By: Ted Dabrowski and John Klingner

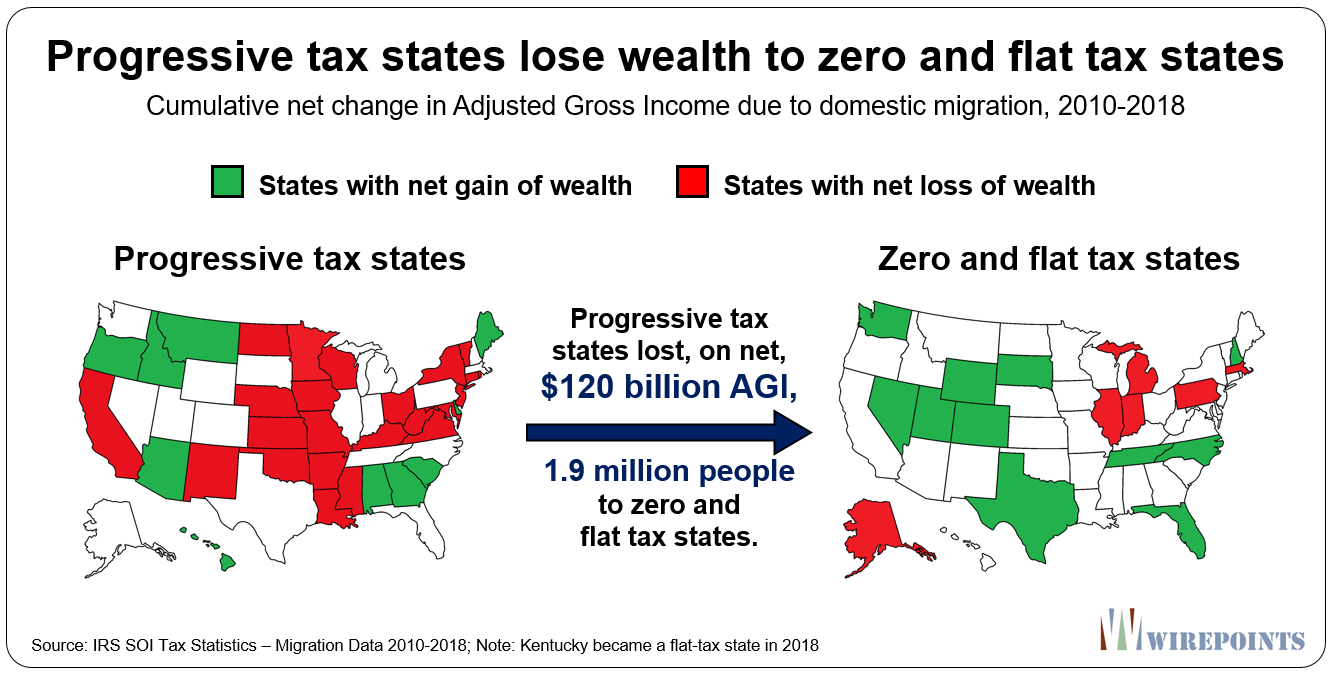

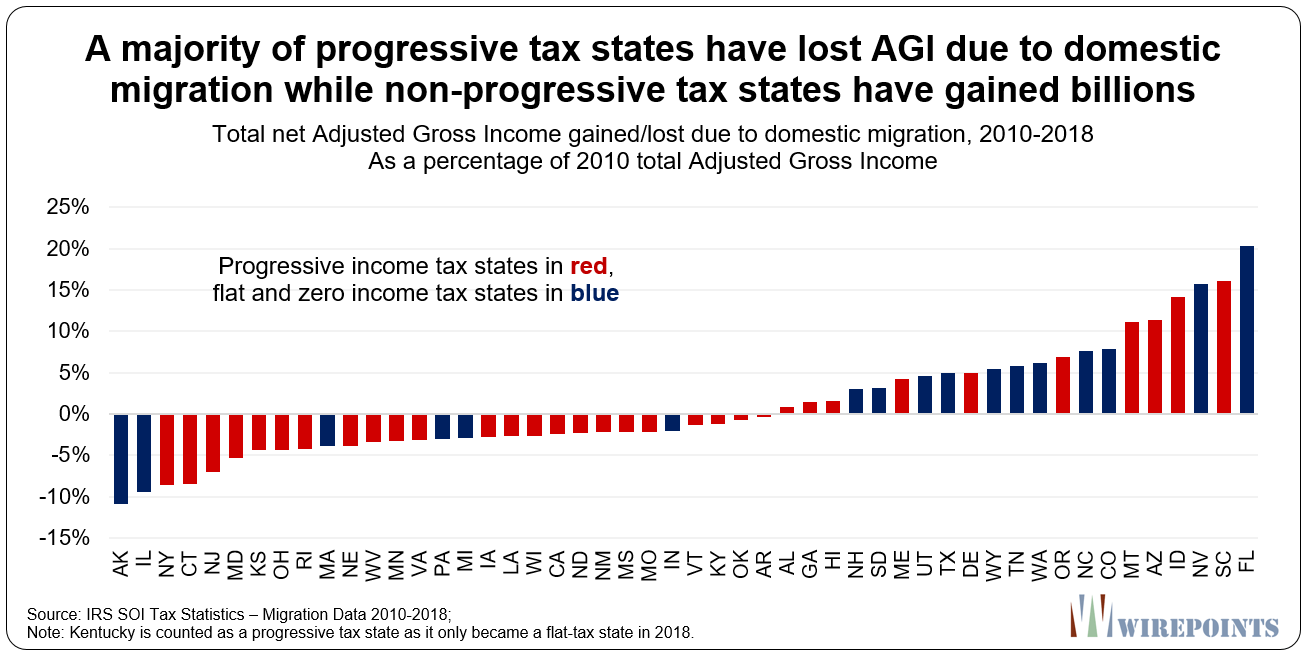

Flat and no-income tax states, as a group, are beating out progressive tax states in the contest for people and their incomes, according to the last decade of IRS migration data analyzed by Wirepoints.

The nation’s seventeen flat and no income tax states won a net 1.9 million residents and $120 billion in Adjusted Gross Income (AGI) from progressive tax states during the 2000-2018 period. That’s nearly a 4 percent AGI gain for the flat and no income tax states, based on their 2010 base of $3.3 trillion in AGI. A table with the individual winners and losers over the time period is provided below.

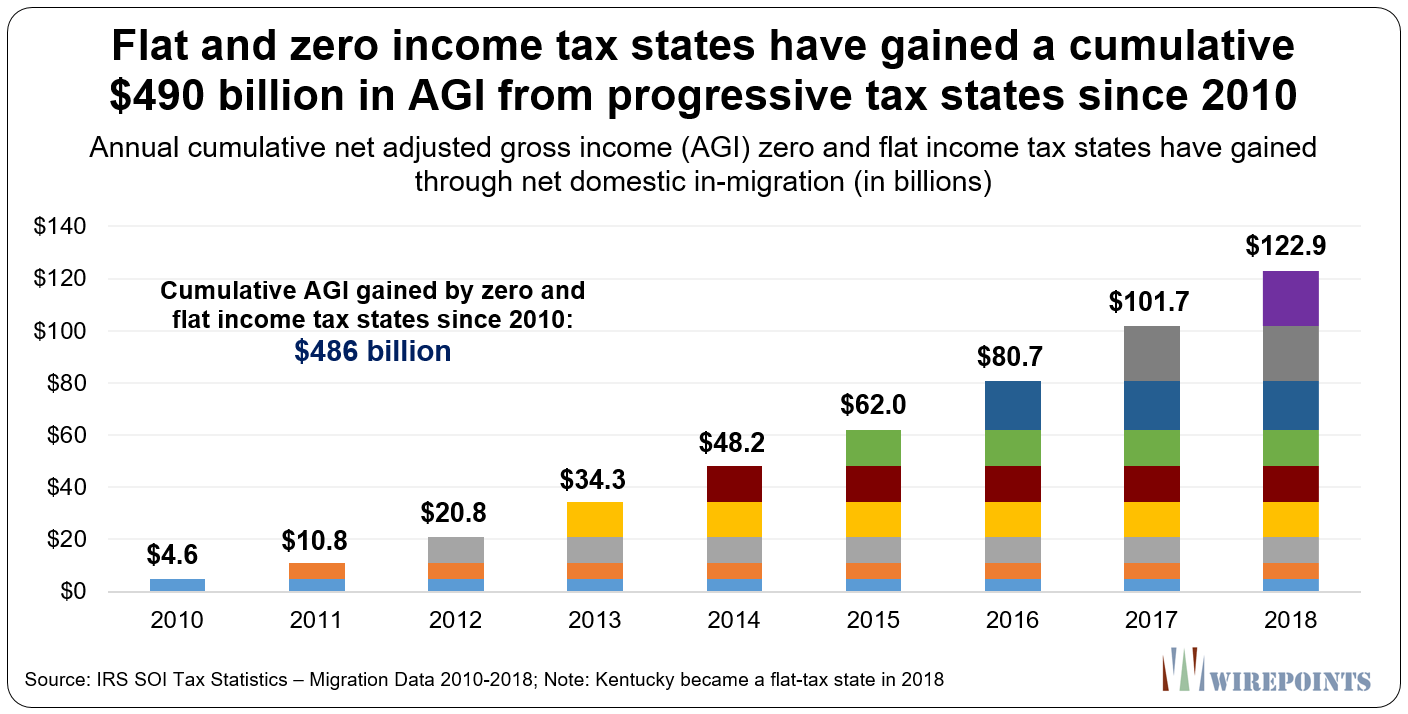

The net gains in AGI not only bolster the tax base the year in which they come in, but they also help all subsequent years. The gains pile up on top of each other, year after year.

That means the country’s flat and zero income tax states, as a group, have accumulated $490 billion in AGI since 2010 from the nation’s progressive tax states, adding vibrancy, investment and tax revenues to the winning states.

States don’t change their income tax schemes often, so when they do, it’s a big deal. The change pits those who favor progressive taxes against those who want a flat tax or no income tax at all. Eight states don’t tax income at all in the U.S., while ten states have flat income taxes. Thirty-two states have some form of a progressive tax scheme.

Connecticut was the last state to move to a progressive tax structure in 1996, while North Carolina (2013) and Kentucky (2018) changed to a flat tax more recently.

Now some Illinois politicians want to abandon the state’s flat tax in favor of a progressive income tax. They argue, among other things, that higher taxes will bring more stability and people to the state.

But the movement of people and wealth across the country tells a different story.

The accumulated pattern over the past nine years is pretty clear. People are moving from progressive tax states to flat and zero income tax states. Of course, people move for a whole host of other reasons beside taxes: jobs, housing, family, weather, retirement, corruption, etc. Taxes are only one reason. But for many people, they are a big one.

The wealth accumulation by the flat and zero-income tax states is all the more impressive considering there were just 17 such states (not including Kentucky) compared to 33 progressive tax states.

Total gains

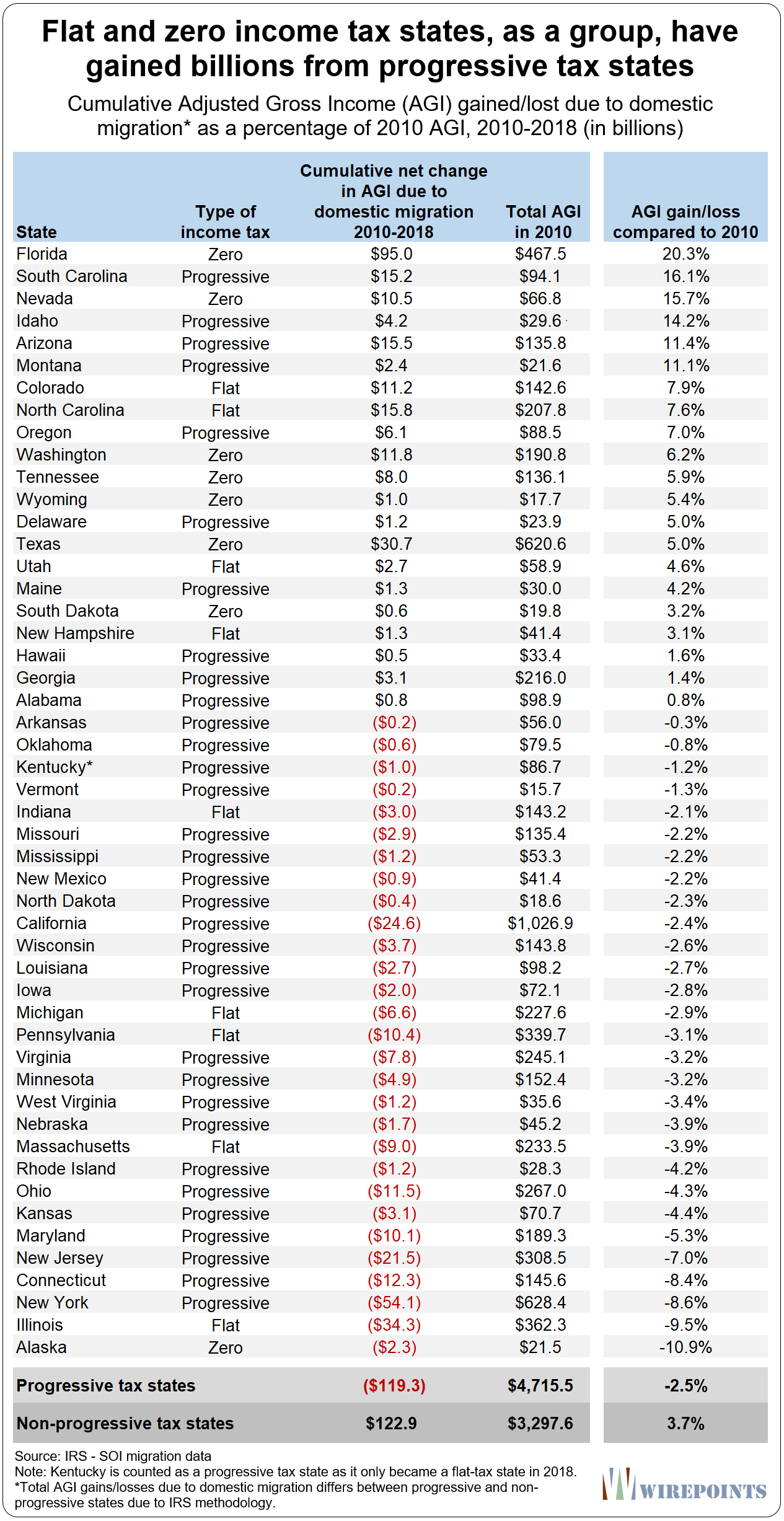

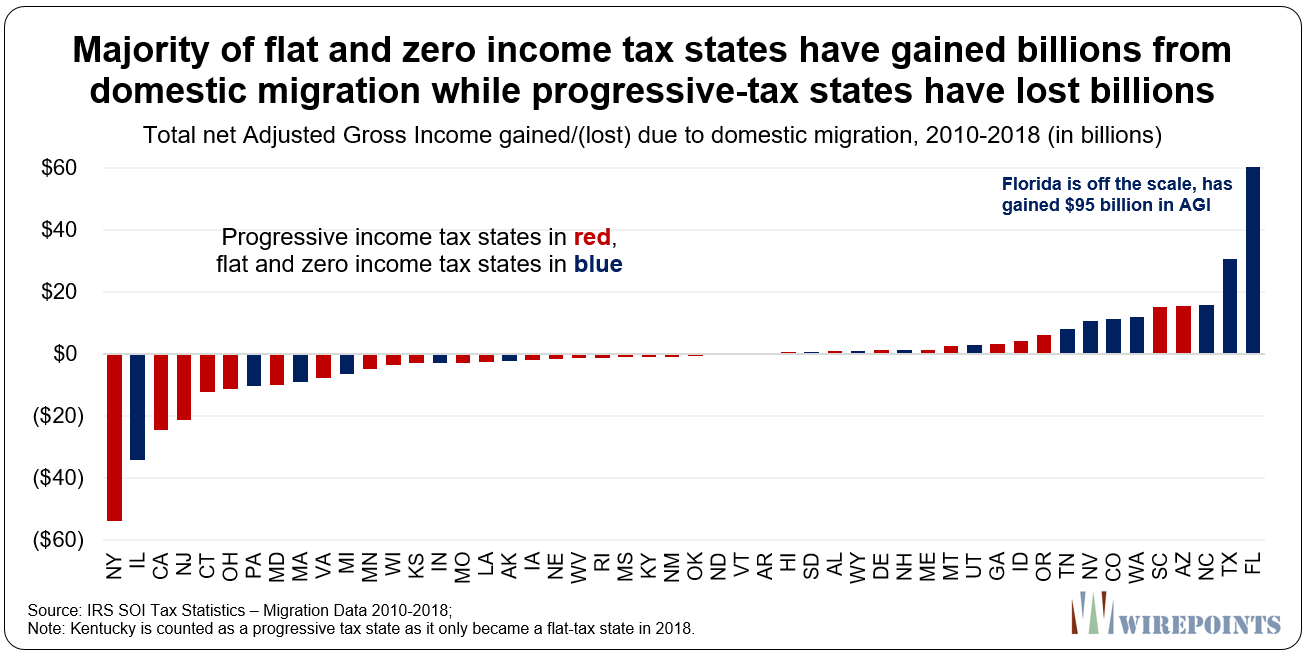

The $120 billion total is the net transfer between the two groups of states. In terms of individual total wealth gained from migration, zero and flat income tax states make up seven of the top ten winners of net domestic migration.

Florida, a state with no income tax, has been the biggest winner by far. The Sunshine State has gained nearly a million net people and over $95 billion in AGI from other states since 2010.

Zero-tax Texas is up next with a gain of $31 billion in AGI, followed by North Carolina with $16 billion. Two progressive tax states, Arizona and South Carolina are next, then non-progressive Washington, Colorado, Nevada and Tennessee. Progressive tax Oregon rounds out the top 10.

In contrast, the list of top losers is filled with progressive tax states. New York is the worst in the country; it has lost a net $55 billion in AGI to other states since 2010. Illinois, where politicians want to join the ranks of progressive-tax states, is next with a net loss of over $34 billion. Progressive tax California, New Jersey, Connecticut and Ohio are next. Flat tax states Massachusetts and Pennsylvania along with progressive Maryland and Virginia round out the top ten losers.

The gains and losses states have experienced since 2010 aren’t trivial. Winning states have, on average, seen net AGI gains from other states equal to 10 percent of their 2010 base AGI. Once again, Florida takes the top spot with an in-migration gain equivalent to 20 percent of its 2010 AGI. Progressive tax South Carolina is next with a gain of 16.1 percent, followed by Texas with 15.7 percent.

Illinois, meanwhile, lost the equivalent of 10 percent of its 2010 AGI to other states, the 2nd-worst loss in the nation behind Alaska.

What all this shows is that progressive tax states, if they’re attractive in other ways, can still win people and their incomes. And it shows that a flat tax state like Illinois can lose people if it’s corrupt, mismanaged and financially crippled.

So no, taxes aren’t everything. But add a progressive tax scheme to the nation’s most mismanaged, most-indebted, near-junk-rated and highest taxing state in the country and you’re asking for trouble.

Just follow the money.

Read more about why a progressive income tax would harm Illinois:

- If the wealthy flee, ordinary Illinoisans will be left holding the progressive tax bag

- Illinois enacting a progressive tax hike is like Sears attempting a turnaround by hiking prices. COVID-19 only makes it more absurd.

- Don’t be fooled by claims that a progressive income tax for Illinois would mean property tax relief

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level. Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Tax, Tax, Tax the honest hard working slave taxpayer.

See how this really works as Illinois is loosing population fast to Faster.

Illinois ” Land of Slavery”

Moral of the story for states. Tax on consumption, not income.

Ted and John, your maps are a bit misleading, because some states you show as having progressive tax rates essentially operate more like flat tax rate states. For example, you show VA as having a progressive rate, but there’s only one rate on taxable income over $17K. As you well know, that’s not the type of tax gradient IL is looking at. VA shouldn’t be grouped with IL in more ways than one.

They’re using the same math the pro Fair Tax folks use when they paint flat tax states as extreme outliers in a progressive tax world.

There shouldn’t be any income tax to begin with. That said, we’re moving to Phoenix, and I can say that it is FAR cheaper in regards to taxes there than here even with an income tax. Property taxes are under 1/4 what they are here.

BTW Anyone who is a Democrat, leftist, socialist etc need not look at Arizona–it’s full. They are holding the gate open long enough for my family and myself to get in. Temperatures routinely reach 200 degrees and it’s an ugly barren wasteland.

There’s a reason there are low taxes in Arizona- most of the state is a geographic wasteland. And yet, property is sky high to purchase.

Chapman- I was being sarcastic about the wasteland comment. The Sonoran desert has more plant and animal species than anywhere on the planet, except the rainforest. That’s hardly a wasteland, and in fact, Illinois is more of a wasteland than Arizona is.

Northern Arizona is forests of ponderosa with more annual snow than Illinois. Phoenix is now the 5th largest city in the nation with companies relocating there. It’s not perfect, but FAR better than staying in Chicago.

did you look at Nevada?

…yes, I hear car windshields blow out in AZ during the summer!…I’m sure Messrs Madigan, Cullerton, et al, and the current/past IL State legislature, and especially the Illinois public unions, with their terrific “pensions”, would like to thank you for the estimated 20%?-40%?-60%? reduction (ie public union donation) in the sale price of your home in ILL., as a result of (1) the long term property tax liabilities that come with it, and (2) the depressed economy as a result of having the highest, or almost highest taxes in the country, while holding last place of all states regarding fiscal… Read more »

….Ill. Dems/Repubs have avoided a variable income tax for many years….I presume so not to animate/upset the wealthy class, that can call attention to their shenanigans….so they went instead with unlimited property tax exposure (to pay fabulous pensions, issued by Mr. Madigan et al), with the suburbs @ about 33% higher than Chicago, and with big breaks for the wealthy, so they would not get too hot….now, the usual no cost cutting, and the legislature (Madigan) proposes just higher tax rates….thats of course disgusting, but we probably need the wealthy class more in this fight, so a variable tax increase… Read more »

If the state was interested in fairness, they would’ve introduced a revenue-neutral fair tax. They didn’t.

If the state wanted to reduce the tax burden on the working class, the tax rate for the $0-$10,000 tax bracket would be 0%. It’s 4.75%.

If the state truly wanted to offer some property tax relief, they would’ve increased the property tax credit long ago instead of lumping a tiny 1% increase with the fair tax.

JB wants to buy your soul for a few bucks. Are you willing to sell so cheaply?

Ted—we decided after running the numbers that we would save enough on property and income taxes to save enough to fully finance a home in the no income and low property tax state of Tennessee. I work from home and just need to be near a decent “connection” airport. We’ve been contributors on Illinois Policy for years as we have fought and lost many battles with DNC leadership. Once Governor Rauner was defeated by tax cheat Pritzker, the wheels started into motion. We love it here in Illinois. We will miss our small and beautiful lake and friends and all… Read more »

Plus. it’s really only a long one day drive back to most areas of Illinois from Tennessee to visit.

The more you tax the more people who flee. This is death spiral.

The Greed of the Cops, Teachers and Firemen have destroy the quality of life in Illinois for GOOD.

The hard working honest taxpayer does not stand a chance.

There will be no job opportunities’ for the next generation.

The sooner you leave the better off your life will be.

The best day of you life will be the day you say “GOOD BYE ILLINOIS”.

Illinois “The Land of Slavery”

The irony only grows in the Land of Lincoln where we formerly understood the Emancipation Proclamation and its historical significance. Then again, all is in line with the Opposite World swirling in the air and descending on USofA.

Wouldn’t a progressive property tax rate make more sense? It fits the bill of populist appeal is to “punish the wealthy”. It can’t be escaped: Property isn’t portable, income is. Property taxes are responsible for certain local entitlements (OPEBs and extraordinary public employee benefits). Therefore, enterprise funds may be created at County or township level to sequester the funds raised by a p-tax surcharge, to keep these entitlements funds safe from anxious little hands in Springfield. If designed properly, a graduated property tax rate surcharge might provide a workaround to access billions in TIF dollars. More… Read more »

Don’t give into the narrative that more revenue is needed. The state needs to cut back spending, and reduce all taxes if it wants to thrive in the years to come.

I absolutely agree that Illinois government industry needs spending cuts, pension entitlement reform and reduction of incestuous crony corruption.

How to make that happen is at issue.

One thing we know for certain: these sociopathic predators will not let their revenue stream be disrupted voluntarily.

Strategies that might work against them involve using tactics which they endorse (‘tax the wealthy’) but which would damage them and their supporters personally.

The rich will find a way to get around any tax. I know a guy that removed a toilet to same some money on his real estate taxes.

Some states shown with progressive income taxes are progressive in name only, i.e. not in any meaningful sense. For example, in Virginia, the highest tax rate (5.75%) begins at a taxable income of only $17,000, even for a married couple filing a joint return. Interestingly, the Democrats here took complete control for the first time in a long time this year (governor and both houses of the legislature) and there have been no income tax increases, at least not yet.

I have no issue with the concept of a progressive tax. Like others, the concern is how it is implemented/utilized. Now that lenders are reluctant to provide credit, taxes become the only source of revenue. It’s easy to visualize rates going up 10% (not including inflation) each year on the middle income and 20% on the wealthy for the next 5-10 years. My guess that would eliminate 10% of the Illinois population, perhaps more. That will cause serious home depreciation. If you think that’s not likely, the only alternatives are drastic cut backs in government spending and/or bankruptcy (if allowed).… Read more »

If voters in Illinois vote for Pritzkers progressive tax increase, it’s over. Illinois is at a tipping point. Right now I’m not certain voters in Illinois are smart enough to realize this after voting in Pritzker, a host of Leftist Democrats, and LL as Mayor. I’d say even with the economic collapse Pritzker has created, and the irresponsible state ‘budget’ just passed, the tax increase has at least a 50/ 50 chance.

My best friend and his wife were smart enough. He has a tech job and can work from anywhere. They ran the numbers on what would happen if the progressive tax were to pass and they moved 2 years ago to a no tax state. He could not be happier. More bang for the buck, and no state income tax made moving a no brainer.

my place sold. we close in Aug/Sep. I don’t know where to land is the problem. But, leaving is not a problem

Arizona’s top progressive tax rate is LOWER than Illinois’ flat tax rate.

All the Cops, Teachers and Firemen retire to Florida to live their life out in Luxury Homes and drive Luxury cars at age 45 to 50. If you retire after fully vested pension you end up with over $100,000 per year with 3% annual increases for LIFE. Many, many get over $3 million to $5 million in total. They only paid in $100,000. Illinois honest hard working taxpayers are getting SCREWED BIG TIME. Getting rid of herpes will be easier than selling a home in Illinois.

Illinois “Land Of Slavery”

Blah, blah, blah. Back from your time in rehab for severe alcoholism and still spouting your hatred for anyone who earned a pension from a municipality, county, or state. You are a small minded , evil, hateful person and I’m sure you beat your wife and dog. Shut up.