By Ted Dabrowski and John Klingner

Illinois lawmakers continue to ignore pension reform so, not surprisingly, Illinoisans are on the hook for billions more in pension debts.

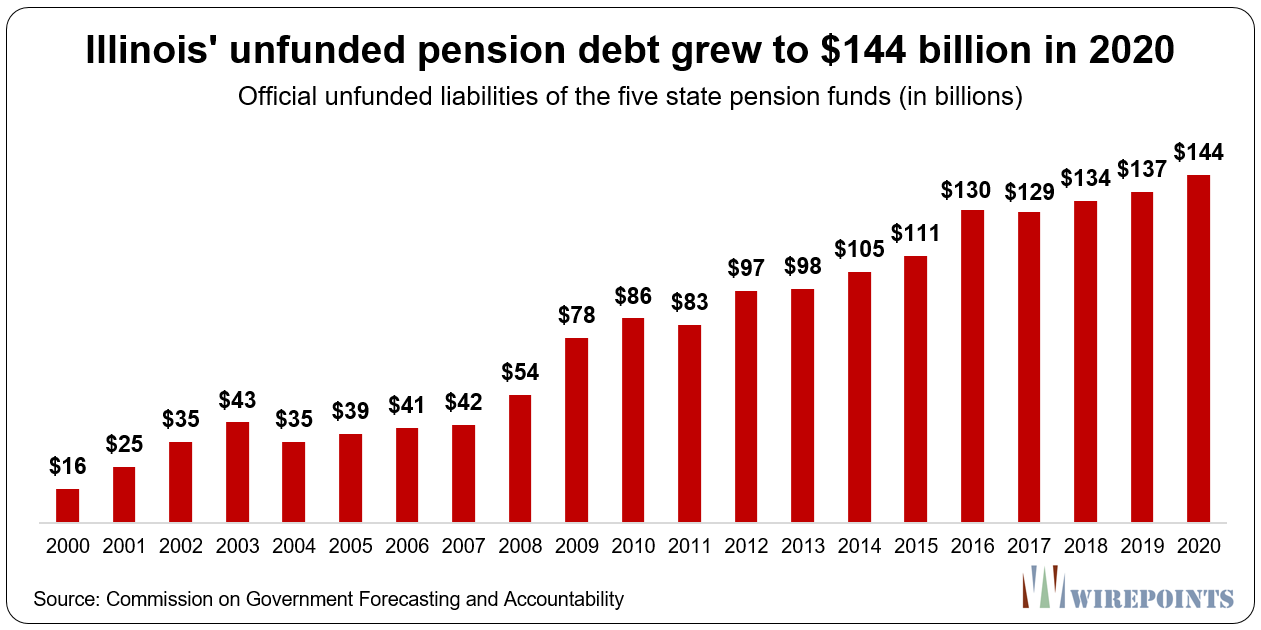

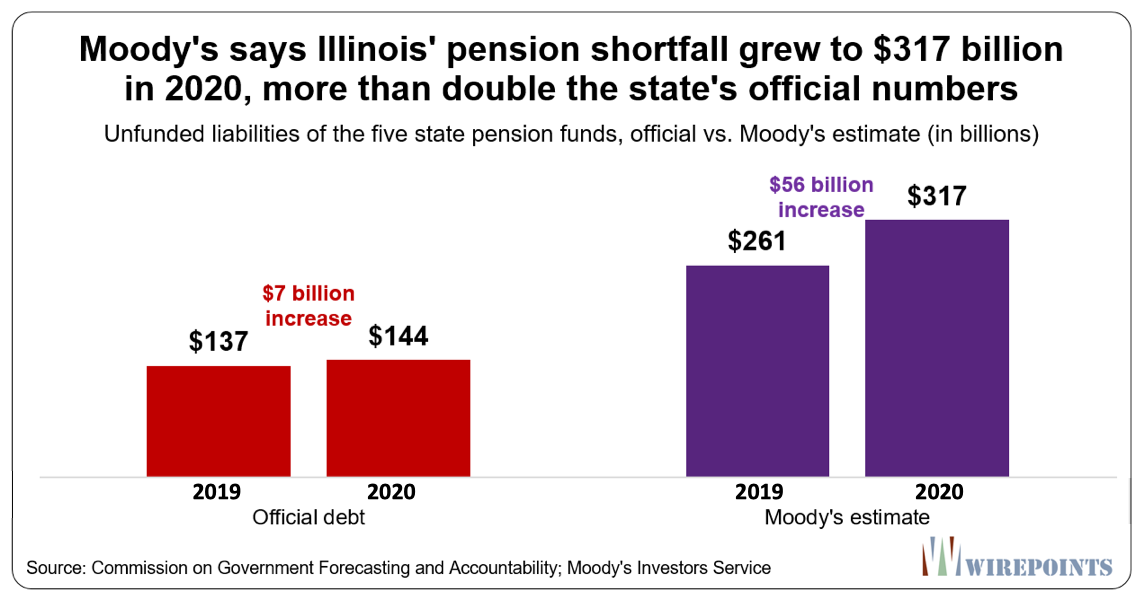

The officially-reported shortfall at Illinois’ five state-run pension funds – for state workers, university employees, judges, lawmakers and teachers outside Chicago – increased to $144 billion in 2020, up $7 billion from the year before, according to a new report by the Commission on Government Forecasting and Accountability.

The growing shortfall continues the long-term trend in Illinois of increasing debts, higher taxes and worsening retirement security for government workers. Residents are paying more into pensions every year only to see the funds’ health stagnate and debts rise.

Here are the three key takeaways from the COGFA report:

Here are the three key takeaways from the COGFA report:

- As the government measures things, each Illinois household is on the hook for $30,000 in future taxes to pay down the state’s record $144 billion shortfall. In contrast, Illinois households were on the hook for “just” $3,500 in pension debts in 2000. (The per household numbers only take into account the five state-run funds and are based on official numbers.)

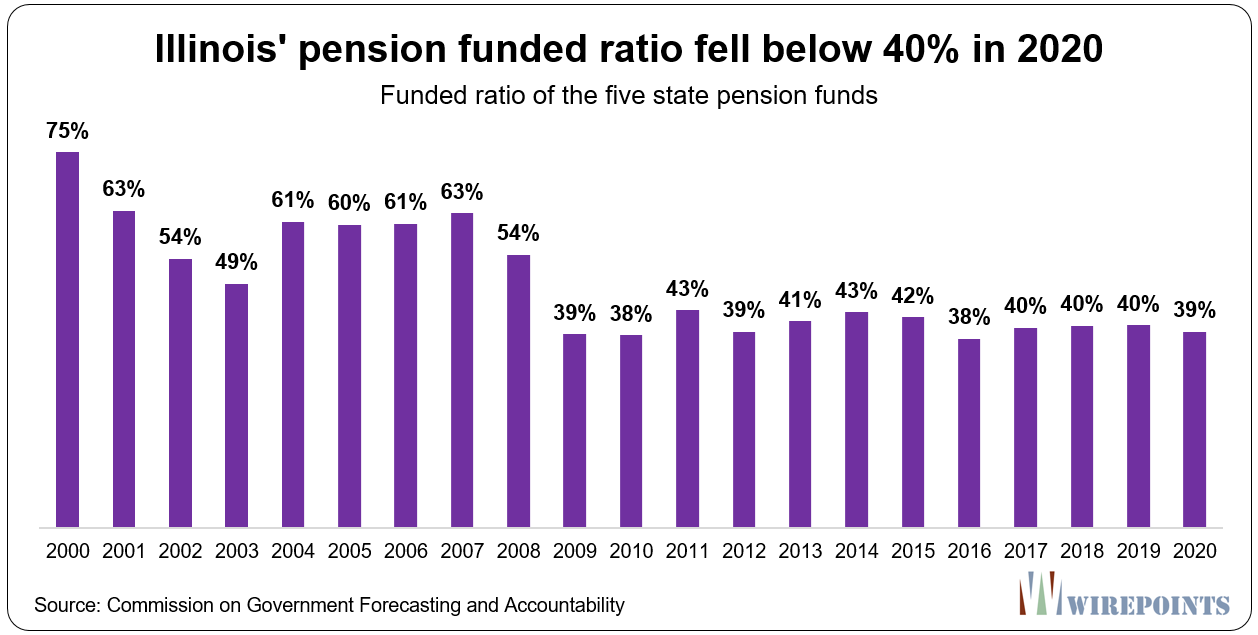

- Illinoisans are burdened with trying to keep afloat the second-worst funded pension plan in the country. Collectively, the plans have only 39% of the money they need on hand today to meet their future payouts to pensioners. Retirement security for government workers has worsened despite increasingly growing contributions by taxpayers.

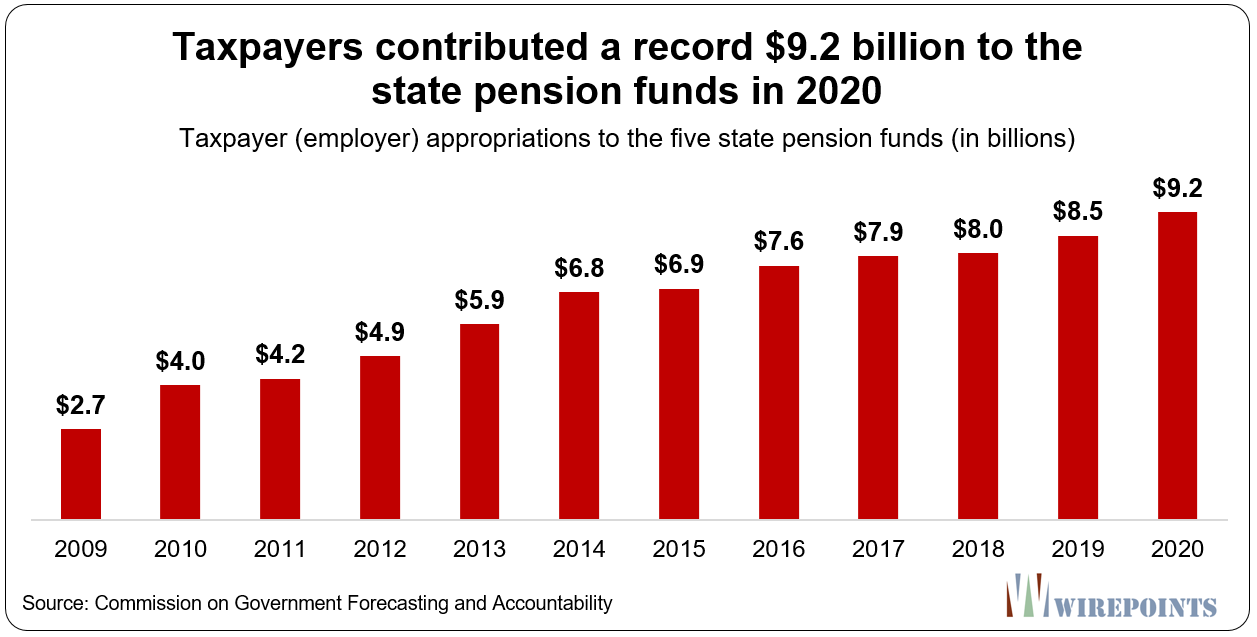

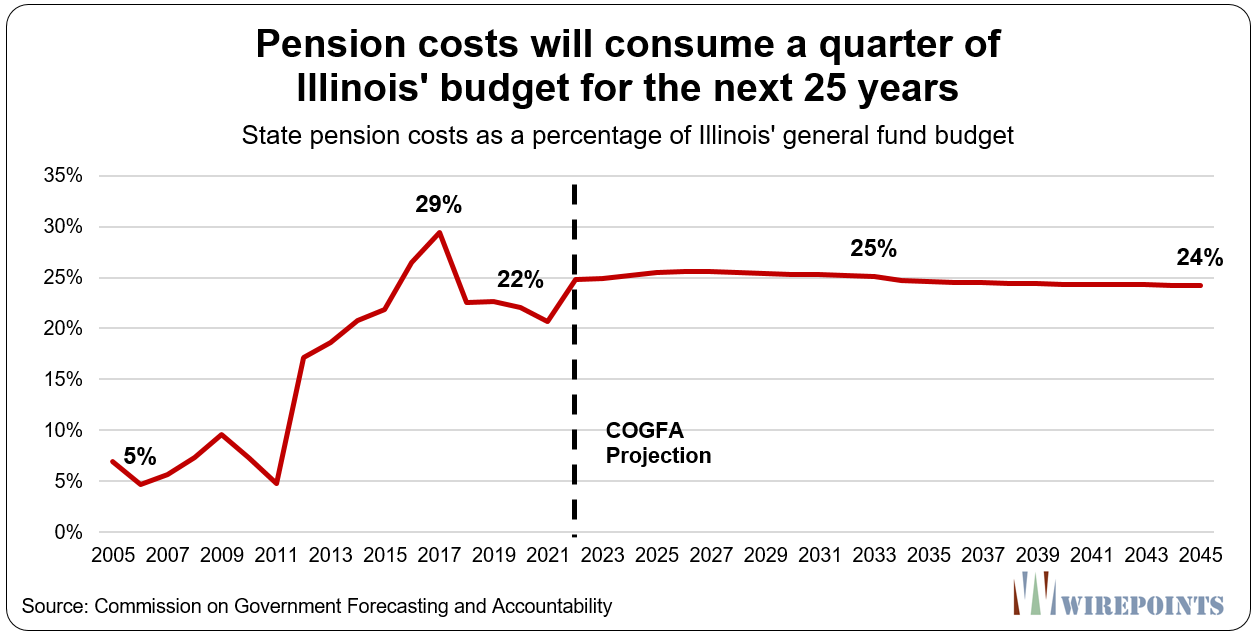

- Taxpayers contributed a record $9.2 billion from the General Funds budget to pensions in 2020 – a fifth of the state’s budget in 2020. COGFA projections show that a quarter of the state’s budget will continue to be swallowed up by pensions for the next 25 years.

Not covered by COGFA, but detailed at the end of this piece, is Moody’s own estimate of Illinois’ pension debts. The rating agency, which uses more realistic assumptions in its models, says the state’s pension shortfall rose to $317 billion in 2020. That’s more than double the official, rosy scenario reported by the state.

2020 pension details

The collective funded ratio for Illinois’ five state funds fell to 39 percent funded in 2020, down a percentage point from last year and far below the 75 percent funded ratio in 2000. Illinois’ funded ratio is the second worst in the country and a key reason why Illinois has flirted with a junk rating the past few years.

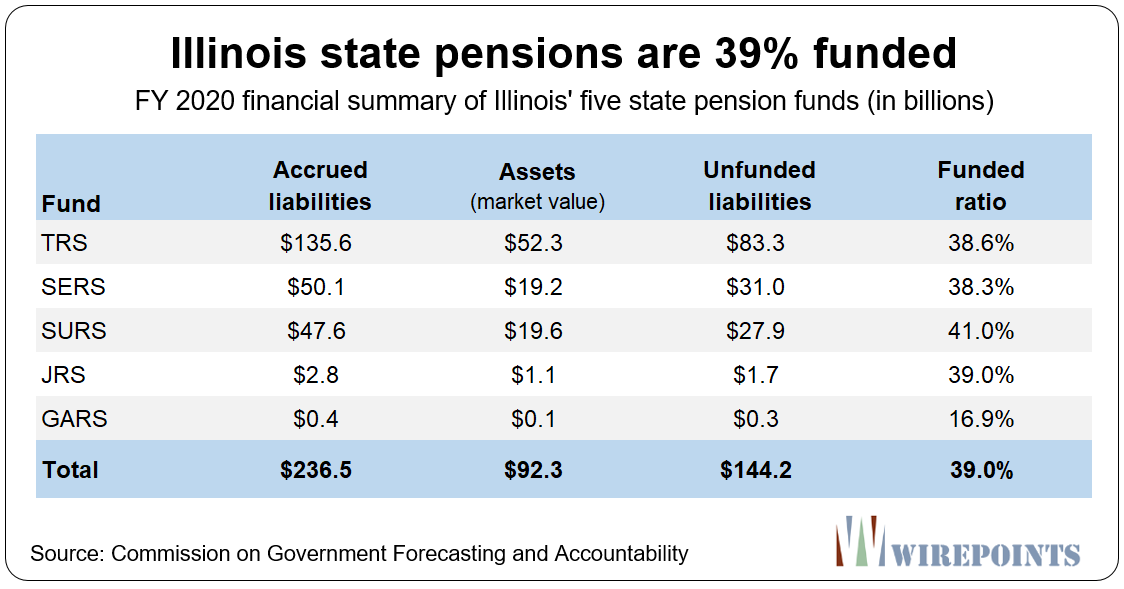

Of the five funds, the State University Retirement System is the healthiest at 41 percent funded. The General Assembly Retirement System, the perennial loser among the five, is less than 17 percent funded. The lawmakers’ pension fund requires a yearly taxpayer bailout worth $20 million just to remain solvent.

Of the five funds, the State University Retirement System is the healthiest at 41 percent funded. The General Assembly Retirement System, the perennial loser among the five, is less than 17 percent funded. The lawmakers’ pension fund requires a yearly taxpayer bailout worth $20 million just to remain solvent.

In 2020, Illinois taxpayers contributed a record $9.2 billion to the five funds – $700 million more than last year and double the amount compared to a decade ago.

In 2020, Illinois taxpayers contributed a record $9.2 billion to the five funds – $700 million more than last year and double the amount compared to a decade ago.

Those growing pension contributions continue to crowd out spending on other vital services in Illinois. The state’s pension costs skyrocketed as a percentage of the state’s budget in 2012 and have remained high ever since.

Those growing pension contributions continue to crowd out spending on other vital services in Illinois. The state’s pension costs skyrocketed as a percentage of the state’s budget in 2012 and have remained high ever since.

2020’s contribution consumed more than a fifth of Illinois’ general budget. COGFA estimates that pension costs will grow to a quarter of the budget and remain that high for the next 25 years. No other state in the country consumes more of its budget for pensions.

$144 billion is actually $317 billion

$144 billion is actually $317 billion

COGFA’s official $144 billion shortfall is based on the government’s rosy assumptions – largely due to overly optimistic investment returns.

The rating agency Moody’s assumes far lower investment returns going forward, resulting in a pension shortfall for Illinois that totals $317 billion in 2020. Moody’s estimate is up $56 billion from 2019, largely due to falling interest rates in 2020.

The agency’s calculations put Illinois’ per household debt at more than $66,000 each. It’s the highest debt burden for state pensions in the country.

Any way you measure it, the burden on Illinoisans is growing.

Any way you measure it, the burden on Illinoisans is growing.

For more on Illinois’ pension crisis and what can be done about it, read Wirepoints’ four-part series:

- Illinois is the nation’s extreme outlier

- Illinois pensions: Overpromised and overgenerous

- Why pension reform is legal

- A solution for Illinois state retirement crisis and Pension Solutions

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more. Chicago Public Schools is failing its students in almost every way. What can be done to save the educational futures of Chicago’s children? Join Wirepoints’ Ted Dabrowski as he participates in an education roundtable discussion hosted by Seeking Educational Excellence (SEE).

Chicago Public Schools is failing its students in almost every way. What can be done to save the educational futures of Chicago’s children? Join Wirepoints’ Ted Dabrowski as he participates in an education roundtable discussion hosted by Seeking Educational Excellence (SEE). If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Thank you Ted and John for hammering away at this and putting out the factual numbers. Just don’t know how we can fix this through voting. Jack Roeser (God Bless Him) was hammering away at this decades ago, as well as Bill Zettler shining a light. Too bad not enough people listened back then. Thanks again for trying to shine the light and find a solution. Maybe more people are waking up.

The first step should be for everybody to pay what they are supposed to (non-negotiable).

As I always say as long as the people who receive the pensions are responsible for deciding how to fix the pension system nothing is ever going to happen. If you are getting a pension from the state of Illinois you like things just the way they are. You are working for yourself you are not working for the people who elected you

These fraudulent pension funds/scams are a house of cards waiting for the wind to cave them in. But WHEN will that wind arrive? I honestly am surprised it has not already arrived and caved in 🐾

Left the state. Not my problem anymore. Politely but strongly recommend Illinois residents do the same.

Would love to, but many have family obligations and have roots here. We should not have to leave because of corruption, but don’t know at this point if we can fix it. Tough decisions. Glad that you were able to get out.

You have an obligation to your family to MOVE, actually. But most won’t and most will suffer the consequences.

What happened to the state’s Comprehensive Annual Financial Report (CAFR) for 2020? That fiscal year ended 13 months ago yet no report on the Comptroller’s website.

Correct. And no explanations offered.

It is late because they are probably having troubles “smoothing” out the (shortfall) numbers….

Apart from taxpayers, — a disorganized group that may not have standing — the group with most to lose is comprised of public employees and pensioners with the longest life expectancies. Those at the lower pay levels within that group should begin to press their unions to look after their interests by demanding marshalling of pension assets to preserve the funds. I don’t think retired union members have a vote in union leadership so the actives should find a champion and vote him/her/them into the leadership. New leadership should study the options for litigation or legislation to preserve the funds… Read more »

Self-defense mechanism: There’s one ‘protected class’ of property owners. Those who own property within TIF footprints may be taxed at higher rates, but that TIF money can come right back to TIF owners’ individual pockets. Therefore, all Illinois taxpayers seeking to survive should seek the same defense mechanisms used by the political class. Most of Illinois is unincorporated. Only an incorporated municipality may form TIF. Therefore all of Illinois property should incorporate as a Village or Villages. Municipalities have the authority to declare all property within as “blighted” and therefore eligible for inclusion in TIF. Municipalities are not required to… Read more »

I confess to being un-FIT to say anything about TIFs but are you advocating primarily residential TIFs? I did a bit of research and came up with an Ohio outline that provides: “• A TIF may be comprised of specific private parcels (a “parcel” TIF) or a political body may create an “incentive district” TIF • Political body’s ability to TIF residential property is very limited in a parcel TIF • Incentive districts may include both residential and commercial improvements.” Microsoft PowerPoint – Tax Increment Financing_Daniels.PPT [Compatibility Mode] (ohioauditor.gov) Does the municipality have to approve or endorse the TIF? I… Read more »

In Illinois TIF must be in a municipality. Per Illinois case law “Blighted” property is whichever Mayor says it is. If a new municipality forms, its government could choose to declare the whole village blighted. TIF freezes the assessments of parcels within. That means that 23 years of EAV inflation, if any occurs, is taxed for TIF incremental income, and is given to municipal governments to give to their cronies…or in the case of the newly proposed Illinois Village of TIF, the municipal government could choose to rebate each property owner their own TIF incremental payment, annually. (Note that TIF… Read more »

You mention in the beginning in Illinois TIF must be in a municipality, so is it illegal to have TIF district’s within a village, the village that I reside in which encompasses 21 miles and cannot expand any further there is 8 TIF districts go figure.

a village is a municipality by legal definition

so you understand, if your [property resides within TIF footprint where TIF funds are given to property owners to tuckpoint buildings, or for road improvement or historic preservation that make that small area very appealing….then TIF may enhance your property values relative to (KEY PHRASE “relative to”) other properties OUTSIDE the TIF footprint whose p-taxes must be raised to pay for the mandatory social service provision (schools, etc) of TIF freeriders.

Residential TIF are the absolute worst economic burden Illinois taxpayers are forced to endure. Taxpayer monetary burden #1.TIFs typically take taxpayer money today (or raise bonded debt guaranteed by taxpayers) to pay TIF developers and property owners. Taxpayer monetary burden #2. Residential TIFs create a new school enrollment taxpayer burden, which by law must be funded almost entirely by non-TIF taxpayers. TIF statute actually forbids payments to taxing bodies for social services expenses (except a few strictly limited) in order to protect TIF bondholders. As an example, Woodstock CUSD taxes approximately $10,000 per pupil annually. That is, tax levy divided… Read more »

Taxpayer burden #3. Residential TIF employ bugger-thy-neighbor tactics to grasp greater than fair share of State educational funding.

TIF distorts taxable EAV calculations upon which State school funding allocations are based. Communities with high actual property values in TIF are essentially stealing

State funding from poorer communities which haven’t employed that trick.

About 5 years ago, Illinois education funding “reform ” law locked in base funding amounts for TIFrich school districts based upon their then-current, artificially low taxable EAVs.