By: Mark Glennon*

Although the amounts are small for now, Chicago has joined the list of Illinois municipalities having state money intercepted to cover alleged pension underfunding. It’s the latest example in the expanding story of how pensions and municipal bondholders are locking up key assets of financially troubled cities and towns across the state.

The Bond Buyer reported on Friday that Chicago’s firefighter pension initiated the intercept process for two claims totaling $3.3 million for its 2016 and 2017 contributions. The city denies the obligation and claims it fulfilled its statutory requirements, though the Illinois Comptroller has begun holding money back from the city.

“Sources said the police fund may also soon act to cover what it considers are delinquencies.”

Full details are in The Bond Buyer article.

Towns and cities across Illinois all are now subject to similar intercept if they fail to make pension contributions in amounts required by state law. Under the intercept laws, pensions can request the Illinois Comptroller to seize the shortfall out of money that ordinarily flows from the state to the municipality including, most importantly, the municipality’s share of sales taxes.

In the case of Chicago, however, only grant money flowing from the state to the city can be intercepted for pensions, not sales tax. But Chicago has already sold ownership of all future sales tax that it collects through the state (which comprise about 92% of its total sales tax collections) to an independent entity as part of the new, “securitized” approach to selling bonds. In other words, Chicago’s sales tax revenue from the state has already been hocked to pay bonds, though the city does retain residual rights to cash not needed to make the bond payments. The list of municipalities selling future revenue in that manner is likewise growing. Riverdale and Bridgeview sold similar securitized bonds.

Importantly, fiduciary concerns of pension trustees appear to have driven Chicago’s firefighter pension to request the intercept. The fund board’s chairman told The Bond Buyer, “The board of trustees has a fiduciary duty to ensure that all monies due and owing to the fund are contributed to the fund consistent with the requirements of the Illinois Pension Code. On behalf of participants and beneficiaries, the board of trustees will continue to take all necessary steps to fulfill that duty.” Notice, also, that the fund’s fiduciary counsel has apparently been at the center of negotiations with the city, which is indicated in The Bond Buyer article.

That same duty is no doubt weighing heavily on other pension trustees across the state as they consider exercising their intercept remedy. All pension trustees are charged by law with a high duty of care towards the pension. Wirepoints research found about 400 police and firefighter pensions that appear to have been shorted on pension contributions and may have intercept rights — for 2016 alone.

Why haven’t trustees of those pensions exercised their intercept rights? As we wrote earlier, they may fear they’d be killing the goose that lays their eggs. They’d be putting further financial drain on the municipality they need to survive in the long run. Whether that’s a legally valid reason under fiduciary standards, however, is questionable.

What we do know is the list of intercepts is growing. Harvey and North Chicago were the first. The Illinois Municipal Retirement Fund has also filed intercepts against four municipalities, according to the Bond Buyer.

Pensions and bondholders are playing the insolvency game smartly (from their perspective), as we’ve written often. It’s all a matter of getting ownership, liens or some kind of priority on anything and everything of value before things blow up. When that happens, they’ll get paid first. Service recipients and taxpayers are in growing danger of have nothing to work with. Even a formal bankruptcy wouldn’t help.

For further background on the intercept laws see our earlier articles below.

*Mark Glennon is founder and executive editor of Wirepoints.

Pending Bill Would Expand Pension ‘Intercept’ To Illinois University System 6-21-18

IMRF Enters The Pension Intercept Mess: Implications For Hundreds Of Illinois Towns And Cities 6-14-18

The Harvey fallout: Are Illinois public safety pension trustees protecting police and firefighters? 6-10-18

Latest on Harvey’s Pension Intercept and Why it Matters for All Illinois Towns and Cities 5-29-18

The predictable war has begun: bondholders vs pensions vs service recipients vs taxpayers 5-22-18

Illinois pension trustees’ failure to request intercepts exposes ugly reality 5-17-18

How the now feared ‘pension intercept’ became law. (Hold your nose.) – Quicktake 4-20-18

Second domino falls in Illinois: North Chicago revenues garnished for pensions 4-20-18

What’s Ahead For Chicago: Forced Tax Increases, Priority For Pensions And Bonds 2-25-18

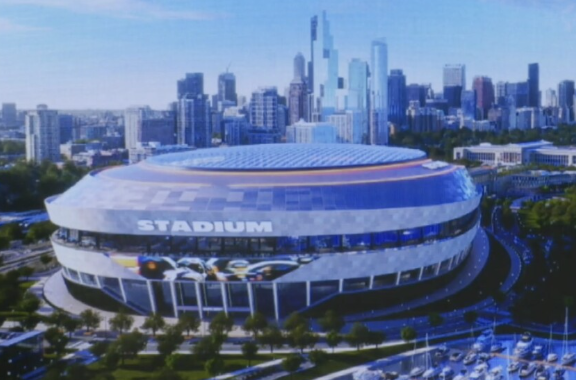

Ted joined Scott Slocum to talk about the huge potential cost to taxpayers for the Bear’s proposed new stadium, why the economics of publicly-funded sporting arenas don’t work, what the latest criminal justice statistics tell us about the SAFE-T Act’s impact so far, the latest developments on Chicago’s ongoing migrant crisis, and more.

Ted joined Scott Slocum to talk about the huge potential cost to taxpayers for the Bear’s proposed new stadium, why the economics of publicly-funded sporting arenas don’t work, what the latest criminal justice statistics tell us about the SAFE-T Act’s impact so far, the latest developments on Chicago’s ongoing migrant crisis, and more. We’re supposed to worry that climate change itself is to blame for Illinois’ failing climate policy, but far bigger problems are obvious.

We’re supposed to worry that climate change itself is to blame for Illinois’ failing climate policy, but far bigger problems are obvious. Traumatizing robberies and violent crime continue to go up in Chicago this year, hitting a six-year high compared to the same time last year. It’s crime in neighborhoods perceived as safe, sometimes taking place in broad daylight, that’s driving the increased fear among Chicagoans and suburbanites.

Traumatizing robberies and violent crime continue to go up in Chicago this year, hitting a six-year high compared to the same time last year. It’s crime in neighborhoods perceived as safe, sometimes taking place in broad daylight, that’s driving the increased fear among Chicagoans and suburbanites. Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

We always hear about pension underfunding yet year after year my property taxes-sales taxes-and countless other taxes go up and within those taxes money is designated toward pension payments. Seems like taxes appropriated to pensions are “Diverted” to either higher salaries or political pet projects over the years yet the taxpayers are always on the hook. It’s like you make your mortgage payment and the employees gives themselves raises and you still owe your bill again and again. Misappropriations of funds should be illegal and probably is.

Wish the Chicago Bears could make so many big interceptions hahahahah

I bet contract expirations play into this. if you’re a pension trustee, and your future-pensioners have a fully executed contract that doesn’t expire for 4-5 years, why not intercept? Get yours before everyone else.

That said, the Fire Fighters contract expired in June 2017 and I’m not sure if a new contract was signed: https://www.scribd.com/document/368948776/City-of-Chicago-Labor-Agrement

Vacate Illinois before you can’t.

^^^^^^ What he said

and I bet the former public employees drawing pensions have already vacated the state.