By: Ted Dabrowski

Like so many local government leaders throughout Illinois, Wheaton city officials are desperate to do something about the city’s uncontrollable police and firefighter pension costs. The unfunded liabilities of the city’s public safety pension funds have jumped to $56 million over the past 15 years, and that’s despite major increases in taxpayer contributions into the funds.

Wheaton officials’ solution to the problem? Borrow more money. They’re considering a scheme using Pension Obligation Bonds, or POBs, that would let them gamble with taxpayer money in an attempt to improve pension finances. It’s simply a bad idea, especially in Illinois, where fiscal mismanagement and corruption are rampant.

Wheaton officials’ solution to the problem? Borrow more money. They’re considering a scheme using Pension Obligation Bonds, or POBs, that would let them gamble with taxpayer money in an attempt to improve pension finances. It’s simply a bad idea, especially in Illinois, where fiscal mismanagement and corruption are rampant.

Several Illinois cities have recently borrowed tens of millions via POBs, including the cities of McHenry and Freeport, and so has the Addison Fire Protection District, which took on $34 million in new debt. They’re all betting they can earn more in the financial markets than the interest costs of the loan they took out.

Official Wheaton board minutes reveal the city is also considering borrowing millions via POBs. Bankers from Baird and Marquette Associates have presented the idea, with Baird showing examples of Wheaton borrowing $56 million, equal to the city’s entire public safety pension shortfall.

The idea, in its most simple form, is this: Wheaton borrows $56 million for 20 years. The city then contributes the money to the pension funds so they can invest in stocks, bonds, real estate and other risky markets. The hope is that 20 years from now, when the money has to be paid back, the pension funds have earned higher investment returns than the rate at which the city borrowed the money.

If that looks like nothing but a gamble to you, you’re right. City officials want to borrow millions to see if they can beat the stock market. What could go wrong?

First, borrowing more money does nothing to solve the city’s actual problems. Sure the pension funds get a $56 million boost to their assets – and that makes the pension funds healthier immediately – but Wheaton taxpayers are now on the hook for the $56 million POB. That’s no comfort at all to taxpayers. They’re still on the hook for $56 million either way, but now they owe the bankers and not the pension funds.

Two, if the gamble loses money, taxpayers are on the hook for those losses, too. Taxpayers are already on the hook for millions in pension shortfalls. They can’t afford to let city officials make things worse.

Three, a flood of cash into the pension funds will let city officials give the illusion that they’ve done something about the local pension crisis. And that means any real efforts toward pension reform will stall.

Four, more borrowing doesn’t change the fact that pension promises in Illinois continue to grow faster than taxpayers can pay for them. More debt does nothing to end the 3 percent compounded COLAs. It does nothing to change the rules that let Illinois government workers retire in their 50s with full benefits. And it does nothing to change the fact that the pensions government workers get are totally disconnected from what those workers contribute into their plans.

Five, Wheaton’s strategy doesn’t change the other structural problems with Illinois pensions: pensioners living longer, lower-than-expected investment returns, too many retirees and not enough active workers, other actuarial assumption changes, and increases in pension benefits.

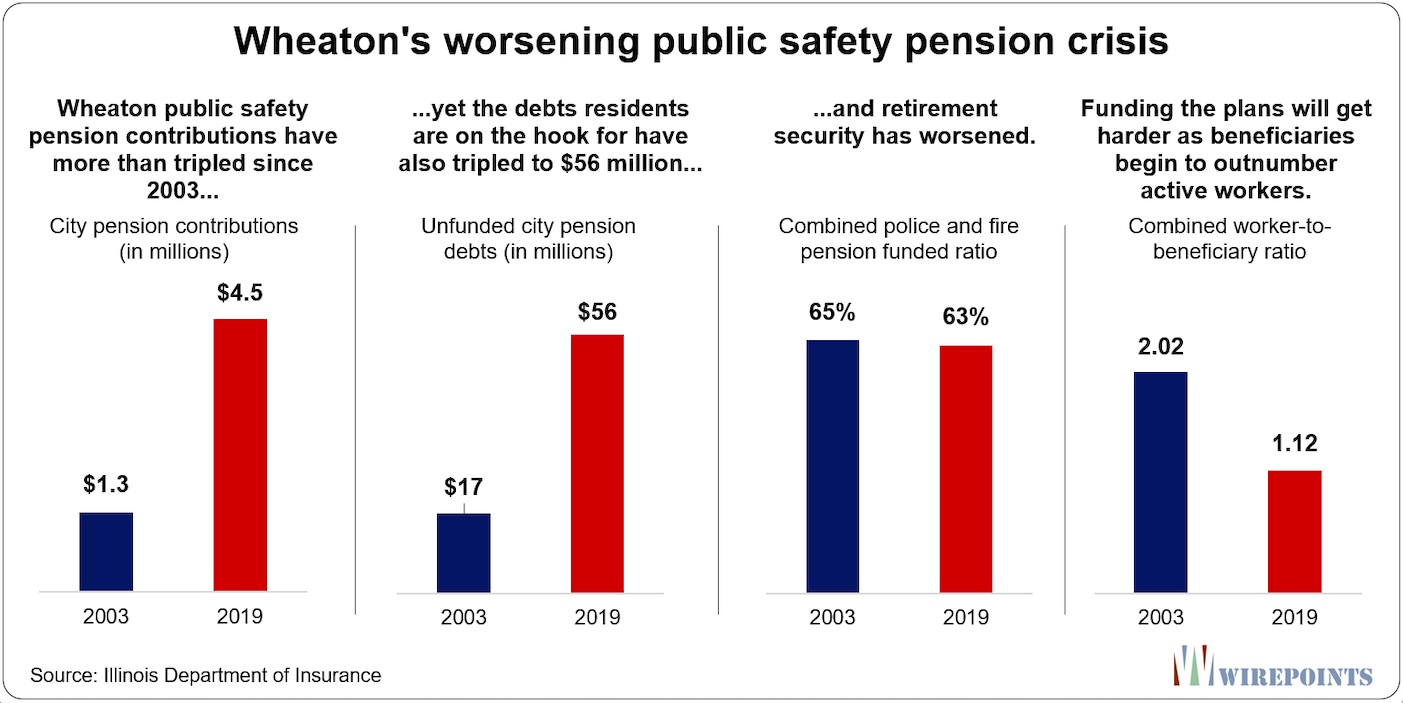

Those problems are behind the following graphic, which shows that no matter how much Wheatonites fork over in taxes, their obligations to pensions only grow. Since 2003, city contributions to police and firefighter pension funds have more than tripled, and yet the pension debts residents are on the hook for have also tripled over that same time period. Despite the efforts by taxpayers, retirement security for Wheaton public safety workers has also gotten worse.

And as the public safety workforce shrinks to make room for rising pension costs, the situation worsens. Today, there are just 11 active workers contributing into the pension funds for every 10 pension beneficiaries taking funds out.

In 2003, it used to be 20 active workers for every 10 beneficiaries.

There’s plenty more wrong with the POBs. More debt means less borrowing capacity should there be an emergency or the need for infrastructure. Rating agencies may look unfavorably at the increase in debt. And borrowing, instead of reforms, is just another can kick.

Residents don’t need their local officials pretending to be market traders with taxpayer money. If they think they can beat the market with $56 million, why not borrow even more, like $100 million. And if it’s so easy, every unit of government should be playing the game. Borrow at 2 to 3 percent and try to make 6.5 percent.

If they did, it would be a disaster for taxpayers. A few governments might win, but many more, often the most desperate and indebted, would lose.

That’s why national organizations such as the Government Finance Officers Association recommend that governments don’t issue POBs. The GFOA knows most governments don’t have the expertise to make good investment decisions and can’t be trusted with the responsibility.

The bottom line is this: POBs are inherently unethical. They transform local governments from service providers into trading houses – with taxpayers unwittingly providing the risk capital.

************

For further background, Wirepoints reported on then-Chicago Mayor Rahm Emanuel’s plan to borrow $10 billion in POBs.

- Rahm Emanuel’s latest can kick: Borrow $10 billion for Chicago pensions

- Pension Obligation Bonds Are Like Big, Fat, Dangerous Margin Loans For Stock

- Chicago CFO’s Stupendously Bad Timing On Her Last Pension Obligation Bond

- Emanuel’s real motivations for Chicago’s $10 billion pension bond plan

- Liquidation Sale. That’s How To Think About Chicago’s Proposed Pension Bond

- Emanuel’s misleading pension bond presentation to Chicago aldermen

- What an honest press conference with Rahm Emanuel might look like

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Anyone else notice that in spite of incredible pension obligations looming in places like Chicago, the city continues to offer the very pensions that are underfunded? Isn’t the first rule when you are being buried to stop digging the hole you are in?

In a rational world, yes. But liberals live in a fantasy world in their heads, much like Wonderland. They believe 5 impossible things before lunch.

Wheaton property will become worth “what the market will bear”. Currently, the market supports rental property investors. (Insurance/pension/annuity funds ‘chasing yield’). The CAP rate (rate of return) needed to justify property purchase is higher in Illinois due to political industry corruption. This causes a downward influence on property values, because the cost-per-corruption is a value-shaver applied to the numerator . Wheaton will lose population who do not profit from this economic model. Wheaton property title may revert to banks who have intimate relationships with political-industry actors who initiated this negative feedback loop, and revert title of REO to such actors.… Read more »

The General Assembly is responsible for initiating an amendment to the Illinois constitution for pension reform. That’s the only way.

There is a link in the WirePoints article to a City of Wheaton memorandum dated March 8, 2021 titled, “Analysis of Future Funding of Police and Firefighters’ Pension Liabilities – Continued Discussion: Pension Obligation Bonds.” That memorandum is included in the Wheaton City Council Planning Session packet also dated March 8, 2021. https://wheaton.il.us/AgendaCenter/ViewFile/Agenda/_03082021-1598?packet=true https://wheaton.il.us/AgendaCenter The March 8, 2021 memorandum indicates the Wheaton City Council began investigating the police and fire pension funding in earlier meetings. “At the September 21, 2020 City Council Meeting, the City approved engaging Marquette Associates to perform the aforementioned analysis.” “At the November 23, 2020 Planning… Read more »

Tonight is the night.

Monday April 26, 2021 the Wheaton City Council Planning Session at 7PM.

The public is invited with open arms.

See the above comment for the URL to the 38 page pdf with the subject title, “Analysis of Future Funding of Police and Firefighters’ Pension Liabilities – Continued Discussion.”

Here are the four public sector union bargaining units at the City of Wheaton and the expiration date of their corresponding collective bargaining agreements (cba). IAFF Local 3706 (Fire, cba expires April 30, 2021). IUOE Local 150 (Public Works, cba expires April 30, 2021). MAP Chapter 450 (Police Sergeants & Lieutenants aka Command, cba expires April 30, 2023). MAP Chapter 699 (Police Patrol Officers & Investigators, cba expires April 30, 2023). The majority of the pension obligations are for employees in these union locals, with the remainder being management and non-union employees. One reason the pensions are underfunded is the… Read more »

Where is the forecast of annual pension payments for Wheaton?

In other words let’s see what is the City Council so afraid of year by year.

And how does Wheaton compare to all the other municipalities in Illinois that have IMRF, downstate fire, and downstate police?

One would think Wheaton would be near the top of that group in terms of ability to pay pensions.

The damn state can’t even get ROI’s promised on pension investments they make. How many times have they had to downgrade their predictions throughout this bull market. The one thing politicians aren’t talking about is inflation. The CPI has already hit over 2% this year and climbing. Inflation is here, big time already. A severe “correction” in the stock market is coming faster than anyone will admit. And there are already too many cities/towns/villages who are “over reserved” according to state audits of their respective Reserve Funds. Tax money galore sitting in the municipalities being used as a pork barrel… Read more »

From the buyers perspective, I don’t see the logic of purchasing this bond. It would make more sense for them to just play the stock market themselves than give it to Wheaton to do the same thing.

FYI: The historical rate of return for stocks (after compensating for inflation) is around 7%.

I can’t imagine how much above that Wheaton would have to offer to tempt buyers.

There are many financial entities which must, by law, purchase bonds (think insurance companies, annuities, and your own local governments like schools).

These entities are ‘chasing yield’. There is great demand for any debt instruments which qualify under the law for investment purposes.

Are you asking if the ‘buyers’ are using critical analysis to discern whether there is a great medium- or long- term risk to Illinois public issued debt paper?

You can answer your own question when you understand how those who run OPM funds are compensated, and that CYA techniques merely involve following (loosely) the law.

By the way, great job on your articles and your graphs are gorgeous.

Some Illinois City father’s what to Gamble? Ted, they all gamble.

All of Illinois is just a huge lottery and it’s been a losing game for decades.

I’ve been here for 60 years and this state is a massive embarrassment to me and my family.

We, those of us who hang around, are the stooges.

Any solution that doesn’t address the original problem (needed pension reform), isn’t an option to even consider.

The viability of pension bonds depends on bond buyers being as ignorant as Illinois voters. Most bond buyers are investing other peoples’ money and there are funds that buy junk and people who buy those funds. The people who buy those funds get “official statements” which no doubt explain [to those who read them] that they risk losing all their money. As recollection serves, the S.E.C. rarely takes any action against the malefactors in this market. Those malefactors include a willing list of public guardians who will do anything for a fee. That is to say: actuaries, consultants, accountants, bond… Read more »

That’s an excellent summary.

Pension Rule 5a: If pension participants overwhelmingly approve of something, do the exact opposite.

“They’re still on the hook for $56 million either way, but now they owe the bankers and not the pension funds.” Why would that matter? Oh that’s right, your plan is to steal from pensioners and not from the bankers. The money the state owes to pensioners is a crisis but the money owed to bondholders is necessary and it shouldn’t be reduced. Funny thing though…if all of the pension debt was in GO bonds the state wouldn’t need a constitutional amendment to reduce its obligations. Since bondholders are only protected by the contracts clause and not the additional protection… Read more »

What you seem to miss out on is that everyone in Illinois is hurting because of unaffordable pension costs. Retirement security for you guys has collapsed. Taxpayers are paying through the roof – the nation’s highest property taxes. And services are being slashed, so the little guy is losing. Add to that the biggest outmigration in the country and we’ve got a meltdown going on. You might think more borrowing will help, but that’s a pipe dream. The only way you get out of this mess is either through bankruptcy or an amendment to pensions, with subsequent reforms that cut pension… Read more »

Ted, You completely missed the point and avoided addressing it. If all the debt was in GO bonds then you could perform the cuts that you so desire. After all, bondholders are only protected by the contracts clause. For the record I never said borrowing would help. I was merely pointing out that the debt to bondholders would be easier to discharge per your own logic than pension debt. What say you to that point? Bankruptcy or insolvency may be reached at some point. If that’s the case the courts will determine what can be cut, what can’t, and how… Read more »

PFF, the courts sure as heck have not said that (under federal law with is all that would matter) and you know that full well.

The Illinois Supreme Court has said that and you know it full well. SCOTUS is under no obligation to get involved in this matter and you know that as well. Moreover, no possible claim can be made that no less drastic measures were available when balancing pension obligations with other State expenditures became problematic. One alternative, identified at the hearing on Public Act 98-599, would have been to adopt a new schedule for amortizing the unfunded liabilities. The General Assembly could also have sought additional tax revenue. While it did pass a temporary income tax increase, it allowed the increased… Read more »

PPF, the premise here is that the IL constitution is amended or there is bankruptcy, which are the two ways to override the state constitution and the IL court rulings.

PPF, you brought up an interesting point about the courts raising taxes to pay for pensions. “The courts have been clear. Raising taxes is considered “less drastic” than cutting pensions. As long as more revenue is created taxes will continue to be raised.” But judges, at least at the federal level, cannot raise taxes to solve the problem. For instance, a federal judge could not raise Wheaton’s property taxes in order to cover the pension debt. The Supreme Court was unanimous on this issue 30 years ago. Although, the Court would allow a federal judge to order a taxing body to… Read more »

The courts have been clear. Raising taxes is considered “less drastic” than cutting pensions.

Wow, who told you this WHOPPER lie, or did you make it up on the fly? Never heard such a whopper pension lie in my life….🤣🐾🤣🐾

Are you purposely dumb dog boy or can you just not read? The Illinois Supreme Court in their 2015 decision discussed raising taxes as less drastic than cutting pensions. The information below is directly from the court. Moreover, no possible claim can be made that no less drastic measures were available when balancing pension obligations with other State expenditures became problematic. One alternative, identified at the hearing on Public Act 98-599, would have been to adopt a new schedule for amortizing the unfunded liabilities. The General Assembly could also have sought additional tax revenue…….Public Act 98-599 was in no sense… Read more »

It doesn’t matter that the Illinois Supreme Court feels that raising taxes is “less drastic” than cutting benefits. As far as I know the Illinois Supreme Court has no power to raise taxes. There is also no provision in the state constitution that deals with the funding of state pensions when the pension fund runs out of money. I feel this would ultimately end up in federal court and the federal courts have shown that cutting pension benefits can be part of the overall remedy to underfunded pension systems.

You need to go back and review what happened during the Rauner budget stalemate years. These are some of the things said right before the stalemate. “Illinois is going to run out of money 26 hours from now.”“The state will be without the authority to spend new money for at least a week.”“No one can be paid until the Republican governor and the Democrat(ic) majority in the legislature reach a budget deal.” What happened afterwards? Payments were made to debt holders as well as pensioners. It was automatic. They were first in line even without the general assembly preparing a… Read more »

When it gets to point that the pension fund is out of money and pensions become pay-go then the federal courts will become involved. Let’s take Wheaton as an example. If pension payments start coming out of the town’s budget after the pension fund is out of assets there will come a time when other town expenditures will be affected. If Wheaton decides not to cut other expenditures to pay the pensioners and cuts the pensioners payments then there will be a lawsuit. That lawsuit will eventually end up in federal court. When the city of Detroit had pension cuts… Read more »

“And a final note, when raising taxes was put to a statewide vote it lost by 375K votes” as would be expected most of the time the public at large has a chance not to increase their taxes. Duh! No real surprise there.

Instead of taking Wheaton as an example why don’t we review what’s been happening in Harvey, IL. Search Harvey pension crisis leads to mass layoffs. Here are some of the things that you have wrong. 1. Harvey can’t seek bankruptcy the way Detroit did. Cities in Illinois need to seek permission from the state. Harvey is an extreme case and they have yet to get to bankruptcy court. 2. Pensions have been prioritized in Harvey over other services. In fact Harvey was forced to layoff many police and firemen. 3. Harvey’s pension funds got so low that the Illinois’ First… Read more »

“The other important lesson that resulted from the stalemate? Illinois voters tossed Rauner out of office as he lost by 750k votes. The guy he lost to proposed raising taxes.” Correlation does not equal causation, buddy, you’re smarter than this disingenuous comment. you can’t say Rauner lost because of the stalemate. Rauner only ‘lost’ 100,000 votes from 2014 to 2018, roughly the same number of votes as the Conservative Party Madigan stooge candidate received, and he’s currently under indictment. But JB gained 800,000 votes in 2018 over Quinn in 2014; nearly 400,000 of from were allegedly tallied in Crook County… Read more »

What he/she/it is also missing is that the rental that has been overtaxed and now managed by the state by preventing evictions for delinquent renters and now in some places rent controlled is retirement income too.

PPF, something we really dislike here is when commenters lie about what we have said and support, or make no effort to find out, as you did here. “Oh that’s right, your plan is to steal from pensioners and not from the bankers. The money the state owes to pensioners is a crisis but the money owed to bondholders is necessary and it shouldn’t be reduced,” you say. Wrong. We have long supported dealing with these local pensions by authorizing Chapter 9 bankruptcy for municipalities. We testified in public in Springfield for that and published our testimony here, and have… Read more »

You have advocated for cutting the Illinois contracts clause for pensions but not for bondholders. If you wanted to treat them the same you would be advocating that for both. You have not given equal air time to cutting both and you know it. I sure don’t see it under your policy banner. Sorry I don’t track everything that you have stated throughout your life and instead base it on what your present on this site. Stating that you have argued to reduce bond debt as much as pensions, that’s one big lie right there. Ted wrote that pension bonds… Read more »

Couple of things, PPF. My comment about switching the taxpayer obligation from the pension funds to the bankers was to simply make the statement that nothing changes for the taxpayer – still on the hook for $56 million, just the payee changes. You’ve turned that into more than that. But while we’re at it, let’s look at the state obligations and why we’re so focused on pensions. Moody’s puts the state pension debt for the five state-run funds at $317 billion (their latest estimate for when they finally do the June 30, 2020 numbers). Add retiree health insurance debt and… Read more »

PPF, you are simply ignoring or unaware of what our position has been consistently on this, which has been firm and harsh respecting how bonds should be treated compared to pensioners. Among other things we have written: “If we had sensible leadership, the state and its municipalities would be working in concert to, well, stiff existing bondholders. That may sound harsh but it isn’t. That’s what you have to do in insolvencies. It’s a hardball game. The whole point is to protect those you want to protect, which in this case should be citizens who need services and unsecured creditors… Read more »

“the state bonds have legal payment priorities and some are secured, making cutting them far more difficult.”

Far more difficult to cut compared to pension obligations that are protected by the contracts clause of both the US and Illinois Constitution as well as its own constitutional protection embedded in the Illinois Constitution? The challenges to cut protected pension payments doesn’t seem to difficult to you. We really don’t appreciate lies around here.

My my hit a nerve? But you promised… Good luck with that.

The Supreme Court hasn’t yet looked at ‘equity’. Soon enough some litigant points out that most pensioners are old, white and live out of state; and every dollar sent to Frank the retired firefighter in Naples is one less dollar for the community of Harvey to provide basic services for systemically oppressed BIPOC. You know a ‘woke’ Supreme Court of IL will ignore the constitution; and Supreme Court of the United States won’t touch that dumpster fire from a mile away. https://www.illinoispolicy.org/harvey-pension-crisis-shows-why-local-governments-need-a-401k-option/ “Pension benefits accumulated by the city’s firefighters – what’s owed to them in retirement – grew by nearly… Read more »

Pensions Paid First – I am having trouble following you. Do you support the issuance of Pension Obligation bonds? Surely you must understand the concern many have about turning a local government into a Wall Street casino, especially since so many investments are subject to political pressures, making sound returns more difficult than one might think. And I don’t understand why GO bonds are being discussed, other than to make argumentative points to Wirepoints. Are PO bonds a good idea? Or do they really slip over the elephant in the room? The intractable pension debt in Illinois. $400 billion –… Read more »

PPF is a useful idiot for his masters. The dump-and-pump scheme is working fine: First, get useful idiots to defend absurd economic tax-taking/debt-incurring policies which favor–in the short term–useful idiots. Then, cram down values of the assets securing the debt and absurd shiny objects (like unreasonably high pensions at insanely young ages) used to secure useful idiots’ favor. Then, buy all the busted-out assets (taxable(non-TIF) Illinois real estate owing the pension debt) at pennies on the dollar using bank leverage from friendly/ or/ family-owned banks which are taxpayer-backed (heads: bank wins, tails: taxpayers lose). THEN, let the useful idiots know… Read more »

Susan.

You Hit. Nail. On. Head.

The Swamp will win, taxpayers and PPF will lose.

Great. So what do we do about it?

My best guess is: Charter cities, crypto currency based (so that in a good plan, participants are rewarded).

PPF your Mommy is calling, your grill cheese sandwich is ready, come upstairs and eat.

One thing not mentioned. This is Wheaton! A very nice middle to upper middle class town which should have the resources to dig out of problems without PO bonds. I mean, the town has arguably the best Christian college in the nation and one of the most prestigious and oldest golf clubs in the world. If Wheaton has these problems, what does it say about the rest of the State!

Mr. Pensions Paid First:

Actually it’s the govt ee unions & legislators who bargained and GOT the exorbitant pensions that are paid way too early and increase with overly generous CPI/COLA, which makes the private sector taxpayers the ones who’ve been looted.

Is it really “bargaining” when all branches of elected government depend on govt ee union $$ and votes? More like bribery/extortion.