By: Ted Dabrowski and John Klingner

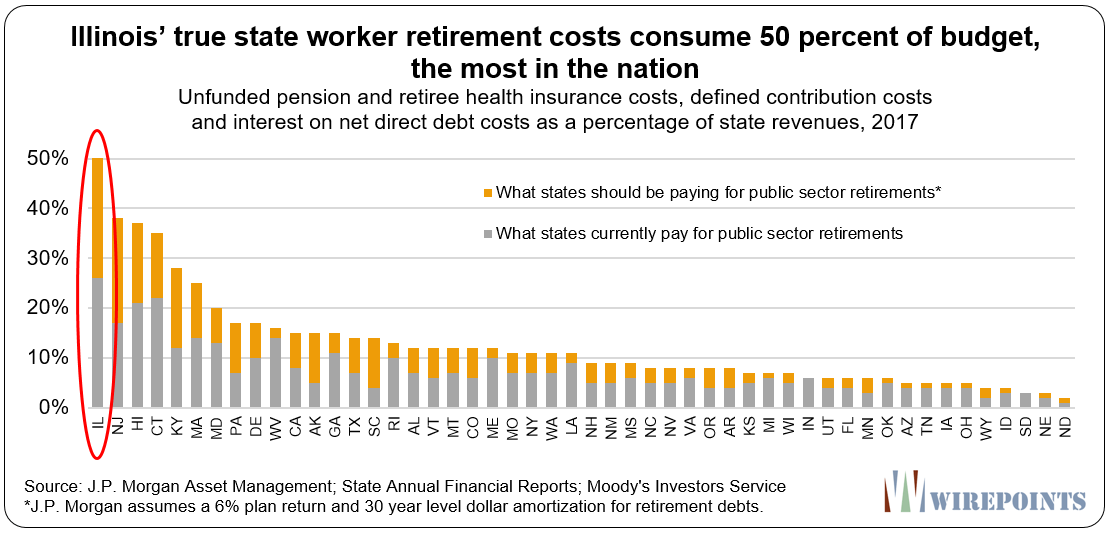

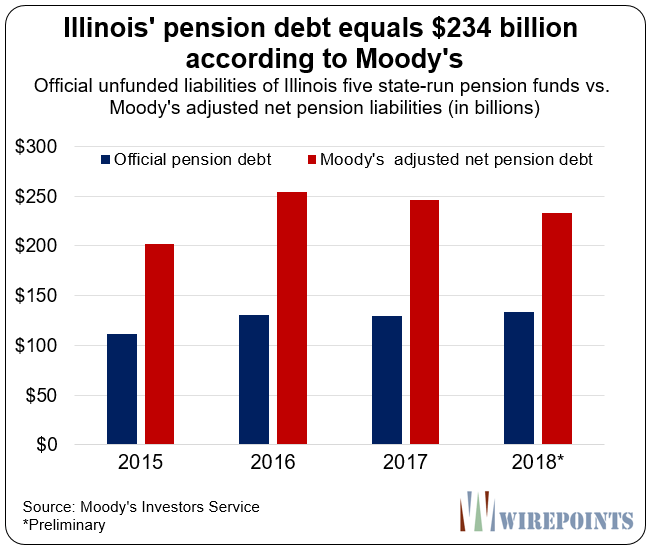

Official reports on the health of Illinois’ pension plans consistently understate the depth of the state’s crisis. Based on unrealistic assumptions, those reports have been long used by politicians to mislead the public.

But a recent Illinois Auditor General report based on work by the actuarial firm Cheiron doesn’t read like something authorized by Springfield politicians. It criticizes much of the state’s pension reporting methodology while making valid recommendations to fix them.

The report matters because it echoes some of what groups like Wirepoints have been calling for: realistic reporting that tells the truth about the depth of Illinois’ pension crisis. Illinois politicians will never truly address the crisis as long as they can paper over it with their own numbers.

The report is the result of a 2012 law that requires the Auditor General to review the assumptions and valuations prepared by the actuaries of the five state-run pension plans. Cheiron, an actuary, was hired as the auditor and this year’s report is the latest version. Think of it as an audit of the 2018 actuarial reports.

Cheiron found the actuaries’ assumptions for 2018 as “generally reasonable” – meaning the fund actuaries didn’t do anything out of line with what the state calls for. But read the study and you’ll see they critique many of the state laws that let politicians kick the can into the future.

Here’s what worries the Auditor General:

Targeted funding ratios are too low. Currently, the state’s funding laws call for the pension plans to be 90 percent funded by 2045. That means by not targeting 100 percent, the state is systematically underfunding its plans year after year.

Cheiron recommends “that the funding method be changed to fully fund plan benefits and… should target 100% of the actuarial accrued liability…”

Interestingly, Cheiron’s call for a 100 percent funding target is in direct contradiction to a “reform” scheme being pushed by the Center for Tax and Budget Accountability and considered by Gov.-elect J.B. Pritzker. The CTBA plan would leave the Illinois pensions just 70 percent funded in 2045, far less than the 100 percent the Auditor General calls for.

It takes too long to pay down unfunded liabilities. Cheiron doesn’t call it kicking the can, but it criticizes the long period set by the state for paying down its pension debts. Cheiron finds that Illinois laws push repayment of the shortfalls “further into the future” than other public plans do.

Cheiron and the state actuaries appropriately propose shorter repayment periods. TRS and its actuary, for example, call for a 20-year repayment period, down from the state’s mandated 27-year period. SURS and SERS also make recommendations to shorten the repayment period.

State contributions are too small. Cheiron is also right to point out that the state doesn’t even put in what’s called the “tread water” contribution amount – the amount needed to prevent the pension shortfalls from simply getting worse. Think of the tread water amount as the minimum payment necessary on your credit card to keep the unpaid balance from growing.

Cheiron estimates that the state needs to put in some $2.5 billion more than statutorily required in 2019 just to ensure things don’t get worse next year – never mind how much more is needed to actually pay down the state’s billions in unfunded obligations.

Investments are getting riskier. While Cheiron did not make firm recommendations to lower the pension plans’ overly ambitious interest rate assumptions (it did recommend TRS lower its rates to 6.75 percent but then acceded to a 7 percent rate), it did acknowledge that the pension funds are taking on more risk to meet their investment targets.

With targets of nearly 7 percent and bond rates near historical lows, investment strategies have necessarily become riskier. And if those investments don’t work out, the plans will become even more unstable.

The interest rate assumptions matter. The state reports the unfunded liability at just $134 billion using assumed investment rates of nearly 7 percent. But Moody’s, which uses market rates that are more realistic, puts the state’s shortfall at $234 billion – $100 billion more than Illinois’ politicians say it is.

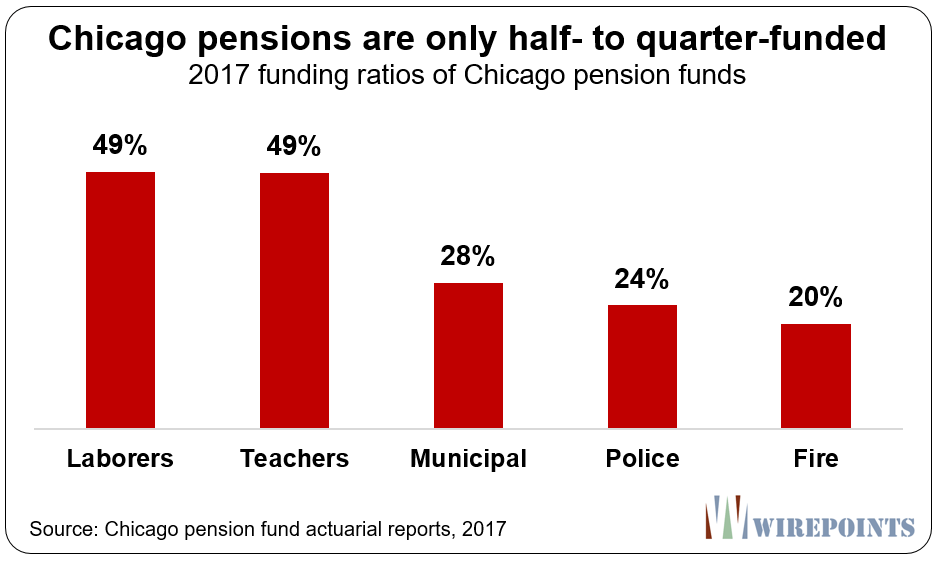

Solvency worries. Cheiron is worried about the health of the state’s pensions funds: “If there is a significant market downturn, the unfunded actuarial liability and the required State contribution rate could both increase significantly, putting the sustainability of the systems further into question.”

Wirepoints has made that argument for some time, raising concerns about the solvency of the pension fund for lawmakers (GARS), the three major Chicago funds covering municipal, fire and police employees, as well as dozens of downstate police and fire funds. They are all at funding levels below 30 percent and face the real risk of virtual insolvency.

Add it all up

Illinoisans deserve to know the true cost of Illinois’ pension debacle. And pensioners should understand just how real the risk of insolvency is.

Cheiron’s recommendations to the Auditor General are at least the start of a more honest conversation. When you add up all of the firm’s suggestions – and use more realistic interest rate assumptions – Illinois’ dire straits becomes far more obvious. The state alone has built up more than $300 billion in retirement debts. Illinoisans can’t bear that burden without reforms, starting with a constitutional amendment, that allow the state to reduce the existing debt pile.

To be clear, the Auditor General has no power to enforce what Cheiron recommends. But its report, combined with increasing pressure from the rating agencies, the bond market and the stock market, will eventually bring about change.

Whether that change comes in the form of reforms or insolvency is entirely up to Illinois lawmakers.

Read more about how bad Illinois’ pension crisis has gotten:

- Illinois’ other debt disaster: $73 billion in unfunded retiree health insurance benefits

- Flashback to 1994 reveals Edgar’s ramp up of Illinois pension crisis

- IL’s pension shortfall worsens to $134 B despite strong markets, increased contributions

- Special Report: Illinois state pensions: Overpromised, not underfunded

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

All pension reform efforts have always been held unconstitutional by the Illinois Supreme Court under the provisions of the Illinois Constitution. But that same Constitution also requires enactment of an honest annual balanced budget (Art. VIII, Sec. 2), which is always a fiction, especially given the multi- billion dollar unfunded government pension scheme and unprofessional practices reported by the Auditor General. Perhaps it is finally time for someone (if not the see no evil Illinois Attorney General) to file a lawsuit – (preferably in federal court since the Illinois Courts have a conflict of interests – pursuant inter alia to… Read more »

How about a qui tam action against government officials? I think some taxpayers could initiate that. See http://ndlawreview.org/wp-content/uploads/2018/03/Beck-07.pdf

They say watch “Lawrence of Arabia” and “Exodus” for a short intro to the Middle East. I suggest viewers watch “Widows” and “Vice” (both recent releases) for a depiction of what goes on in the government. All of those freshmen Congresswomen think they are going to change history because they are socialists, LGBQT, Muslims, or Populists who can’t be bribed (LOL). They can’t hold a candle to the Amy Adams character Lynne Cheney who pushed her husband to become one of the most evil guys in US history. It makes me wonder if women working behind the scenes helped to… Read more »

I’d be a little more selective on where you get your information. Your “source” is hardly credible.

Sorry, it is way too late to save IL or Chicago from financial oblivion from unfunded pensions. We have been in the longest Bull Market in US history and the pension funds at nearly every major public pension fund in America is lagging below 75%; when they should be funded at this point at 125%-135% to withstand the inevitable Bear Market. A Bear Market which is coming any day now. And when that Bear Market arrives it is GAME OVER. No saving anyone, especially if it lingers as long as the Bull Market lingered. I won’t shed any tears over… Read more »

think the machines basic game plan will be to keep issuing a mountain of bond debt, wait a couple years till next presidential election were they will have a great chance of dems taking the whole sha-bang–presidency,house & senate and then push for bailout for all the taxudos states. how to spin bailing out a bankrupt/irresponsible Illinois vrs a Wisconson will be the hard part but am mostly afraid citizenry is so stupid they could get away with it. BECAUSE TRUMP IS THE GREATEST THING TO EVER HAPPEN TO THE ILL MACHINE!!! even with SALT tax elimination. according to trib,… Read more »

When it comes to 2020, just remember JB is literally worth twice as much as Trump. Not saying I have a shred of evidence, but the Governorship may be a stepping stone to DC. Pritzger/Emanuel 2020 FTW!!

Does the report say anything about projected borrowing costs impact on the future? Illinois will have to pay higher and higher interest rates to borrow money given Federal Reserve action, and the decline in the states’ bond rating.

not sure I understand it all, but because i have no life tried to read report. Isn’t another peculiarity to Illinois is it using Actuarial Cost Method–Projected Unit Credit Method rather than what most commonly used in pubic sector cost reporting –Entry Age Normal Method (which is what GASB- 67 & 68 requires). if they used Entry Age Normal Method current costs would be astronomically higher. or am I wrong?

Isn’t Frank Moutino (current Auditor General) a madigan hack?

If you understand the difference between the actuarial cost methods, you certainly understand the real problem is politicians promise gold-plated Bugatti benefits, but only pay for a Buick. The financial fictions and actuarial manipulations merely extend the intergenerational theft. The day of reckoning is coming.

You are right and Cheiron actually recommends that in the future they move to Entry Age Normal…FWIW.