By: Ted Dabrowski

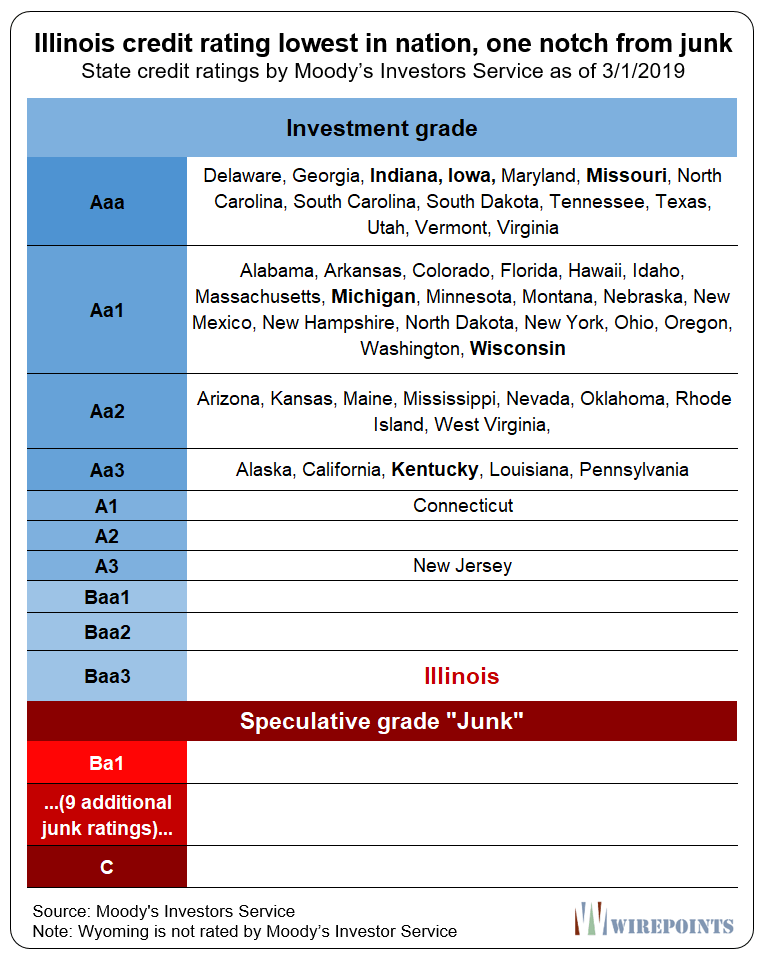

Go to this page on Rich Miller’s Capitol Fax and you’ll see a Wirepoints graphic that shows just how bad Illinois’ credit rating is compared to every other state in the nation. The graphic, shown at the end of this piece, was part of a Wirepoints’ article highlighting Indiana’s celebration of its AAA credit rating and Illinois’ just-one-notch-above-junk status.

Unsurprisingly, the commentary by some of Miller’s followers blamed former Gov. Bruce Rauner for the terrible rating – as if Illinois’ fiscal collapse started just four years ago when Rauner became governor. It’s the same narrative that was pitched by the Pritzker administration before he released his proposed budget – just read Deputy. Gov. Dan Hynes report for a start.

It’s true Rauner’s four years were a failure and that the Rauner/Madigan impasse made things worse. But to blame Rauner alone for Illinois’ near-junk status is short-sighted, to say the least. Illinois was a fiscal disaster long before Rauner.

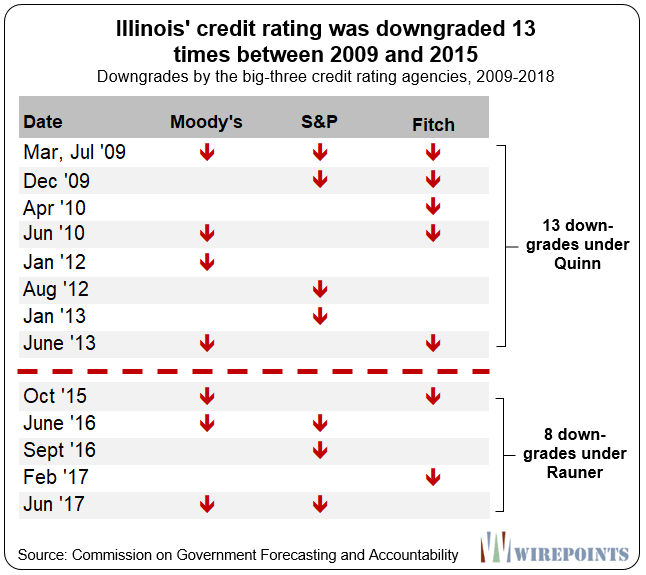

In case you need a reminder, take a look at this graphic and the eight years before Rauner. Illinois was downgraded 13 times by the big three rating agencies during the Gov. Pat Quinn years, and many of those downgrades occurred even after the “temporary” tax hike that raised over $31 billion in additional tax revenues from 2011 through 2014. The tax hike was supposed to fix Illinois’ pension and unpaid bills problems.

A second reminder is that Illinois was already the nation’s worst-rated state as far back as 2010, by Moody’s Investors Service.

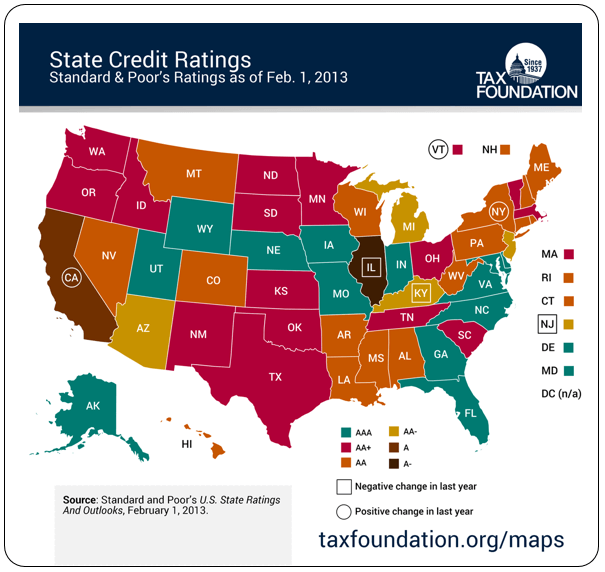

And as the Tax Foundation graphic below shows, Illinois stood alone among states in 2013. By then, S&P had also slapped Illinois with the lowest credit rating in the nation, which, by the way, was right in the middle of Illinois’ then-temporary 2011 income tax hike.

No, the near-junk rating isn’t because of Rauner. It’s because Illinois politicians on both sides of the aisle – from Gov. Jim Edgar to Gov. Pat Quinn – pursued a no-reform, can kick, borrow and tax agenda. Gov. Pritzker’s latest plan promises to do the same. None of the credit rating agencies liked his budget proposal. See what they say: Fitch. S&P. Moody’s

If you want to see how Illinois’ mess was really created, read Wirepoints’ 20 facts Gov. Pritzker doesn’t want ordinary Illinoisans to know

See the below to learn more about Illinois current crisis:

- What Pritzker’s progressive tax rates will probably look like

- Moody’s to Pritzker: “New taxes could threaten to increase the outflow of Illinois residents”

- Illinois’ lethal combination: Rising property taxes and stagnant incomes

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted, I thoroughly enjoy your articles when the rating agencies are brought into the picture. It is my opinion, based on what I see, that rating agencies are no longer rating agencies. They have stepped outside their fiduciary purpose as impartial raters, and actually have made themselves part of the very investments they are rating. For example Pritzker is “meeting” with an agency… Why? A rating agency is supposed to rate an investment periodically the way it IS, not the way their investors “hope” it was, not the way they would like it to be, not the way it could… Read more »

The better question to ask is… “Whos responsible for Illinois credit rating still being near junk and not junk?”. The collusion of investors, politicians and the rating agencies are keeping it investment grade so they can make lots of high yields off a constitutionally enslaved taxpayer.

Vote with your feet and leave Taxistan!!!

Dem politicians need to throw their voters a reason for Illinois woes. Since these voters can’t be allowed to feel any blame for the mess, it makes sense to blame someone they didn’t vote for….Rauner. The liberal voters don’t think deeply about issues so they are easy to fool.