By: Ted Dabrowski and John Klingner

Illinois spends 70 percent more per student on K-12 education than Florida does and yet the Sunshine state overall outperforms Illinois in national testing. That was the topic of Part 1 of this series.

Illinois spends about $16,200 per student on K-12 education while Florida spends just $9,600, according to the most recent U.S. Census data that includes federal, state and local funds. What’s driving that per student gap?

Pensions, for one thing.

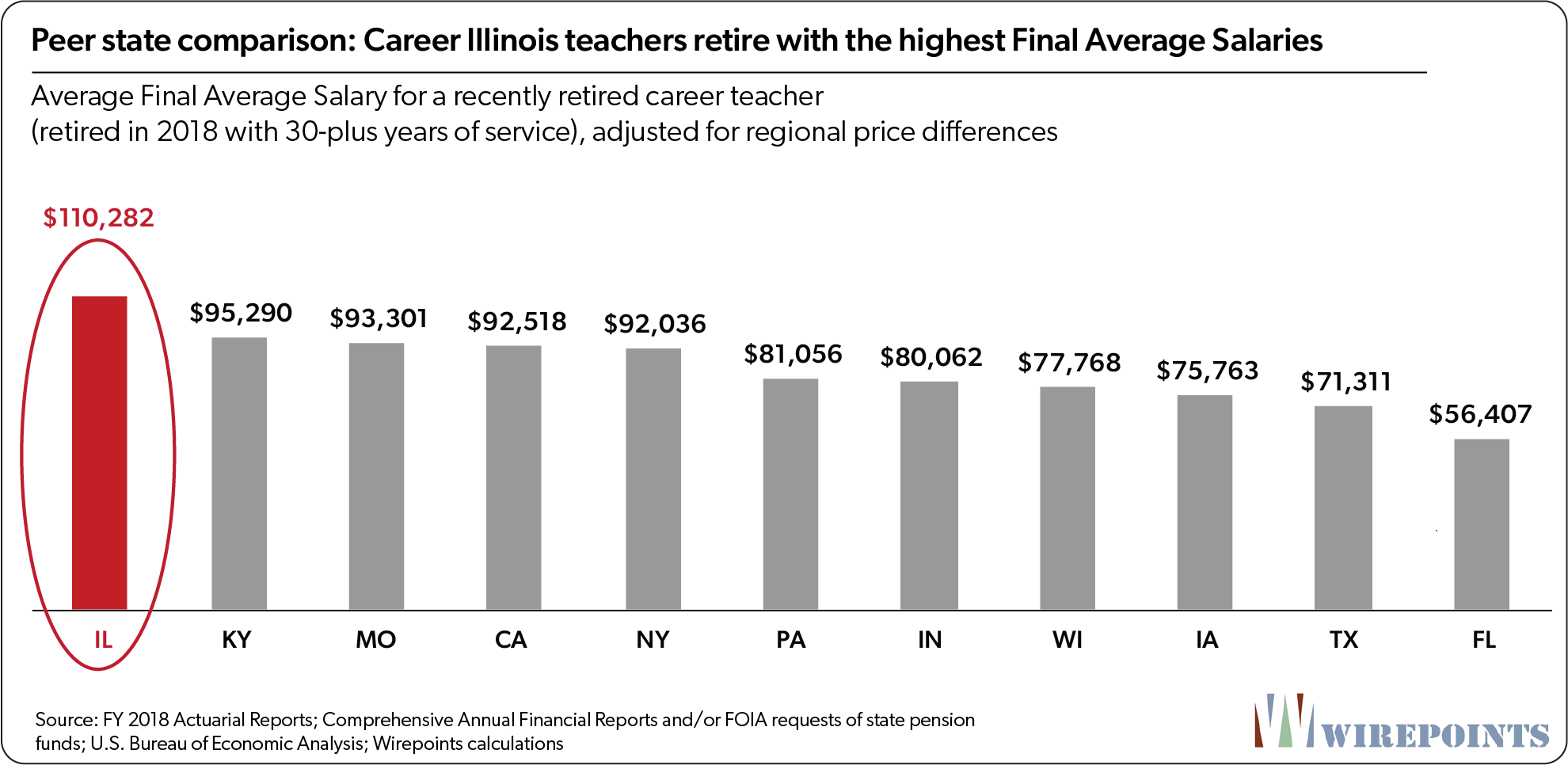

And it’s not just in comparison to Florida. We looked at pensions in the nation’s five largest states plus Illinois’ five neighbors and found Illinois teacher pensions are far higher than in any of the other states. Illinois even beats out big-paying New York and California.

The topline stat: A recently retired, career Illinois teacher will collect over $2.9 million in lifetime pension benefits during retirement. At the other extreme are states like Texas and Florida, where similar teachers with 30-years plus of service will receive about $1.4 million in retirement benefits. That’s more than a 100 percent difference in lifetime payouts.

It’s those excessive benefit levels, along with a lack of reforms, that has made Illinois the nation’s extreme outlier when it comes to pension shortfalls.

That’s unsurprising considering Illinois is also an outlier in each of the four key drivers that impact teacher pensions:

That’s unsurprising considering Illinois is also an outlier in each of the four key drivers that impact teacher pensions:

- Final salaries: The salaries used to determine starting pensions are far higher in Illinois ($110,000) than in any state surveyed.

- Starting pensions: Illinois’ starting pensions of $81,000 are the highest of any state.

- Retirement ages: Illinois teachers retire at 59, earlier than in most states. Compared to Indiana and California, Illinois teachers get three more years of benefits.

- Cost-of-living adjustments: Illinois teachers automatically get a 3 percent compounded COLA every year in retirement beginning at age 61. That boost doubles a teacher’s benefit after 25 years in retirement, the most generous benefit of any state surveyed.

The details – Breaking down teacher pensions

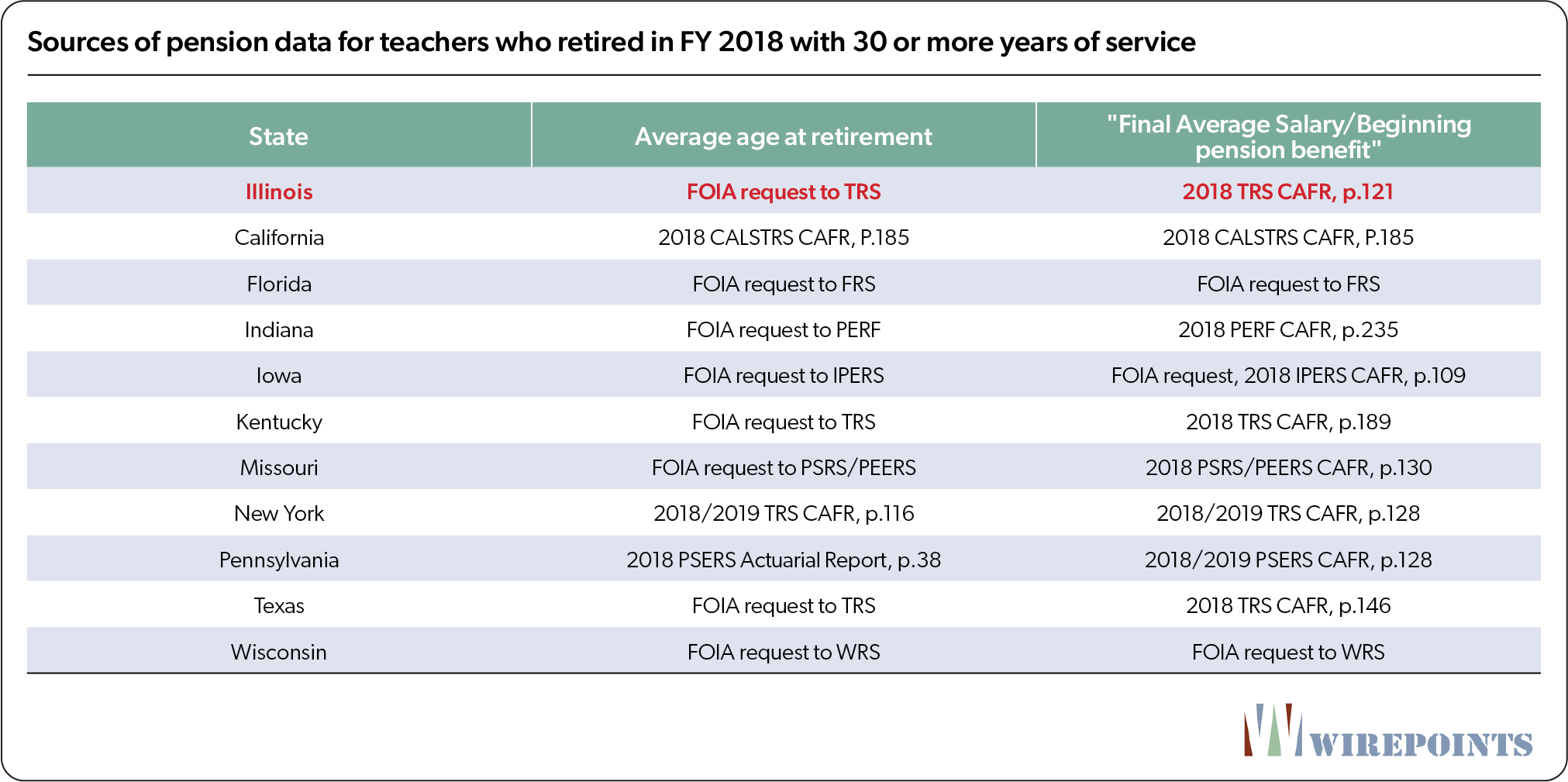

Wirepoints used data available in each state pension fund’s Comprehensive Annual Financial Reports, as well as information obtained via FOIA requests, to develop an apples-to-apples comparison across state-run teacher pension plans. We collected the data of teachers with 30 years or more of service who retired in Fiscal Year 2018. (See Appendix below.)

All compensation data shown below is adjusted for regional cost differences between the various states.

For more details, see Solving Illinois’ Pension Problem – Overpromised & Overgenerous and Wirepoints’ Pension Solutions.

Highest Final Average Salaries

Calculating a teacher’s pension starts with determining an average final salary.

Career Illinois teachers retire with, on average, a Final Average Salary of just over $110,000, the highest among the states Wirepoints surveyed. For Illinois teachers, the final salary is based on the average of the four highest consecutive annual salaries within the last ten years of service.

Career Florida teachers, in contrast, end up with a salary of about $56,400, about half as much as an Illinois teacher and the lowest of any of Illinois’ peer states. Florida’s Final Average Salaries are based on the average of the five highest years of compensation during employment.

Illinois teachers’ high final salaries translate into the highest starting pension benefit of any peer state.

As mentioned above, starting pensions are determined by a final salary and each state’s individual pension “formula” that also takes into account years of service and a “multiplier.”

The starting pension is the core of a teacher’s benefit. It serves as the base for any cost-of-living adjustments teachers might receive. Teachers in some states also participate in Social Security, which adds to their total retirement benefits.

The beginning benefits for an Illinois teacher were just under $81,000. Again, Illinois was the outlier among the states surveyed.

Florida teachers, by comparison, receive about half that amount in total benefits – just over $43,000. That amount is made up of $28,000 in pension benefits and $15,000 in Social Security benefits.

A note here is that Illinois and New York are not that far apart when it comes to starting pension benefits. It’s when COLAs, as described below, are applied that the big differences in lifetime benefits show up.

A note here is that Illinois and New York are not that far apart when it comes to starting pension benefits. It’s when COLAs, as described below, are applied that the big differences in lifetime benefits show up.

Early retirement ages

The earlier teachers can retire and collect full benefits, the bigger their lifetime pensions will be. In Illinois, the average retirement age for recently retired career teachers is 59. Florida teachers, on average, work an additional 0.75 years before collecting a pension.

The real difference shows itself in comparison to states like Indiana and California, where Illinois teachers get three more years of benefits than their counterparts. For an Illinois career teacher, that adds $240,000 to the total lifetime benefits.

Once the starting pension is set, the biggest driver of lifetime pension benefits is the state’s generosity with cost-of-living adjustments.

Again, Illinois outpaces the other states.

Illinois teachers 61 and older automatically get a 3 percent compounded COLA every year in retirement. The effect of that boost doubles a teacher’s benefit after 25 years in retirement, regardless of inflation, the health of the pension fund or the state’s general finances.

Meanwhile, California provides only a simple 2 percent benefit to its retired teachers. New York State’s COLA is even smaller – a maximum of 3 percent on a teacher’s first $18,000 in benefits.

Some states don’t even offer a guaranteed COLA. Indiana, Texas and Pennsylvania only grant a benefit when the state legislature votes for it. Those states go for years without increases. And Illinois’ neighbor Iowa offers no COLA at all.

Florida used to offer a 3 percent compounded COLA, but stopped teachers from accruing that benefit in 2011. Today, career retirees receive a portion of that 3 percent benefit based on how many years they worked before 2011, divided by their total years of service.

To summarize the impact of COLAs, an Illinois teacher’s starting $81,000 pension will grow by 3 percent annually on a compounded basis. In 25 years, that pension amount will total about $160,000, or double the original amount.

To summarize the impact of COLAs, an Illinois teacher’s starting $81,000 pension will grow by 3 percent annually on a compounded basis. In 25 years, that pension amount will total about $160,000, or double the original amount.

In contrast, a Florida teacher’s starting $28,000 pension will grow by 2.4 percent annually on a compounded basis (27 of the teacher’s 34 years of service qualify for 3%, resulting in a 2.4% COLA). In 25 years, that pension amount will total about $50,000. The teacher’s other benefit, $15,000 in Social Security, will receive a COLA based on yearly inflation.

************

For decades, Illinois politicians have given away perks and pension sweeteners to government workers, including teachers, which we’ve documented in detail here. Illinois’ extreme outlier status when it comes to teacher pensions is a direct consequence of that.

Illinois’ pension benefits are just one of many factors that have created the worst retirement crisis in the nation – and they’ve helped blow up Illinois’ education spending. Illinois’ per student spending grew more than any other state in the country, in percentage terms, from 2007-2019.

Don’t be fooled by Illinois politicians’ continued call for more money for education. As long as they ignore pension reforms, those additional dollars are only going to end up paying for growing benefits and pension shortfalls, not classrooms.

Read more about Illinois K-12 education and pensions:

- Illinoisans would pay 40% less in property taxes if the state spent at levels where students perform better: Florida

- Illinois education spending soars while outcomes flatline – Special Report

- Administrators over kids: Seven ways Illinois’ education bureaucracy siphons money from classrooms – Special Report

- Illinois Pensions – Overpromised & Overgenerous

- Wirepoints’ Pension Solutions page

Appendix

- Wirepoints acknowledges there are many new tiers offering different levels of benefits across the states, including in Illinois, but the overwhelming majority of earned benefits are still owed to teachers in older tiers.

- Wirepoints ran the benefits of teachers in state-run pension funds, excluding teachers in the Chicago Teachers Pension Fund and the New York City Teachers’ Retirement System. Adding those city teachers to Illinois and New York’s calculations would not materially change the results of our calculations.

- Teachers in the majority of Illinois’ peer states participate in Social Security. Those benefits are included in our analysis of teachers’ total retirement benefits.

- Wirepoints used the U.S. Bureau of Economic Analysis’ Regional Price Parities Index to adjust for cost-of-living differences across states.

- Social Security actuarial tables were used to determine life expectancy.

For more details, see Appendix C in Illinois Pensions – Overpromised & Overgenerous.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level. Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Sorry, I missed something here. What was the Governor’s 403LB Plan?

My wife is a teacher and she’s earned every cent of her pension. It’s not her fault that politicians separated the system from social security, and are unable to manage the states money. There’s also already a 2 tier system where new teachers pay almost 9% of their salary towards payments with adjusted COLA cap half of what it is now. This benefit is so weak that by the time teachers receive it’ll be worth less than social security (Not good)! Ted continues to beat a dead horse even when the IL scotus has blocked decreases to tier 1 pensions.… Read more »

*If you don’t like the state – LEAVE*

If you are able to do so, you’ll soon realize that Illinois isn’t the utopia you once thought.

She didn’t earn *hit. She got her inflated salary, worked 9 months a year (or 12 months for extra pay), probably had her graduate degree paid for too, and now she’s milking the system for the pension.

I’ve worked in business for 35 years and the work I do is nothing compared to what our teachers do

Yep, Burger King Fry Cook is not much of a job compared to anything…😺🤸♀️😺

“It’s not her fault”, but she and her unions put these very politicians in power and have kept them there. They cheered while the politicians diverted funds to their various “social justice” causes. The unions created the problem, but now whine that it’s not their fault.

When you are relying on others to pay your pensions, it’s not prudent to tell them to LEAVE.

Just as insane people don’t know they’re insane, maybe greedy people don’t know that they’re greedy?

This comment illustrates the antisocial, predatory narcissism of households which have enriched themselves at the survival level expense of their communities. To them, it is their unalienable right no matter the consequences, pesky little details like taxpayer pickups OPEBs and pension spiking are ignored, it is always someone else’s fault, they really think they earned it, and if others don’t like it they can just go to hell. And, of course, they believe–and need others to believe–that they care passionately about children. From this comment we can extrapolate all that needs to be known about all public sector teachers, and… Read more »

The horse is not dead. Pre-covid, teachers only had 8 years worth of pension payments in the retirement fund. The system is going to go bust.

Actual retirement income is higher for Chicago teachers because they also have 403b plans. They are paying 2% for their pensions while other municipal workers pay 8% to 10% for their pensions. Thus, teachers can divert that 6%–8% of income to the 403b plan (if they are savers) and enjoy a more secure retirement than what is provided by their pension.

Anyone can save a portion of their own money for retirement. There is no matching element to a 403b plan and they are not mandatory but voluntary. As investments go, 403b is much more expensive than other choices. Payroll deduction and tax deferral are its 2 main advantages. I have serious issues with the “teaching profession” but no one should be criticized for saving their own money in preparation for old age. Any employment offers a similar opportunity on save/invest.

Nothing attempted to date has succeeded in overcoming this malignant disease affecting Illinois population quality of economic life.

One novel solution to try: give EVERY Illinois citizen the State-guaranteed defined-benefits enjoyed by teachers.

Start with Medical Professionals (because one can argue that they are ‘essential workers’).

Expand these entitlements to each and every civilian profession.

Arguments against this proposed solution will illustrate the narcissistic self-serving, predatory, sociopathic motivation of the proponents of status quo.

Then, who knows. Voter apathy or deliberate ignorance may shift toward solutions that actually help people rather than enriching predators.

Or treat tax hikes as a diminishment and impairment of our retirement. I don’t need to have the exact same retirement as public sector workers, but I need to be able to save more to get a retirement package that matches what they’ll receive. Tax increases prevent me from adequately funding my own retirement. Arguments of pensions vs 401(k) bear striking similarities to the argument of equality vs equity. For example, state pensioners get the same tax write-off on their pension contributions as I do my 401(k) even though their benefit is far more generous. Shouldn’t I get triple the… Read more »

Very good point. In that vein:

Teachers contribute at most 2% in return for( guaranteed) annuity.

Their annuity value is unobtainable by anyone else, because IRS limits annual contrbutions to tax-deferred plans.

Very good idea to give private sector workers tax credits to offset one of the exploitative disparate advantages given public sector.

At the very least our savings accounts should get 3% interest vs the 0.01% we get now all guaranteed by the state. But it would have to be FDIC insured somehow. Very few of us would trust the State of Illinois but they are still paying 1% per month after 90 days for money they owe you in a near 0% interest environment which was never indexed to inflation.

Does anyone know what late payments are in other states?

Like social security, a cap on annual payout should be put into place.

Three more years of collecting benefits is three less years of contributing towards those same benefits.

Illinois Teachers = Gold-plated Rolls Royce price, Yugo performance. The cherry-on-top is that many of these retirees are spending their pensions in FL and AZ, while the sucker taxpayers continue to labor to pay for them.

Overgenerous pensions and the failure to address them in a timely manner are the reason behind all of the fiscal issues that plague Illinois. It is too late at this point to do anything about it. The next 25 years will be painful for anyone who can’t relocate to another state.

The Federal Government converted their employees from civil service retirement to a defined contribution plan decades ago as did many private employers who once offered defined benefit pensions. It can be done efficiently over time. Pension problems and middle class abandonment sank Detroit but it was bond holders who took the hit. The Unions seemed to escape with minimal damage.

The ones that took the hit are the ones that retired before they were eligible for Medicare. They had to pay for their own healthcare which is pricey when you’re older than 55.

I agree it is pricey for medical coverage.But to consider this as “taking a hit”, I’d disagree. The aisles of Menards, Target, Costco etc. are filled with full and part time employees working for their current medical insurance at group rates and qualifying for Medicare part B (and thus Medicare Advantage) while collecting pension checks from state and local retirement funds.

The day of reckoning will come for the smug public unions. When it does, I hope the courts show no mercy.

the courts are in on the take,judges ask the unions and jesse snarkey how to rule,illinois is a complete joke

Eventually math beats politics.

i hope so,this state is a rigged joke,as long as the unions and fat boy pritzker gets their money,they could care less about the tax paying citizens

The day of reckoning will come or the day of band-aid fixes. The latter would be, for example, replacing the three percent annual pension increases with some inflated cost of living index that won’t be much less than three percent on average. The taxayers will party, and the politicians will take credit for the “victory.” But the party will be short-lived when the taxpayers learn that this change barely put a dent in their PT bills.

You can totally eliminate pension increases, but the taxpayers would still be paying for six-figure pensions indefinitely.