By: Mark Glennon*

Illinoisans voting on the “Fair Tax” constitutional amendment who have not already studied it probably will be duped into the wrong choice because the ballot is deceitful and incomplete.

Moreover, it is not separate from a ballot for other matters as clearly required by the Illinois Constitution.

Moreover, it is not separate from a ballot for other matters as clearly required by the Illinois Constitution.

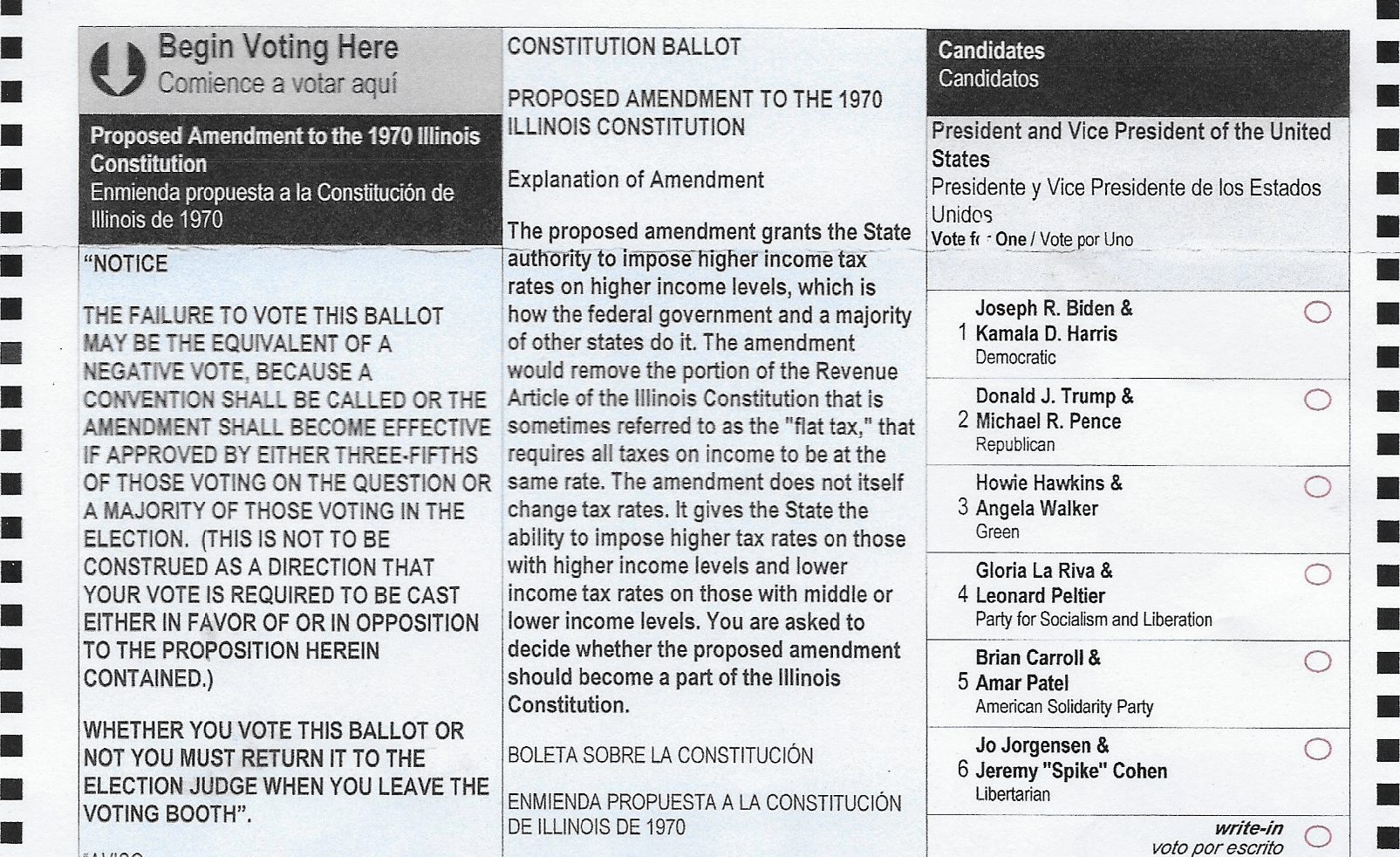

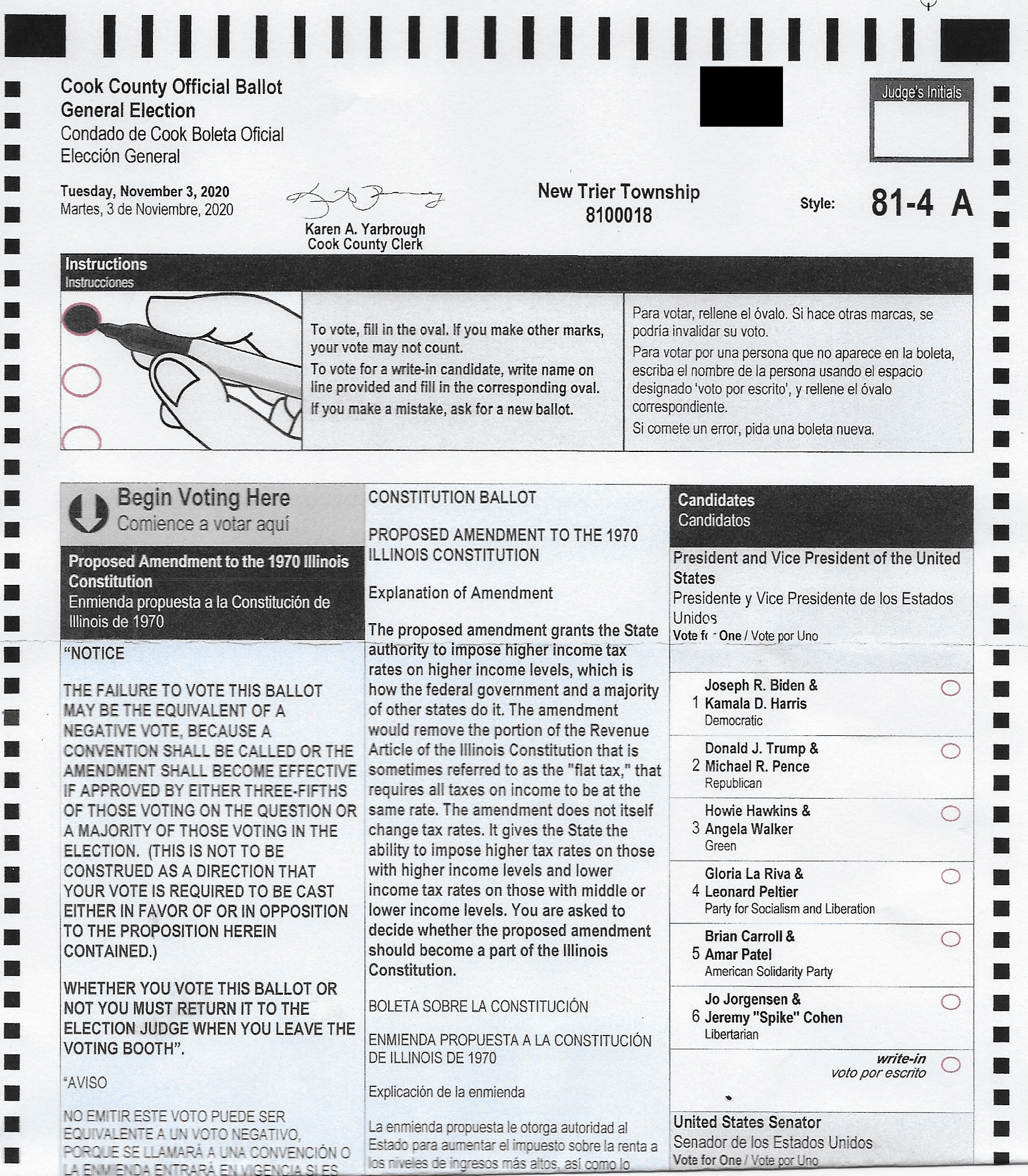

A ballot form is reproduced below that contains the Fair Tax language. It’s a mail-in ballot sent to a Cook County voter, but the language for the Fair Tax vote will be identical in all counties across the state. That language is as follows:

The proposed amendment grants the State authority to impose higher income tax rates on higher income levels, which is how the federal government and a majority of other states do it. The amendment would remove the portion of the Revenue Article of the Illinois Constitutions that is sometimes referred to as the “flat tax,” that requires all taxes on income to be at the same rate. The amendment does not itself change tax rates. It gives the State ability to impose higher rates on those with higher income levels and lower income tax rates on those with middle or lower income levels. You are asked to decide whether the proposed amendment should become part of the Illinois Constitution.

Note that the amendment itself is not provided, thereby denying voters the option of reading it for themselves. Only a summary crafted by supporters is provided.

That summary is false and misleading for the following reasons:

1. The opening line says or at least strongly implies that the amendment would authorize only “higher income tax rates on higher income levels.” That first line is further enforced where the summary says the amendment “gives the State ability to impose higher rates on those with higher income levels and lower income tax rates on those with middle or lower income levels.”

That’s highly deceptive if not outright dishonest. Middle income earners could also be taxed at higher rates than lower earners, and that’s precisely among the arguments made by many of the amendment’s opponents. The amendment would authorize the state to impose whatever rates it wants on any income level. While the language in the summary may be literally correct at this time, it is incomplete, allowing many and perhaps most voters to read it to say it applies only to high earners.

2. The summary includes material that is a marketing pitch for a Yes vote instead of dispassionate description where it says progressive rates are “how the federal government and a majority of other states do it.”

That’s a biased selection of one aspect of the amendment that its supporters routinely cite in its favor. Amendment opponents have their own list of negative aspects of progressive income taxes yet those do not appear in the summary.

Among those negative facets are the fact that states with progressive rates very commonly tax middle incomes at higher rates than Illinois does now. We, too, have documented 18 progressive tax states that tax middle income earners at the same marginal tax rate as high earners. That reality is contradicted by the summary’s false implication, as stated above, that only higher earners will see higher rates. And the summary ignores that 18 states have zero or flat taxes.

3. The summary omits any mention of the amendment’s effect on corporate taxes – a major omission.

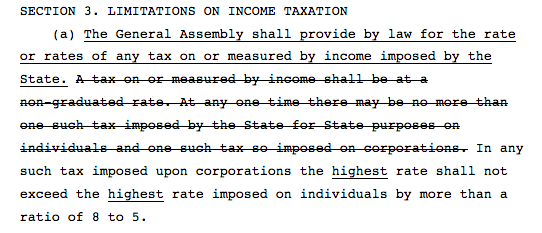

Corporate income tax rates cannot exceed personal rates by any more than a ratio of 8 to 5. The amendment, however, adds the word “highest” where shown here: “[T]he highest rate [on corporations] shall not exceed the highest rate imposed on individuals by more than a ratio of 8 to 5.” That means the cap for corporations would no longer be based on a generally prevailing rate but on the top rate the state chooses to tax its top earners.

The state has already passed the initial corporate rates that would go into effect on January 1 if the amendment passes. The total corporate income tax rate – including the Personal Property Replacement Tax – will go up 10% (from 9.5% to 10.49% when including the replacement tax). Illinois next year would be tied with New Jersey for the highest corporate rate in the nation.

4. The summary omits the amendment’s deletion of the “one-tax” rule, opening the door to more – a major omission.

Under the constitution as now written, “no more than one” income tax can be imposed on individuals or corporations. The amendment, however, strikes that prohibition, as you can see in its full text below.

That means, for example, that the state would be free to impose a separate tax on retirement income with different rates. Or maybe the state would impose separate taxes on income from particular sources that politicians decide they disfavor. The ballot makes no mention of that whatsoever.

Finally, here’s what the Illinois Constitution says about ballots for constitutional amendments: “The vote on the proposed amendment or amendments shall be on a separate ballot. (Article XIV Section 2(b), emphasis added).

That couldn’t be clearer. Now look at the ballot below. There is no separate ballot. The vote on the amendment is on the same form as the vote on other elections.

**************

Over the past several months Wirepoints has linked to every major opinion piece we have found, pro and con, on the Fair Tax. Some have been deceitful, but nothing should anger Illinois voters more than betrayal by their own representatives in Springfield who have presented them with a dishonest ballot.

And it is indeed your own legislators who are responsible. The joint resolution of the General Assembly that put the ballot before the voters also prescribed its form, including the language that summarizes the amendment. We reached out to both the Cook County Clerk and the Illinois Board of Elections to get their reaction to our objections to the ballot. Each pointed out that they had no hand in it, which is correct.

Legislators knew exactly what they were doing. They knew most voters will cast their vote with little understanding of the Fair Tax proposal beyond what they see on the ballot, and they will be deceived.

Votes Yes or No should be on the merits of an amendment proposal presented honestly and legally. Instead, voters will be presented with a ballot rigged to get Yes votes that’s not in the constitutionally mandated form. If the measure nevertheless passes, it should be annulled by courts.

UPDATE: The ballot has now been challenged in court. The lawsuit was filed Monday by a group of retirees and the Illinois Policy Institute. The filed complaint is linked here.

*Mark Glennon is founder of Wirepoints.

Read more about how a progressive tax would hurt Illinoisans:

- Illinoisans need pension reform, not tax hikes

- Illinois’ latest progressive tax ad: Seven things every Illinoisan should know

- Yes, the rich are fleeing Illinois and they’re taking billions with them

- Progressive tax states lose people, income to flat and zero income tax states

- Solving Illinois’ Pension Problem | Part 1: Illinois is the Nation’s Extreme Outlier

- If the wealthy flee, ordinary Illinoisans will be left holding the progressive tax bag

- Don’t be fooled by claims that a progressive income tax for Illinois would mean property tax relief

- Illinois enacting a progressive tax is like Sears attempting a turnaround by hiking prices

BALLOT:

FULL TEXT OF AMENDMENT:

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level. Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Does anyone have a link to the exhibits for the Illinois Policy Institute filing?

Let me start my argument by asking everyone this question. At McDonalds, would you like to pay a different sales tax depending on whether you are a Nurse or a Janitor? The Nurse would pay 15% and the Janitor would pay 5%. SOUNDS RIDICULOUS DOESN’T IT? Now the Democrats and Pritzker are telling us the bottom 5% contribute more Revenue to the State than the top 1% and that’s not fair. BUT WHAT THEY DON’T TELL YOU is that they have run off most of the wealthy from Illinois. And there are far more people paying taxes in the bottom… Read more »

Its no big deal. With the new situation of providing health care for illegals over 65 there will be a worldwide influx of people to Illinois. See, it will all work out.

Vote NO. Tell all your friends to vote NO.

Be sure to have a back up plan in case it passes. Like moving.

Why are certain portions of the mail in ballot “ grayed out” ? In the past, as I remember the grey portions are the Spanish version and some people like me (English speaking) ignore those grey sections. I called the question section posted on the ballot, and the woman who answered the phone said the fair tax section is in grey, just to the left of the voting for presidents. I almost ignored the fair tax question!! Also in grey are the judge retention sections. Why are these in grey??? Are they less important?? I think a lot of people… Read more »

The Democrats call it a Fair Tax yet they can’t even describe it fairly

So if I vote No does it mean no to the fair tax or does it mean I am voting no to the existing flat tax?

That depends on how many votes the Democrats need

Our analysis at OpenTheBooks.com shows that an Illinois family of four now owes more in unfunded pension liabilities ($76,000) than they earn in household income ($63,585). In a state of 13 million residents, every man, woman, and child owes $19,000 — on an estimated $251 billion pension liability.

Look at the bright side; l if you die before it all comes due…you win!

Graduated taxes are examples of the tyranny of the majority over the few. They are morally repugnant.

Remember how our last several tax increases were passed in the lame duck session so the election was already over and we were unable to punish them?

Remember how they passed more than one such increase in the dead of the night?

We cannot possibly trust these people, can we? I know that I do not.

Vote NO.

What they want is you to turn your entire paycheck or your entire retirement fund over to them and it will still not be enough.

And your house, and any assets at the time of your death.

Good job getting this stuff out there. You’re providing an important public service!!

The State has not used any of the previous tax increases to ease the condition of the State’s financial situation and it is hard to believe that this will be the solution. When it does not work, the middle class, and maybe even others, will be the next victims to the tax increases. There is no obvious control over what they can do. Do we trust the State to really care about all the people of Illinois??

More taxes is not the answer. DP has increased taxes several times supposedly to reduce debt, etc. and yet we see that things only get worse. There should be no more taxes and the emphasis should be on streamlining, greater efficiency and less pork-barreling. Illinois government is too big, very inefficient, and very wasteful and needs to be reduced in size. Fewer school districts and pensions more in line with private sector.

Its from the Illinois Democratic machine and you expect it to be fair? That’s not the way things are done in Illinois!

An important essay spotlighting how words can mislead ought to have been proofread before publishing to avoid calling into question what other “oopsies” were made.

Two examples from the first few paragraphs:

“ratees” instead of rates

“fist” instead of first

Freshman (high school!) misses. If you guys need a trained professional writer, editor and proofreader, on project-based hourly basis, let me know.

A shrink friend once told me I was only mildly dyslexic so not to worry about it. So thanks for your offer but we will pass.

Ron,what a petty and snotty comment.

No doubt a former CTU member leeching off of the taxpayer with a $125K annual pension. Go back to the socialist paradise of Venezuela.

The dishonest ballot has now been challenged in court: https://www.illinoispolicy.org/illinois-retirees-file-lawsuit-over-biased-ballot-language-on-progressive-tax/

Good to see i will buy a second home in florida should this pass…bye IL

But it’s being challenged for a different reason.

Keep in mind it’s only a summary, if you weren’t sure about it, you should have read up on it before you voted!

If we could expect Illinois voters to do that we’d never have gotten to this point.

A couple of other points: 1) I would use the fact that they can tax retirements at a different, albeit lower percentage as a marketing aspect for the “no” side. Pensioners will realize that the state will probably come for them, too, and they know that it will start with a “nibble” of something like 1%, to start with. Then it will only go up, like the rest of us. 2) What exactly do they think the long-term ramifications of this will be? Do these people not understand economics and human behavior? Do they think that the most highly mobile… Read more »

We received a booklet from the State with the full text of the amendment, just as shown above. The booklet included the pros and cons. The cons were clearly written by a serious opponent of the amendment. I understand that, if you feel that money spent by the state is mostly wasted or that it goes to help undeserving poor, you don’t want the state to get any of your money to waste. I think a well run state needs to tax the rich more than the poor.

That summary is misleading too. The new lawsuit explains that.

I think the state of IL has taxed enough time for 50% pension and land tax cuts.

Marty – Illinois already taxes the rich far more than the poor. The rich pay the lion’s share of taxes. The amendment doesn’t mention taxing the rich more than the poor – with good reason. What the amendment does is allow the state to tax certain classes of people more than in the past, something the middle class will find out soon.

@Marty You will be singing a different tune when retirement income is taxed, just like all those progressive income tax states do that Democrats point to.

Marty,

you are free to give your money to the poor or to the state. Just go ahead and write the check. Why wait for the state to tax you? In fact just give all your income to the state and then the state can provide for you.

Election Code (10 ILCS 5/16-6) (from Ch. 46, par. 16-6) ARTICLE 16. BALLOTS Sec. 16-6. Whenever one or more proposals for amendment of the constitution or the calling of a constitutional convention or any combination thereof is or are to be voted upon by the people, the proposition or propositions for the adoption or rejection of such amendment or amendments or convention shall be submitted upon a ballot separate from the “Official Ballot” containing the names of candidates for State and other offices to be voted at such election. Such separate ballot shall be printed upon paper of a distinctly… Read more »

ARTICLE 24. VOTING MACHINES

In any election in which there is submitted a proposal or proposals for a constitutional amendment or amendments or for calling of a constitutional convention the ballot label for the separate ballot for such proposals shall be printed on blue, rather than white, material.

It looks like it’s printed in blue, but again it mentions separate ballot.

ARTICLE 17. CONDUCT OF ELECTIONS AND MAKING RETURNS

Whenever a proposal for a constitutional amendment or for the calling of a constitutional convention is to be voted upon at the election, the separate blue ballot or ballots pertaining thereto shall, when being handed to the voter, be placed on top of the other ballots to be voted at the election in such manner that the legend appearing on the back thereof, as prescribed in Section 16-6 of this Act, shall be plainly visible to the voter.

Again, separate ballot.

So . . . 191 words to further define constitution-related ballots in Sec. 16-6 of the election code and our legislative legal-beagles were still able to evade and elide the real question, “What do you mean by ‘separate'”? I suppose they figure they have it covered for the income tax amendment in that the second column has the heading “CONSTITUTION BALLOT,” and maybe (I can’t tell for sure from the image in this posting) there is a blue background for the amendment text?

I would not preempt the ballot process with a lawsuit now. Wait and see if they win, and then sue for violating the Illinois constitution. It’s a risk, especially with the Democrats on the Illinois Supreme BS Court, but this is pretty clearly a violation. But preempting it would just allow them to recover and do it correctly, sooner than later. My guess is that they will argue that the “side of the page” is “separate” as lawyers are wont to do. And the Court would probably give it to them, because it seems to give them everything they want.… Read more »

People that live in Illinois deserve their fate. These shenanigans have gone on for so long that claiming to be an innocent victim is just a ridiculous excuse.

So bring a lawsuit then

Someone needs to STAT file a lawsuit for a TRO, Declarative Opinion, and motion to strike the proposed amendment from the Nov. 3 election ballot. And make a federal case out of it !

I note this story: “Griffin drops another $26.75 million into fight against graduated tax”. Good news – BUT not enough, he needs to be alerted to the need of a legal remedy.

I suspect many people may leave that portion of the ballot blank, unless a Democrat ‘harvester’ tells then to check ‘yes’.

Arizona kicked a measure off their ballot because it mixed up a percent increase with a percentage point increase. This is a pretty clear cut violation of the state constitution that’s not open to interpretation as, say, the balanced budget clause. If they’re going to allow this, screw the pension clause.

https://www.azcentral.com/story/news/politics/elections/2018/08/29/invest-education-tax-measure-kicked-off-november-ballot-redfored/1140338002/

So if this perveted ballot questin passes can it be overturned in court (federal court of course) for not following Illinois law?

A fair tax is one that the poor honest taxpayer has to pay and the HUGE GOVERNMENT PENSION DOES NOT HAVE TO PAY.

Sounds Fair to any Public employee (10% of Illinois) you ask.

Art. XIV, sec. 2, of the 1970 Illinois Constitution provides that: “Amendments approved by the vote of three-fifths of the members elected to each house shall be submitted to the electors at the general election next occurring at least six months after such legislative approval, unless withdrawn by a vote of a majority of the members elected to each house.” Notably, it is the “Amendment” that “shall be submitted to the electors at the general election.” Not some hokey, and misleading, description of the amendment. This ballot does not contain the text of the amendment. This doesn’t even pass the… Read more »

Yes! Thanks for that addition.

The average Joe, the little guy, the honest taxpayer….all have no chance when they go up against the corrupt liberal machine, also called the Democratic party. The only way to win is not to play (in Illinois).

Has anyone attempted to mount a legal challenge to the ballot? This clearly violates the “separate ballot” clause in the state constitution.

Not to my knowledge.

I would think that all that Ken Griffin anti fair tax money would be better served on a legal challenge instead of TV ads (I have yet to see one, maybe I don’t watch enough TV). Either he’s not as smart as we all give him credit for or he knows a legal challenge wouldn’t go anywhere in this corrupt state.

To be expected at this point, sadly.