By: Ted Dabrowski and John Klingner

Don and Paula Parker aren’t your typical seniors. After living the last 20 years in Florida, they recently retired to Illinois.

The Parkers were born and raised in Rockford, Illinois. Don ran a house painting business in the Rockford area for many years while Paula worked in an unemployment office. In their late thirties they moved to northern Wisconsin, where Don was in law enforcement. And fifteen years later, they moved to Florida where Don was self-employed as a handyman and Paula worked full-time in health care.

When it was finally time to retire, they decided “to come home” to be nearer to family. In 2016, they left sunny Florida for a place in Poplar Grove, Illinois, just outside of Rockford.

Now, three years later, they’re experiencing buyer’s remorse. Not because of the weather, but because they don’t know if they can afford to stay in Illinois.

“We decided to move back. So I started researching, and I usually check things out pretty thoroughly. The only thing I didn’t do was check into the political factors in the state, and I wish I had. Because after being here for three years I now see that I would’ve never come back – never – with the political situation the way it is.”

“We’re getting by right now, kinda barely. But it seems like no one cares about people like us, seniors and lower-income people, when it comes to all these new taxes and rising fees.”

Don reached out after attending a townhall in Rockford where Wirepoints and the union-backed CTBA debated Gov. J.B. Pritzker’s proposed progressive income tax. He was frustrated by the pro-tax arguments he kept hearing.

Don reached out after attending a townhall in Rockford where Wirepoints and the union-backed CTBA debated Gov. J.B. Pritzker’s proposed progressive income tax. He was frustrated by the pro-tax arguments he kept hearing.

When we met with Don, it became obvious he follows closely what goes on in the statehouse. He pulled out a long list of tax hikes that the state and his local governments are planning.

He opened up with Illinois’ recent 19-cent gas tax hike and then proceeded to reel off the rest of them. “We’re talking about the bag tax, a progressive tax, a rain tax, a mileage tax, a TV tax, a beer and tobacco tax, a farm tax, a parking tax, a car trade-in tax…”

“It’s concerning to people like us. And it’s not just me. It’s many other seniors we’ve talked to and some lower income people. They don’t know what they’re going to do, they can’t plan for the future. Can they stay, do they have to leave the state? And we’re in that same boat, we don’t know either.”

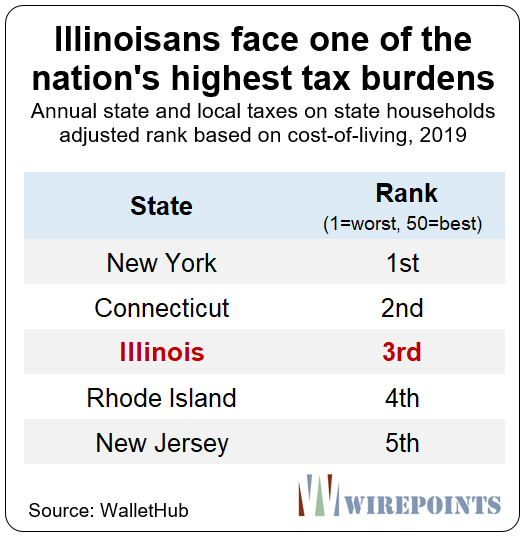

All those new taxes would pile on top of the burden Illinoisans already pay, one of the nation’s overall highest burdens, according to a recent analysis by Wallethub.

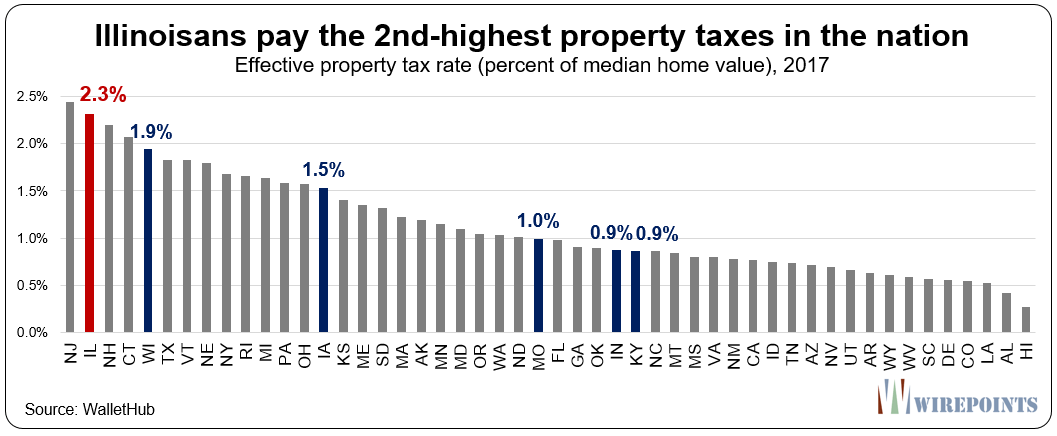

But the situation is even worse for people like Don and Paula, whose fixed incomes don’t grow much, if at all. “If our real estate tax goes up, we’re going to have to move, we are not going to have any choice. And that we don’t want to do. I tell you, we don’t want to move.”

The tax situation is impossible for many across the state. Illinoisans already pay the nation’s second-highest property taxes when based on home values.

As for Gov. J.B. Pritzker’s progressive tax panacea, Don doesn’t buy into the governor’s promises. “To me, if anybody swallows that bait hook, line and sinker, they need to do some fact checking. It’s not as rosy as they present it…if you look down the road a little bit.”

What disappoints Don the most is how politicians seem to ignore struggling seniors. He’s sent messages to Gov. Pritzker and House Speaker Mike Madigan in the past, asking them what he and Paula should do. Don hasn’t gotten a reply, not even automatic email response.

“Do they care, do any of them care about people like us? Do they want us to move? Do they want us out of the state? Why aren’t people like us thought of?”

“It’s a very sad situation.”

Read more about why people like Don and Paula leave Illinois:

- Progressive tax proponents say Illinois is a low-tax state, your tax bills say the opposite

- It’s not just property taxes Illinoisans should be worried about. It’s their home values, too

- Illinois’ demographic collapse: fewer immigrants, fewer babies and fleeing residents

- Illinois’ lethal combination: Rising property taxes and stagnant incomes

- The myth of the progressive tax panacea: What you need to know

- People of every age and income group are fleeing Illinois

- Wirepoints.org/out-migration

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

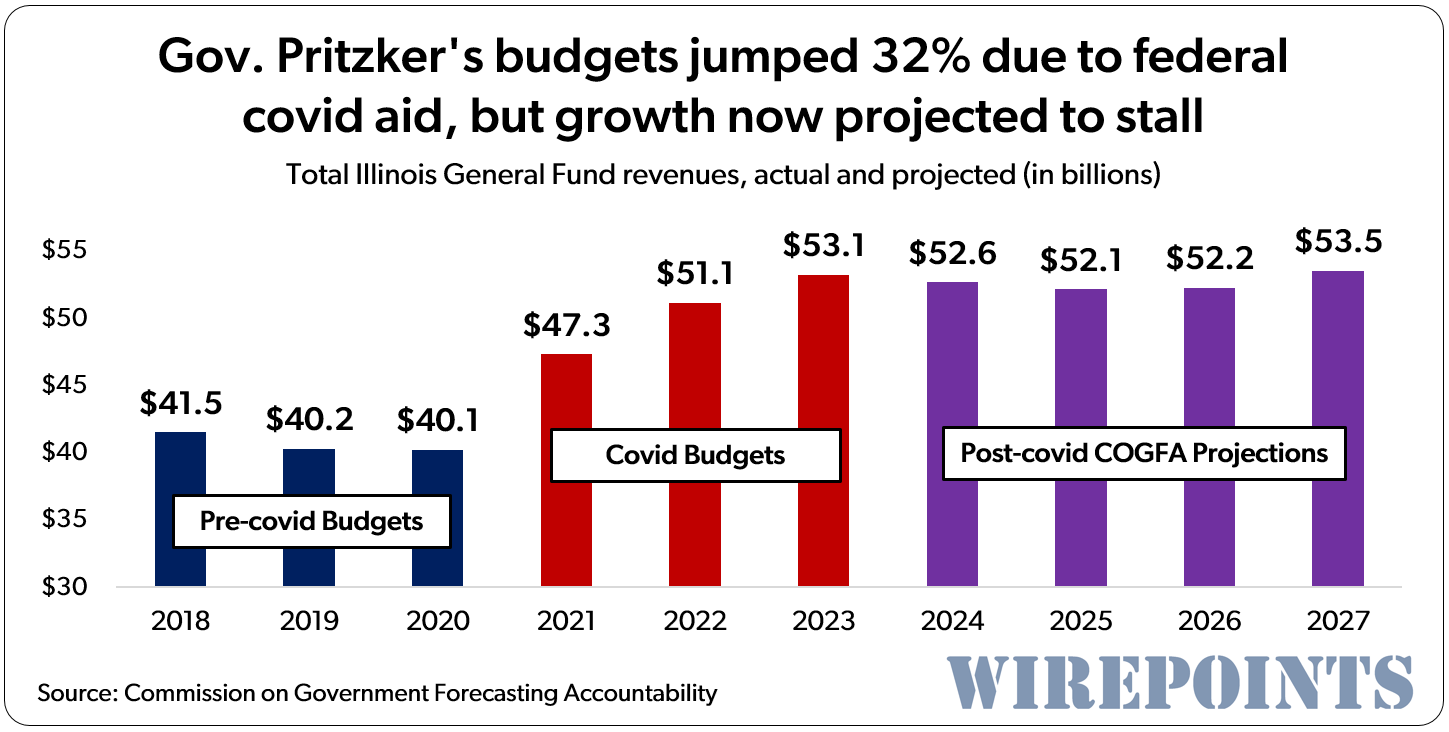

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more. Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow. Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

We are out of here come spring. I have had it.

Nope, don’t care. You wanted to move back to be closer to family? What about visiting once or twice a year? You now know how much its costing you to be, “closer to family”. There is also this thing called the internet and it has every answer known to man on it. Try researching next time before making such a fatal decision.

We are in our 70’s. We moved to Texas this year after 54 years of living in Il. So glad. We almost waited too long. Peole called us crazy . Illinois is not a friendly place. Between abortion, taxes and crime and corruption, it is not a good place to call home. Hoping the rest of our children will follow us down.

I’m not disagreeing here with anything you’ve said, but you’ve reminded me of something I found there more than a little odd when hailing from IL: a sign on a bank’s door “reminding” customers not to carry a weapon into the bank at College Station TX. Those Texans do love their firearms and apparently are used to carrying them almost everywhere. To me its the old story of the man who carries a hammer is on the lookout for a nail. In this case some are likely itchin’ to find a reason–any ol’ reason most likely–to use those guns, I’d… Read more »

How many homicides this year in Chicago have been by CCW holder? I would guess none

as opposed to the 15 year old gangbanger who shot into a crowd and nearly killed a 7 year old girl merely trick or treating? Would you rather have laws at knowing who is carrying? Or do you want 15 year boys running around with 45 magnuns shooting at 7 year olds.

As Dave Chappelle so eloquently put it… The First Amendment is first for a reason. Second Amendment is just in case the First one doesn’t work out.”

so are you a gun grabber James?

Looks to me like a liberal left Illinois and now is looking to turn Texas into a liberal hellhole. Take your antiquated beliefs and shove them. Law abiding people are not looking for a reason to use them. Or wait, would you rather be gunned down by a criminal or have a law abiding person shoot the criminal before they shoot you? Probably the former because you’ve been brainwashed into believing that law abiding people need to be disarmed. Why can’t you get it into your thick skull, that criminals don’t care about gun bans? Guns are NOT going to… Read more »

Boy, this place is filled with people who are quick to judge and will way, way too little evidence to do so. I wrote basically what was meant as a humerous comment, and yet it draws fire as if I were part of some enemy list. Why don’t you and others here take a deep breathe and sit back and relax once in awhile. I’m not nearly the ogre you portray here. I just found something I thought odd and even humerous given my upbringin in IL. No need to start WW III here over that comment. I take no… Read more »

Why did they move back there? Were they blind or just completely niave?

He came back here to be close to his family.

No they were stupid and they used, getting “closer to family” as an excuse for their ignorance. This would be the first time I’ve ever heard of someone moving from Florida back to Illinois. They are now a good object lesson of what not to do.

Of course, the politicians don’t care, and it’s sad because many people like the Parker’s believe they do care. Maybe when the pensions go poof they will realize it. How many keep voting for the same career politicians? Govt’s are broke everywhere due to their own mismanagement, overspending, and corruption. They can’t print money like the Feds, and it never dawns on them to reform, as that would mean admitting their mistakes. So, they keep taxing, as if people can’t simply leave, which of course they are in hopelessly broke places like IL. The teachers are striking in Chicago, but… Read more »

They are not thinking of people like you because they are only thinking about people that are in public employee unions. The public employee unions demand more money and benefits every year, and because they fund democrats, they get it. Democrats also get paid-for voting armies assuring them of additional terms. The democrat party long ago left the working Americans behind in Illinois. They are more concerned with placating and pandering to illegals, public employee unions and crony capitalists like Exelon and cannabis. Follow the money and you will understand exactly what the politicians in this state care about. That… Read more »

They’re white, and he’s a white man, so no, no one cares about people like that. If they don’t move out again, the Democrats will effectively confiscate their home.

Question? If seniors were exempt from school tax’s would it be more financially prudent and tolerable to stay? Almost 60% of our property tax’s go to the school district which we don’t use at all. Public schools are always on a spending frenzy and because of that are in constant need of more tax $$$. Community college tax’s are O.K. since they have many continued educational programs for seniors.

Then you would have those insane additional tax levies applied to all of the working age citizens in the municipality. That would exacerbate the existing problem by further driving out the people bearing the already heavy burden.

I like your idea in spirit, but whatever one does not pay someone else must.

The solution is to fix the spending, not move the hot potato around the board.

I agree that everyone would pay more but that is by design. In the 36 Illinois counties with PTELL any exemption including homeowners/senior./disability/abatements are reflected in higher rates because taxing bodies can get whatever was levied the year before not billed or collected. This was not disclosed when Ptell was pushed only that they are limited to a max of 5% increase. Reforms are sorely needed. Reliance on property to fund services should be changed to local county income tax/personal property tax plus reforms in exchange for a cap on property tax’s. It is not easy for seniors to pull… Read more »

Farmer’s, who used to pay taxes based upon the fair market value of their land, are now instead taxed based upon some theoretical productivity value.** Interestingly enough, when a developer buys the ground to subdivide they retain the same exemption that the farmer’s get. Now when one entity gets a break someone else has to pay more to pick up the slack. Perhaps then maybe if farmer’s were again required to pay their “fair share” based upon the value of their land taxes would drop and become more affordable for seniors. After all one might opine that the schools spend… Read more »

He should have researched the state of the state before he moved, not after. An examination of the various reports and online resources such as this one would have told him what was coming. And it’s not a matter of if, it’s a matter of when.

He told us he usually does his homework, but this time he failed to research the political situation in Illinois. He told us he never would have moved here had he known how bad it was. Never.

someone tell them about the senior tax freeze exemption and homestead exemption

they’ll be fine… other than being completely moronic for moving from Florida to here

The senior tax freeze only freezes the assessed values not the tax’s. Tax’s can still go up depending on the tax rate. It helps in an upward market but because of PTELL rules and if home values go down you are stuck with the higher assessment for 1 year and a higher tax rate to compensate for lower EAV.

Why, why, why would anyone think it’s a good idea to move from Florida to Illinois? Didn’t they notice all the traffic going in the other direction?

Family ties are strong. I had a friend move to Arizona. Moved back because they didn’t like being so far from their kids.

An excellent point and an issue that keeps many of us here.

At the expense of having your life utterly ruined.

Again the family excuse doesn’t fly when you are 100 miles or less from a neighboring state.

75% of Illinois’s population lives within 50 miles of the state line including everyone in Chicagoland

My wife’s logic is because our lives will be shorter then the eventual collapse plus we live right down the street from the grandchildren’s school and a few other things…life must be similar to others because many stay for the same reasons. Interesting though, most vote Democrat with a team line of “Democrats look out for the little people like us” or some similar jargon. I will say though in Illinois many Republicans are Democrats too ,,, all one has to do is look.

I disagree, Indy. I moved back here from Texas as my parents were aging and approaching the point where they would need care, though that was before Illinois’ problems were severe. Moving to Indiana or Wisconsin would not have worked. Countless others have similar personal reasons for being here. Far more have career or economic reasons that force them to stay, which we have listed before.

The family excuse doesn’t fly.

You can move to a neighboring state, still be close to kids and yet be safe from Illinois’s collapse.

Don should of did his research before moving as he looks foolish now.