By: Ted Dabrowski and John Klingner

There’s no indicator quite as damning of a state’s failure to govern than the flight of its residents to other states. In Illinois’ case, the state is doubly damned as IRS migration data shows there’s not a single group of people that the state attracts more than it repels.

Everyone is leaving Illinois. Old and young, rich and poor, it doesn’t matter.

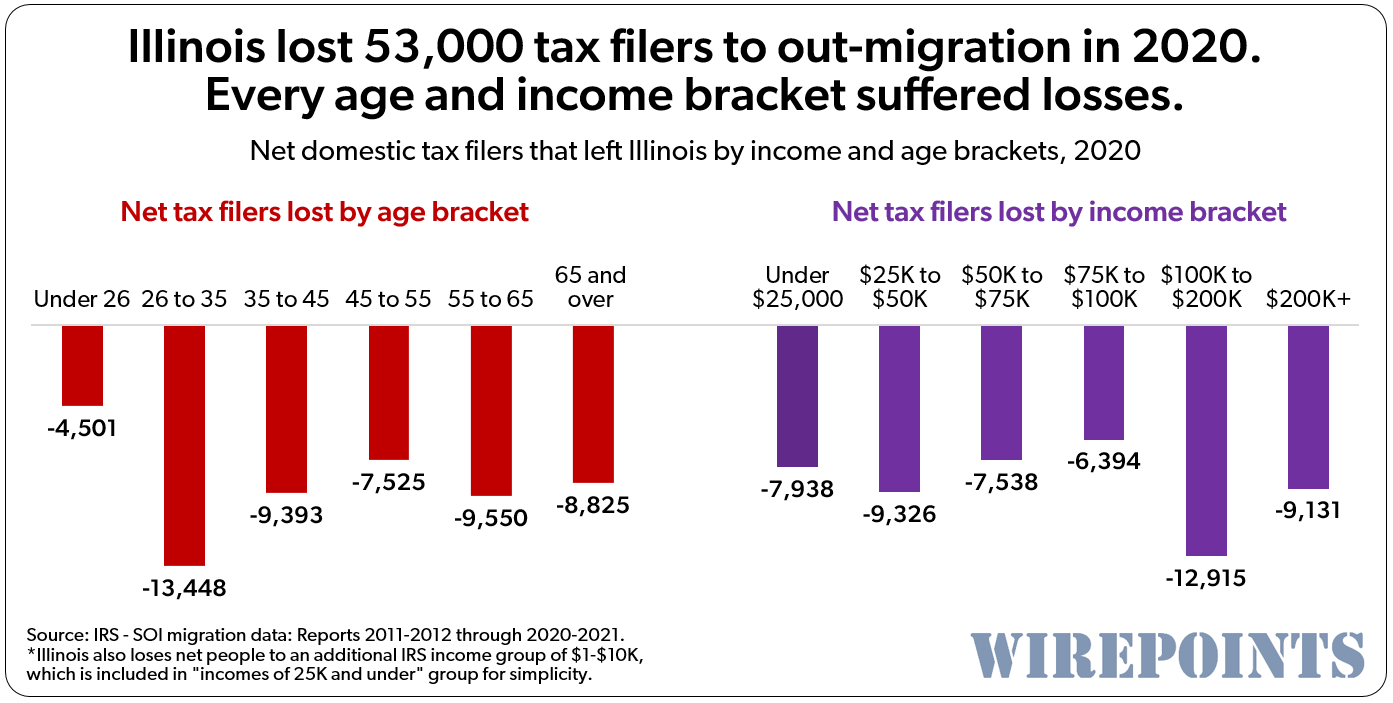

The latest data from the IRS shows Illinois lost a net 105,000 people to other states in 2020 due to out-migration. 53,000 of those leavers were the tax filers and the other 52,000 were their dependents.

Outmigration-deniers say the state’s losses are due to retirees seeking better weather. But the data shows the urge to leave is universal. Illinois lost tax filers from every age and income group in 2020.

Notably the biggest losses of residents were two that should be a big cause for concern: the prime-working-years age bracket of 26 to 35 (-13,448 filers) and the higher-income-class bracket of $100 to $200K (-12,915 filers). Illinois is losing its mobile young and its wealthy cohorts more than any other groups.

The IRS report provides hard, indisputable data on the movement of Americans between states. The department reviews tax returns annually to track when and where tax filers and their dependents move. The IRS has also broken out the ages and income brackets of filers since 2011.

The IRS report provides hard, indisputable data on the movement of Americans between states. The department reviews tax returns annually to track when and where tax filers and their dependents move. The IRS has also broken out the ages and income brackets of filers since 2011.

This year’s report is based on tax returns filed in 2020 and 2021, covering taxpayers and their dependents who moved from one state to another between 2019 and 2020 (See appendix for changes in Wirepoints’ reporting methodology).

The long-running exodus

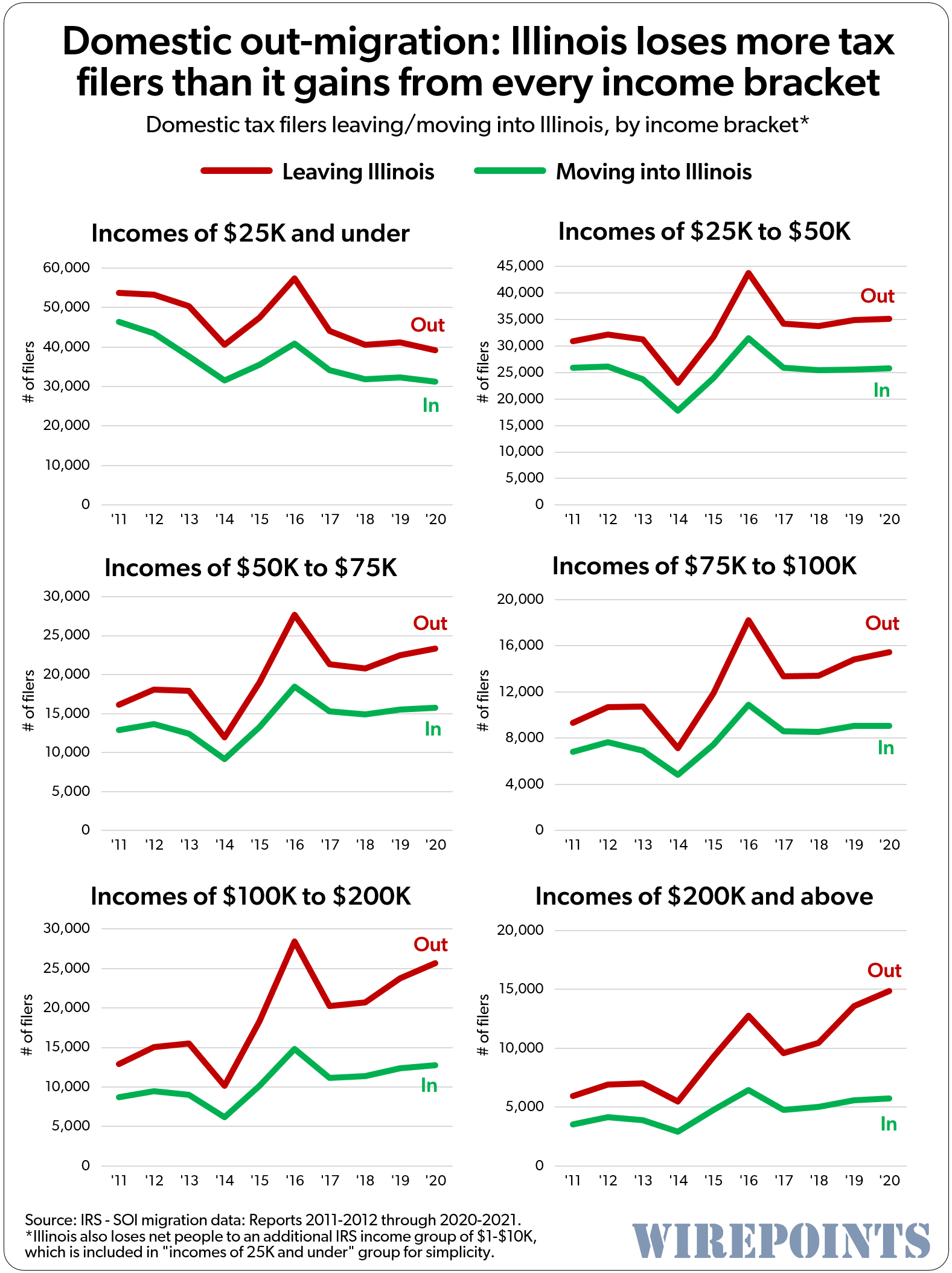

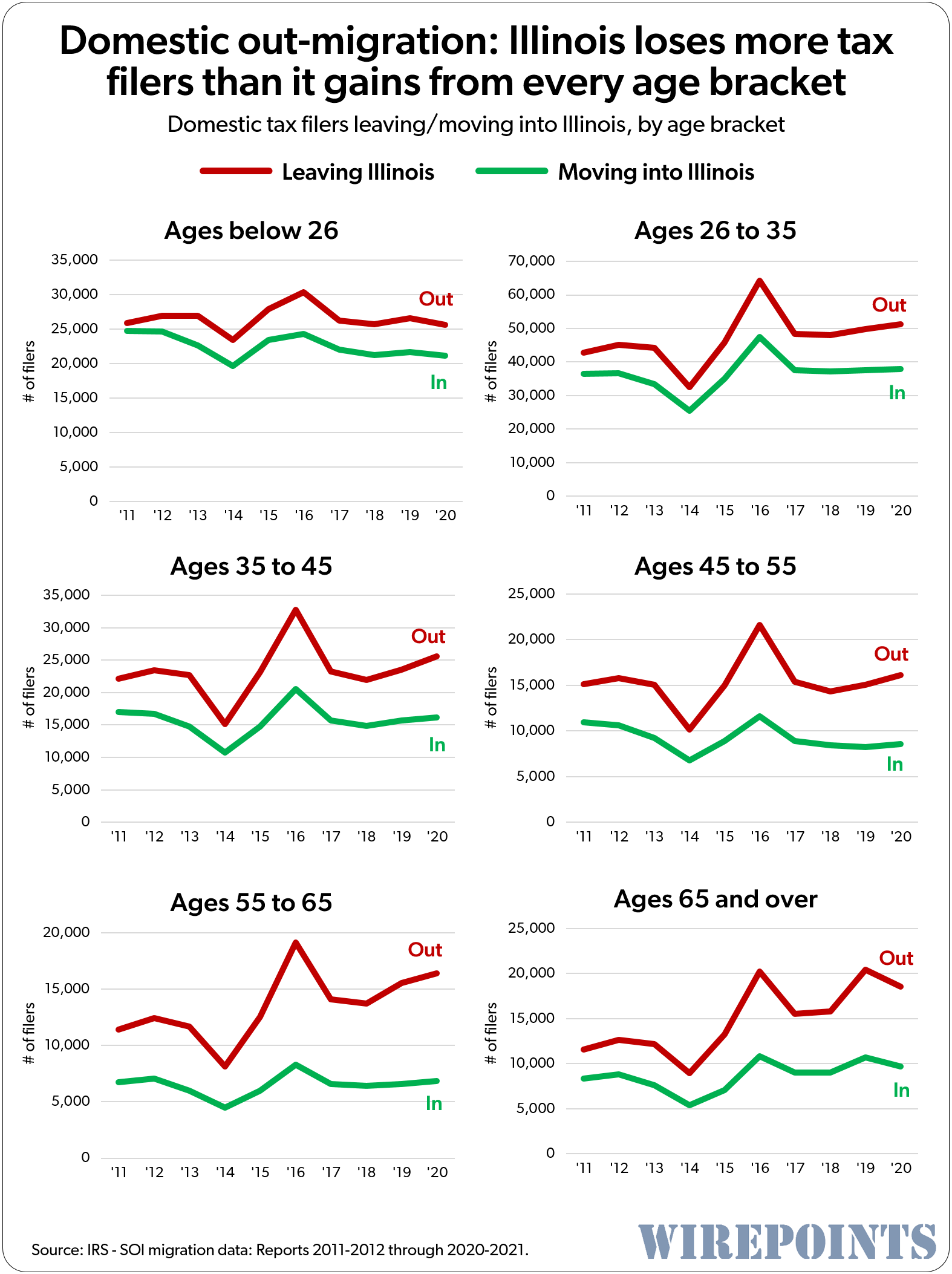

Illinois’ loss of taxpayers isn’t a new phenomenon. The charts below include the in- and out-migration of tax filers by age and income between 2011 and 2020. In every year and in every bracket, far more tax filers have left the state than moved in.

Not only that, but the gap between those moving in and moving out is consistently growing, spelling even more trouble going forward.

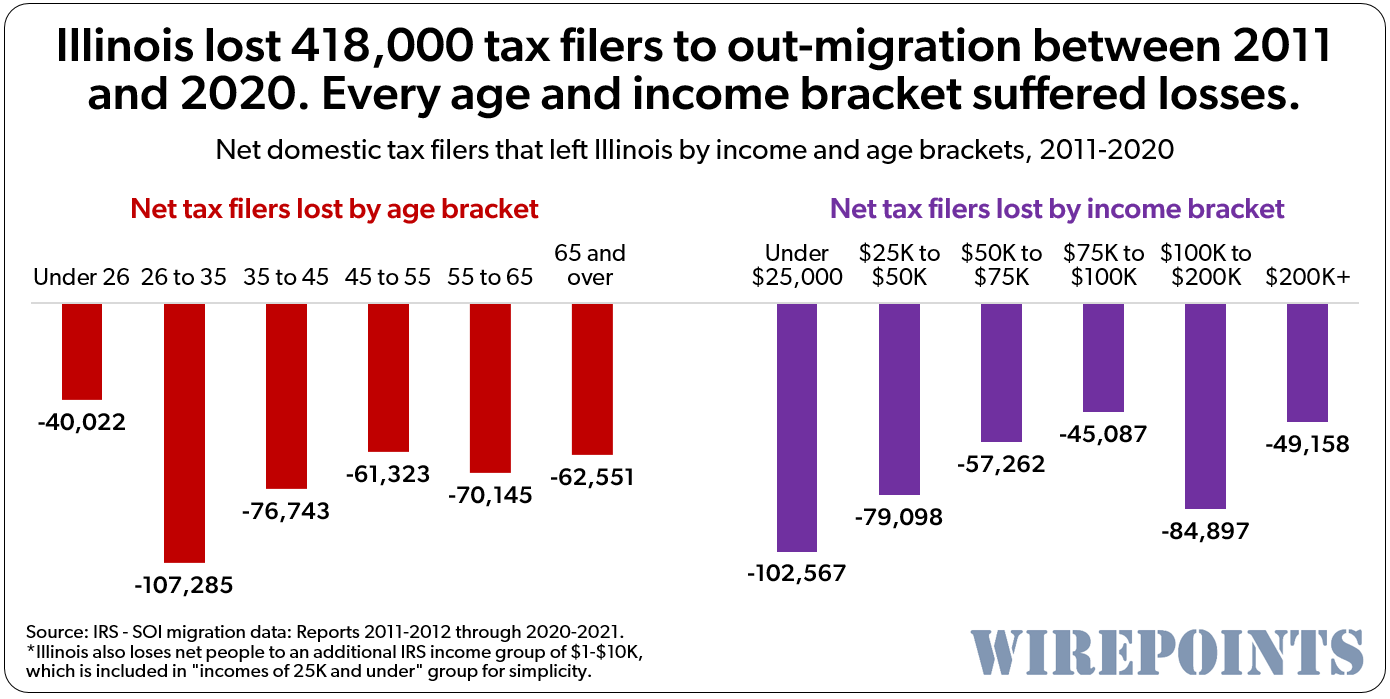

Wirepoints combined the impact of that decade of net out-migration into the one chart below. Between 2011 and 2020, Illinois gained 990,000 tax filers from in-migration but lost 1.408 million to out-migration. That’s a net loss of 418,000 tax filers. And when you include their dependents, Illinois lost a whopping 843,000 people, on net, to out-migration.

Wirepoints combined the impact of that decade of net out-migration into the one chart below. Between 2011 and 2020, Illinois gained 990,000 tax filers from in-migration but lost 1.408 million to out-migration. That’s a net loss of 418,000 tax filers. And when you include their dependents, Illinois lost a whopping 843,000 people, on net, to out-migration.

All of the metrics that make Illinois a national outlier drive the state’s growing exodus. Illinois isn’t just losing elderly people looking to retire to a sunny state, it’s losing prime age workers that found better job opportunities elsewhere, empty-nesters that wanted to escape the state’s high taxes, and wealthy businessmen like Ken Griffin who moved their companies to less crime-filled locales like Florida.

All of the metrics that make Illinois a national outlier drive the state’s growing exodus. Illinois isn’t just losing elderly people looking to retire to a sunny state, it’s losing prime age workers that found better job opportunities elsewhere, empty-nesters that wanted to escape the state’s high taxes, and wealthy businessmen like Ken Griffin who moved their companies to less crime-filled locales like Florida.

Illinois has to fix those issues if it wants to remain competitive and draw people back.

Appendix

For years Wirepoints and others have reported the “taxpayer migration” year based on the IRS migration report date. Take, for example, last year’s “Migration Data 2019-2020” IRS report which is based on tax filings made in 2020. Most reports cited the migration data as 2020, which matches the IRS nomenclature.

However, the IRS explained in an email to Wirepoints that: “The 2019-2020 Migration Data refers to tax returns that were submitted to the IRS in calendar years 2019 and 2020, which corresponds to tax returns and income that was earned in 2018 and 2019, respectively.”

That means the true outmigration year in the example above is 2019, and not 2020. Wirepoints has adjusted its ‘migration year’ to 2020 in this year’s 2020-2021 report to more properly reflect this fact.

Read more from Wirepoints:

- State of denial: Gov. Pritzker says IRS migration data isn’t ‘migration data’

- New IRS migration data: New York, California, Illinois are the nation’s big losers of people and their wealth, Florida, Texas the big winners – A Wirepoints 50-state survey

- The Illinois exodus continues. New IRS data shows the Prairie State is nation’s 3rd-biggest loser of people and wealth to other states

- The Great Re-Sort: New, National Survey Indicates Political Migration Will Soar

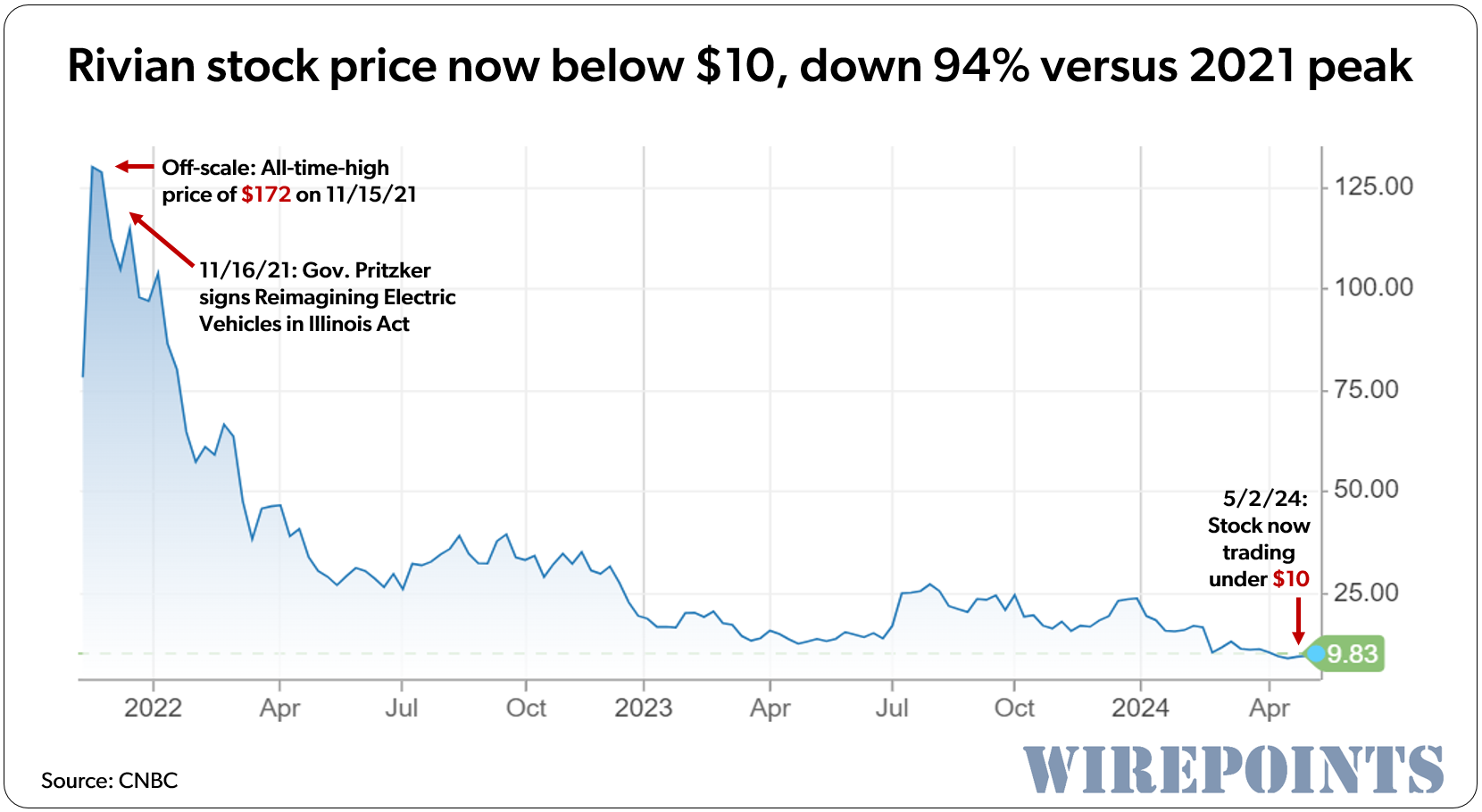

At $1.5 million per job, the new incentive package from the state is at least 15 times the norm. For this much money, the state could have just handed out a million bucks to 827 people, instead of creating 550 jobs.

At $1.5 million per job, the new incentive package from the state is at least 15 times the norm. For this much money, the state could have just handed out a million bucks to 827 people, instead of creating 550 jobs. Ted joined Jeff Daly to discuss the university student protests erupting across the nation on the Israel/Palestine conflict, why it’s so dangerous for society if the media abandons facts in favor of narratives, why that allows government to spin away the problems like crime and financial crises, why it causes the voting public to become apathetic, and more.

Ted joined Jeff Daly to discuss the university student protests erupting across the nation on the Israel/Palestine conflict, why it’s so dangerous for society if the media abandons facts in favor of narratives, why that allows government to spin away the problems like crime and financial crises, why it causes the voting public to become apathetic, and more. When you hear the complaints from Illinois politicians, remember the hypocrisy: 40,000 bused to Chicago, but 161,562 allowed to fly directly to Florida.

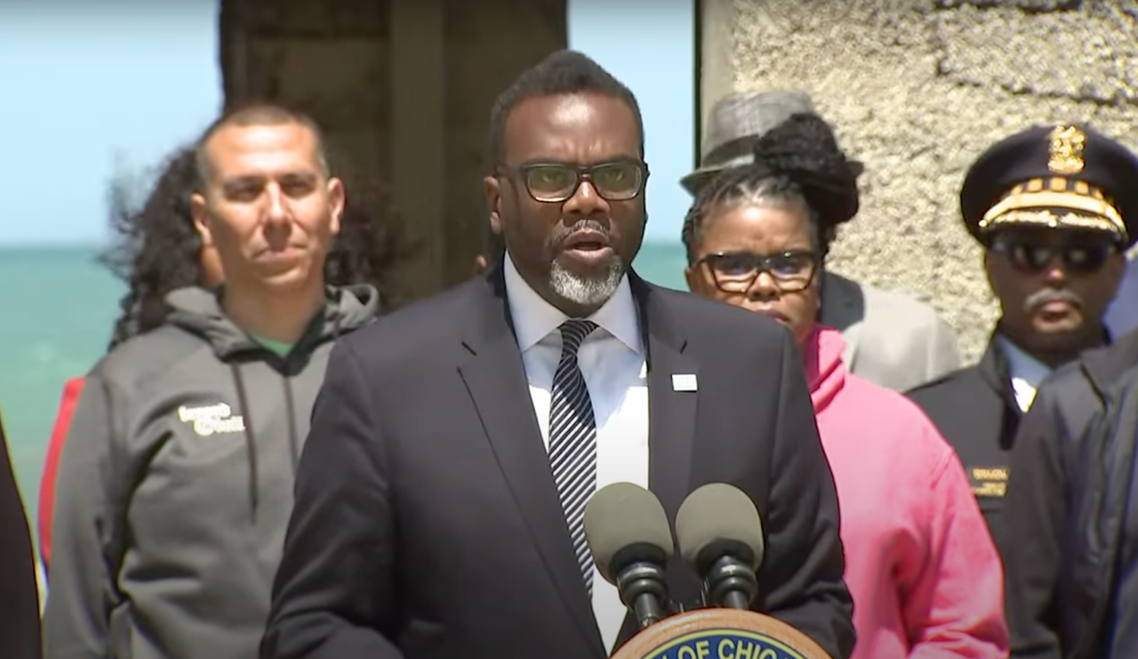

When you hear the complaints from Illinois politicians, remember the hypocrisy: 40,000 bused to Chicago, but 161,562 allowed to fly directly to Florida. Nearly one year ago, Chicagoans cheered Mayor Lori Lightfoot’s removal from office. In her place was Brandon Johnson, who promised a more inclusive approach to building a “better, stronger, safer Chicago.” It hasn’t turned out that way. Today, there’s little disagreement that Mayor Johnson has disappointed on most key issues. On crime. On policing. On migrants. On education. On governance. Even on foreign affairs.

Nearly one year ago, Chicagoans cheered Mayor Lori Lightfoot’s removal from office. In her place was Brandon Johnson, who promised a more inclusive approach to building a “better, stronger, safer Chicago.” It hasn’t turned out that way. Today, there’s little disagreement that Mayor Johnson has disappointed on most key issues. On crime. On policing. On migrants. On education. On governance. Even on foreign affairs. Ted joined Dan and Amy to talk about the problems and costs of the Chicago Bears’ proposed new stadium, why its unlikely to happen in its current form, why the ongoing wave of violent crimes makes residents scared of the city, and why the funeral of slain police officer Luis Huesca matters to Mayor Johnson’s reputation.

Ted joined Dan and Amy to talk about the problems and costs of the Chicago Bears’ proposed new stadium, why its unlikely to happen in its current form, why the ongoing wave of violent crimes makes residents scared of the city, and why the funeral of slain police officer Luis Huesca matters to Mayor Johnson’s reputation.

They are destroying cities and therefore the States they reside within on purpose.

These once glorious, industrious cities are set upon the best waterway, rail and roadway systems into the country. They are creating the exodus thereby decimating the property values with crime, taxes etc. Then they and their Chinese partners will snap up the wasteland at pennies on the dollar while eliminating any need for “elections” since there will be no opposing party left.

The immutable laws of economics will have their say.

If we are not losing people have JB explain how we lost a congressional seat?

He removed it to cheat on his taxes!

Query- Since property taxes and pensions are the two largest discussions on this site and realistically nothing will be done on pensions so that leaves property taxes. If there was quick and real reform on property taxes (1-2 years max) how many people would decide NOT to leave? Dropping the taxes to 2%-1.5% of value or less statewide would dramatically increase home values thus increasing with a reasonable tax rate. This could be only for residential not commercial for a start. Would you stay? Ideas on how this could be done and how to implement. Property taxes as % of… Read more »

At a macro level, Leftist Democrats in IL have a huge spending problem – just look at the Red State bailout bonanza and how it quickly was spent. And the $1B obligation added to provide illegals with healthcare. Playing around with the revenue pieces doesn’t address the spending problem. Leftist Democrats on every fiscal measure are out of control. Of course they won’t admit this, so how can you possibly try to mitigate what they won’t own up to. No, Pritzker and the Leftist Democrat schemes are all about confiscating more.

Lowering property tax rates does not necessarily guarantee an increase in home values. However, it is possible that lower property taxes could make homes more attractive to potential buyers and lead to an increase in demand, which could in turn increase home values. My real estate tax bill covers 6% for pension costs, 14% is paid to the county and nearly 75% for schools. All of these entities would need to play along with your idea and live on less. Likely? Highly doubtful. Imagine the outrage if the state declared that all these mouths to feed were told to cut… Read more »

https://www.indystar.com/story/opinion/2023/04/29/reduce-tax-burden-on-hoosiers-65-and-older-by-eliminating-school-taxes/70160764007/

Here’s an opinion on Indiana property taxes. Hope the link works.

Absolutely solid reasoning, and borne out by home values in States with property tax rate caps (California and Indiana have tax rate caps of 1% of fair market value). Home values are inversely correlated to property tax rates. That is due to cost of carry: most potential buyers need to qualify for a mortgage. To qualify, monthly payments must not exceed a certain percentage of household income. If it costs potential buyers an additional 2% of total home price here annually, the only variable factor that can change to make the buyers qualified is price of home. Furthermore, many in… Read more »

I predict the gaps between out and in migration statistics – by age as well as income disparity – will be much, much wider in 2021 and 2022. The hot, hot housing market that started in the second half of 2020 created the perfect opportunity to maximize proceeds from selling while achieving exodus from Illinois; it certainly served as my trigger to exit. According to Illinois REALTORS, the number of Illinois home sales in 2020 outstripped 2019 (pre-COVID) by 10%, but 2021 exceeded 2019 by 23%. And despite a dramatic increase in interest rates last year, 2022 surpassed 2019’s volume… Read more »

So, help me understand. If we increase our Medicaid cost for illegal immigrants to $1.0B. Illinois loses $10.5B in income meaning about another $500MM in income tax revenue not to mention potential sales tax revenue and we cannot cut our spending, we actually need to spend more, where does the windfall of $1.5B+ come from? I guess I will be one of the taxpayers old Jelly Belly JB wants to move. I earn more than those moving here, so the state losing more tax revenue which does not matter. Another 18 months and then hello red state! Illinois & Chicago… Read more »

We may lose revenue with every immigrant but we make up the difference in volume!

All Illinois has to do is request more illegals be sent here from the border states.

Whatever it takes to get some population growth going!

There is an old joke that goes like this.

Waiter, I have two problems with this meal.

#1-The food tastes like Schitt.

#2-And there is not enough of it.

That is agenda 2030.

That 26-35 age bracket is brutal. That’s basically people who started their careers but decided they’re going to finish their careers somewhere else before they get too settled. That’s the group moving from rental to home ownership and starting families. And they’re probably never coming back.

I know this bracket well. It’s the midwestern and beyond recent college grads who move to Chicago and live in Lakeview, Lincoln Park, the loop, west loop, etc. They live the lifestyle for a few years, get the big city experience. Some of them stay like many of my neighbors, but many of them leave and return to a smaller town. It’s easy to be a bigger fish in a smaller pond when you have big city experience. Look up the website bios of many professionals (especially chefs, lawyers, accountants, advertising, consulting, etc) in smaller markets like KC, Indy, Milwaukee,… Read more »

Democrats pretend there isn’t a problem, because new immigrants tend to replace these people. This influx of people annually has given lots of cover for Democrats and their policies, making it seem as though things are just fine.

Not new immigrants – these aren’t people from poland or india arriving through chain migration. They are illegal immigrants from Mexico taking over the suburbs. Even my mostly white community is changing, with any non-white person of means, paying as much as they can afford, to buy a three bedroom split-level for $500k, to get away from the unwashed masses of immigrants flooding most towns not already mostly white. I have no problem with this, I’ve always been a classist, not a racist, and if you can afford to live here, good for you, and you’re a parent, you’re gonna… Read more »

Have you ever heard anyone that left say it was a mistake? I never have.

Not once. You can find folks who keep themselves connected by living in a border state. This is by far the easiest way. Anyone that leaves sees an instant bump in everything that costs so much more in Cook County. Groceries, gas, utilities, mortgage, and much higher quality schools usually.

As I got my DuPage County tax bill yesterday, I’m reminded of how much I want to leave this state and will do so as soon as I can. Everyone, not just retirees, get an immediate “pay increase” the minute they leave. Cheaper property taxes, cheaper income taxes, cheaper gas, everything cost less than Illinois unless you’re an idiot that moves to another blue state.

Got my tax bill yesterday too, 7% overall increase fueled by a 19% increase for the school district. Surprisingly no increase in teacher pensions but that’s a ticking time bomb.

Thats why home sales & prices are continuing to boom across Indiana even with the slowing economy & higher interest rates.

The benefits of Fiscally Responsible Government & low taxes continues.

This and the never ending supply of Money Printer go Brr fleeing blue states into red states. One of the benefits of red states is that they used to be cheaper and more affordable than blue states. These days, not so much. The less desirable blue states are becoming the low cost of living states: new mexico, michigan, etc…

Since these data are lagged to just prior to the Covid era, my feeling is that this is only going to get worse. Illinois was one of the “severe lockdown/masking/schools closed” states, and people are still masking in medical facilities here. Only in the last month has my local teaching hospital relented on masking for ordinary check-ups and even things like physical therapy. Have you ever tried to work out with a mask on? It’s ridiculous, but that’s how brain damaged our policies are. These little miserable things have a big impact on quality of life. The straw that breaks… Read more »

A bad problem made worse by the fact that the people responsible for making the decisions that have caused taxpayers to flee refuse to even acknowledge that taxpayers leaving more frequently than they arrive is even occurring.

Or that they’d consider that a problem needing correction even if they agreed it was happening.

That would be the same people voting on reams of legislation they haven’t read, just as fast as they can, on their way toward another pat-ourselves-on-the-back ‘balanced’ budget.

Illinoisans are so tolerant of all this mendacious governance.

These graphs are beyond the comprehension of most graduates from the Illinois public school system (especially Chicago). Perhaps that is the core problem. We now have one or two generations of extremely poorly educated residents of voting age. If their minds haven’t been trained to reason, or to understand basic data, they will believe the lies of whomever is speaking the loudest. If this theory is correct, that means it will also take one or two generations to correct the problem, and of course that can’t start until Illinois drastically improves its public education system. Illinois leaders have no incentive… Read more »

‘If this theory is correct” It is

My other theory is that something in the Illinois ground, air, or water causes mass stupidity.

There is no such thing as magic dirt.

The moderate suburban kids usually go out-of-state, many of whom will not return. It’s the SJW’s who commute to UIC/DePaul as they work towards their unmarketable degrees that are the problem. They all want to work the non-profit circuit but be compensated like a young professional. Unfortunately for us, they’re the growth sector around here. Definitely not adding to the tax base.

My son is looking for a starter home, he’s 26, he pre-qualifies for 250K. But there is no market for starter homes in Illinois, basically starter homes in North Illinois are dilapidated shacks priced above 250K. I encouraged him to leave Illinois and look near his cousins in TX for a place. Never thought I’d be telling my kids to get the hell out of Illinois, but I actually feel it’s good advice and it’ll give the wife and I a reason to vacation south more often. We are only still here because our other kids have our grandkids here,… Read more »

It might be time for an extended family meeting. I bet others in the family are sticking around out of concern for you.

If you thought it could not get any worse here’s an article that defies logic. Heard this yesterday. With good credit your mortgage rates goes higher with a lower credit score it will go down. The reasoning is that many first time buyers are priced out of the market by both home values and higher mortgage rates. They fail to mention how high property taxes factor into the equation. So now we will be subsidizing those with poor credit.Bizzarro World on steroids.

https://www.newsweek.com/biden-raises-costs-homebuyers-good-credit-help-risky-borrowers-1795700

I pushed my boys to Indiana. Unfortunately I’m stuck here because my wife won’t move, but that’s temporary for me. Tired of the economic hardship!

So, are you dumping Illinois or the wife?

both!

IL is one of the cheaper urban markets outside of small to medium sized rust belts towns. Even with IL’s higher RE taxes, it’s still cheaper to buy in IL considering the high interest rates and higher home prices elsewhere. This has only some to do with IL and more to do with the trifecta of the federal government, federal reserve and financial institutions. They’ve been juicing the market with low interest rates for years, encouraging lax lending, and a lot of that money has flowed into the residential investment market. Not too long ago we had the iBuying phenomenon,… Read more »

Sad story about people duped by real estate hucksters elsewhere and Florida is full of them, so buyer beware. That said, Chicago and collar counties are not cheaper than prices elsewhere and especially so if one factors in the seemingly forever spiraling real estate taxes. And the weather pretty much sucks here 8 months out of the year as well.

Florida has been the place for real estate specuvestors to lose their money for a century now, so that’s no surprise: Gailbraith had a chapter IIRC called Florida, sweet Florida in his 1955 epic The Great Crash (highly recommended BTW) about the 1920’s. But as for other places being cheaper, yes, maybe three or four years ago other markets were cheaper than Chicago. But now, no way. Look at the appreciation rates: in Nashville, prices rose 22.4% in just 2021 alone. The median price is $431,000. TN has risen almost 50% in the past two years. SLC’s home prices have… Read more »

Yep, grandkids are keeping many of us retirees stuck in IL.

You can always move to a neighboring state like Indiana & Wisconsin.

The grand kids argument isn’t flying.

The data doesn’t lie, yet Pritzker continues his gaslighting and use of his favorite name calling – carnival barkers.

I left Taxistan in my mid 40s.

Don’t regret leaving and my bank account has an extra $200K in it from lower property, sales, gas income, etc. taxes.

Taxistan is run by the corrupt Illinois Dems and their masters the public sector unions.

One word describes it perfectly – RACKET!!

Even though Illinois doesn’t tax retirement income, some seniors still want out. Illinois can’t fix the weather, no matter how much it pretends it can.

FYI: I know Illinois provides some property tax relief for seniors. Can someone explain how that works? For example, if the tax on a home is $10,000 when they turn 65, what happens in subsequent years? Thanks.

You would think with no state income tax on retirement income that retirees would be flocking here in droves. Strangely, they’re not. If anything, maybe current in-state retirees treat it like golden handcuffs.

Once you apply for it and are approved, the senior exemption renews each year automatically. Currently in Cook County, it’s a maximum of an $8K reduction from your equalized, assessed value.

The senior freeze exemption is where the money is at. But you need to be below a certain income amount, basically living off social security or a small pension to qualify. And you have to reapply every year.

Good luck qualifying for the senior freeze. Dupage used to be 55k and is 65k or less per household to qualify. You still get zero offsets. For example, Social ecurity is counted as the gross amount received and excludes any medicare premiums paid.

Other than the standard homeowners and senior exemptions any additional senior property tax cap is only for those pretty much eligible for welfare. Incidentally, if one had their homestead and senior exemption in place and then applied but was denied the additional real estate cap, one must reapply for the homestead and senior exemption because at least in Cook County, these exemptions are dropped with the denial. Crafty bunch in Cook County

When companies such as Ken Griffin or Boeing leave, their employees, who are usually well compensated, also leave, taking their AGI. Those are not retirees. Lose those companies, lose their executives, and the low end employees lose their jobs.

Add Guggenheim Partners to the list.

This is just the beginning, many more to come in the future. The race is on to get out of Dodge. The increasing taxes and decreasing service is a death wish for Illinois. Texas and Florida’s economies are growing like wildfire. No one has sold more Florida Real Estate than the teachers union pension fund.

They are the same group leaving Illinois and buying up the real estate as well.