Don’t fall for the “progressive-income-tax-for-property-tax-relief” tax swap referendum – Wirepoints

While this new advisory referendum could be nothing more than a political distraction, it could also be that lawmakers are gauging Illinoisans’ appetite for another bite at a progressive income tax hike – this time with lower property taxes as a sweetener.

While this new advisory referendum could be nothing more than a political distraction, it could also be that lawmakers are gauging Illinoisans’ appetite for another bite at a progressive income tax hike – this time with lower property taxes as a sweetener.

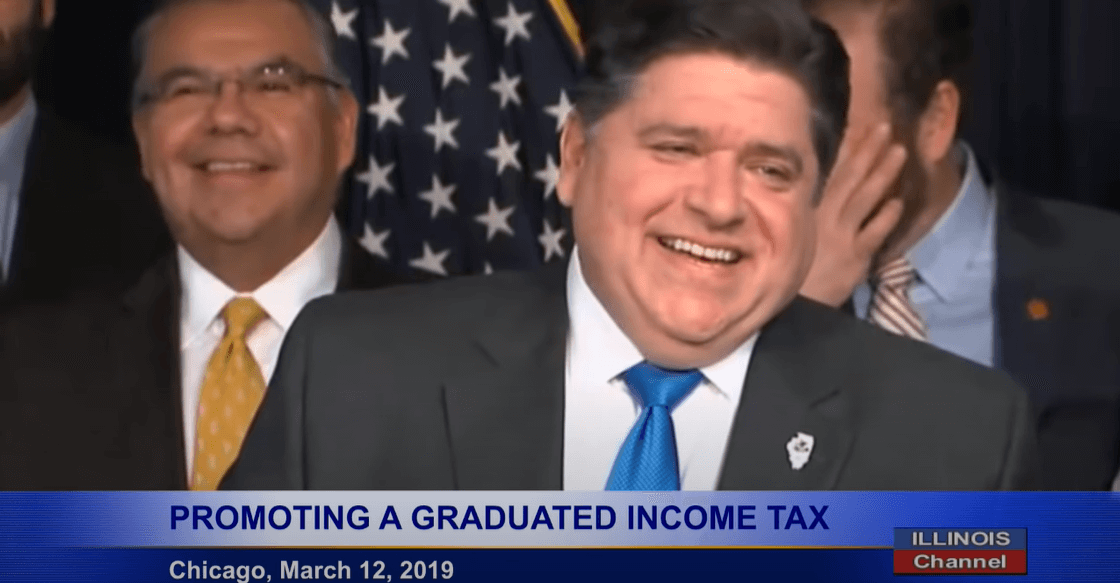

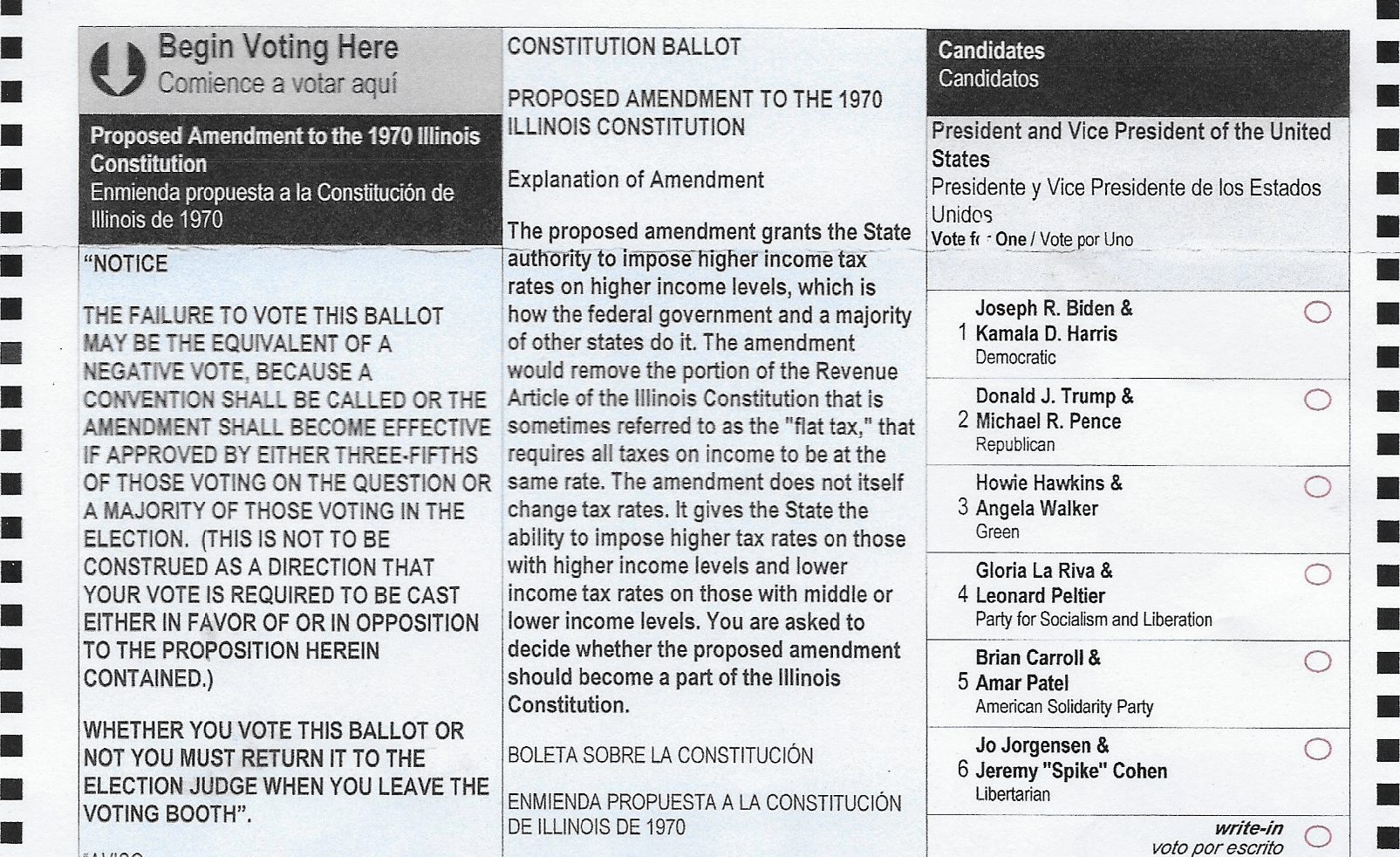

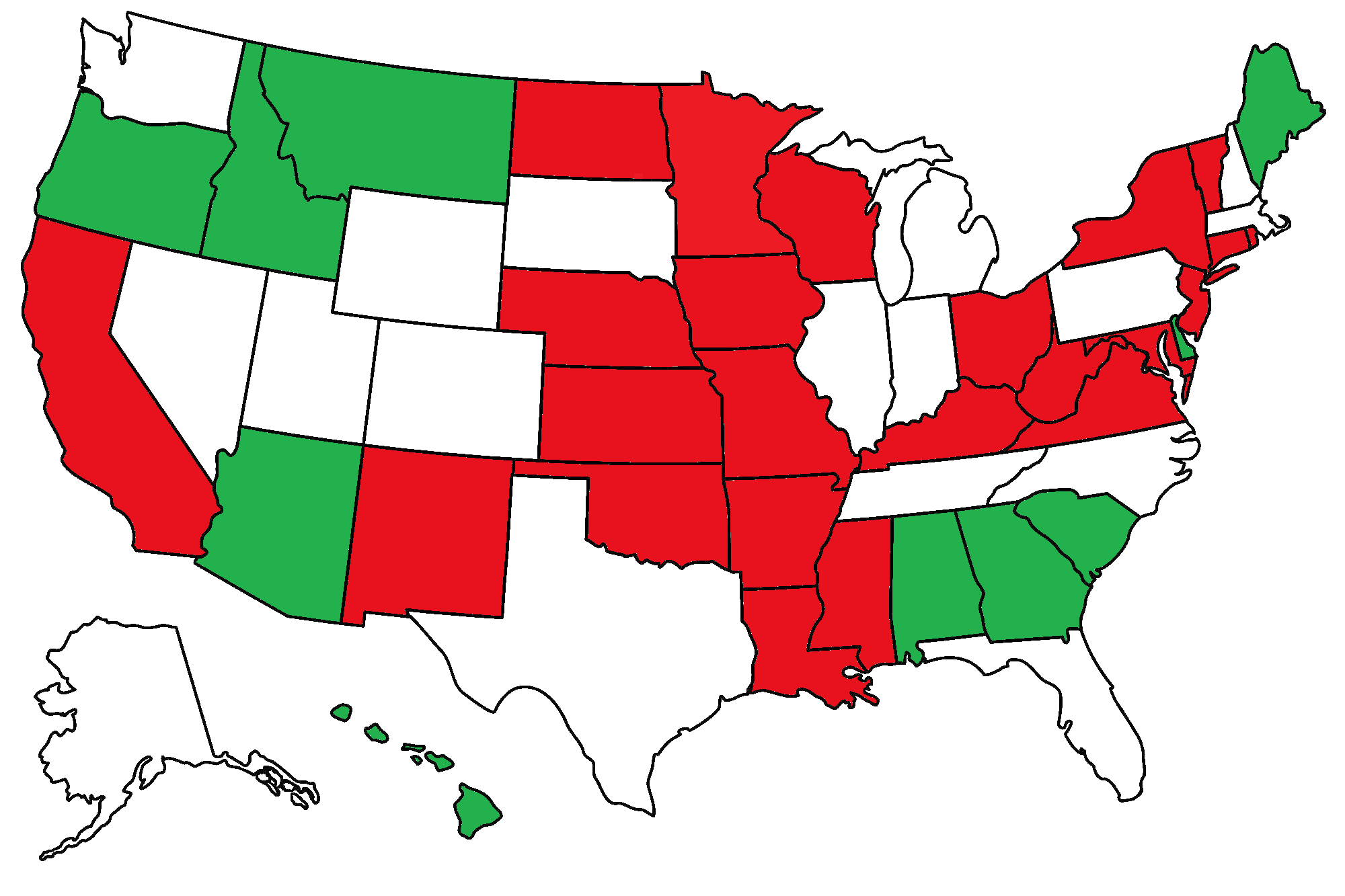

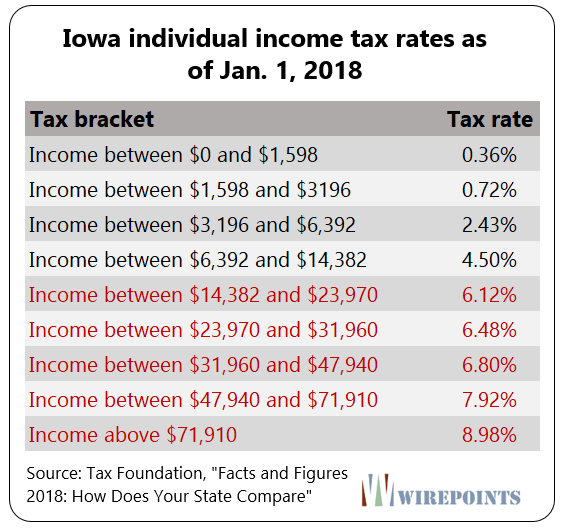

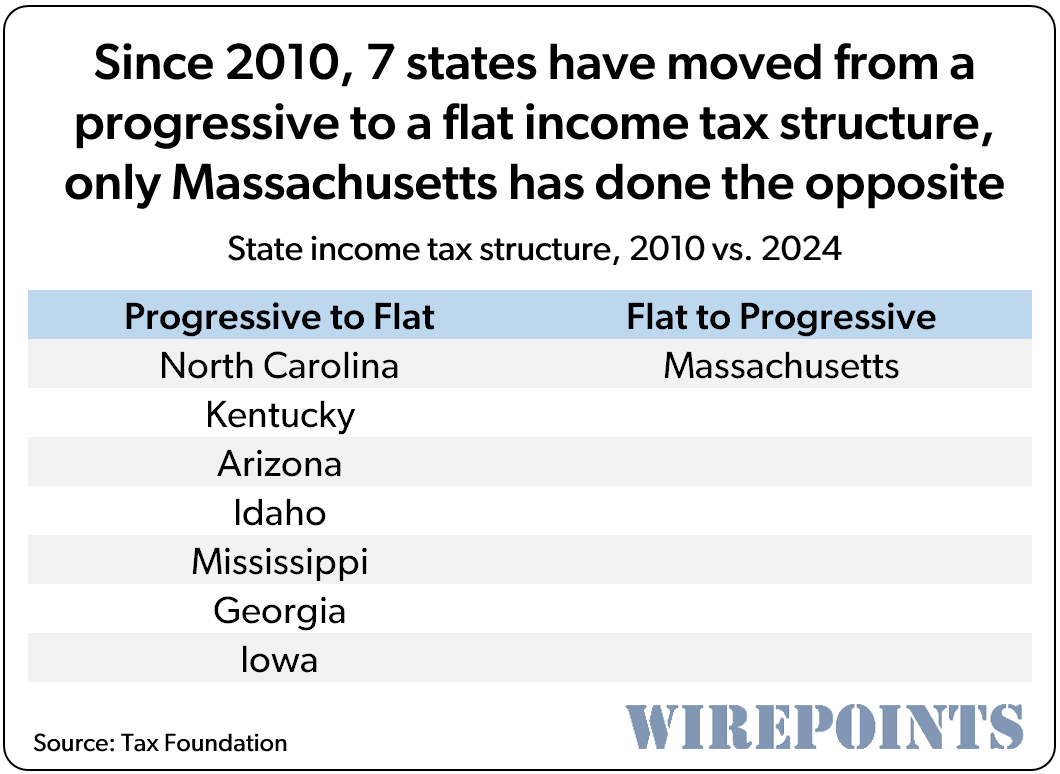

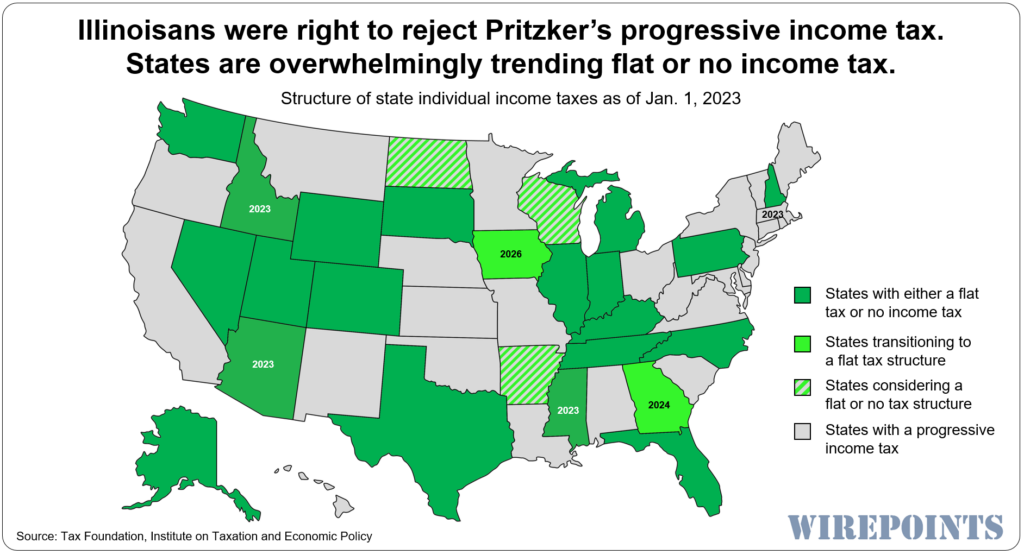

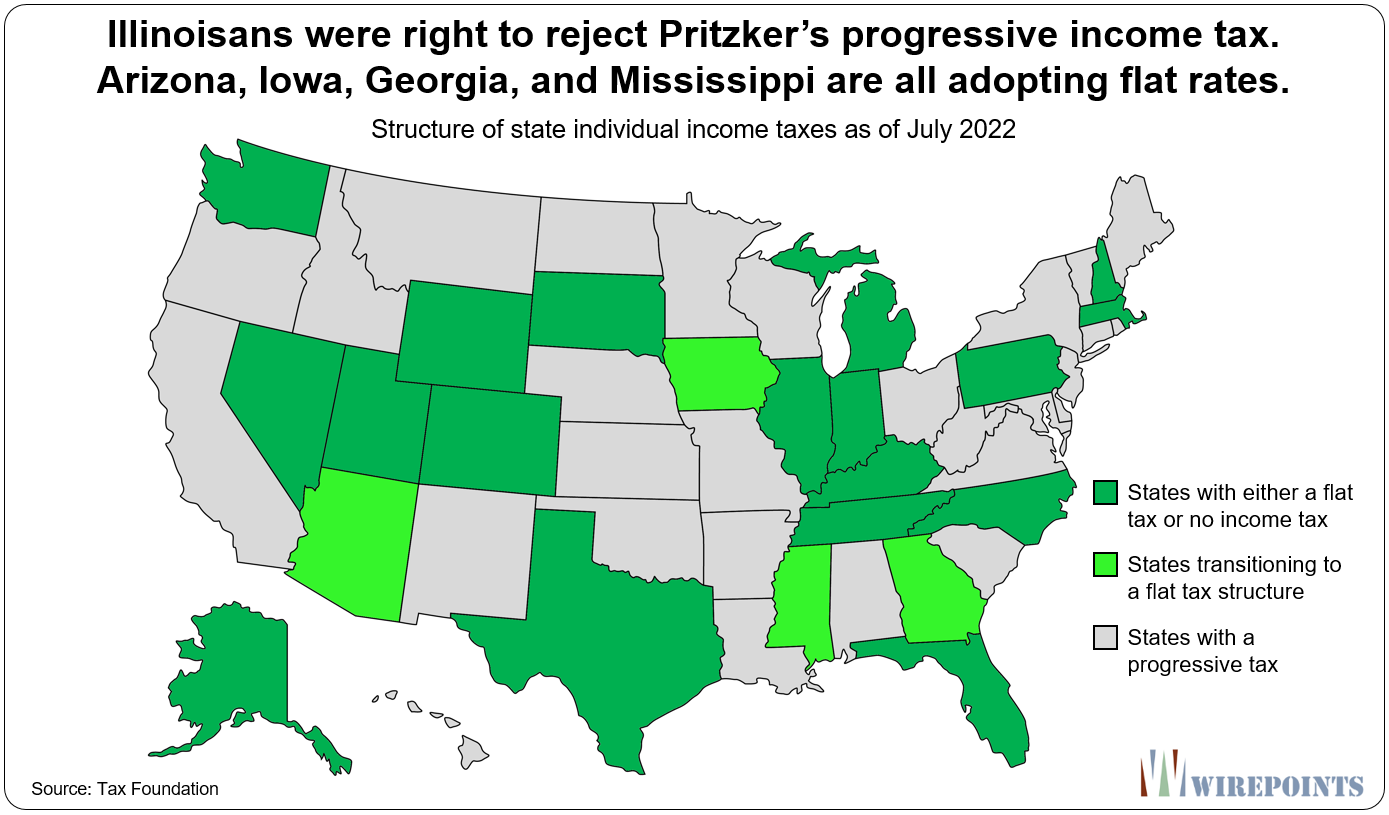

In 2020, Illinoisans rejected Gov. J.B. Pritzker and his legislative allies’ push for a progressive income tax scheme in Illinois. And with it, they rejected claims a progressive tax would “modernize” Illinois’ income tax. Right they were. Over the past decade far more states have moved to a flat tax structure than vice-versa.

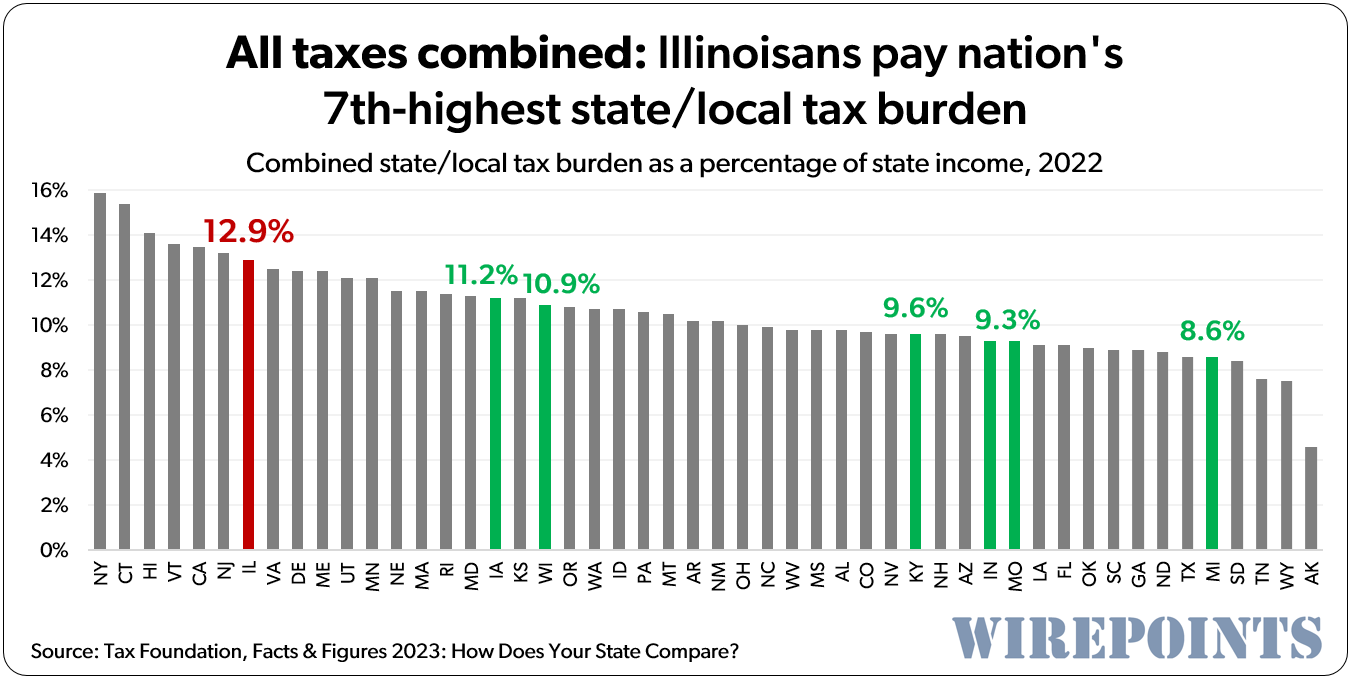

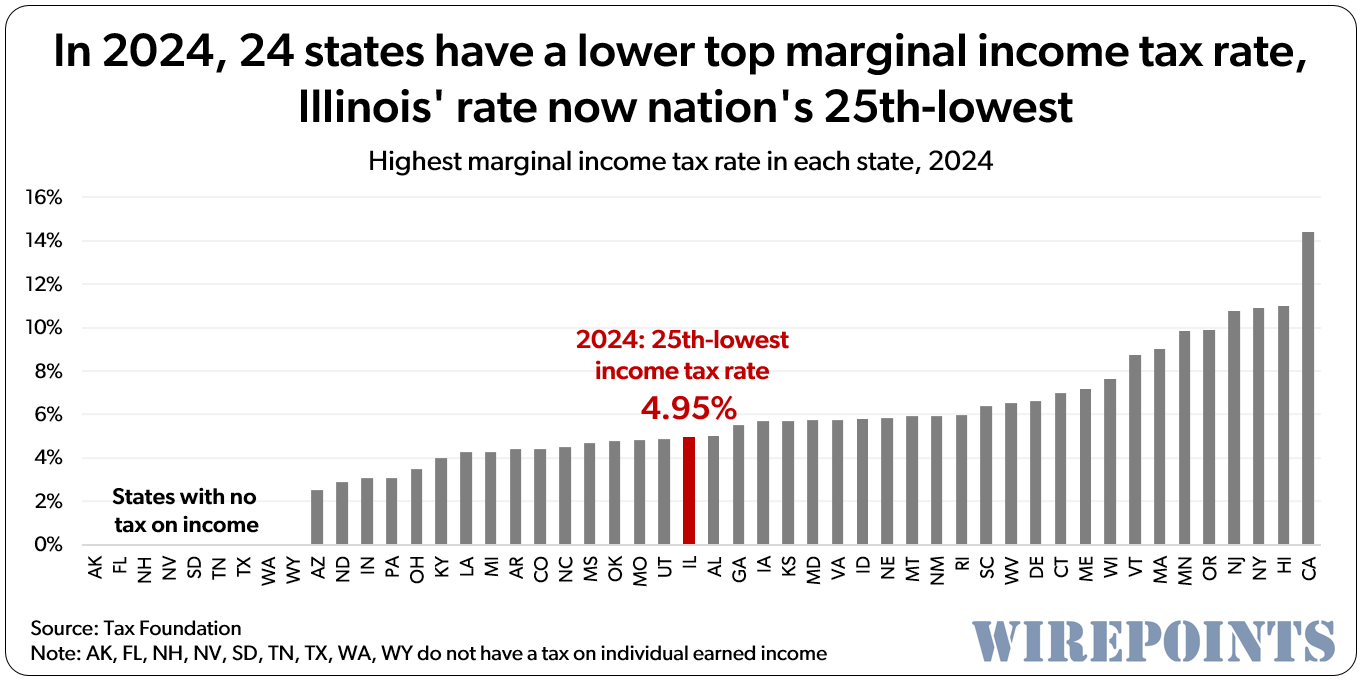

In 2020, Illinoisans rejected Gov. J.B. Pritzker and his legislative allies’ push for a progressive income tax scheme in Illinois. And with it, they rejected claims a progressive tax would “modernize” Illinois’ income tax. Right they were. Over the past decade far more states have moved to a flat tax structure than vice-versa. Illinois’ individual income tax has had a moderating effect on Illinois’ otherwise overall high tax burden. It’s been one of the few tax “advantages” Illinoisans have had. But that advantage has been gradually worn down over the years.

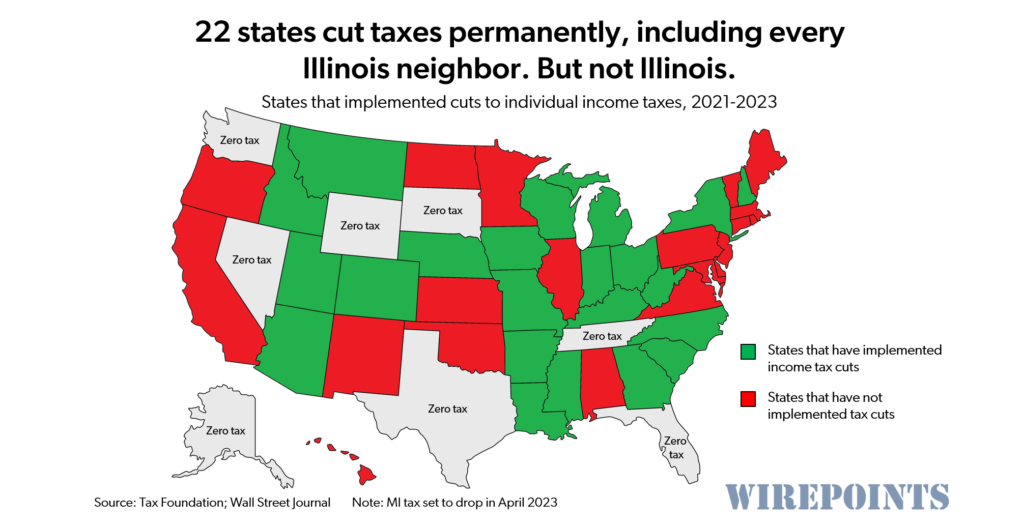

Illinois’ individual income tax has had a moderating effect on Illinois’ otherwise overall high tax burden. It’s been one of the few tax “advantages” Illinoisans have had. But that advantage has been gradually worn down over the years. State lawmakers across the country have given their residents permanent tax cuts over the last two years. In all, 22 states have cut individual tax rates since 2021 as a result of booming state-government revenues. But don’t expect any cuts under Gov. J.B. Pritzker.

State lawmakers across the country have given their residents permanent tax cuts over the last two years. In all, 22 states have cut individual tax rates since 2021 as a result of booming state-government revenues. But don’t expect any cuts under Gov. J.B. Pritzker. Illinois Sen. Bob Martwick, an ally of Gov. J.B. Pritzker, is reportedly planning to offer a new version of a progressive tax scheme for Illinois “as soon as next month.” A quick scan of national reporting reveals the foolishness of any such tax hike proposal. States across the country are overwhelmingly moving towards flat and zero income tax structures. An Illinois tax hike would be moving

Illinois Sen. Bob Martwick, an ally of Gov. J.B. Pritzker, is reportedly planning to offer a new version of a progressive tax scheme for Illinois “as soon as next month.” A quick scan of national reporting reveals the foolishness of any such tax hike proposal. States across the country are overwhelmingly moving towards flat and zero income tax structures. An Illinois tax hike would be moving  To all those Illinoisans who opposed the progressive tax back in 2020: you’re being proven more right every day. This year alone, four states decided to transition their individual state income tax from progressive to flat.

To all those Illinoisans who opposed the progressive tax back in 2020: you’re being proven more right every day. This year alone, four states decided to transition their individual state income tax from progressive to flat.

Speaker Welch wants Illinois to have a second go at a progressive tax scheme, this time committing the tax hike proceeds to pensions….which means it would help pay for Mike Madigan’s pension benefit of $149,000 a year.

Speaker Welch wants Illinois to have a second go at a progressive tax scheme, this time committing the tax hike proceeds to pensions….which means it would help pay for Mike Madigan’s pension benefit of $149,000 a year.