaving Chicago for a reason! The reason being that the leftists running things have ruined the City. Don’t bring that failed politics here!

They are absolutely turning the suburbs blue. There was that viral tweet last year where some millennial laments that all her city friends leave the city for far flung suburbs (Bolingbrook was her example IIRC) instead of inner ring suburbs like Skokie, Morton Grove, etc. This is mostly true, but many of the inner-ring suburbs are so diverse that they are united nations dystopian that you can’t even share a beer with your neighbor. One family I know moved to the Skokie/Morton Grove area for a year and complained that there were no English speaking children on the block for… Read more »

I already decided I was leaving before it was even the talk of the town. Getting a notice of underpayment penalty of just over $1 for failure to adequately make my estimated taxes on unearned dividend income pretty much sums it all up. It’s really hard sitting here being jealous of others who were able to get to the place they could leave, while also finding myself wishing away years of my life until I can retire and do the same. I pray when the time comes I’ll be able to sell my home and my woke neighbors will be… Read more »

not sure if anyone pointed out already this Trib headline-I found the supporting data interesting

LGBTQ residents moving to Illinois from states with conservative agendas: ‘I don’t want to be ashamed of where I live’

By Lizzie Kane

Chicago Tribune

•

Apr 24, 2023 at 5:00 am

Although there is no data cataloging these moves, real estate experts said a number of households have relocated to Illinois, or are preparing to relocate, in search of a safer and more welcoming environment for the LGBTQ community.

Go figure, the crowd that thinks men can become women also believes that Illinois is a good place to live. LOL they’re all delusion…terrible lifestyle choices.

Lol… how true! As an older conservative gay guy, I’d like to yell ‘Don’t move here’, but with these libtards “You can’t fix stupid”…

Sure, PPF, IL revenue has increased. The property taxes in our home here in SC went down from $1695 to $1600. Meanwhile, property taxes in our old home in IL went up $200+. Because SC has a $2 billion surplus, income tax rates have gone down and may disappear in another 2 years. Gas is $3.20 gallon, while isn’t the gas tax in IL going up again this summer? I’ve kept my 630 area code cell number and the state and local taxes have gone up on that. Sure revenue increased, it’s called death by a thousand cuts. Or, turning… Read more »

Moved for central IL to TN a few years ago. IL went back though my tax records and found a $48 dollar discrepancy, on a payroll tax, sent a bill ($145) to me in TN. So my first year here I paid more tax to Il than I did in TN

My plates for 3 truck, one motorcycle, and a work trailer.

cost about the same as 1 truck in IL But the riads are much better here.

The only surprise is the Fleeing numbers are not higher. They will be going up in the next few years as taxes double and double again. PPF is right, you must raise taxes. The hard-working family man is right by moving. Best of luck with raising costs and declines population.

Taxistan will respond to the lost tax revenue by raising property, income, sales, etc. taxes!!

This will be fun to watch from low tax Colorado.

The exodus is masked by the fact that it happens so slowly, perhaps 1 percent a year. When Illinois finally has a year when it’s 2% leaving instead of 1%, that may start the stampede. Residents will start feeling the pressure to sell their house and beat their neighbors out of the state. There will be a “now or never” mindset. In the meantime, I’ll relax and watch the homes in my red state appreciate in value, probably somewhat in proportion to the blue state’s loss of appreciation. You can join me now, join me later, or remain stubborn in… Read more »

Those folks that waited to sell property in Detroit never recovered. Many went to their graves either underhoused or with a mortgage on their new suburban home.

The problem is just because AGI leaves does not mean preexisting obligations for pension, POB’s and other debts leave. The state stills owes X amount, it’s just there are less to pay it which means more per capita.

I reluctantly left several years ago, ending up in Florida. Low property taxes, no state income tax, 7% sales tax, and gas is $3.25 a gallon.

What you didn’t mention is that property taxes don’t go up every year in Florida, some years they go down.

I live in north central Florida and my property taxes went down quite nicely this year.

Florida House sends $1.4 billion tax relief package to Senate

It’s a downward spiral now.

Has been for a number of years. As we wrote here long ago, “it’s happening.”

The Illinois political economy as always has several interconnections. This is why the recent points of focus at Wirepoints – commercial real estate, crime, the incredibly poor education system, high taxes and the never melting iceberg known as pension debt all matter. Query whether the commercial real estate market will be the precipitating event for an increased exodus. Overall property tax revenue can’t go down, and additional 20 percent on residential tax bills will be dismal. I have lived through several business cycles where the numbers looked bad, including 2008. But 2008 was caused by a total neglect of underwriting… Read more »

Even the White House said last week it is concerned about the impact of a commercial real estate crash. Other than Crain’s (which has covered it well) the press here ignores it.

How is JB going to spin this one.

He may just ignore it. So far, the regular press has ignored it and not asked.

No one in the legislature, governors mansion, or mainstream press will care while revenues have increased. You can explain the increase in revenue on the juiced up inflationary economy post pandemic but most people won’t care. As I’ve said many times, as long as revenue is going up they can brush aside population loss. Talking to the masses about opportunity costs of people leaving won’t garner any attention. If the press does ask JB the question, he will throw in a couple of “carnival barkers” and “spelunkers” comments along with stories of record revenue and credit upgrades, and we will… Read more »

Agreed. And the relative position of Illinois will decline year by year, making us hopelessly uncompetitive.

This is not going to end well.

Well Mark, it looks like JB went with a different answer. He, with Rich Miller’s help, is pointing out that the addresses in the report only reflect the mailing address and not actually where people live. I was not expecting that.

Yup. Pathetic. We will have our own piece on that ridiculous answer soon. I guess the IRS is just another carnival barker. Same with the Census Bureau, moving van companies and our own eyes and ears. All carnival barkers. Oh, and the Wall Street Journal, too. See their article on top left of homepage.

Note that it is the higher incomes and the young college graduates (taxpayers for 45 years) who are leaving in big numbers. The remaining are low income or no income residents.

Who/what is JB going to blame when the revenue isn’t enough? He can’t blame the flat tax because the state boomed after the fair tax failed. He can’t blame millionaires not paying their fair share because if they technically weren’t the last few years, how did the state do so well?

By not calling out the free federal money and its inflationary impact as the primary driver of Illinois’ financial situation, he pretty much backed him into a financial corner.

Like all communists, he’ll blame his enemies, and accuse deplorables of cheating on taxes, or moving out of state, or discouraging business formation.

nixit, JB’s political plan seems pretty straight forward. If people complain about population loss he counters that all the reports are just estimates and he can say that those same estimates were wrong last decade. Results in boring back and forth that most voters tune out. If you say look at all the high income people leaving the state, JB can counter with revenues are up in the state and that IRS data doesn’t accurately reflect where people actually live. Boring back and forth about accuracy of data but tax revenue is still where expected so public tunes it out.… Read more »

Illinois revenue won’t drop but it’s not keeping the pace of inflation. Which means its dropping in real revenue.

I’ve never disputed that. Just that “real” gains or opportunity costs don’t land with the regular voters.

“Straight” and “forward” is not how I would describe fatty’s politics. Is this from the communist’s dictionary?

The most significant place to observe population loss is Chicago. The lack of population really begins to matter to a high overhead city. And at some point even the media will report on it. One can look to Baltimore, which mimics Chicago in both policies and dismal outcomes. Baltimore’s population is now at 560,000. Its most prominent employer is Johns Hopkins – and they are tax exempt. Crime is most often cited as the reason for leaving – and as in the South and West sides of Chicago-black population loss has been and will continue to be significant. Schools are… Read more »

He absolutely will blame all those things you mentioned and no one in the Chicago press will challenge him.

Downward spirals are unfixable and pretty much irreversible. The only question now – where is the bottom?

It looks like this, the tallest abandoned building in East St. Louis, completely empty, blighted….