By: Ted Dabrowski and John Klingner

“Should the Illinois Constitution be amended to create an additional 3% tax on income greater than $1,000,000 for the purpose of dedicating funds raised to property tax relief?” That’s the wording of a new advisory referendum that will be on the November ballot. The referendum question is just one part of a contentious bill that changed several election laws and was rapidly passed by a supermajority of Democrats this week.

While the referendum might end up being nothing more than a political distraction, it could also be that lawmakers are gauging Illinoisans’ appetite for another bite at a progressive income tax hike – this time with lower property taxes as a sweetener.

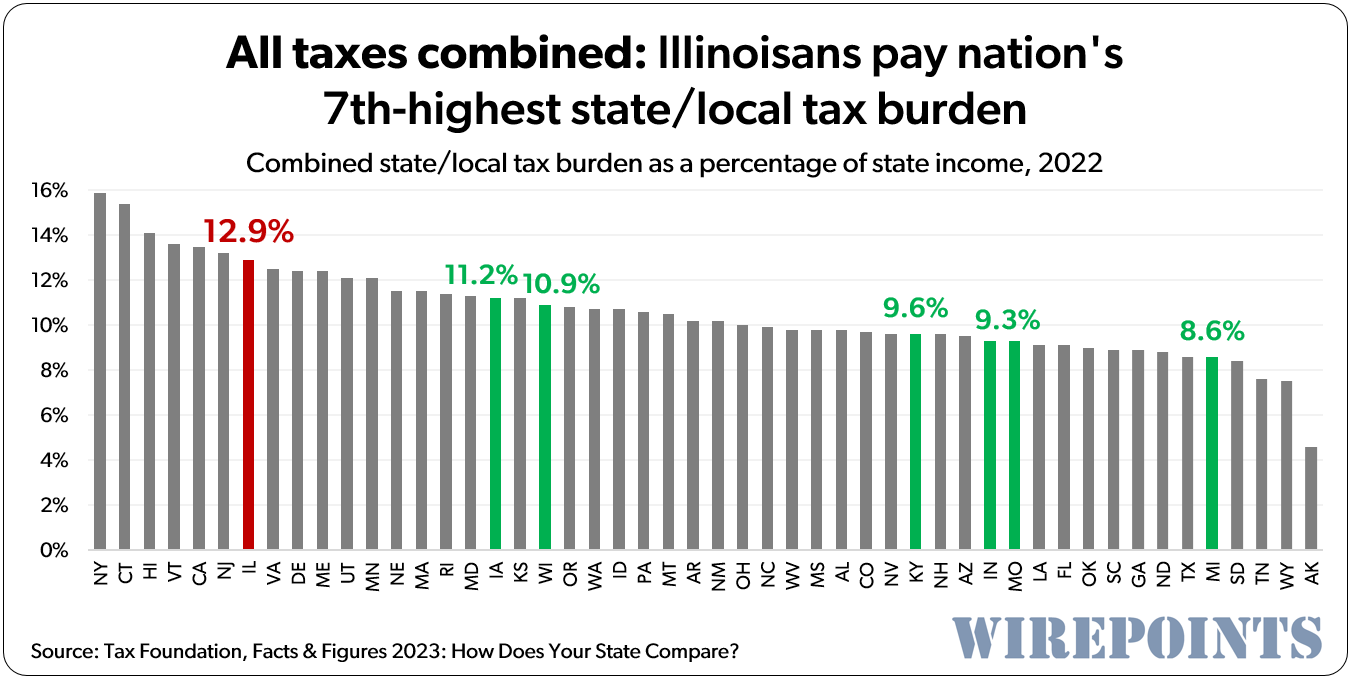

The problem with a tax swap like the one proposed is it would do nothing to lower Illinoisans’ overall tax burden, already the nation’s 7th-highest. Expect Illinoisans to continue to leave, and for the wealthy to leave even faster if they eventually become a target of such a law.

In the end, the proposal totally ignores the cost drivers that continuously push Illinois taxes higher, which is the real problem that ultimately needs fixing. Like the overwhelming power of Illinois’ public unions and their rapidly rising contract costs. Or the guaranteed, multi-million dollar lifetime pensions that keep rising as government salaries jump (see CTU). Or the number of local government units in Illinois, the most-in-the-country, which continue to bloat.

Here’s what Illinoisans should know before voting on this advisory referendum:

For one, the proposal would change Illinois’ current flat income tax structure into a progressive tax structure. The proposal would create two tax brackets: taxpayer incomes up to $1 million would be taxed at 4.95%. Every dollar above $1 million would be taxed at a marginal rate of 7.95%.

If that sounds familiar, that’s because it is.

Gov. J.B. Pritzker already tried to get a progressive income tax hike passed in 2020, but Illinoisans rejected the governor’s “Fair Tax” amendment 55 to 45 percent. Illinoisans simply didn’t trust lawmakers to not hit the middle class with higher marginal tax rates.

Second, Illinoisans have no idea how lawmakers would decide who would get “property tax relief” and in what amount. But wealthy suburban areas could certainly expect to pay higher income taxes and get little property tax relief in return.

Third, a permanent shift in tax revenues away from local property taxes and toward state income taxes would further centralize spending and power with lawmakers in Springfield. It’s already hard enough to fight back against spending at the local level. What little is left of local control, especially over schools and public safety, would disappear further. A tax shift would be like Illinois allowing its spending to be centralized and controlled by politicians in Washington, D.C. and expecting good outcomes.

Fourth, by not addressing the root cost drivers of Illinois property taxes, local taxes would keep rising anyway. Without any pension, labor, or government consolidation reforms, costs would continue to rise and local governments would be forced to raise money any way they could via other taxes and fees.

Fifth, a 3% income tax surcharge on income above $1 million would only drive-out wealthy taxpayers at an even faster clip than they’re already departing. Wirepoints has already written extensively about the out-migration of the wealthy here, here and here.

**********************

The proposal is only advisory, but it still gives Illinois taxpayers a chance to send a powerful message to the state’s political class.

What that message will be depends on how they vote.

Read more from Wirepoints:

- Pritzker doubles down with $827 million of taxpayer money for expansion by troubled electric vehicle maker, Rivian

- A disappointing first year for Chicago Mayor Brandon Johnson

- Death to Facts: Northwestern journalism prof Steven Thrasher tells pro-Palestinian demonstrators to reject objective reporting

- Even more evidence Illinois can thank the federal government’s covid bailouts for its budget bonanza

- 81% of registered Illinois voters failed to turn out for March primary

- Traumatizing Chicago robberies, violent crimes at six-year high

The bill passed despite their votes in response to certain incidents where local prosecutors are thought to have been too lenient with non-citizens assaulting cops.

The bill passed despite their votes in response to certain incidents where local prosecutors are thought to have been too lenient with non-citizens assaulting cops. The Wall Street Journal Editorial Board cited Wirepoints’ analysis of Chicago student proficiency data in their latest piece condemning the Chicago Teachers Union’s outrageous contract demands…all while a vast majority of Chicago’s children graduate unable to read at grade level.

The Wall Street Journal Editorial Board cited Wirepoints’ analysis of Chicago student proficiency data in their latest piece condemning the Chicago Teachers Union’s outrageous contract demands…all while a vast majority of Chicago’s children graduate unable to read at grade level. Ted joined Tom Miller of WJPF to talk about the details of Gov. Pritzker’s proposed $52 billion budget, why the state is struggling now that federal covid dollars have run out, the controversy surrounding Tier 2 government pensions, why Illinois’ expensive education system fails to teach children to read, the outrageous demands of the Chicago Teachers Union, and more.

Ted joined Tom Miller of WJPF to talk about the details of Gov. Pritzker’s proposed $52 billion budget, why the state is struggling now that federal covid dollars have run out, the controversy surrounding Tier 2 government pensions, why Illinois’ expensive education system fails to teach children to read, the outrageous demands of the Chicago Teachers Union, and more. Ted joined Jeff Daly to discuss how politicians can never spend enough on education despite there being no accountability for that spending, the growth of education staffing across Illinois, Mayor Brandon Johnson’s $1 billion demand for Chicago schools, why Gov. Pritzker is providing $830 million in taxpayer subsidies to struggling EV carmaker Rivian, and more.

Ted joined Jeff Daly to discuss how politicians can never spend enough on education despite there being no accountability for that spending, the growth of education staffing across Illinois, Mayor Brandon Johnson’s $1 billion demand for Chicago schools, why Gov. Pritzker is providing $830 million in taxpayer subsidies to struggling EV carmaker Rivian, and more.

Illinois (D)’s policy mimics “Fight Club’…

“Welcome to Fight Club. The first rule of Fight Club is: you do not talk about Fight Club. The second rule of Fight Club is: you DO NOT talk about Fight Club! Third rule of Fight Club: if someone yells “stop!”, goes limp, or taps out, the fight is over – we win & get to raise their taxes…

They should just raise taxes to 8%. Fund the pensions with all the money, put T2 into T1. If that ain’t enough raise taxes to 10-12%. Then everyone can get on with life…

You must be part of the Chamber of Commerce of adjacent states wooing IL residents! Rather than public pension driven perpetual tax increases how about stop offering pensions to new public employees as of 12/31/24 and give them 401k with matching feature like in the real world since the 80’s, fund existing pension obligations until they eventually are done, and trim and reallocate the state budget to true needs instead of every want someone in Springfield cooks up.

Illinois residents (Chicago residents mostly) are too ignorant to realize that spending more means higher taxes. As crazy as that sounds, they don’t make the connection. Nothing in Illinois will get better. Nothing in Illinois will be fixed. Stop overestimating the intelligence of the Illinois public. If you seek fiscal or moral sanity, you must leave the state. Face reality WP readers.

An income for property tax reduction scheme is nothing more than a total tax hike no matter how it is packaged because Illinois, despite its already high tax situation, needs more taxes. Illinoisans it seems just can’t quit spending money finding all sorts of new spending programs to throw money at while not having the money to pay for all of the State’s existing funding needs as it is. Higher and higher taxes is the future because, quite simply, it is the desire of the Illinois people to spend more money.

That is a load of nonsense Riverbender. For example, all the polling shows Illinois people do not want the state to be a sanctuary state at this time. What do our politicians do? They spend hundreds of millions more on the illegals- likely over $1 billion right now. With billions more in future years. The desire of the majority of people is not to spend this money. Our crooked politicians want to spend it. I could give other examples. Gerrymandered legislative districts allow this to happen. Remember Pritzker’s broken promise about a fair voting map?

Communism is never popular, that’s why they force it upon citizens. A minority of loud, angry malcontents force their beliefs upon everyone else and the lie about it. There’s never been a popular communist revolution or uprising. It’s always a small number of people who take over either by force or by usurping the Democratic process and then changing the rules and processes to try and ensure communism in perpetuity. Russia had an elected Duma and the Czar had all but abdicated. But the commies still took over and ended all of that. China had an early-stage Democracy in between… Read more »

Perhaps it is that those small number of people vote while the majority are too busy watching Taylor Swift, football or baseball to take time to vote. priorities it seems these days.

Actually no, we want low turnout. Our best Republican successes came from midterms with low Democrat turnout. Republicans are outnumbered in IL, no way around that, and any success we used to have has been neutered by gerrymandering, mail in balloting aka fraud, and rule like this no slating thing. Democrats have been doing well in midterms since 2018 because they somehow (wink, wink) turned 800,000 presidential year voters who never showed up for mid-terms into habitual midterm voters. Republicans can’t over come that, even if every Republican Trump voter showed up to vote in a midterm, it still wouldn’t… Read more »

While I understand your feelings, that I agree with, the overall Illinois voting population obviously wants more spending and a very large percentage could care less based upon their absence from the polls on election day. The spending is not just on illegals but now its also a football stadium, a baseball stadium, mass transit, assorted social programs and the paying for past decisions like the Medicaid expansion as well. Until the majority of Illinoisans that don’t want tax and spending cuts go to the polls the continuation of spending and related tax hikes will continue on and I should… Read more »

Pritzker needs a willing legislature to serve him up the bills. It appears the legislature is rigged through gerrymandering. I suppose they still teach in the history classes in our schools that the people elect the legislators. That is not factual any longer in our state, as there are many gerrymandered districts where party operatives shape the district block by block, to finish the more conservative folks. Furthered by bills like the D’s passed just last week. At any rate, I get your point about the majority of Illinoisans. I view it as the makers (taxpayers) and the takers (… Read more »

It’s very much like this in Republican states too. There are few states with party splits between legislature and state wide offices.

If Pritzker and Democrats want a bigger slush fund to spend on Democrat boondoggles like Gotion and Rivian, they can put the ‘Pension Python’ aka as ‘Squeezy’ on a severe diet.

That’s not an option. They can prevent further increases but there will be no cutting of pensions to free up money for other spending initiatives. If Illinois doesn’t want taxes to increase they will need to cut spending in areas where allowed. Pensions are off limits.

IMO Taxistan is a lost cause. 5 years ago CO had a $30B pension deficit. Dem Guv and Legislature passed a bill to put pensions on a better financial standing going forward. Key terms; All CO pension beneficiaries would have to pay more for their pensions, CO taxpayers would have to pay more in taxes, Retirement ages were raised except for Police and Fire. Teachers retirement age was increased from 58 to 62. You should have heard the belly aching. To me this was a Win Win pension agreement for everybody in CO. Not sure this would ever happen in… Read more »

One out of three. Not too bad in baseball hitting terms.

PPF,

I guess wait for the Chicago bankruptcy and then have terms crammed down by Bankruptcy Judge like Detroit.

Da Judge

You need get the state to allow Chicago to enter bankruptcy proceedings. Have they allowed that for Harvey? East St. Louis? lol. Maybe some day you’ll be able to get Chicago in bankruptcy and make them take a 4.5 percent cut like Detroit.

As far as the state is concerned, none of your ideas other than raising taxes are allowed.

Do you think CTU would back legislators who’d give the green light?

The ‘law’ didn’t stop Pritzker and Democrats from raiding earmarked road funds.

No didn’t raid funds. As determined by a judge, those funds were properly spent as to the rules of the amendment. A unanimous ruling by the ILSC has also determined that you can’t cut pensions. So again, you ain’t cutting jack Jack.

Oh yeah, they found a ‘judge’. A veil of legitimacy to breaking the law, that when written and passed was ONLY for roads. Fib all you want, but the same legal nonsense can be pulled on Squeezy and you know it.

It wasn’t ONLY for roads. Talk about lying. Did you even read the amendment or did you just read a Facebook post?

Expecting judges to cut their own pensions is like expecting Trump-appointed judges to sustain Roe v Wade. Do you suppose the pro-choice proponents are going to sit back and urge deference?

Speaking for Michigan, they raised the sales tax from 4% to 6% while reducing property taxes. For a while it was an even trade off. Now my relatives all report that their property taxes are higher than ever AND they still have a 6% sales tax.

What really has to happen in Illinois is the public sector needs to go on a fiscal diet.

Dear El Gordo and the “ usual gang of idiots “, I wish to make this as simple as possible regarding your advisory question.

Let’s go Springfield!

The progressive tax won’t pass this way. The only way this passes is if the voters feel threatened by their own taxes going up. The legislature will need to have a flat tax increase already passed that will only be implemented if a progressive constitutional amendment fails. Once the voters are forced to decide between higher taxes for themselves or higher taxes for the “rich”, it will pass. The voters rightfully don’t trust Springfield, so only under direct threat of higher taxes for themselves will they vote for higher taxes for the other guy.

That famous “higher taxes for the ‘rich'” that has a funny way of being higher taxes for the middle class when implemented. People never learn it seems…

No doubt RB. It won’t prevent further taxes for the middle tax but may delay it a bit. If the choice is a guaranteed tax increase for oneself today vs a higher tax on the “rich” and possibly a tax on me down the road, people will kick that can all day long.

Look no further than the abuse of the motor fuel tax on gasoline – The legislature after many years of budget abuse by Democrats demanded that fuel taxes go 100% for roads. Now Boss Pritzker says he’s determined it’s ok to raid the fuel tax fund for one of Democrats favorite charity – the CTA.

Pritzker and Democrats absolutely cannot be trusted with one thin dime of taxpayers money.

All the points in the article are spot on, and the point about not further centralizing power and spending in Springfield is key. The D’s have concentrated all the power there by disenfranchising the voters through gerrymandering, in other words rigging, their voting districts. And once they have the power, do they give the citizens a voice? Just ask yourself if the D’s asked the voters if Illinois should become a sanctuary state, or whether we want all this LTGBQ+ grooming and transgender cr*p pushed in our schools? No way do I trust the people in power at the state… Read more »

…but taxing the wealthy is working so well for California.

Lottery was supposed to help education. Tolls were supposed to be temporary until original roads were paid for. This is more sleight of hand wizardry from the self perpetuating loop of public pensions and govt creating a revenue stream to spend any which way but the stated purpose.